-

PEPE’s large holders sold off significant portions of their holdings in the last 30 days

On-chain data revealed that the memecoin was undervalued and could rally after the event

As a seasoned crypto investor with a keen eye for on-chain data and market trends, I find the recent developments surrounding PEPE, the popular memecoin on Ethereum, intriguing. The large holders of PEPE selling off significant portions of their tokens within the last 30 days has raised some eyebrows in the community.

Several market investors view the impending Spot Ethereum [ETH] ETF debut as a potentially positive sign. In contrast, large-scale PEPE [Pepe] token holders appear less enthusiastic about this development.

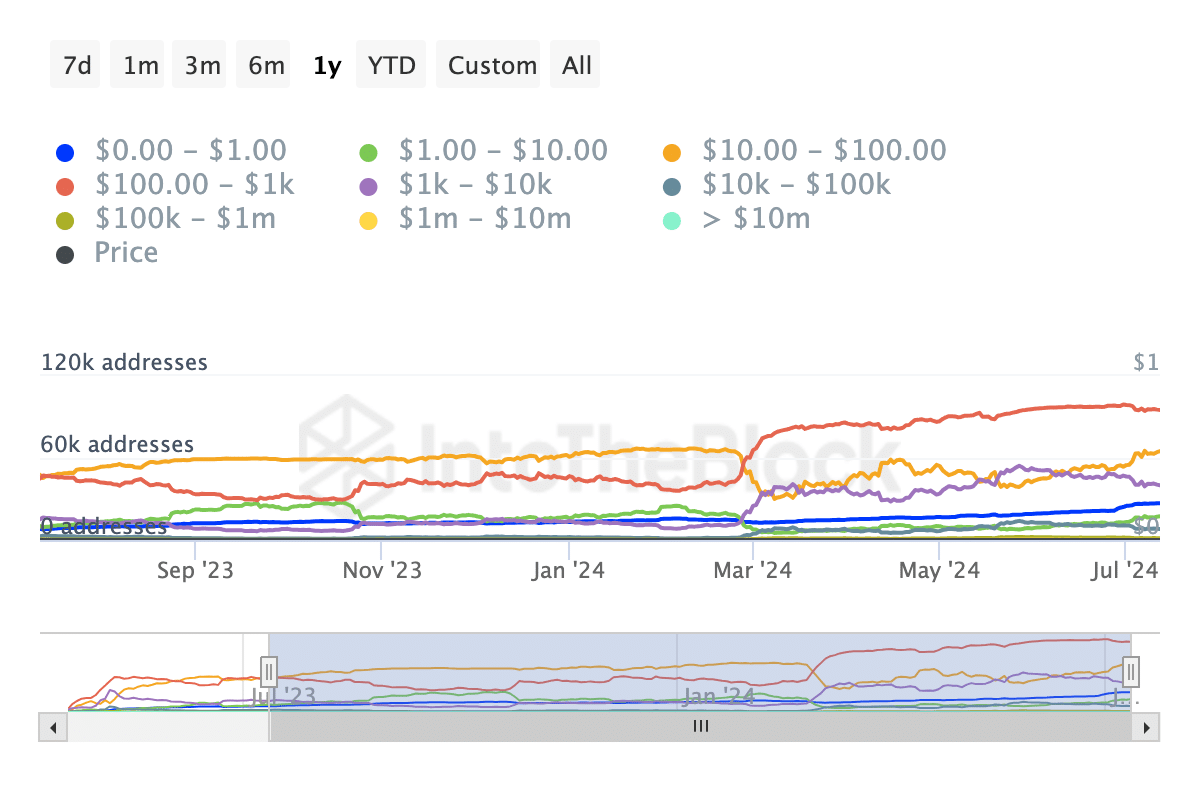

As a researcher, I discovered this insight by analyzing the holding data associated with various addresses. This specific metric enables us to categorize addresses into distinct clusters based on their buying or selling tendencies regarding their assets.

Is the memecoin in chains?

As of the current moment, PEPE token addresses containing values between $100,000 and $10 million experienced a double-digit percentage decrease. This drop suggests that these holders may have disposed of some of their tokens over the past month.

It’s unexpected that PEPE, being the leading memecoin on the Ethereum network, wouldn’t align with the overall bullish sentiment in the memecoin market.

As a researcher studying the potential impact of Ethereum Exchange-Traded Funds (ETFs) going live on the price of PEPE, I hypothesize that the value of PEPE might rise if this trend persists. This development could serve as a catalyst for PEPE’s growth. However, it may be difficult to maintain this upward momentum without an increase in buying pressure from investors.

As of the moment this information is being released, PEPE‘s value stood at $0.0000087. This figure represented a decrease of 49.27% compared to its record-high price achieved on May 27th.

Based on the findings from the analysis, a potential increase in circulation could lead to a decrease of approximately 55% from current highs for the token. Yet, following the Ethereum ETF’s launch, there is a strong possibility that the token will exhibit positive performance on price charts.

Higher highs will come later

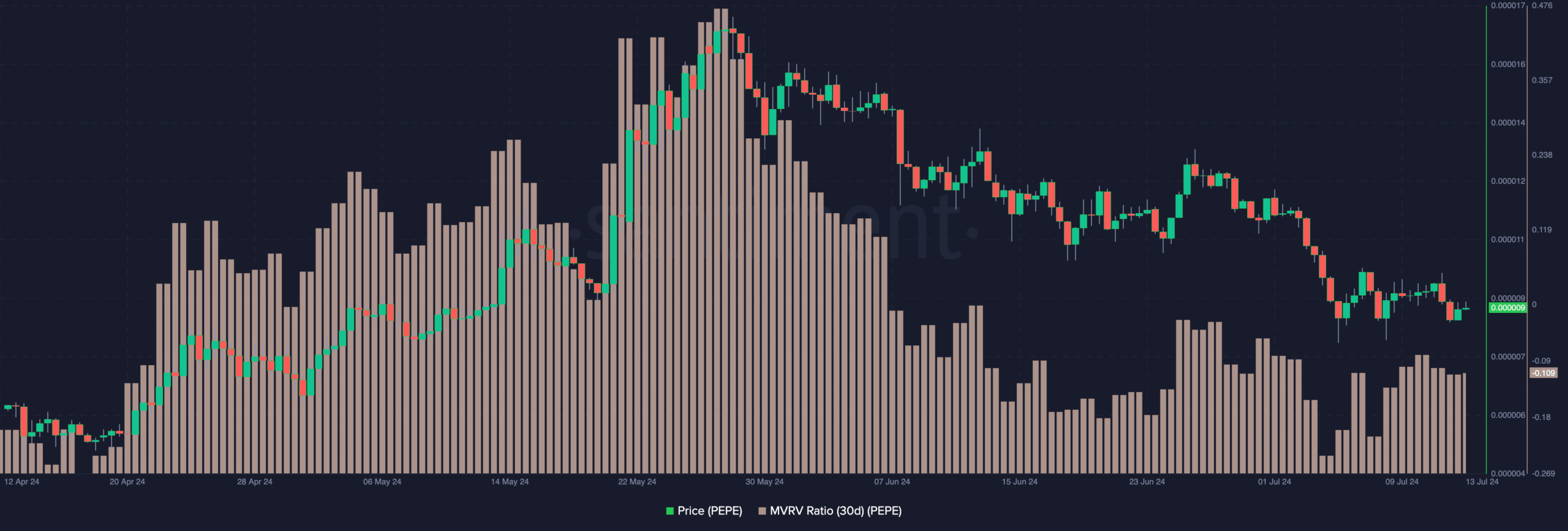

The MVRV ratio signaled this outcome, offering valuable insights into market profits.

When the market capitalization grows faster than the realized capitalization, indicated by an increasing ratio, investors may feel compelled to offload their cryptocurrencies. Conversely, a decreasing ratio implies that the realized capitalization significantly surpasses the market capitalization.

As an analyst, I would interpret this as: The current market conditions have resulted in unrealized losses for most investors holding PEPE, and there’s usually little incentive to sell during such periods. At the present moment, PEPE’s moving average variance ratio over the past 30 days stands at -10.90%. This suggests that the token has experienced weak demand dynamics recently.

Despite the downside, this quirk could potentially make memcoin holders reluctant to sell. Consequently, some may view the coin as underpriced given its present market circumstances.

Should buying demand increase significantly in the future, there’s a chance the price may try to revisit its previous highs reached in May. Surprisingly, certain analysts hold optimistic views about the memecoin despite the pessimistic indicators before the ETF debut.

Realistic or not, here’s PEPE’s market cap in ETH terms

One possibility: Donny Dicey, an analyst at X, shares his perspective on how the token may respond following the Ethereum ETF debut.

“The Ethereum ETF becoming active could rekindle excitement in the market, potentially leading to a surge in value for memecoins. It’s not certain that this will happen, but if it does, the market capitalization of these coins might reach 5.5 billion once more.”

Read More

2024-07-14 07:03