-

Despite overtaking Solana, ETH’s NFT trade volume dropped last month

ETH’s price depreciated by over 7%, and market indicators were bearish too

As a seasoned financial analyst with a deep understanding of the crypto market and its trends, I have closely monitored Ethereum’s [ETH] performance in the NFT space over the past few months. Initially, Ethereum took a backseat to Solana [SOL] as the latter gained traction in the NFT ecosystem. However, Ethereum made a comeback by registering the highest amount of NFT sales volume in the last 30 days, according to Coin98 Analytics.

In recent months, Solana [SOL] emerged as a formidable competitor to Ethereum [ETH] in the NFT market. However, Ethereum has regained its lead in this area more recently. Therefore, it’s interesting to examine the current state of Ethereum’s NFT ecosystem.

Ethereum outshines Solana

As an analyst at Coin98 Analytics, I’ve recently come across some intriguing data in the NFT market. Specifically, Ethereum recorded the most significant sales volume for Non-Fungible Tokens (NFTs) over the past month.

In addition to Ethereum (ETH), Solana (SOL) and Bitcoin (BTC) were the top three performers in terms of NFT sales last month. Specifically, Ethereum recorded organic sales of approximately $137 million worth of NFTs. Solana and Bitcoin followed closely with sales of around $101 million and $75 million, respectively.

To discover the most successful Non-Fungible Token (NFT) collections on Ethereum as per DappRadar’s latest data, AMBCrypto conducted an investigation. The findings revealed that Liberty Cats, Pudgy Penguins, and Bored Ape Yacht Club were the leading NFT collections during the previous 30-day period.

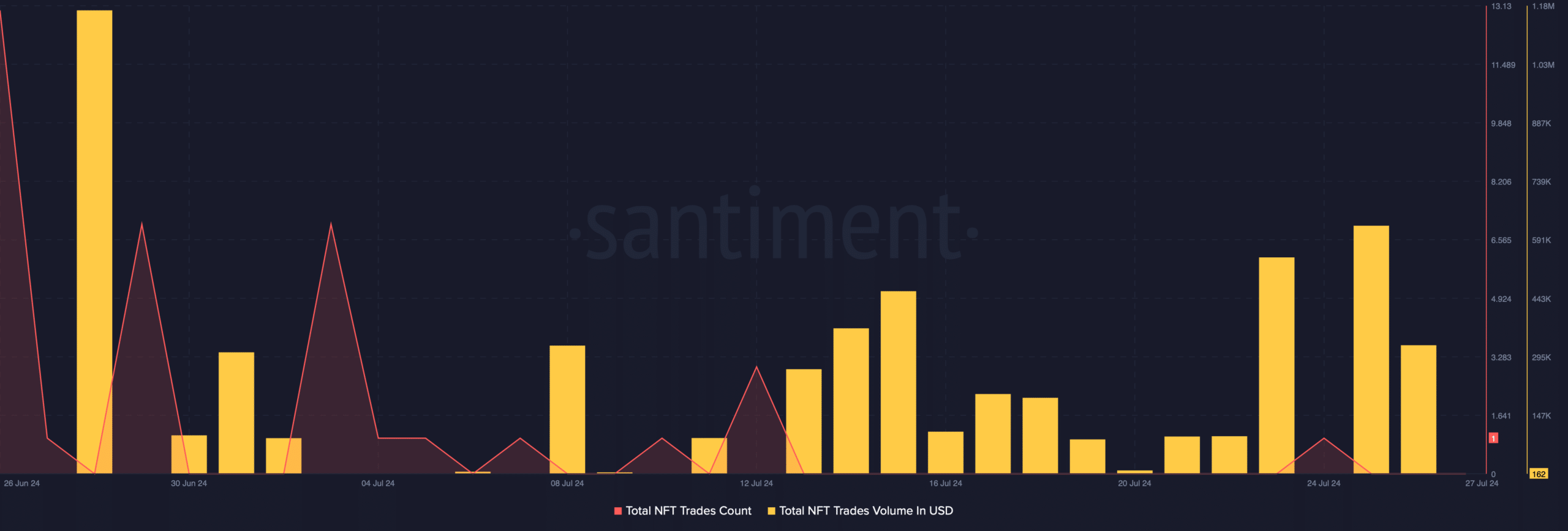

Yet, upon examining Santiment’s figures, a contrasting scenario emerged. Based on our assessment, there was a significant decrease in ETH‘s NFT trade counts last month. Additionally, its NFT trade volume in US dollars followed a similar downward trend during the same timeframe.

“According to the renowned analytics tool Cryptoslam, there was a decrease in Ethereum NFT sales during the previous month.”

According to the available data, Ethereum’s sales volume for Non-Fungible Tokens (NFTs) decreased by approximately 39% last month. A comparable downward trend was observed in both the number of sellers and NFT transactions, with values dropping by around 3.22% and 59%, respectively.

Nonetheless, ETH’s number of NFT buyers did hike marginally over the aforementioned period.

A look at ETH’s state

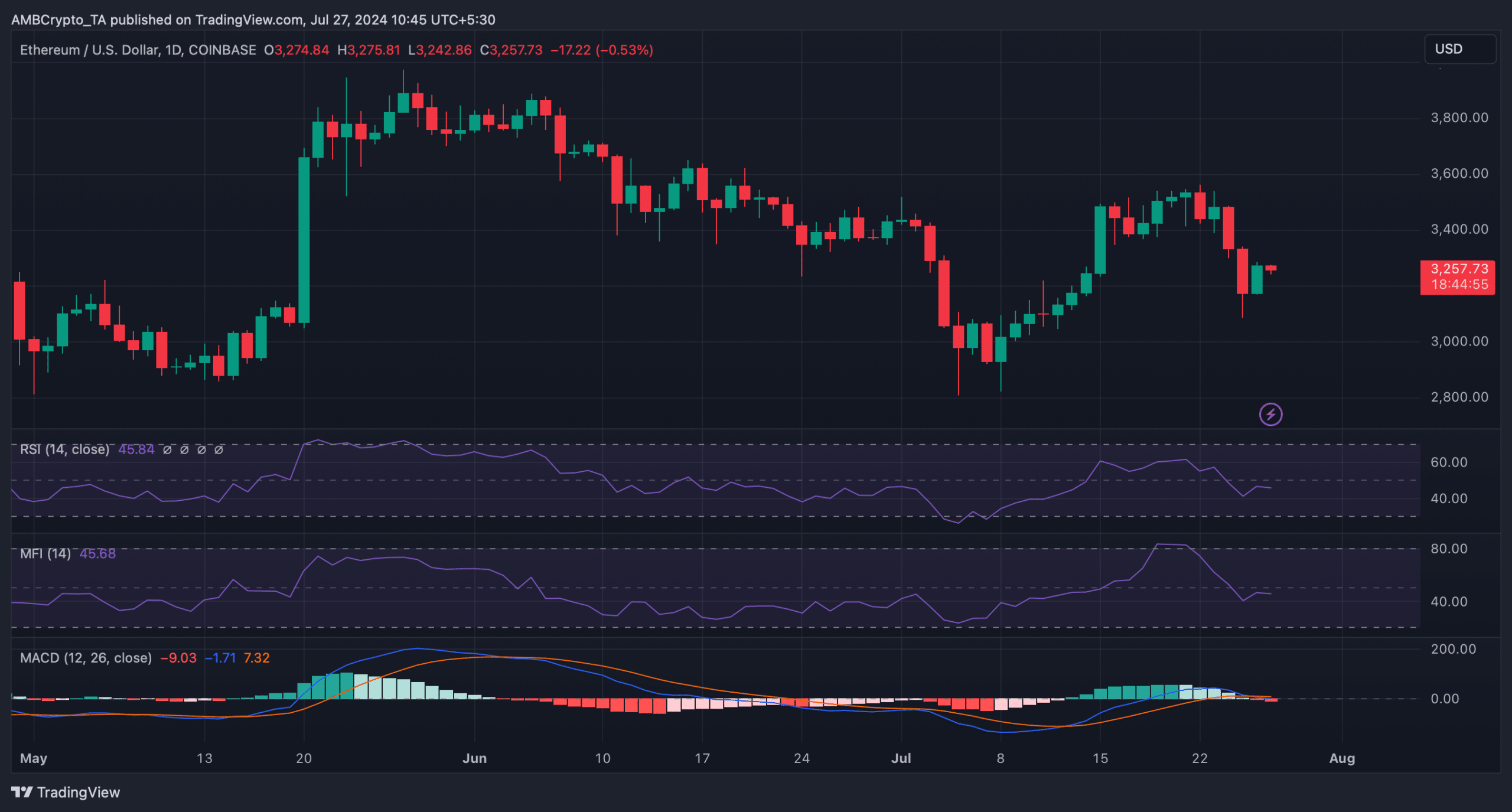

As events unfolded in the NFT sector, ETH‘s price experienced a significant decline of approximately 7%, causing ETH investors to become net sellers. Currently, Ethereum is being traded at $3,258.75, and its market capitalization exceeds $391 billion.

Examining the day-to-day price movements on a token’s chart is crucial for determining if the downward trend will persist.

Based on our examination, the MACD technical signal for Ethereum turned bearish. Its Relative Strength Index (RSI) recorded a decrease, while its Money Flow Index (MFI) similarly trended downward. These indicators collectively point towards a potential prolonged price drop for Ethereum.

Read Ethereum’s [ETH] Price Prediction 2024-25

At present, the fear and greed index for Ethereum (ETH) stands at 39%. Contrary to what one might expect, this figure signifies a “fear” phase in the market. Historically, when this particular metric reaches such levels, it has often preceded a bullish trend.

Read More

2024-07-27 12:30