- BlackRock’s iShares Bitcoin Trust (IBIT) saw a $102.7M inflow, marking nine days of gains.

- Bitcoin’s RSI at 59 indicated strong bullish sentiment, despite recent negative sentiment trends.

As a seasoned researcher in the crypto space with extensive experience tracking market trends and institutional adoption, I find the recent developments surrounding Bitcoin particularly noteworthy.

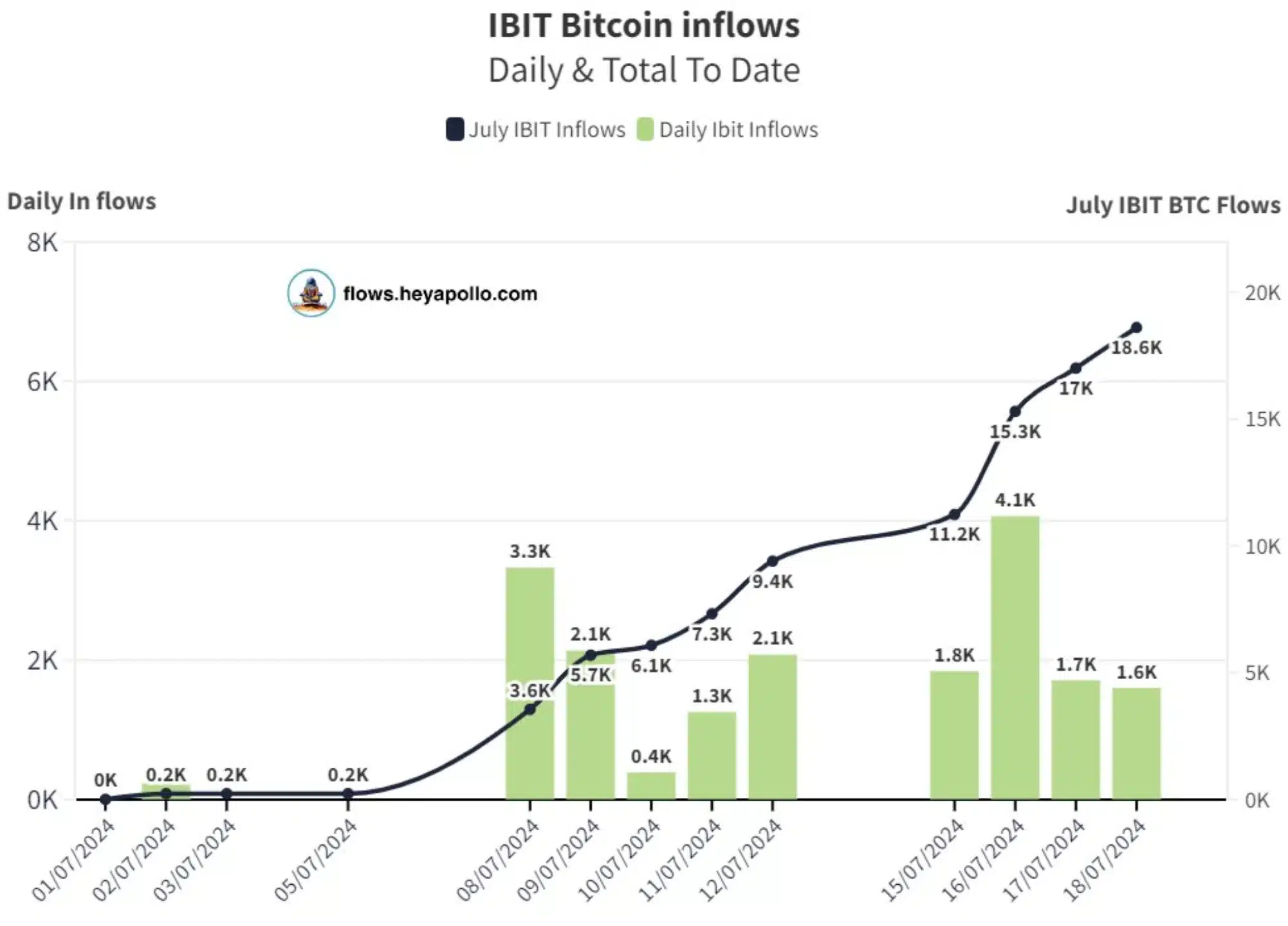

On July 18th, there was a significant investment of $102.7 million in the iShares Bitcoin Trust (IBIT), managed by BlackRock.

For nine straight days, IBIT, among all spot Exchange Traded Funds (ETFs), experienced net purchases, setting it apart as the sole ETF with this uninterrupted record.

BlackRock’s increasing Bitcoin adoption

This month, BlackRock made waves by investing over a billion dollars in Bitcoin, underscoring the growing trend among institutions to embrace the cryptocurrency.

Expanding on the same, Thomas Fahrer, co-founder of crypto data platform Apollo, said,

“This month, Blackrock has bought approximately $1 billion in Bitcoin, with a recent purchase of around $107 million representing about 18,600 coins. This marks a significant increase in Bitcoin investments for the company.”

Drop in positive sentiment

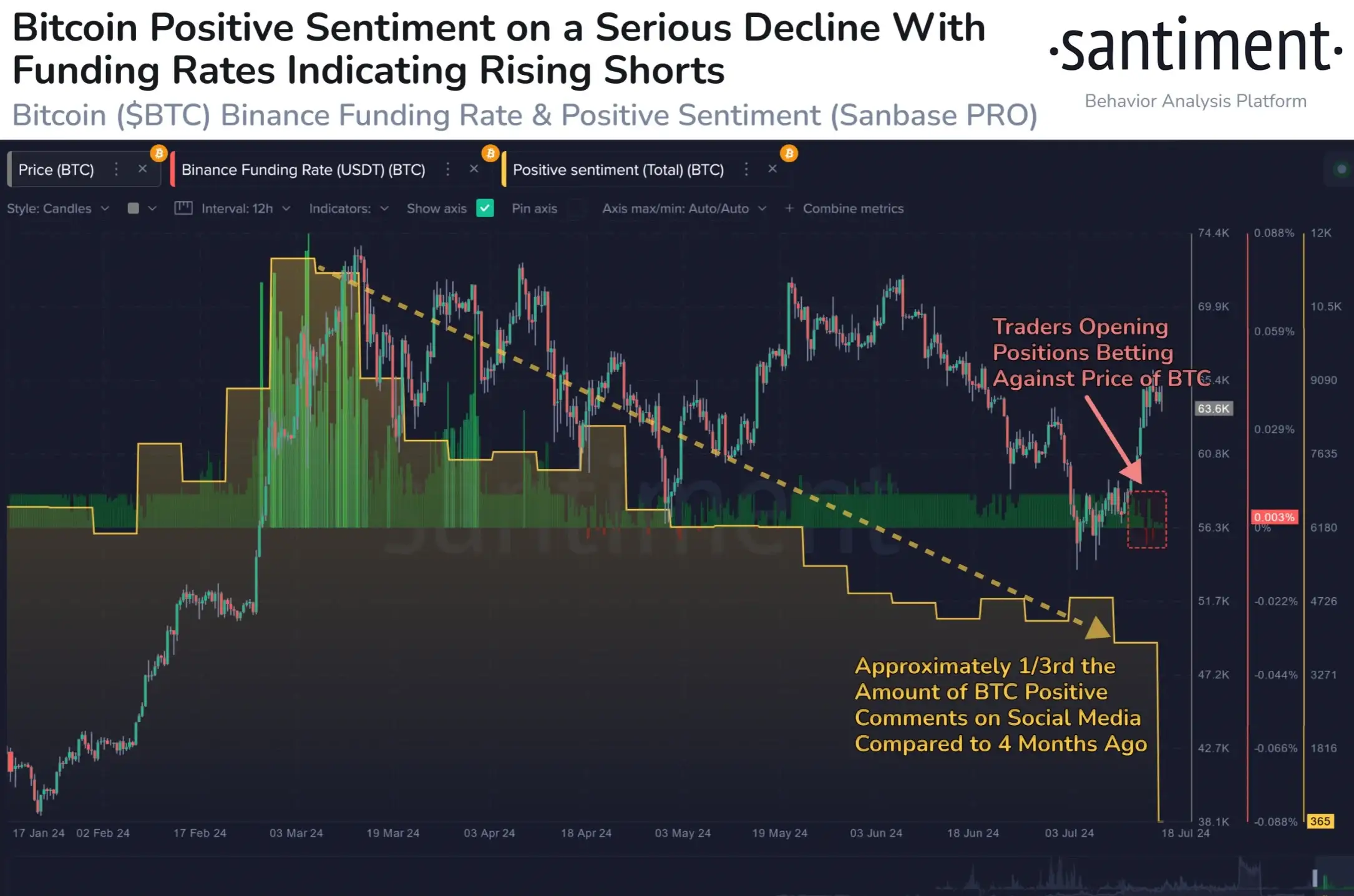

An uptick in the cryptocurrency market size has occurred this week. Yet, this development hasn’t altered the optimistic outlook towards Bitcoin, which has noticeably waned since March.

This includes sentiments from social media platforms like Twitter, Reddit, BitcoinTalk, and 4chan.

Based on my extensive experience in financial markets, I’ve noticed a concerning trend lately. While there has been a significant decrease in optimistic sentiment towards a particular asset, things have taken a turn for the worse. Not only are investors becoming more cautious about holding long positions, but many are actively seeking to profit from its potential decline by taking up short positions. This shift in trading strategy is a clear signal that market sentiment towards this asset is increasingly bearish.

According to blockchain market intelligence firm Santiment,

“On @binance, numerous traders are placing bets for a price decrease in Bitcoin by initiating short positions. Concurrently, two influencing factors are at play, boosting the probability that the value of cryptocurrency may surge instead.”

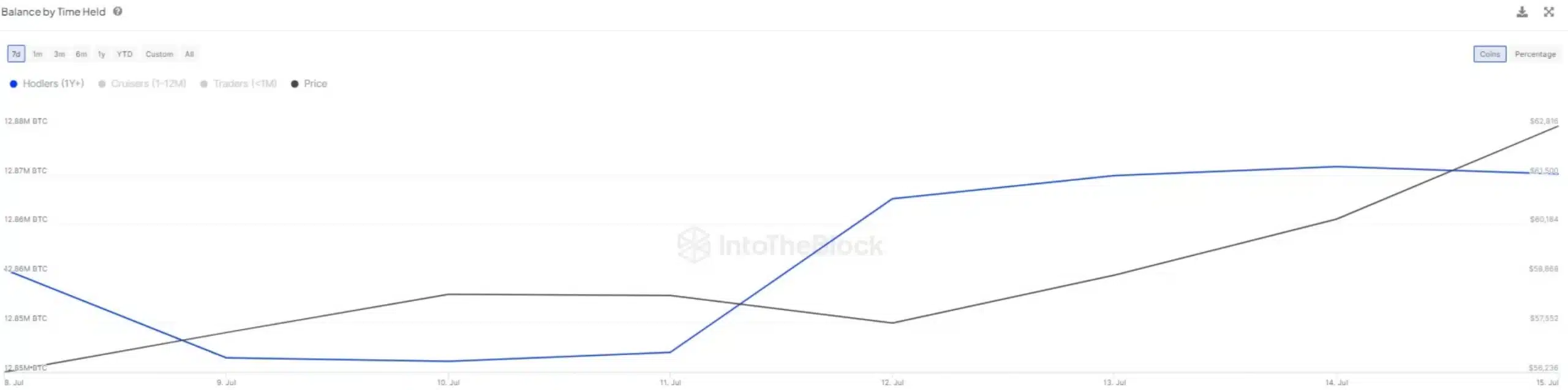

Long-term holders stand strong

At present, Bitcoin was experiencing a decrease of 0.84% and could be purchased for around $64,304. Yet, the RSI reading of 59 suggested a robust bullish trend in the primary cryptocurrency.

Long-term Bitcoin investors showed their conviction through this observation, according to IntoTheBlock’s analysis based on on-chain data.

Last week, Bitcoin investors with a long-term perspective demonstrated faith in the cryptocurrency by increasing their holdings, disregarding concerns over past dealings with Mt. Gox and the German government’s regulatory actions.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-19 16:08