- 21Shares took VanEck’s lead in the pursuit of a Spot Solana ETF

- A surge in Solana inflows can be expected IF the applications go through

As a researcher with a background in the crypto market, I’ve seen firsthand how institutional interest can significantly impact the price of digital assets. The recent filing by 21Shares for a Solana ETF is an intriguing development, considering VanEck made a similar move earlier.

The surge in Solana’s (SOL) market success over the past few years has piqued the interest of numerous Wall Street firms. Consequently, there’s growing enthusiasm among these institutions for launching a Solana Spot Exchange-Traded Fund (ETF).

21Shares moves in

Swiss asset manager 21Shares aims to cash in on the surging popularity of Solana by filing an application to launch a Solana ETF in the US. This step comes soon after a comparable application was submitted by rival firm VanEck.

As a researcher examining the 21Shares application, I can explain that the eligibility of their product relies significantly on the regulatory classification of Solana as an altcoin rather than a security under U.S law. This presumption is crucial because Security Exchange-Traded Funds (ETFs) are subject to more stringent regulations compared to standard ETFs.

As a crypto investor, I understand that if the SEC decides to classify the Bitcoin ETF proposed by 21Shares as a security, the company might reconsider its application. The reason being, securitized ETFs involve more stringent registration requirements that 21Shares may find challenging to fulfill. Consequently, they could choose to withdraw their application rather than navigate through the complex regulatory landscape.

How will SOL be affected?

It’s possible that the introduction of a Solana ETF could significantly increase the value of Solana (SOL) in a way similar to how Bitcoin’s price rose following its own ETF approval.

As a researcher examining the impact of Bitcoin’s price surge on potential Solana Exchange-Traded Funds (ETFs), I’d like to share some insights from a recent analysis by GSR Markets. They used Bitcoin’s 2.3x price increase as a benchmark, which is an interesting starting point for our discussion. However, it’s essential to note that Solana ETFs may not attract the same level of investment as Bitcoin ETFs due to differences in market size and investor interest.

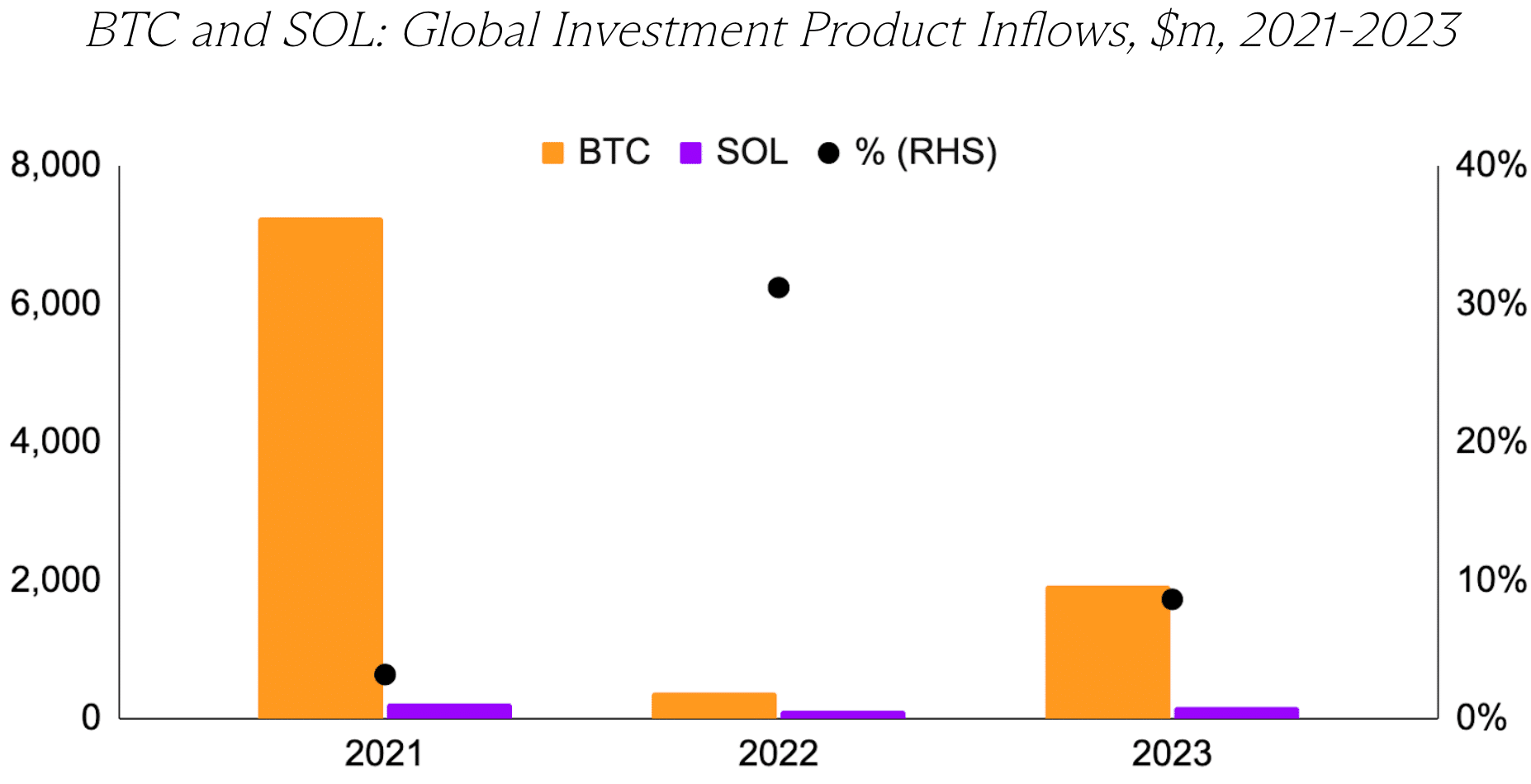

In the bear scenario, it was estimated that Solana’s inflows would grow by 2%. This implied a subdued demand for Solana ETFs, representing just 2% of the total inflows in comparison to Bitcoin.

As a researcher studying the potential inflows into Solana, I’d like to introduce you to the Base Case scenario. In this situation, we anticipate that Solana would attract only 5% of the total inflows compared to Bitcoin. This moderate assumption is based on historical investment trends in Solana-related products from the years 2021 to 2023. To minimize external factors, we exclude the year 2024 from our analysis to avoid any potential influence of Bitcoin ETFs.

As an analyst, I’d interpret GSR’s bullish outlook for Solana (SOL) as follows: In their most optimistic assessment, they considered SOL’s greater relative inflows during 2022 and 2023. Consequently, they projected that this altcoin could potentially draw approximately 14% of the total inflows, with Bitcoin accounting for the remaining average share.

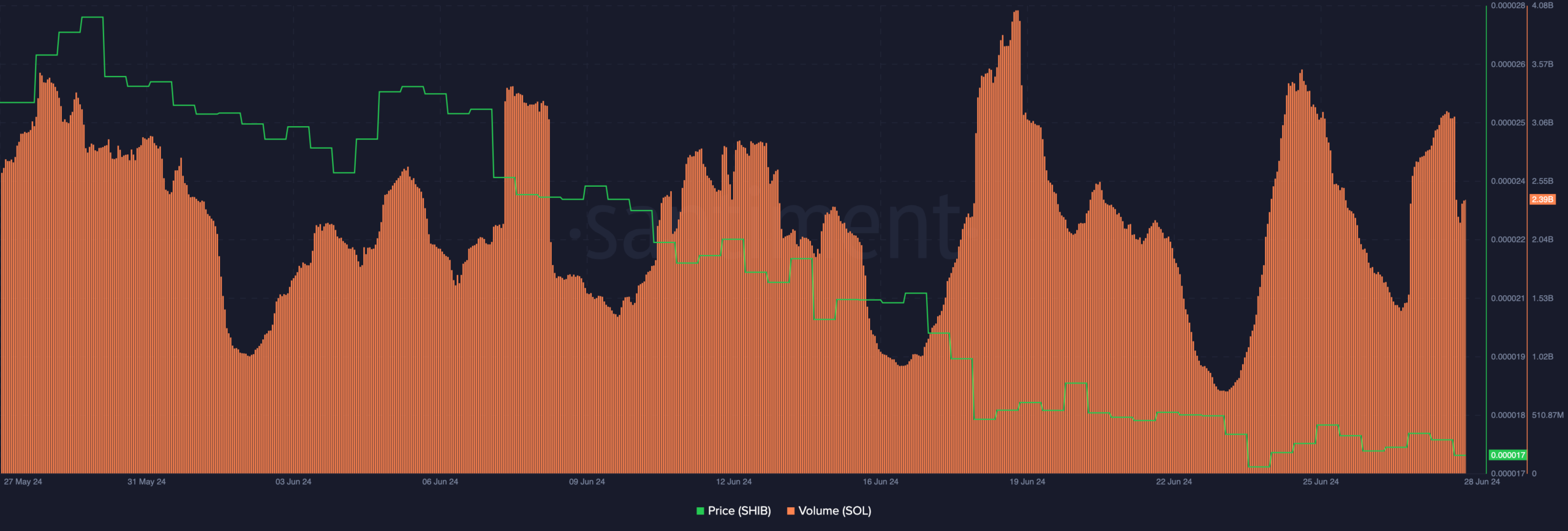

Currently, the price of SOL is at $141.80 during this report’s creation, representing a 2.53% decrease in value over the preceding 24 hours. Notably, the trading volume has also diminished by approximately 33.23% within the same timeframe as depicted on the charts.

Read More

2024-06-29 17:11