- Bitcoin’s 2024 halving is fueling divided sentiment right now

Anthony Scaramucci believes in BTC’s adoption curve and potential as a mainstream asset

The long-awaited Bitcoin halving in 2024 is now imminent – this is the “D-day.” While some are thrilled, others are split into two groups: those anticipating significant price drops and those believing in a potential increase of up to ten times the current value.

Over the past week or so, opinions about Bitcoin have been strongly contrasting due to its volatile price swings in the market. Currently, Bitcoin is worth more than $62,000, but this value dropped below $60,000 only six hours prior to this assessment, caused by geopolitical conflicts between Israel and Iran.

Outside of its price movement though, the question remains – Is Bitcoin a safe haven?

Anthony Scaramucci’s bullish viewpoint

In a recent conversation with CNBC, Anthony Scaramucci, the Founder of SkyBridge Capital, provided insights on Bitcoin’s unusual price fluctuations.

“Bitcoin is on an adoption curve.”

He added,

“An inflation hedge or store of value that others are touting won’t be apparent to you until a user base exceeding a billion exists. Consequently, it will be significantly more volatile for now.”

From this point of view, Scaramucci proposed that the perception of Bitcoin as a risky investment or a safe haven asset will remain unclear until it gains wider acceptance in the market.

Bitcoin’s supply and demand expectations

The Bitcoin halving, as anticipated, has led to conflicting views regarding its impact on supply and demand. Contrary to the prevailing assumption of increased selling pressure, miners are instead reducing the amount of Bitcoin they’re putting up for sale. This unexpected turn of events could potentially lead to a short-term price increase, defying conventional wisdom and adding an intriguing twist to the halving story.

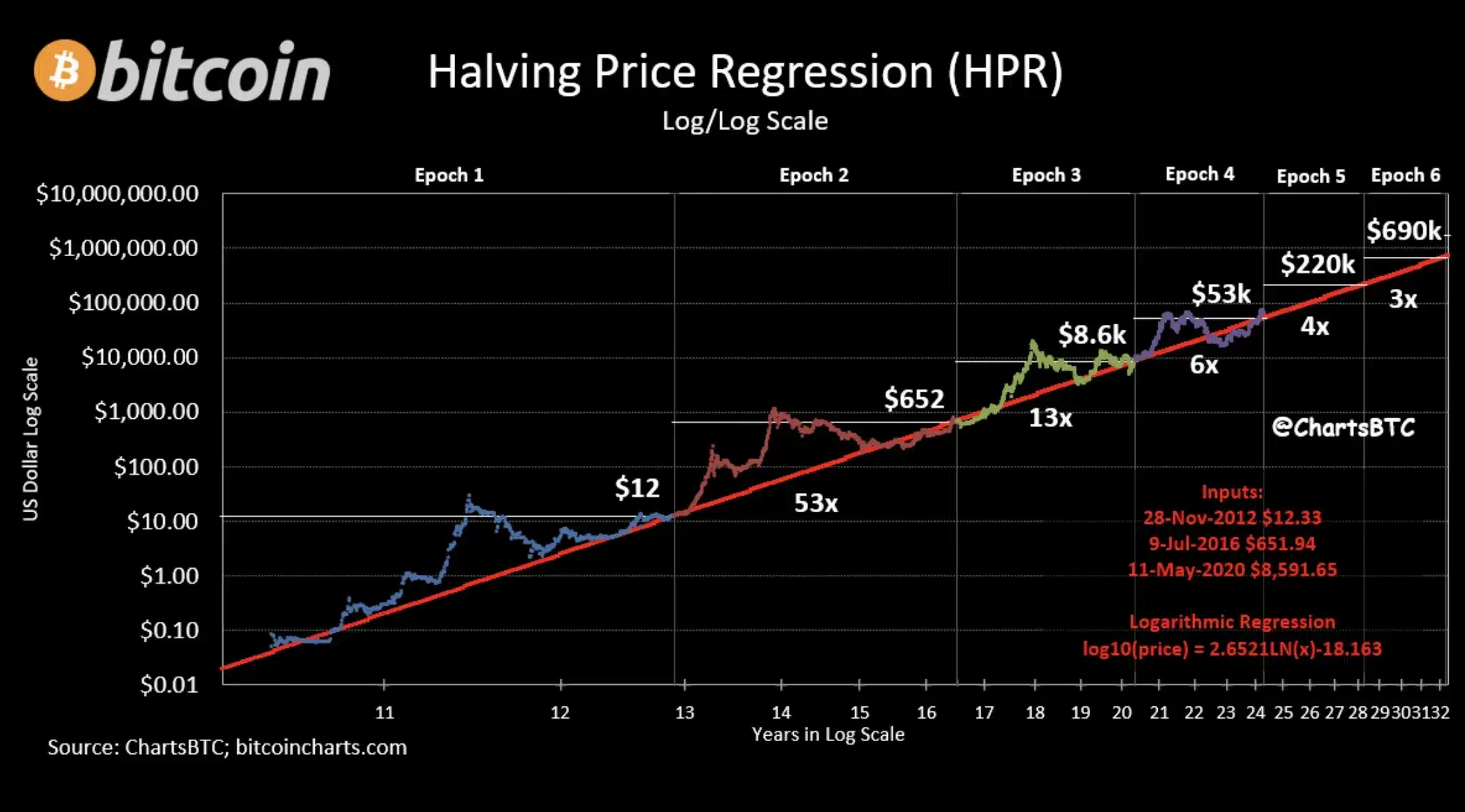

According to ChartBTC’s analysis, historical information shows that Bitcoin’s price has typically risen after previous halving occasions.

In a recent talk with CNBC, Anthony Pompliano, the founder and partner at Pomp Investments, made similar comments.

“Ignore the noise of short-term price movements.”

Despite the criticism from figures like Peter Schiff, Bitcoin’s popularity and optimism among its supporters will likely persist.

“Throughout the past week, advocates for Bitcoin have offered explanations for its decline on Saturday. They argued that since other financial markets were closed, Bitcoin was the only asset available for selling. However, with all markets now in operation, Bitcoin is experiencing another significant drop, leaving Bitcoin supporters without valid justifications.”

Bitcoin’s future outlook

To sum up, Scaramucci anticipates that Bitcoin will gain widespread acceptance as a regular investment asset, potentially even surpassing gold’s current market value.

In other words, despite acknowledging the impact of short-term events such as wars on Bitcoin’s price, he remained optimistic about its future growth over the long term.

“Bitcoin price could hit around $200k.”

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Ethereum ETF Day 1 beats ‘20% of BTC’ estimate – What’s next?

- Solana memecoin BODEN feels the heat after Biden’s exit: Will SOL suffer?

2024-04-19 10:47