-

XRP faced high selling volume, but there’s reason for bulls to be upbeat.

Traders might smell opportunity with prices at a key HTF level.

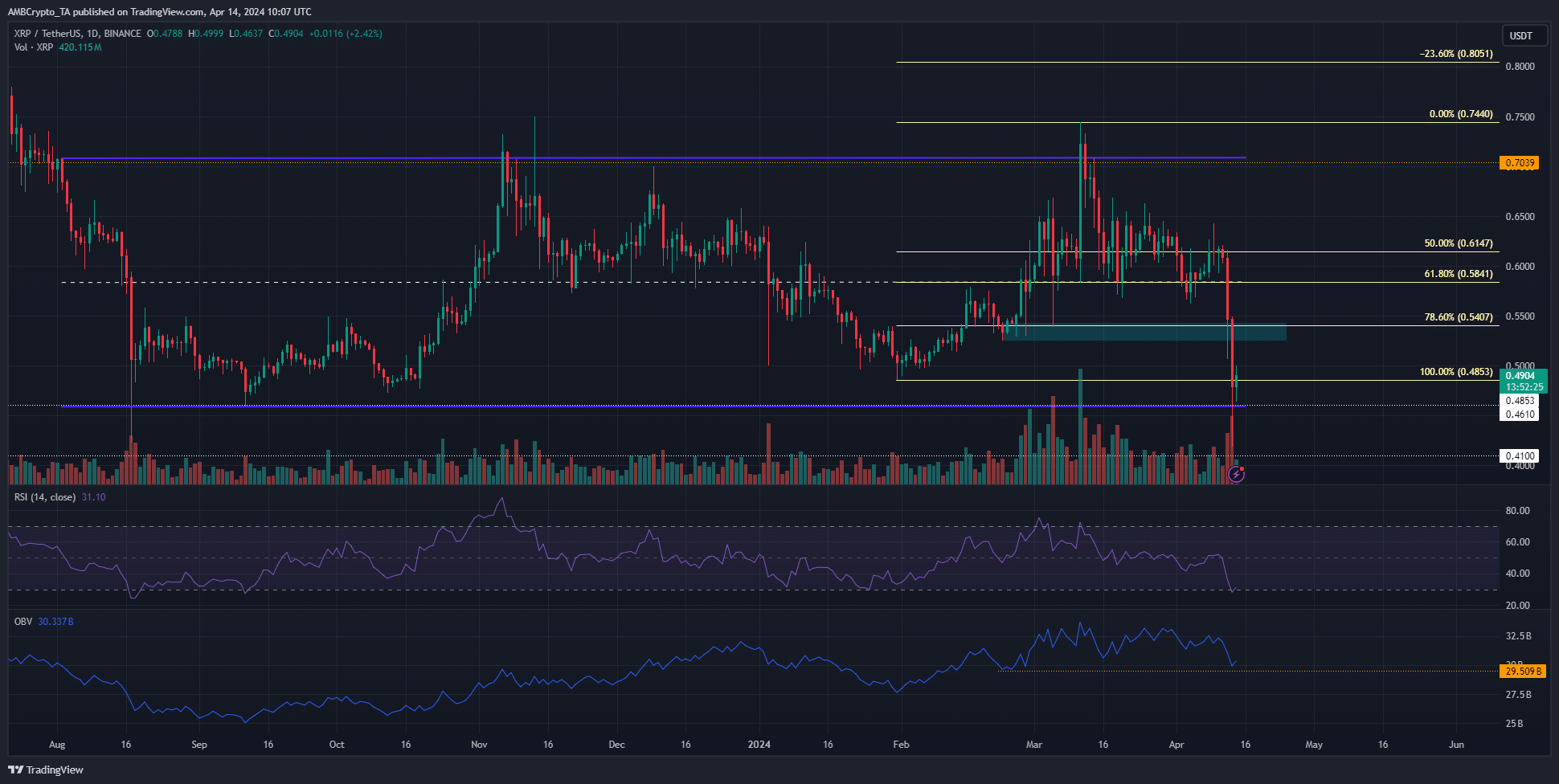

On the days between the 11th and 13th of April in 2024, Ripple (XRP) experienced a significant decline, dropping by approximately 32%. This was the most substantial and rapid price decrease observed that year, pulling prices down beneath the $0.54 support level.

Despite the intense pressure, the bulls might have some reason to be optimistic.

For swing traders and investors, it’s important to acknowledge that XRP was merely hovering above a significant support line in its higher timeframe chart at $0.46. Could this potentially lead to a strong XRP rally, despite the possibility of Bitcoin [BTC] experiencing another decline later in the month?

The range lows retested once again

XRP experienced a change in market trend towards bearish when the price dipped under the $0.525 threshold. This downward push also caused the price to fall below the previous support level at $0.485.

There was good news for the buyers amidst all this chaos.

During the past 8 months, the price range (indicated in purple) hit its lowest point at $0.46 back in September 2023. Since then, this level has not been revisited. As a result, it could have been an excellent buying opportunity based on risk-to-reward potential.

According to the OBV’s assessment, the price level from late February hadn’t been undercut, suggesting that the selling activity hadn’t surpassed the buying activity in recent times.

Until it does, the bulls have some reason to hope for a recovery.

With an RSI of 31, the indicator was just shy of entering the oversold zone. This doesn’t necessarily mean a quick turnaround is coming up, but it does highlight significant selling pressure in the previous trading period.

XRP sentiment was bleak, to put it mildly

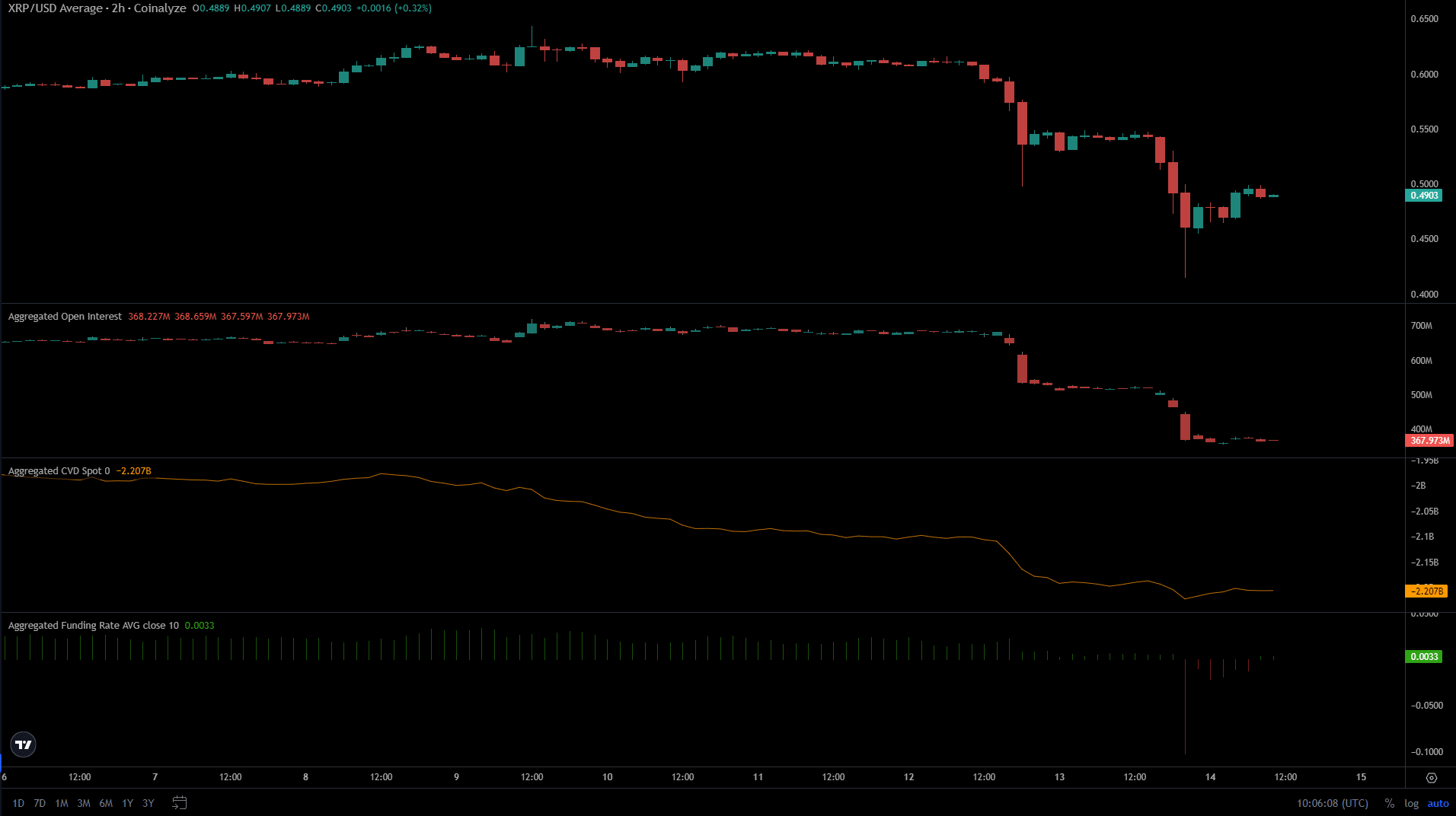

In April, data analyzed by Coinalyze indicated a prevailing bearish trend. Open Interest decreased significantly from approximately $680 million on the 12th, to around $367 million as of the present reporting.

The funding Rate had been negative in the past 24 hours, but was slowly climbing above 0.

Over the last week, the stock market sector for Cardiovascular Diseases (CVD) has been declining, with recent losses intensifying this downward direction.

Realistic or not, here’s XRP’s market cap in BTC’s terms

Based on current market feelings, a swift rebound seemed unlikely. The absence of appetite in active markets added to the disheartening outlook for investors.

A change in the spot CVD and OI downtrend could be a sign of a bullish spark.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-04-15 06:15