-

WIF has recorded a significant decline in demand over the past week

Low social activity confirmed the hike in bearish sentiments too

Over the past 24 hours, the value of the meme cryptocurrency Dogecoin (WIF) has dropped by more than 10%. This significant decline has made it the top loser in the crypto market based on CoinMarketcap’s statistics.

At the current value of $3.50, WIF experienced a 14% decrease in price during the stated time frame, resulting in additional weekly losses.

More control for bears?

Over the past month, WIF‘s price has taken a downturn after a prolonged period of increase. Notably, during the last week, this cryptocurrency lost around 13% of its value when observed on a weekly chart.

The price decrease of this coin is reflecting the overall downward trend in the memecoin market. For instance, Floki (FLOKI) and Pepe (PEPE), two prominent assets, have experienced drops of 7% and 3%, respectively, during the same timeframe.

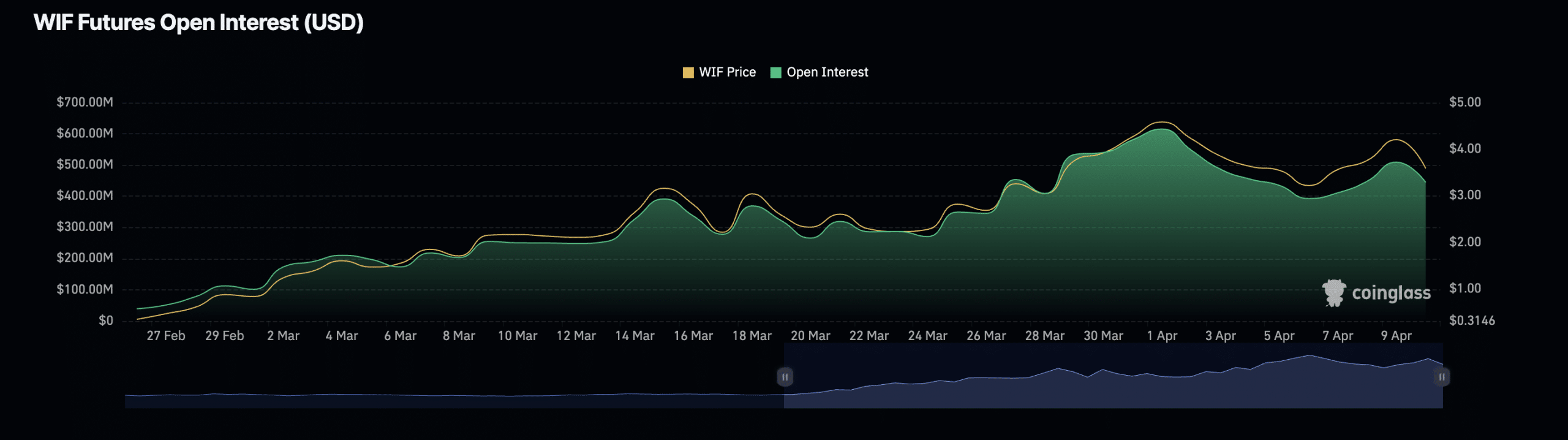

The analysis of WIF‘s Futures market indicates a rise in pessimistic views. Specifically, information from Coinglass shows that open interest for the token’s Futures contracts has decreased by approximately 29% since early April.

The amount of open Futures contracts for an asset signifies the number of unfilled or unsettled Futures trading agreements. A decrease in open interest implies reduced market action and possibly shifting trader attitudes.

At press time, WIF’s Futures open interest was $444.43 million.

The volume of futures trades on WIF‘s derivatives market has decreased, following a downward trend since early April. In the last day, this amounted to $1.3 billion. However, this represents a 9% decrease compared to the previous period.

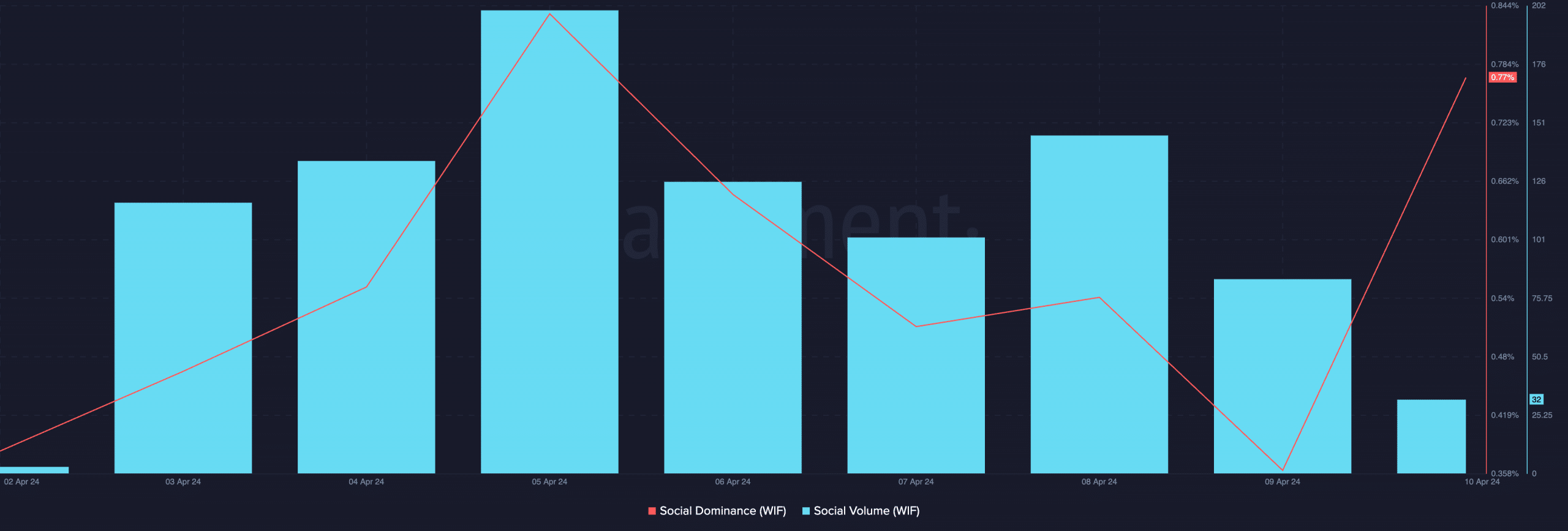

In addition, the social buzz around the memecoin, as measured through on-chain analysis, has decreased noticeably during the last seven days when it comes to social media mentions and hype.

Furthermore, based on Santiment’s findings, the social influence of WIF has decreased by 63% since 5 April, and its social media activity volume has dropped by 58% in the same timeframe.

Realistic or not, here’s WIF’s market cap in BTC’s terms

In simple terms, when an asset’s social media buzz decreases significantly during a time of increasing negative market sentiment, it can be a sign that the asset’s price drop is likely to continue.

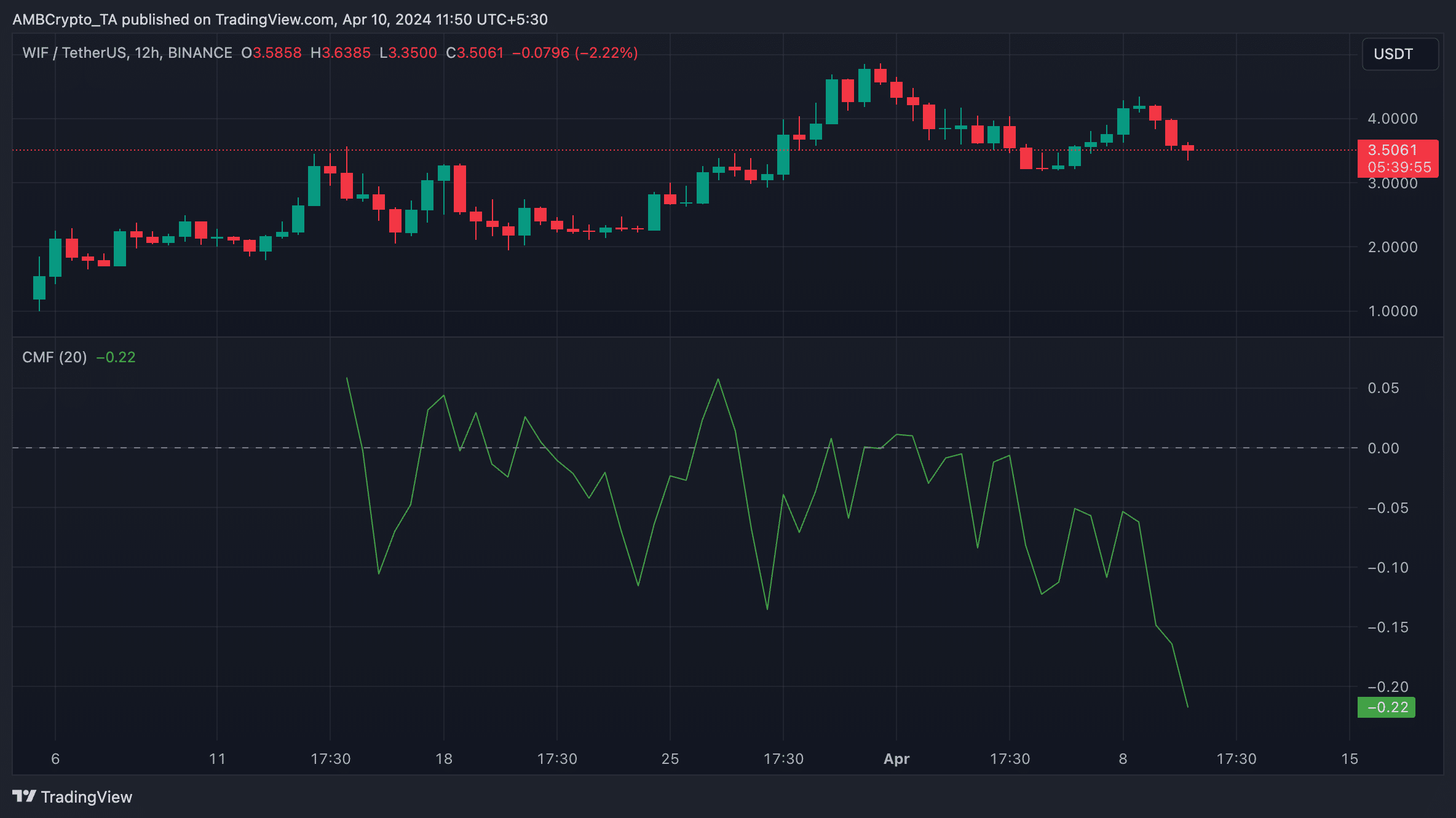

In simpler terms, the daily chart of WIF‘s key momentum indicators, including the Chaikin Money Flow (CMF), indicated a withdrawal of liquidity from its spot market as of now. The CMF, which represents the net flow of money into or out of an asset, had a negative value at the current moment.

The CMF of WIF‘s spot market is showing a decreasing trend of 0.22, indicating that more participants have chosen to sell rather than buy.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-04-11 02:15