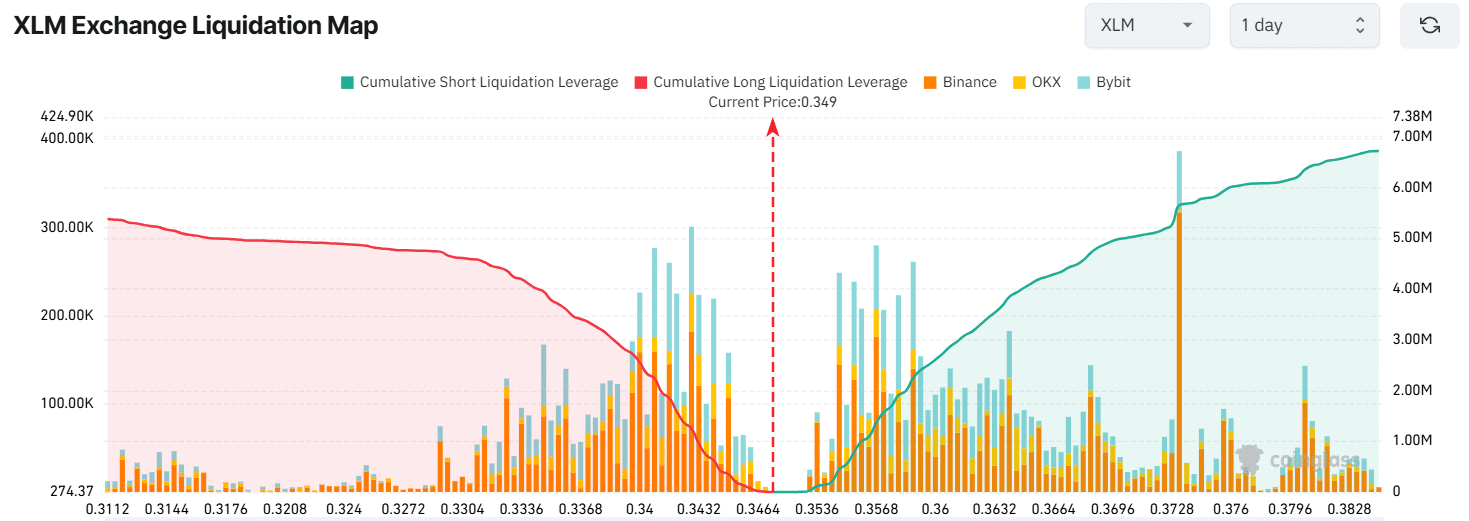

- At press time, traders seemed to be over-leveraged at $0.342 on the lower side and $0.373 on the upper side

- On-chain metrics revealed that exchanges have seen significant inflows of $3.9 million worth of XLM

As a seasoned crypto investor who has weathered many market storms and witnessed numerous cryptocurrency price fluctuations, I find myself cautiously bearish on Stellar (XLM) at this juncture. The technical analysis indicates a potential breach of XLM’s support area, forming a descending triangle pattern – a bearish indicator if there ever was one. Moreover, the significant inflow of $3.9 million worth of XLM to exchanges as reported by Coinglass suggests selling pressure that could further drive down its price.

Despite the persistent market volatility, Stellar’s native token, XLM, is currently under pressure from bearish market forces. At this moment, it seems that XLM might experience a significant drop in price over the next few days. Interestingly, other significant cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and XRP appear to be experiencing similar challenges as we speak.

Currently, XLM finds itself at a vital point of potential support. But with growing selling forces, there’s an indication that it may struggle to hold onto this level. If so, we might witness a decrease in price in the coming times.

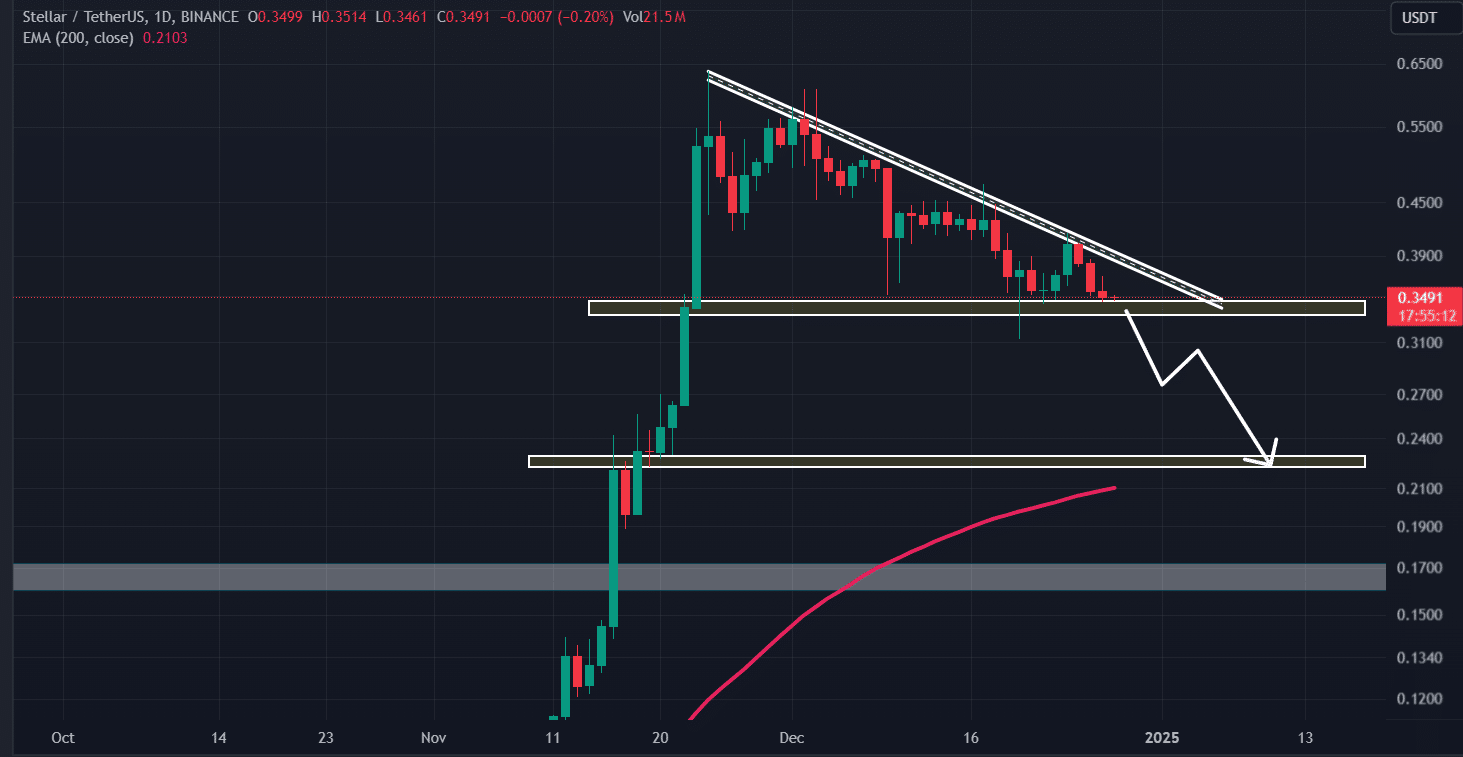

XLM technical analysis and key levels

As a crypto investor, I’ve noticed that Stellar (XLM) seems to have developed a descending triangle pattern on the daily chart, which typically indicates a potential breakout or breakdown. Currently, it appears as though XLM is breaking down, suggesting a possible drop in price as it breaches its support area.

Indeed, on three separate occasions this month, the XLM cryptocurrency has probed at the $0.334 support threshold. With each encounter, it seems that the strength of this support level diminishes progressively.

If Stellar Lumens (XLM) doesn’t maintain its current support at approximately $0.325 and ends the daily chart below this level, there is a high likelihood that the value might decrease by around 30%. This potential drop could lead XLM to reach the future price of $0.225.

Bearish on-chain metrics

It’s important to mention that the negative viewpoint for XLM appears to be validated by traders and long-term investors, as reported by Coinglass, an analytics firm specializing in crypto. The data from XLM’s spot transactions shows a substantial influx of approximately $3.9 million into exchanges across the cryptocurrency market, which could indicate increased selling pressure.

As a crypto investor, when I notice that assets are flowing out of long-term holder’s wallets into exchanges, I take it as a sign suggesting a possible price drop might be imminent. This situation, in my view, often presents an attractive chance for me to sell off my holdings.

Falling Open Interest and major liquidation areas

Over the past 24 hours, not only have long-term investors been holding onto their assets, but traders have also been closing their existing trades. In this same timeframe, Open Interest for XLM decreased by 4.5%, suggesting that traders are hesitant to establish new positions because of the current market anxiety.

As I analyze the current market situation, it appears that traders have aggressively positioned themselves at $0.342 on the lower end, with a total of $1.25 million invested in long positions. However, if the price were to drop below this level, these positions could potentially be liquidated.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-12-28 16:09