- Shiba Inu revisits levels that led to 300% gains.

- More traders are pro-long compared to shorts.

As a seasoned analyst with years of experience in the cryptosphere, I find myself intrigued by Shiba Inu’s [SHIB] recent price action. The parallels between its current levels and those that preceded a 300% surge earlier this year have me reminiscing about the memecoin mania we witnessed back then.

Shiba Inu (SHIB) continues as the second-largest meme cryptocurrency, boasting a market value surpassing 7.8 billion dollars, roughly half of Dogecoin‘s market capitalization.

Reflecting on the past 24 hours, Shiba Inu (SHIB) saw a dip of 3.13%. But as we stand now, the market movements hint at promising prospects for the remaining quarter of this year.

Back at the start of the year, Shiba Inu (SHIB) was priced similarly to how it was before its dramatic 300% increase. This has stirred optimism among investors, who are now hoping for another price surge like the one experienced earlier in the year.

Although it’s unclear if Shiba Inu (SHIB) will be able to match its initial quarter’s performance, the patterns that emerged during its correction period provide useful information for the coming months.

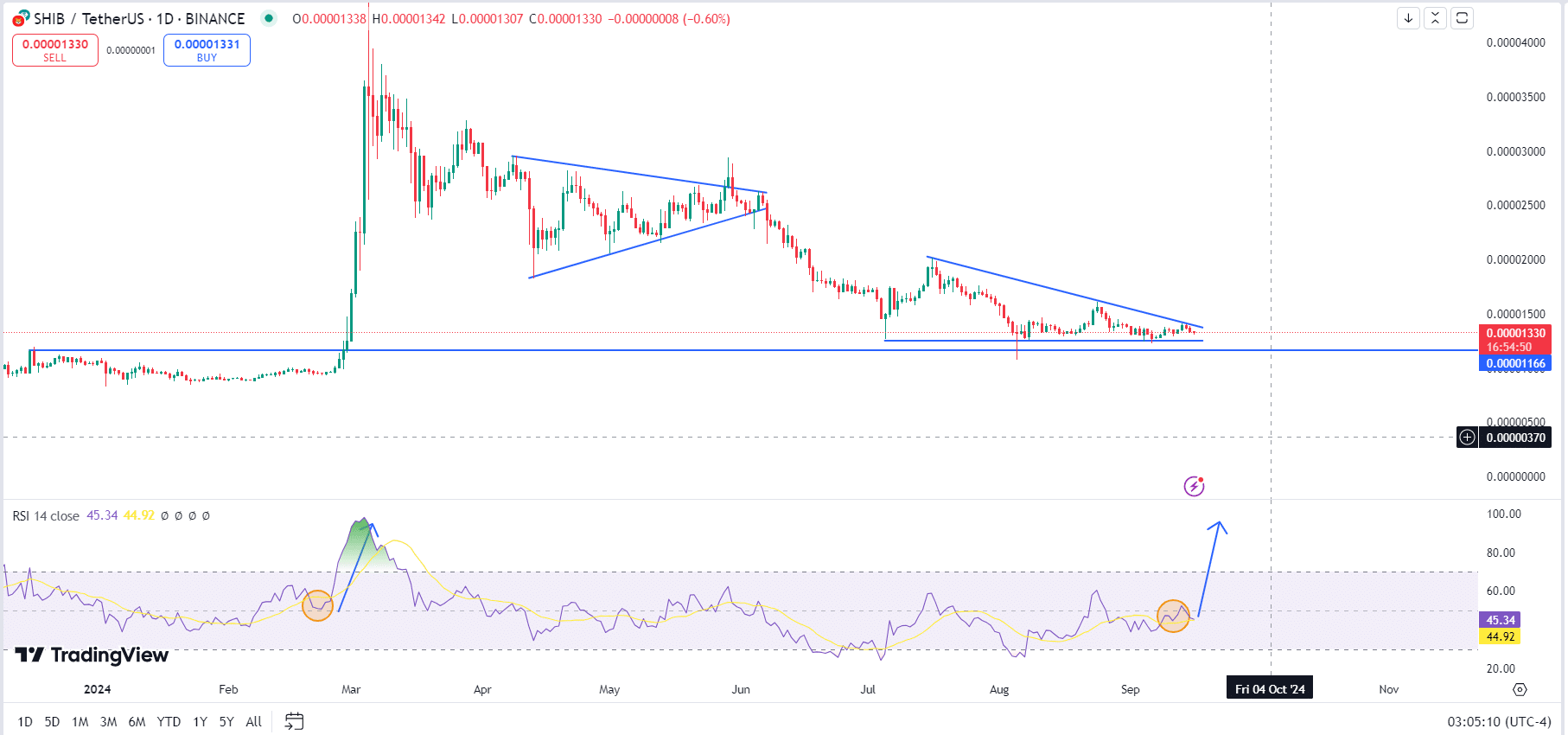

After the consolidation period, a symmetrical triangle shape emerged on our daily graph. Subsequently, the price dropped sharply, reaching a record low of $0.00001264 – a level that many believed marked the floor.

On August 5th, a significant market drop occurred, pushing the price of SHIB/USDT down to $0.00001081 – a new record low. But this dip was quickly rebounded, and since then, the pair has been steadily consolidating within a narrowing triangle pattern.

The use of this shortened form implies an upcoming surge, given that markets typically cycle through periods of contraction (shrinkage) and expansion (growth).

Traders anticipate that Shiba Inu (SHIB) will hold its ground at the base of the triangle’s foundation. Should the price drop beneath this level and remain low, it might indicate a change in market opinion, although such an event is considered less probable.

Even though it’s important to keep an eye on immediate market fluctuations which can sometimes be unforeseeable, remember that patterns tend to be more predictable when considering a longer timeframe instead.

Total liquidations heatmap

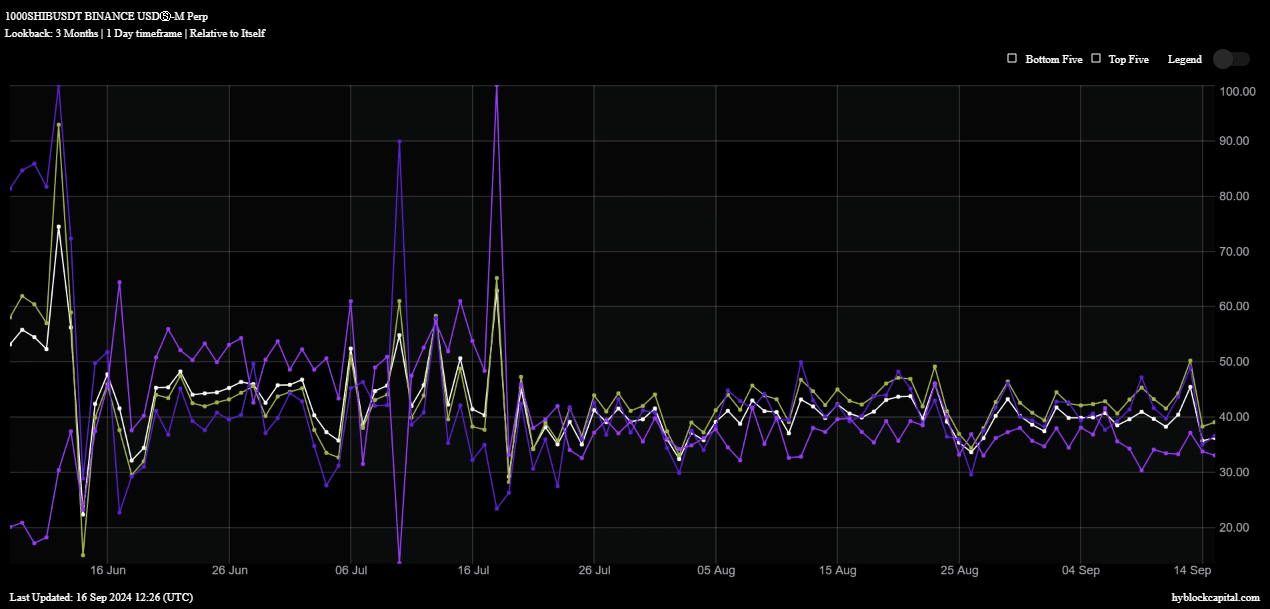

Looking at the Shiba Inu’s total liquidation chart, it is noticeable that there are more long-position holders than short-sellers, even though the broader cryptocurrency market has been experiencing a downtrend since April.

The analysis for Shiba Inu’s futures market shows a positive outlook, as there are more traders holding long positions (38%) than short ones (32%). This difference amounts to a significant 36% advantage for long positions.

Even though the current figures aren’t exceptionally high, they correspond to levels at which Shiba Inu (SHIB) has experienced significant price increases in the past.

Shiba Inu open interest suggest…

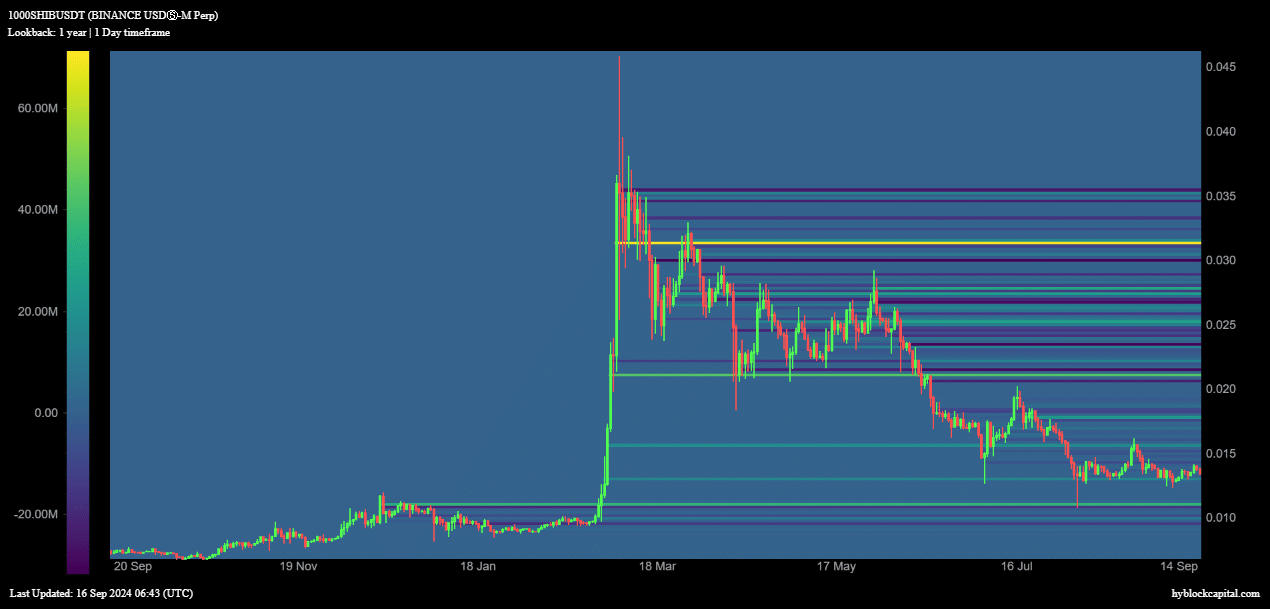

Furthermore, open interest data highlights the potential for upward movement.

Right now, the open interest for SHIB is nearly at its current price mark, sitting at approximately $35.866 million. This suggests that traders are eager to pour in substantial investments once the price touches around 0.000011.

As an analyst, I’m observing a potential swift turnaround in the market, as the buying pressure at this specific level appears to be substantial. Notably, there’s a sizeable group of traders with an open interest of approximately $43.933 million, strategically focusing on the price point of $0.000021. This suggests they anticipate a potential increase in price at this level.

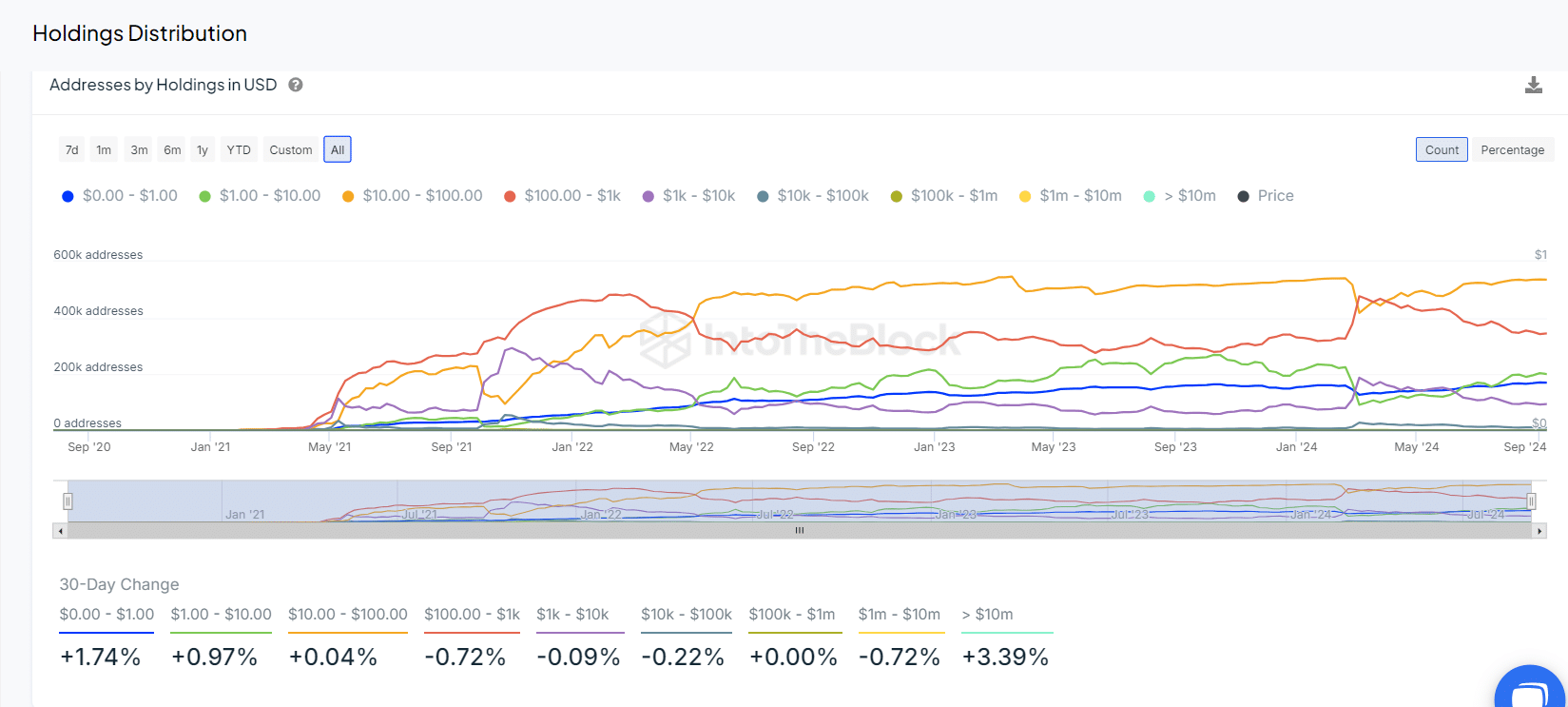

Holding distribution

Over the past month, significant Shiba Inu investors (owning over $10 million worth of SHIB) have boosted their ownership by approximately 3.39%. This increase in holdings indicates a tendency towards accumulating the cryptocurrency, even during the recent downturn in its market price.

Instead, retail traders exhibit varying trends, such as minor upticks, downticks, or no movement at all, resulting in an evenly distributed pattern overall.

Although SHIB‘s current prices are experiencing a drop, the data indicates that it might be preparing for possible increases in value, given the ongoing accumulation. Notably, this trend seems to be more prevalent among significant investors.

Read More

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- The Lowdown on Labubu: What to Know About the Viral Toy

- Masters Toronto 2025: Everything You Need to Know

2024-09-17 11:04