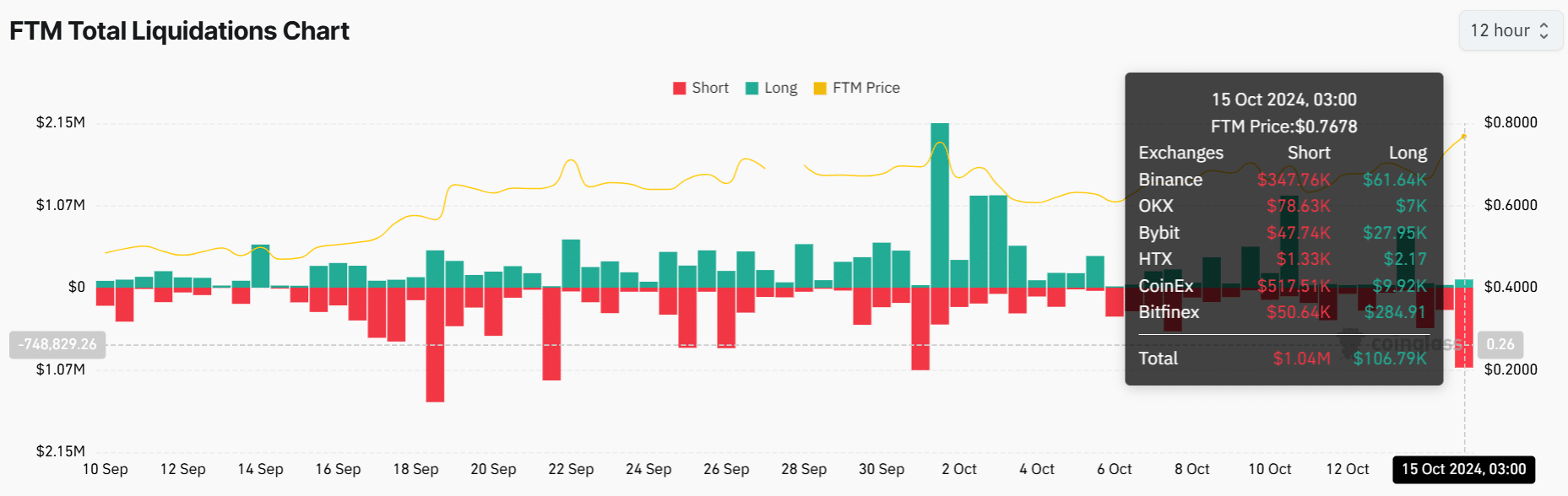

- FTM’s short liquidations spiked to $1M after the price jumped 10% to $0.76.

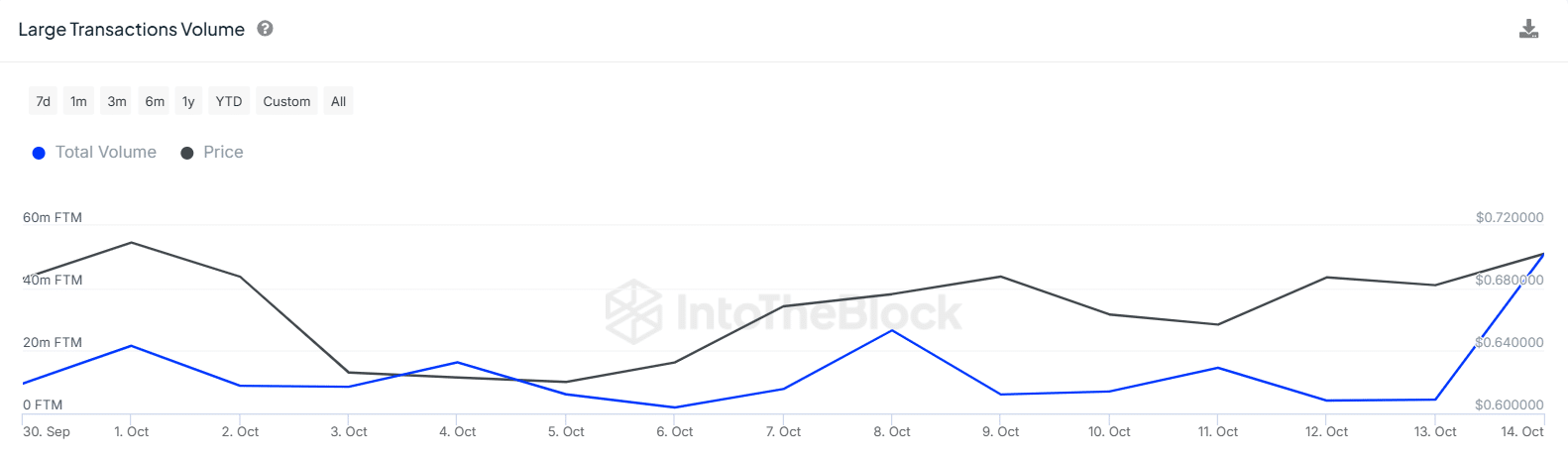

- Large transaction volumes also spiked by 1,000% showing a surge in whale activity.

As a seasoned researcher with years of experience in the cryptocurrency market, I must say that the recent price action of Fantom [FTM] has been quite intriguing. The spike in short liquidations to $1M and the surge in large transaction volumes by 1,000% are clear signs of significant activity in the FTM market.

In the past few weeks, Fantom [FTM] has been experiencing an upward trajectory, with its 30-day growth exceeding 50%. As of now, each Fantom token is being traded at $0.76, following a 9% jump in the last 24 hours.

During this surge in the cryptocurrency market, an optimistic outlook (bullish sentiment) was one factor that contributed. However, two additional triggers significantly boosted the upward trend as well.

Spike in short liquidations

In simpler terms, a surge in Fantom’s value led to financial losses for those who had bet against it (short sellers). Over the course of one day, these short liquidations exceeded $1 million, making it the second-largest such event this month.

When the cost of an investment climbs and reaches a point where short sellers must purchase the asset to meet their obligations, this extra buying demand boosts the value of FTM.

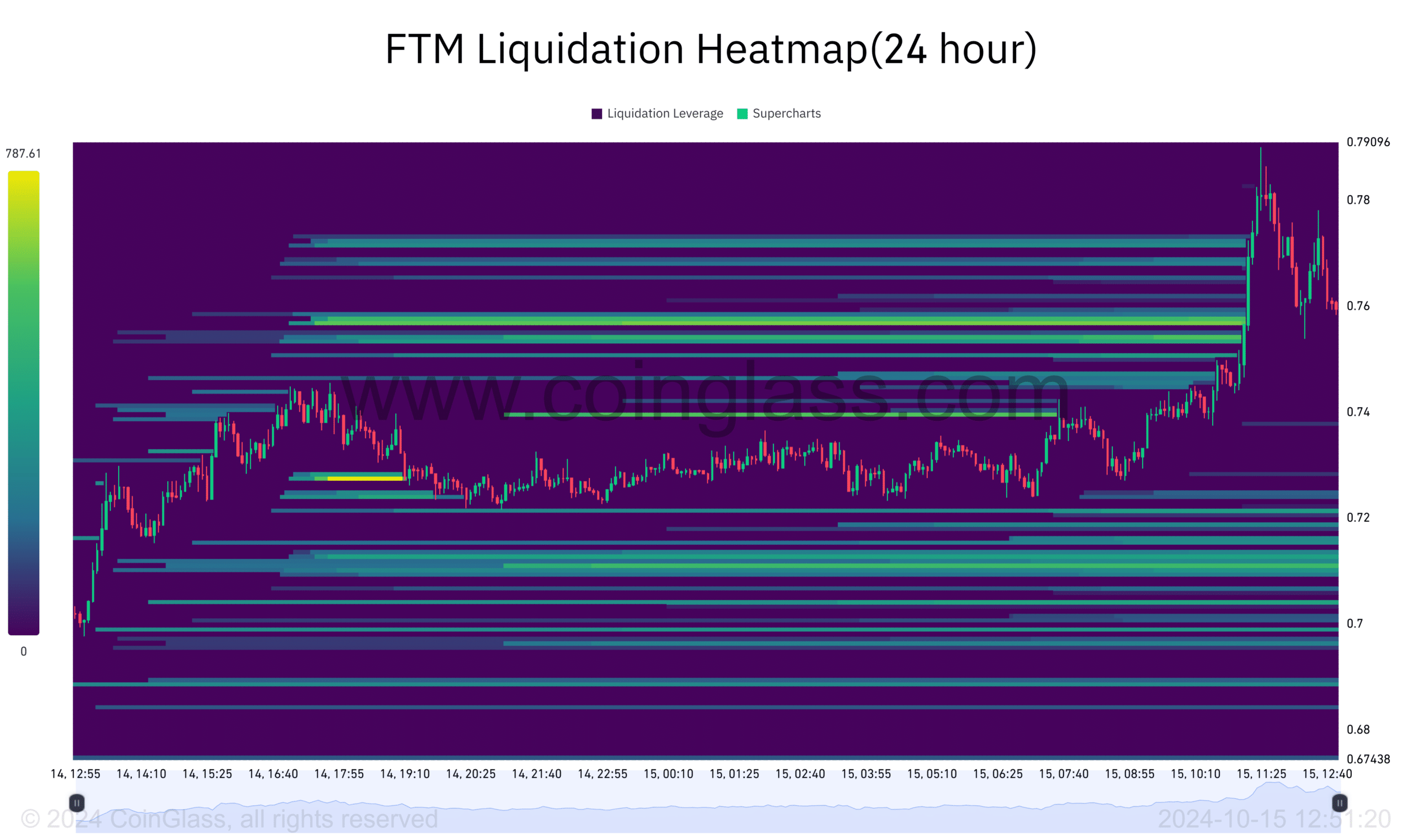

The liquidation chart for FTM indicates a highly active liquidation area ranged from approximately $0.76 to $0.78. When the price ascended and touched these points, it triggered compulsory purchases among short sellers, resulting in increased buying pressure and momentum moving upwards.

Large transaction volumes surge by 1,000%

The increased whale activity has significantly contributed to the all-time high gains of FTM. According to IntoTheBlock’s data, transactions above $100,000 for FTM skyrocketed from 4.38 million to an impressive 50.78 million, representing a stunning 1,000% increase.

It appears that an uptick in significant transactions occurred at the same time as a price rise, indicating it’s possible that ‘whales’ (large investors) might have been buying Fantom (FTM). This surge in purchases could be the reason behind the recent price increase.

Notably, a significant portion – about 73% – of the total FTM (Fantom) supply is managed by whales. Consequently, an increase in substantial transactions might induce price fluctuations or volatility.

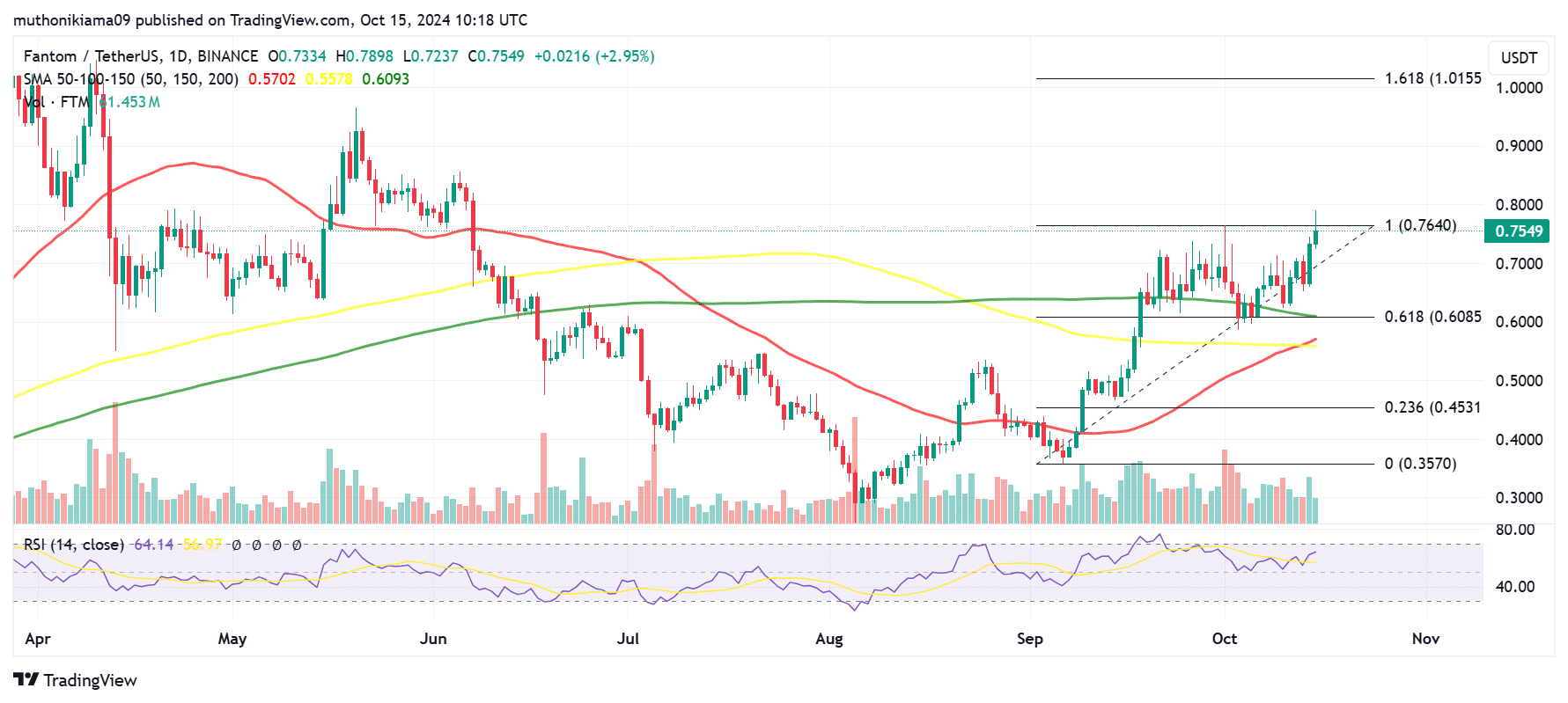

Can FTM rally to $1?

In simpler terms, the price of FTM has been rising strongly since its short-term average (50-day Simple Moving Average) went above its long-term average (150-day SMA) this week. This shift happened at around the same time as a significant increase in buying activity, which is clearly indicated by the spike in the volume histogram bars.

As an analyst, I’m observing that the 50-day Simple Moving Average (SMA) is gradually trending upward and getting closer to the 200-day SMA. If this 50-day SMA surpasses the 200-day SMA, it will create a golden cross for Fantom, which typically boosts the optimistic sentiment among investors.

In simpler terms, when the Relative Strength Index (RSI) stands at 64, it suggests that there are more buyers than sellers, indicating a strong bullish momentum.

Read Fantom’s [FTM] Price Prediction 2024–2025

Should the current purchasing momentum persist and Fantom (FTM) manages to maintain its position above $0.76, the next significant barrier I might encounter would be situated above the $1 mark.

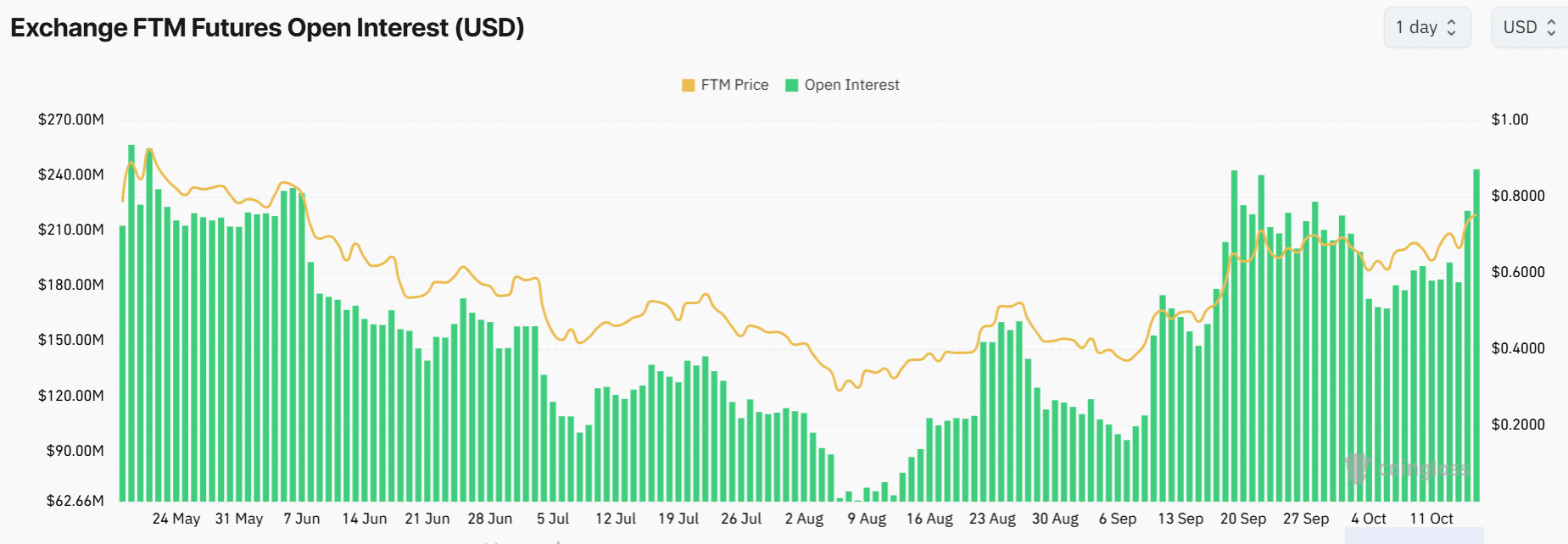

A significant rise in open interest might be contributing to this substantial price shift. At the moment of reporting, FTM’s open interest stands at a staggering $243M, which is its peak since May.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2024-10-16 03:35