-

Fantom dApp volumes have increased three-fold within 24 hours to over $9M.

Rising volumes fueled a bullish rally as FTM attempted to breach a critical resistance at $0.52.

As a seasoned researcher with years of experience in analyzing cryptocurrency markets, I’ve seen my fair share of bullish and bearish trends. Today, however, I find myself intrigued by Fantom [FTM]. Despite the overall market downturn, FTM has managed to defy the odds and surge by 4%, trading at $0.511 at press time.

Today, the cryptocurrency market generally saw a drop, as many alternative coins (altcoins) were trading in negative figures. Yet, Fantom [FTM] bucked this downward trend by increasing by 4%, trading at approximately $0.511 as we speak.

In the last seven days, FTM has been one of the best performers on the market, boasting a 15% increase. This impressive growth is fueled by an increased demand, as trading volumes have spiked over 150% according to CoinMarketCap’s latest data at the time of press.

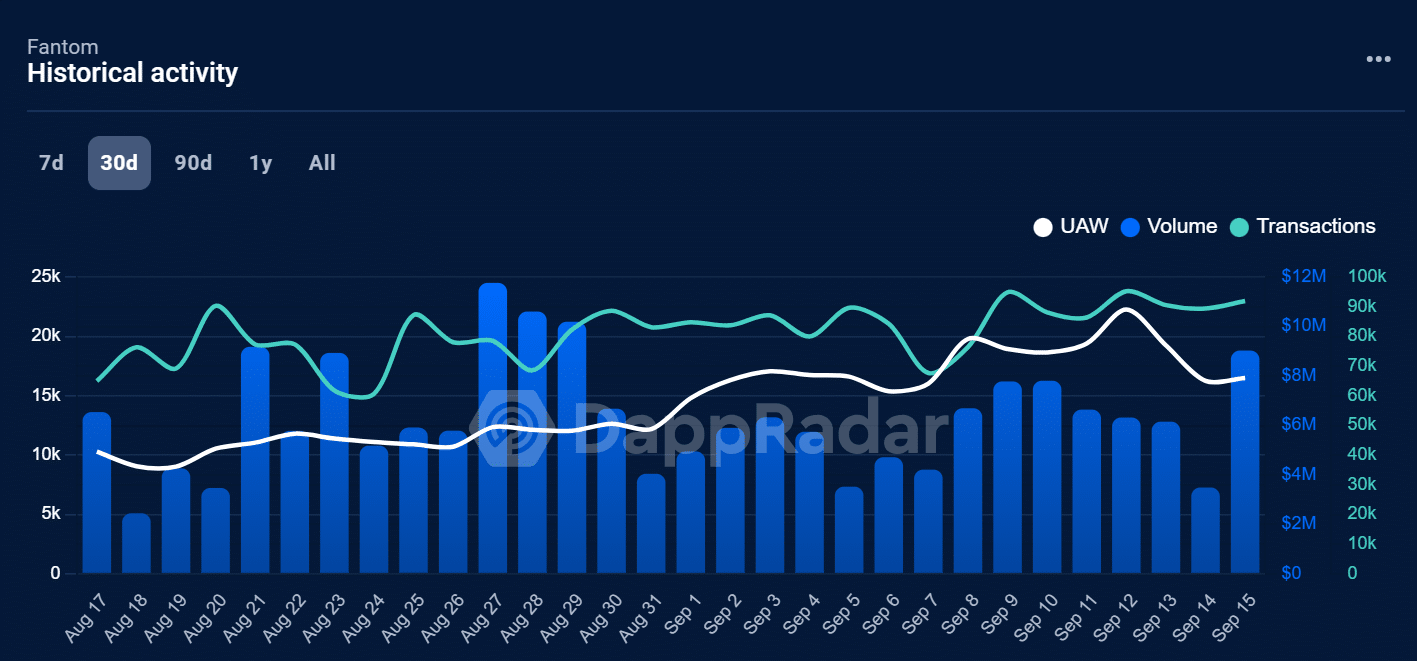

Increased interest in the Fantom network is also fuelling the upsurge. According to DappRadar, dApp volumes on the network surged nearly threefold from $3.4M to $9M within 24 hours.

These volumes have reached the highest level since late August.

The usage of Decentralized Finance (DeFi) within this network is seeing a significant surge. As per the data from DeFiLlama, the total value locked (TVL) on the network has grown by an additional $2 billion, now standing at approximately $77 billion.

Fantom tests a key resistance level

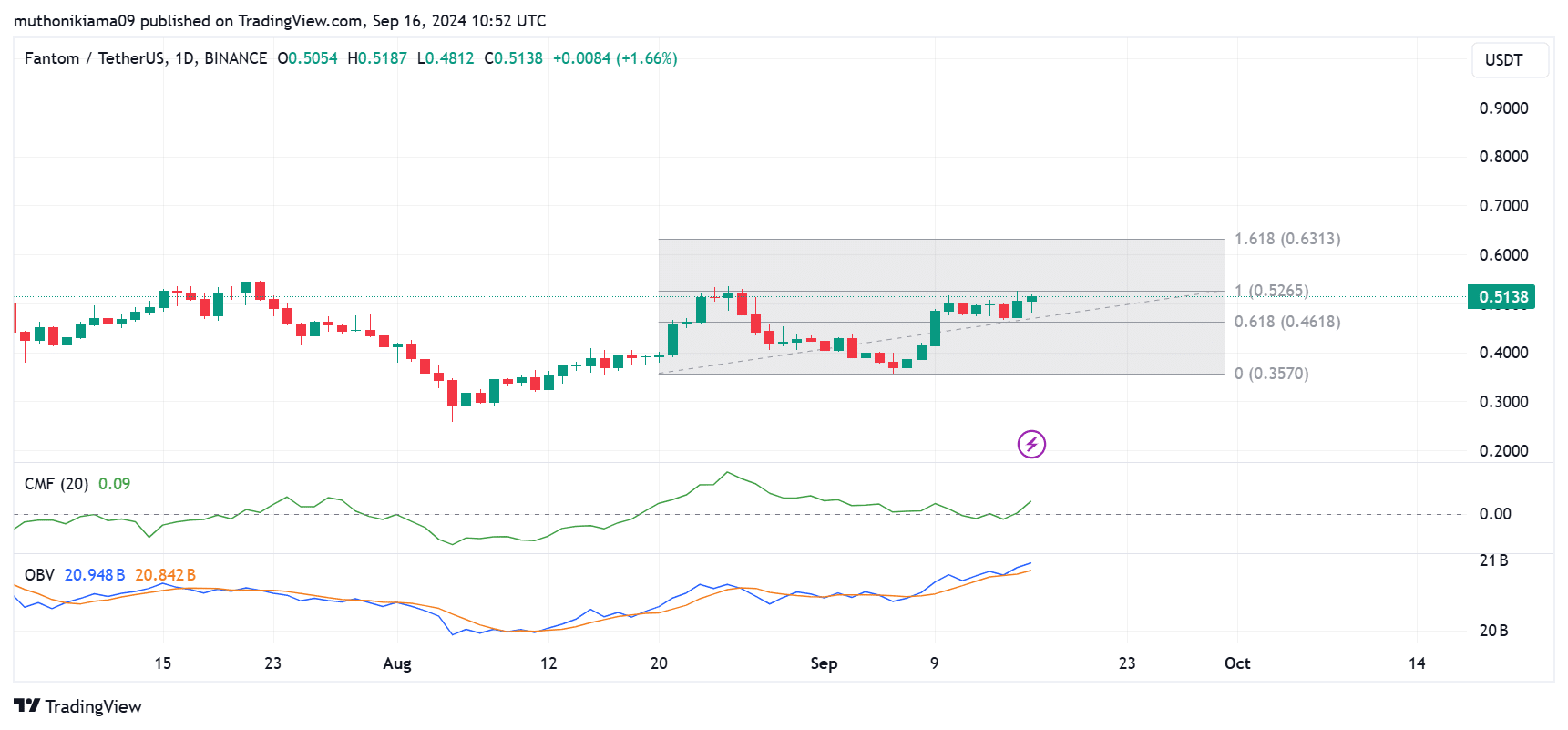

At the moment of reporting, FTM‘s price was aiming for a breakthrough above a crucial barrier at approximately $0.52, having previously established higher peaks.

Nevertheless, Fantom has struggled to break through this resistance for several weeks now, as each unsuccessful attempt is swiftly met with a downward correction.

In simpler terms, the Chaikin Money Flow (CMF) signaled increased optimism from buyers during a market breakout. This indicator has turned favorable, moving upward, suggesting that the demand to buy has surpassed the desire to sell.

The uptrend is also being supported by a surge in volumes, as the On Balance Volume (OBV) indicator is rising. Nevertheless, the sustainability of the uptrend will be confirmed once the smoothing line crosses above the OBV.

If this event materializes, it might facilitate a breakthrough of Fortune Tech Mines’ $0.52 barrier and potentially trigger an upward surge towards the 1.618 Fibonacci level ($0.63).

Conversely, if FTM doesn’t manage to break through the resistance, it might undermine the upward trend and potentially lead the asset to fall towards the support level of $0.46.

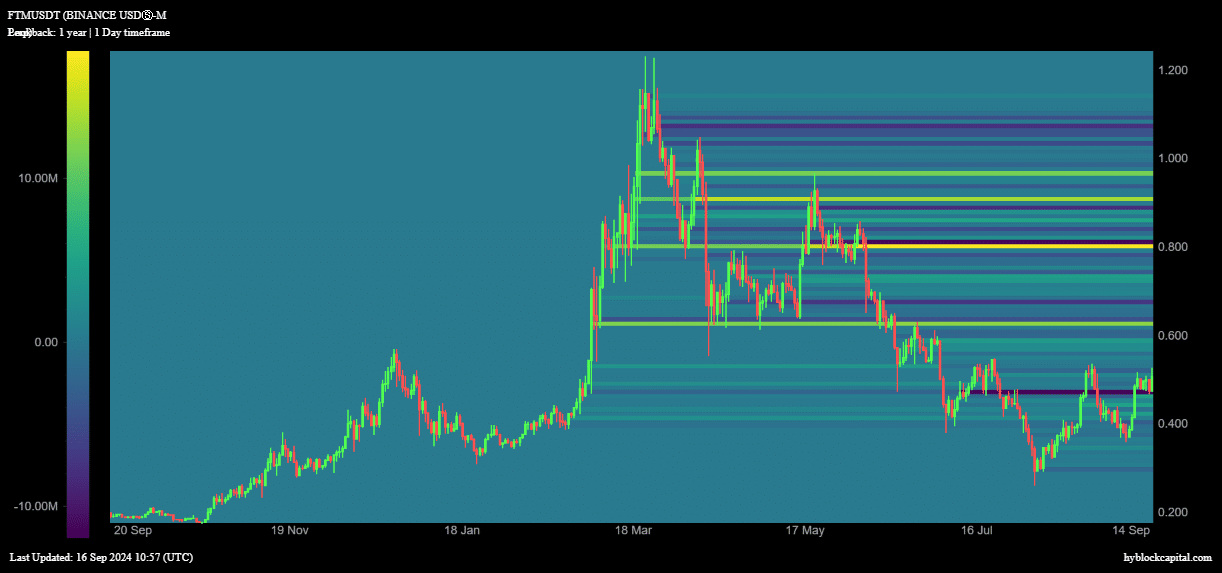

Examining the FTM liquidation thresholds indicates that once the price reaches approximately $0.61, a bullish momentum is likely to be established.

According to data from Hyblock Capital, a short position worth $12 million may be forced to close if Fantom’s price (FTM) reaches between $0.61 and $0.63.

Read Fantom’s [FTM] Price Prediction 2024–2025

As the price nears these points, short sellers could begin to cover their positions to limit their losses, potentially causing further price increases.

Furthermore, Funding Rates for FTM on Coinglass were negative at the current moment, indicating that short positions are prevalent. This hints that many traders believe the rally may not succeed, and that FTM could be moving towards a bearish trend reversal.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

2024-09-17 07:35