- Fantom’s price tested key levels, with increased network activity signaling potential recovery.

- Market sentiment showed optimism as bullish liquidations and technical indicators hinted at a reversal.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I’ve seen my fair share of bull runs and bear markets. After carefully reviewing Fantom’s current status, I find myself cautiously optimistic about its short-term prospects.

The increased network activity is always a good sign, as it often reflects growing interest in the project. However, the tight price range FTM has been stuck in for quite some time now makes me slightly apprehensive. I’ve seen many coins get trapped in such ranges only to see them eventually breakout—or break down.

The MVRV ratio hinting at potential undervaluation is definitely something that catches my attention, as it often precedes significant price moves. But, as always, the market can be unpredictable, and persistent selling pressure could still push prices lower.

The technical indicators I’m observing—the RSI and moving average cross—suggest a potential turning point for FTM’s price, which is exciting news for those who believe in the project’s long-term potential. The bullish liquidation trends further support this optimism, as they indicate that many traders are positioning for an upward price movement.

In the end, I always remind myself that the crypto market has a sense of humor—it loves to keep us on our toes. So, who knows? Maybe FTM will surprise us all and break out of its range sooner than we think. Just remember: “The market can stay irrational longer than you can stay solvent.” Keep your eyes on the charts, folks!

Despite currently trending downwards and being priced at $0.7934 (a decrease of 2.16% over the past day), Fantom [FTM] still managed to pique curiosity among investors.

New network data indicates heightened activity, leading us to ponder: Might this signal the commencement of a price turnaround?

Can FTM break free from its current range?

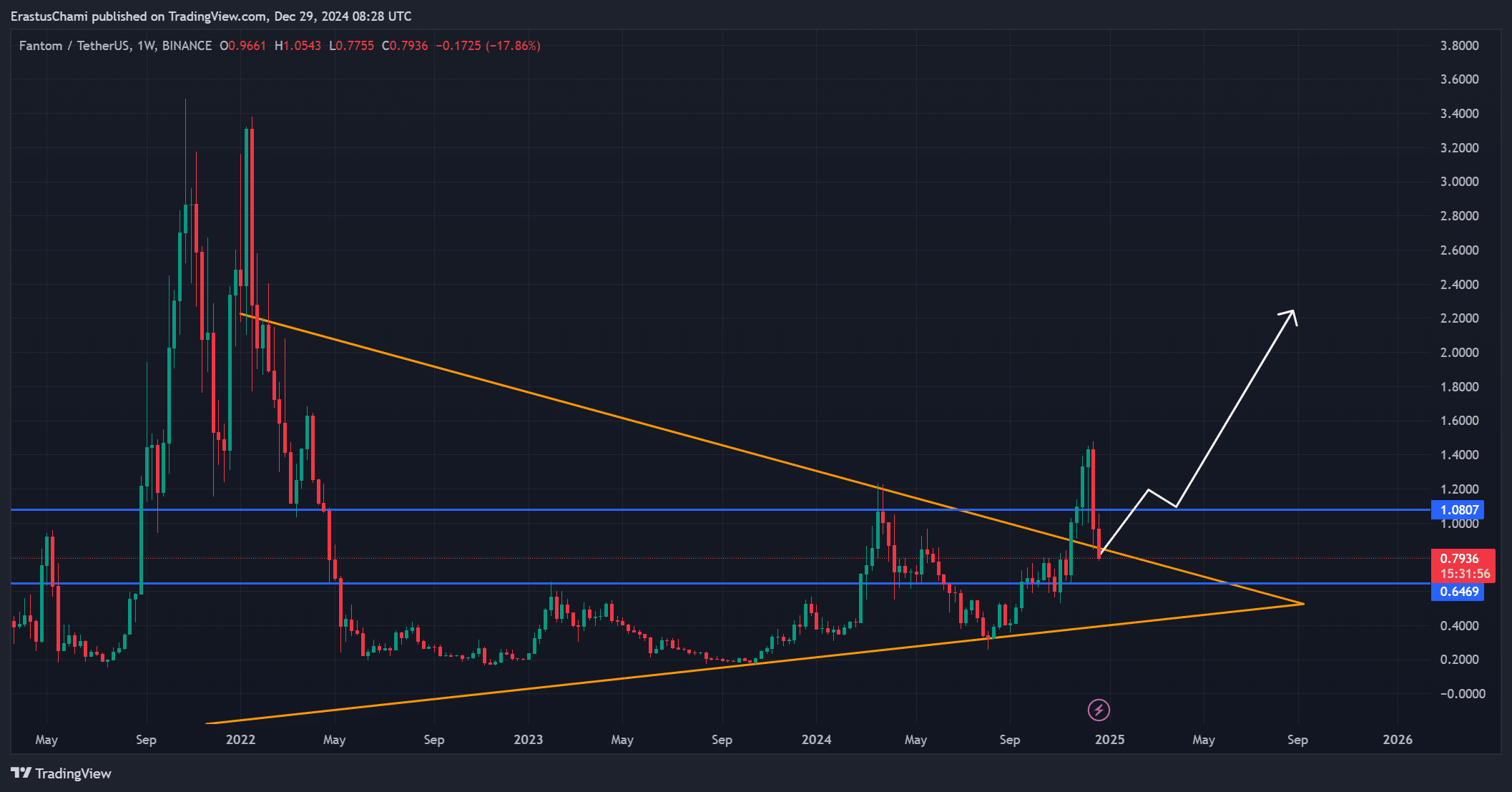

For the past while, FTM’s value has been fluctuating narrowly, with key support at approximately $0.7316 and resistance around $0.9671. If the value manages to surpass this resistance, it could potentially move up towards $1.08 – a level that carries significant psychological significance.

As a crypto investor, I’ve noticed that maintaining the current support is crucial to avoid additional losses. The downward sloping triangle shape evident in my chart analysis seems to indicate an impending significant price shift might be just around the corner.

Therefore, the next few trading sessions could determine FTM’s short-term trajectory.

Is network activity hinting at a bullish future?

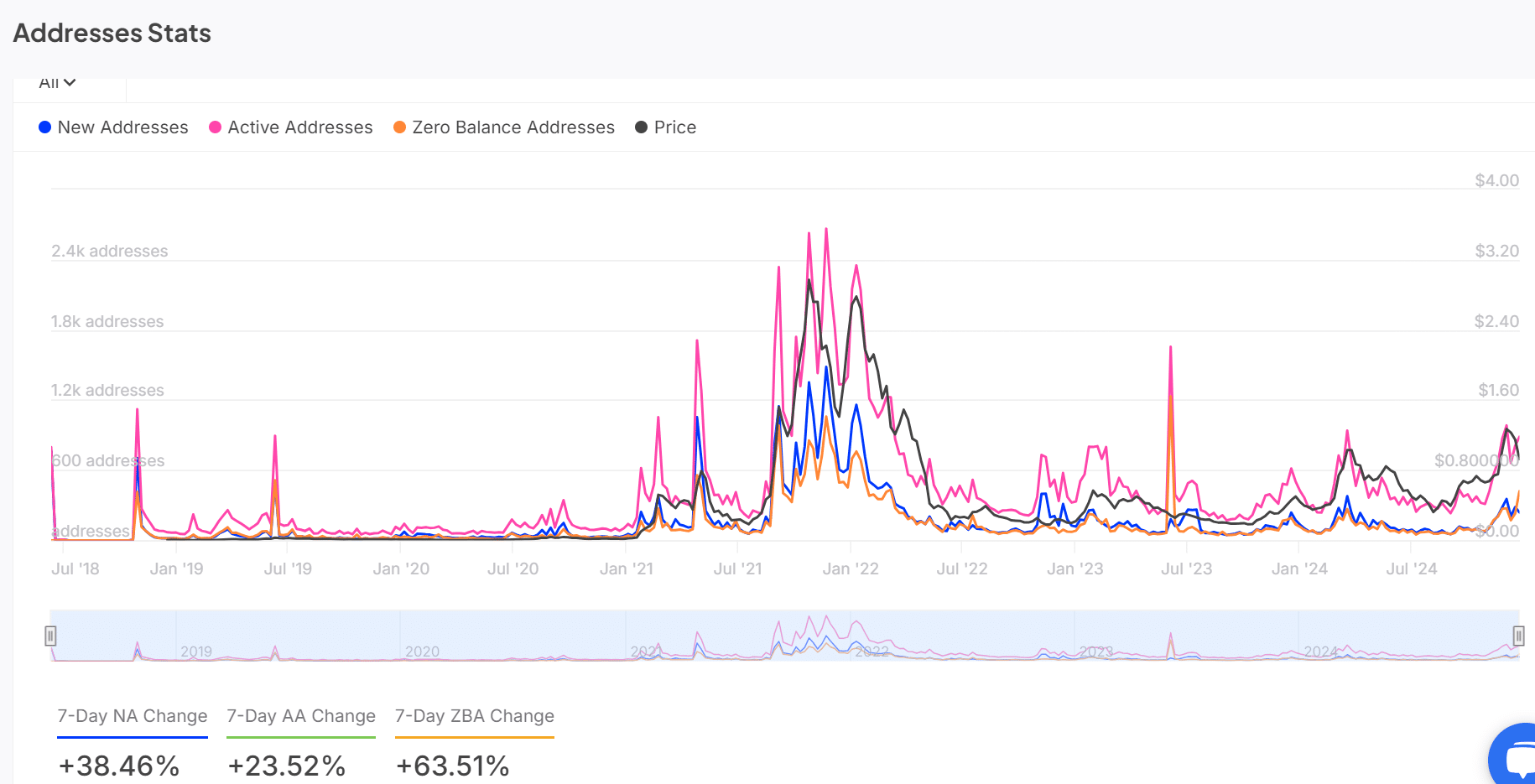

At the moment of reporting, there was a significant increase in Fantom’s blockchain activity. Over the course of a week, we saw a jump of 38.46% in new addresses, an uptick of 23.52% in active addresses, and a remarkable growth of 63.51% in zero balance addresses.

As an analyst, I observed a significant surge in engagement and activity within the ecosystem, indicating a heightened interest and involvement. This growth trend, if sustained, could potentially enhance the long-term worth of Fantom (FTM).

Yet, although these figures seemed encouraging, it’s crucial for continuous expansion to maintain the positive trend. Consequently, network activity continues to serve as an important metric to monitor closely.

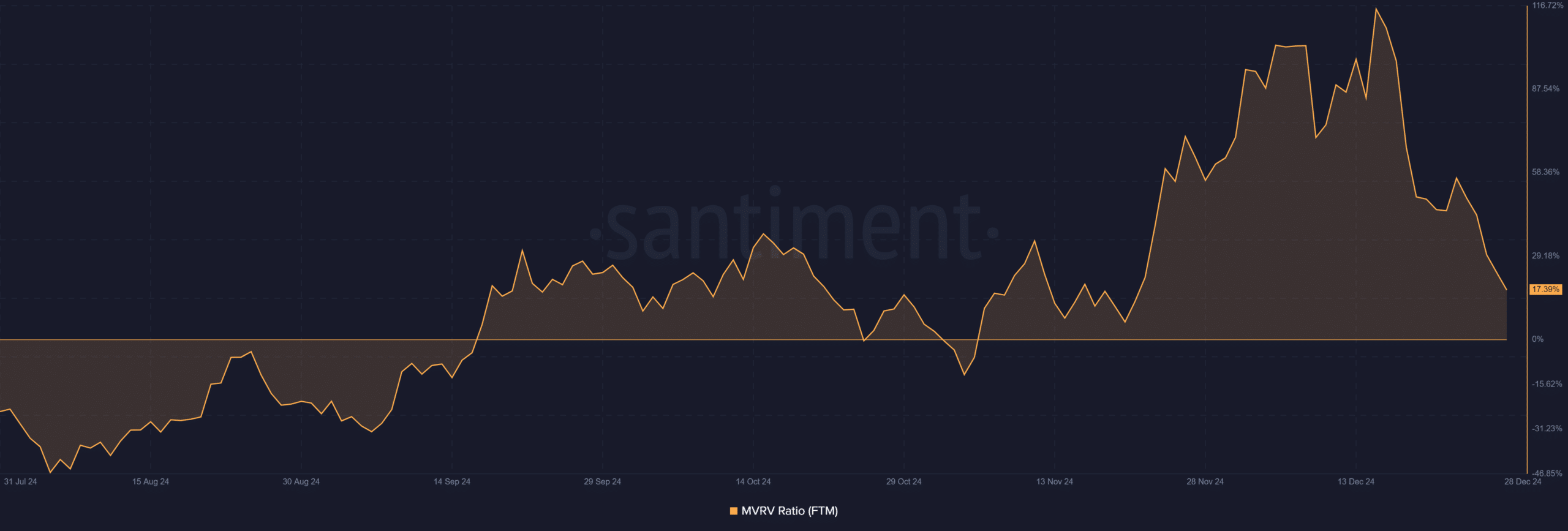

MVRV ratio signals potential undervaluation

17.39% decrease in the Market Value to Realized Value (MVRV) ratio suggests that FTM holders are experiencing less profitability at this time.

Historically, these kinds of drops have typically occurred before substantial price changes, as they frequently indicate that the asset is underpriced.

Potential buyers might be drawn by reduced prices. Yet, constant demand could cause prices to drop further. Keep a close eye on market sentiments to predict future trends for traders.

Are technical indicators flashing a reversal signal?

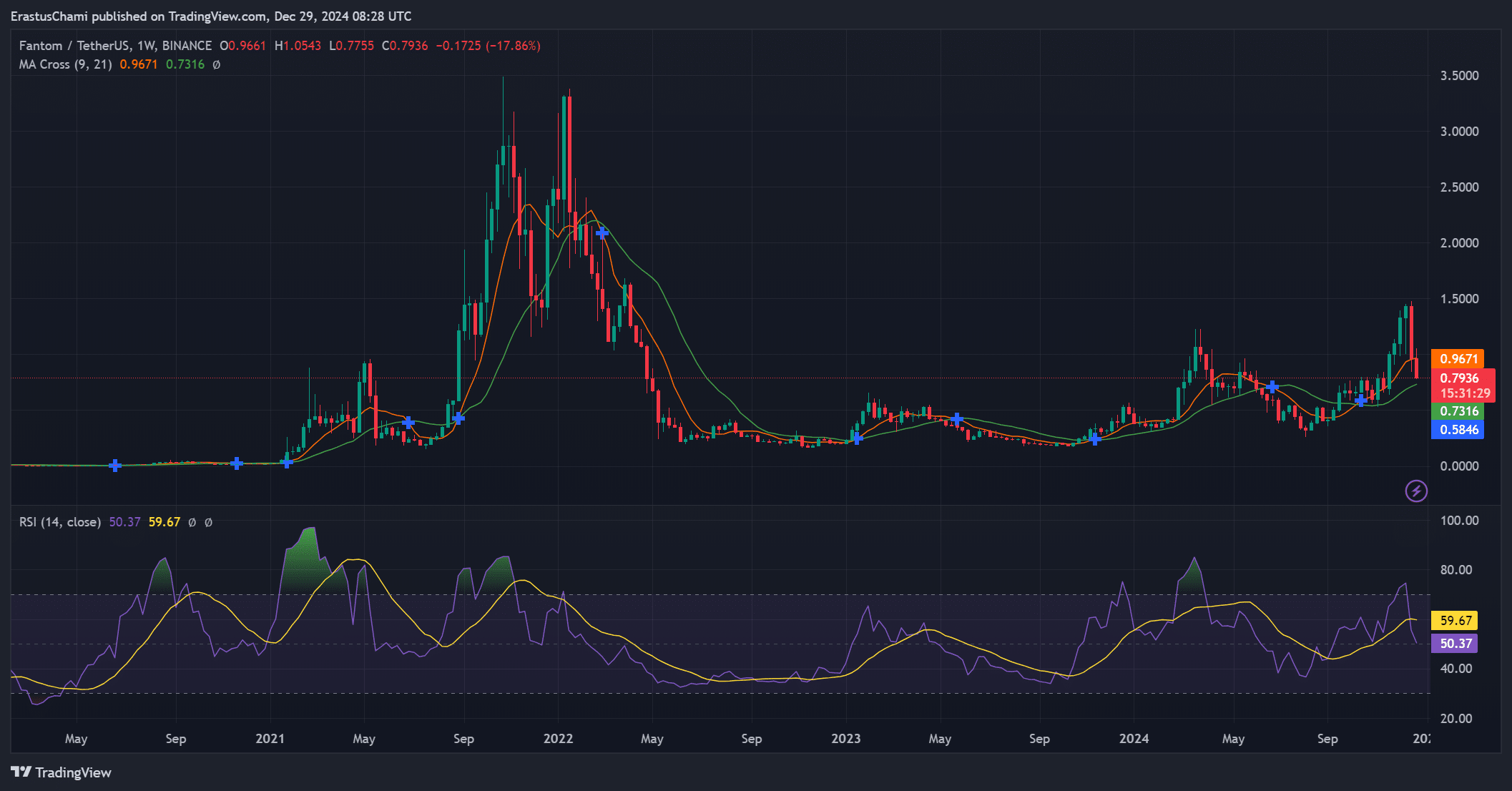

At the current moment, the Relative Strength Index (RSI) stands at approximately 50.37, suggesting a balanced momentum, leaning slightly towards a potential bullish recovery.

As the short-term average was getting closer to the long-term average, this moving average crossover hinted at a possible increase in market turbulence or volatility.

Consequently, these signs suggest that FTM’s price may be about to change significantly, which means the coming days are likely to be pivotal for traders.

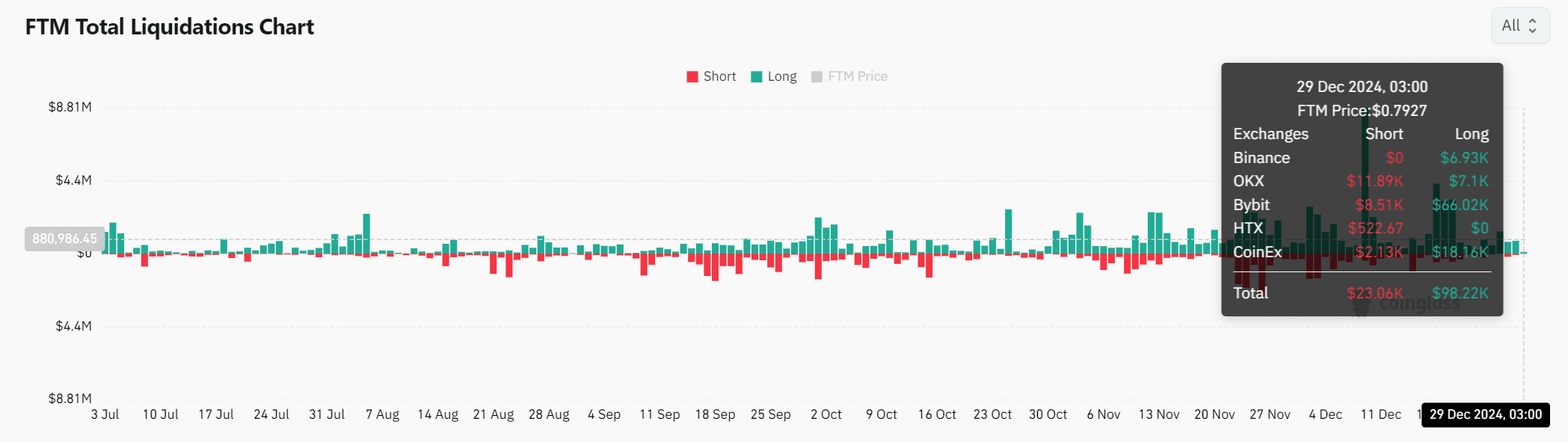

Liquidations suggest traders remain optimistic

As a crypto investor, I’ve noticed a significant imbalance in the market trends: there are $98,220 worth of long positions compared to only $23,060 in shorts. This indicates a strong bullish sentiment, even amid recent market declines. It seems that many traders are optimistic about an upcoming price increase.

Nevertheless, external factors in the market might impact FTM’s success. To gain a complete understanding, it would be beneficial to examine liquidation data together with other performance indicators.

Read Fantom’s [FTM] Price Prediction 2024-25

The increasing network activity on Fantom, coupled with positive liquidation tendencies and technical indications, points towards a possible price surge ahead.

But it’s crucial to keep a close eye on the decreasing MVRV ratio and significant resistance points. If Filecoin (FTM) continues to expand its network and surpasses important thresholds, a potential price increase might occur within the next few weeks.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-12-29 23:04