-

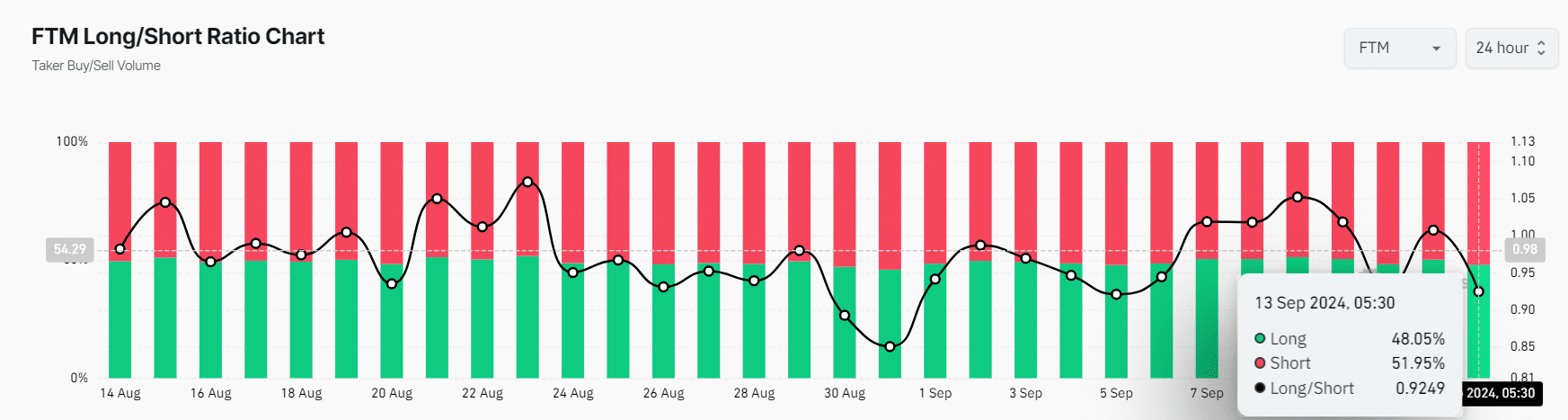

FTM’s Long/Short Ratio was 0.924 at press time, indicating trader bearish market sentiment.

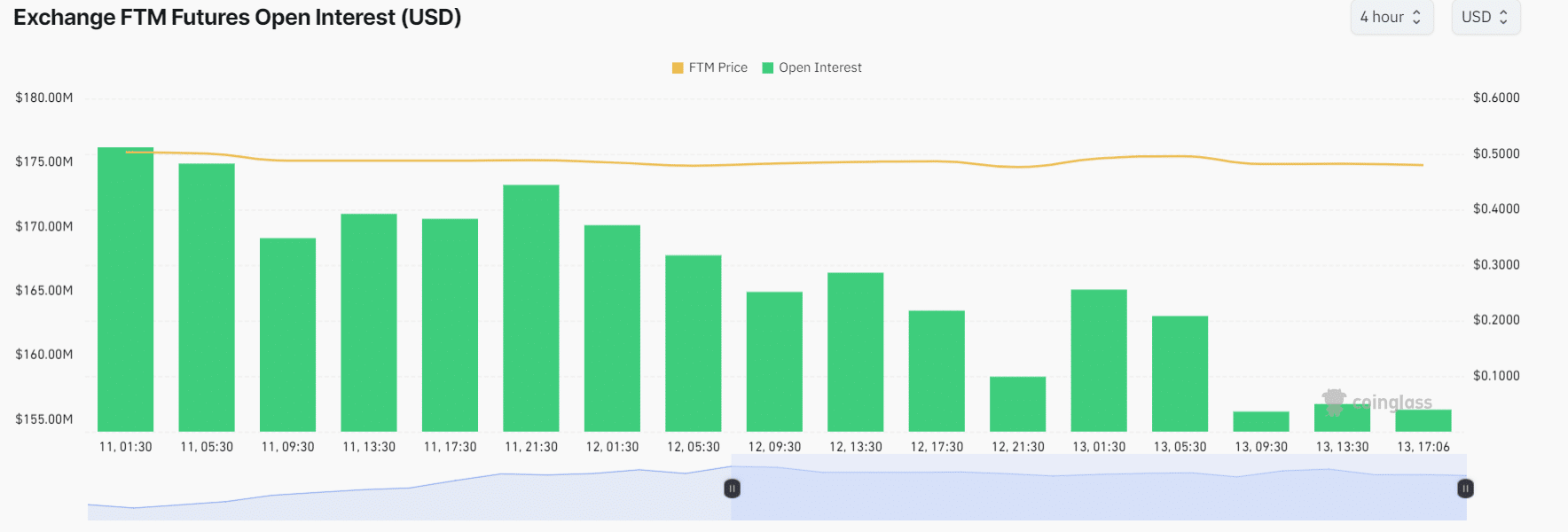

FTM’s Futures Open Interest has declined by 7.5% in the last 24 hours.

As a seasoned analyst with years of experience navigating the cryptocurrency market, I must say that Fantom [FTM] is currently in a precarious position. While it has shown signs of resilience in the form of an inverted head and shoulder pattern, the overall sentiment seems to be bearish based on both technical and on-chain data.

Fantom [FTM] is currently in a crucial make-or-break situation. However, per on-chain data, it seems poised for a price decline in the coming days.

Although an inverted head and shoulder pattern suggesting bullishness forms on the daily chart for FTM, its overall sentiment seems bearish.

FTM technical analysis and key levels

Over the past four days, I’ve observed that Fantom (FTM) has been confined to a narrow band, specifically ranging from approximately $0.472 to $0.50. At the moment of writing this, FTM is hovering near the lower limit of this range. This information is based on technical analysis conducted by AMBCrypto.

On the daily chart, it was moving beneath the 200-day Exponential Moving Average, suggesting a continuous descent.

If Filecoin (FTM) falls beneath the $0.469 mark during daily trading and ends the day below this level, it may likely see a significant decrease of approximately 8%, potentially reaching the $0.431 price point.

If the market opinion changes and Fantom Token Market (FTM) finishes a day’s trading above the $0.50 price point, it might experience an increase of approximately 9%, potentially reaching the $0.55 level.

To put it in my own words as an analyst, after experiencing a substantial 40% price surge from the 7th to the 10th of September, the market has since consolidated.

It appeared that the current market sentiment is more favorable for scalpers, who typically trade in a range-bound market, rather than for investors or swing traders.

FTM looks bearish, on-chain

At the moment of reporting, data recorded on Fantom’s blockchain was indicating a bearish trend. As per Coinglass, a data analytics firm specializing in cryptocurrencies, the Long/Short Ratio for Fantom Token (FTM) was 0.924 at the same time.

A value below 1 indicates trader bearish market sentiment or vice versa.

Furthermore, 52% of top traders held short positions at this time, while 48% held long positions.

Conversely, it appears that the number of open trades for FTM‘s Futures has decreased by 7.5% over the past day. This could mean that traders are closing out their long positions because they’re worried about an impending price drop or due to the unpredictable market fluctuations at present.

Open Interest has been continuously declining since the 11th of September.

Additionally, the Funding Rate for FTM‘s OI-Weighted is below zero and displayed in red, which typically indicates a predominant bearish outlook among traders.

Read Fantom’s [FTM] Price Prediction 2024–2025

After examining all the parameters, it seems that the bears are currently controlling the asset and have the potential to liquidate more long positions.

Currently, FTM is hovering around the $0.48 mark following a 2.5% drop in its price within the past day. Over this same duration, its trading activity has decreased by approximately 27%, suggesting reduced interest among traders.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- BLUR PREDICTION. BLUR cryptocurrency

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

2024-09-13 17:43