- XRP failed to react to the development despite its fundamental deflationary impact.

Demand for the token decreased but the liquidations levels suggested a price increase.

RippleX, the open development platform associated with Ripple (XRP), declared that an update called ‘fixAMMOverflowOffer’ has been implemented. This change allows the Automated Market Maker (AMM) to operate effectively on the XRP Ledger (XRPL) once again.

For those not in the know, an Automated Market Maker (AMM) is a type of smart contract on the XRP Ledger. Its role is to boost liquidity for assets within the ledger and provides an additional deflationary impact for XRP.

Difficulties addressed

According to AMBCrypto’s analysis, the “fixAMMOverflowOffer” version 2.1.1 had been activated in the ledger. As a result, the network now has the capability to manage larger synthetic Automated Market Making (AMM) offers more effectively, an issue that was difficult to handle before.

After the upgrade, XRP‘s price failed to advance and instead declined 12 hours later, influenced by Bitcoin‘s own price decrease.

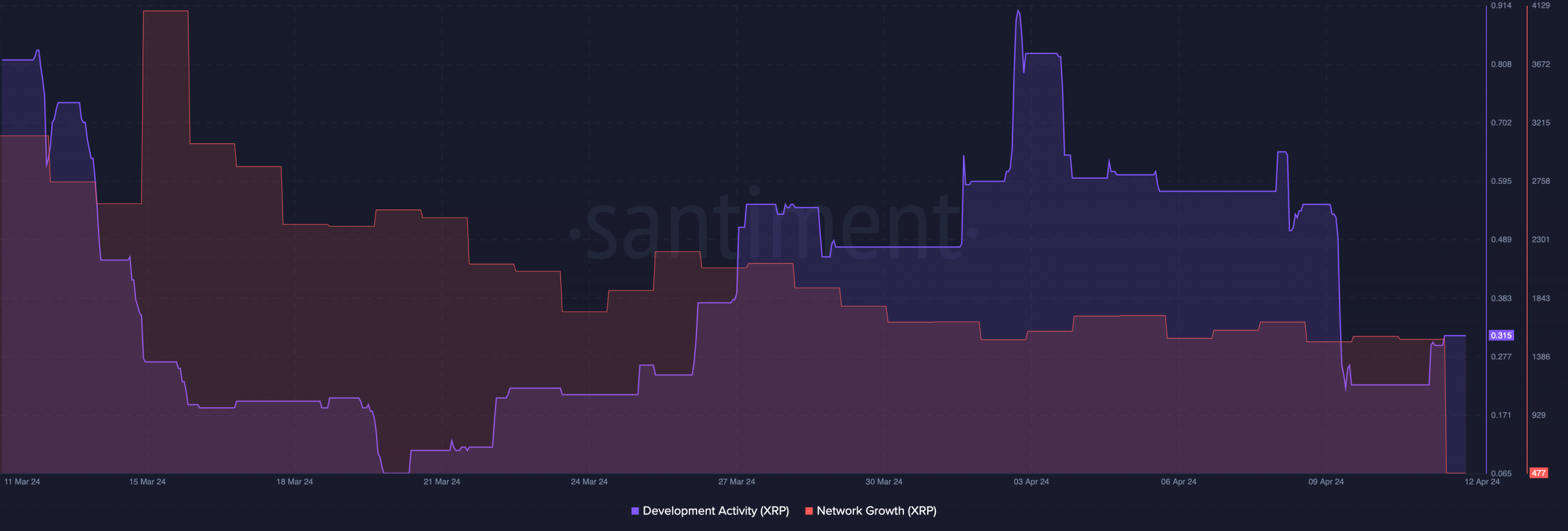

Additionally, Santiment indicates that there was a decrease in development activity on Ripple’s network following the upgrade.

The implication was that developers weren’t putting much effort into refining the network. If this trend persists, XRP‘s value could drop, potentially falling below its current price of $0.54.

If development activity picks up, on the contrary, the token might stand a chance of bouncing back. Similar to development activity, network growth is another area that has been lagging behind.

XRP still isn’t a top choice

The expansion of a network is indicated by the rise in the count of fresh connections engaging with it. An uptick in this figure suggests that acceptance is on the rise, as newly joined users carry out their initial transactions.

Instead of “However, that was not the case with XRP. At press time, network growth declined, indicating low traction. In a case where this metric increases, the demand could spur XRP in the upward direction,” you could say:

If the market conditions are the same or even more unfavorable as of now, the price could drop further. In addition to examining these indicators, AMBCrypto looked into the liquidation levels.

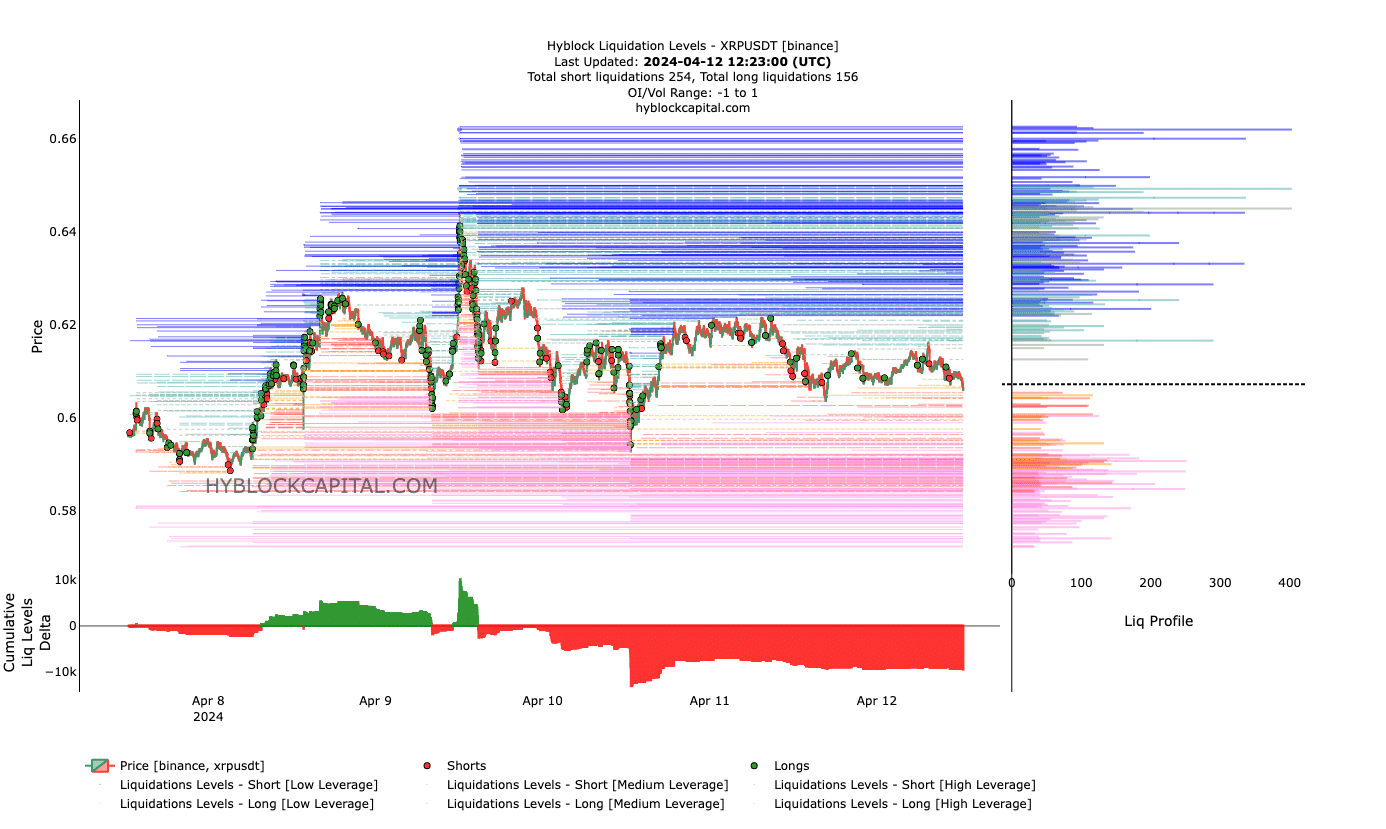

At the current moment, there isn’t much trading activity in XRP between the prices of $0.60 and $0.61. These levels could potentially trigger significant sell-offs (liquidation events) if the market moves in that direction.

If the current situation persists, the number of liquidations for long or short positions may be limited around these price points. However, if the token price increases and ranges between $0.63 and $0.67, numerous positions could be eliminated.

Another way to phrase this is: Furthermore, the Cumulative Liquidation Levels Delta (CLLD) indicated a bias towards buying positions. At present, the CLLD showed a deficit, implying that more short positions were being closed out than long positions.

Read Ripple’s [XRP] Price Prediction 2024-2025

The drop in XRP‘s price showed a bearish trend initially, but this could signal a bullish outlook if the downtrend (CLLD) continues. In that case, there may be a greater probability for XRP’s value to rise.

But if the condition changes, the token might trade sideways in the short term.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- How Potential Biden Replacements Feel About Crypto Regulation

- Why Shiba Inu’s 482% burn rate surge wasn’t enough for SHIB’s price

2024-04-13 08:07