- FTM’s price surged by 85% after a successful reversal from its $0.64 support level

- Metrics pointed to a short-term correction before a potential rally to $1.68

As a seasoned crypto investor with a knack for spotting trends and reading charts, I can confidently say that Fantom (FTM) is currently one of the hottest tickets in town. With its recent 85% surge following a successful breakout from key support levels, FTM has caught my attention and piqued my interest.

Recently, Fantom (FTM) has experienced a robust upward trend after it broke free from a significant bullish pennant structure on its weekly chart. Notably, after bouncing back from the pennant’s support level at $0.64, FTM experienced an impressive 85% increase, reaching its current trading price.

The rally propelled the altcoin beyond its crucial weekly resistance point at $1.08 – Indicating an increase in investor trust within the market.

FTM is breaking barriers on the daily chart

On the daily graph, FTM continued its upward trend by breaking through the latest resistance at $1.20.

Beyond this point, there’s significant resistance at the $1.68 mark, a crucial area of potential obstruction for future growth, considering the current market trend’s momentum.

FTM whales make moves as exchange outflows shrink

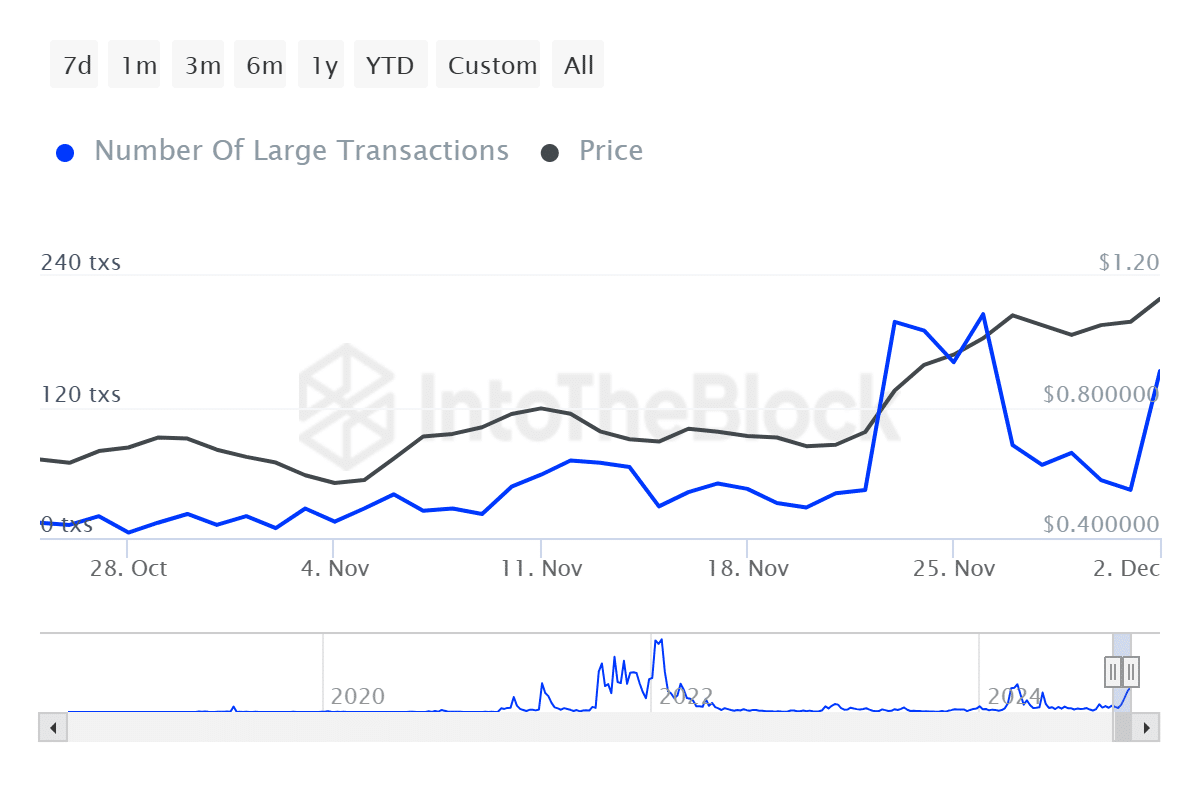

Large transactions involving Fantom have significantly increased, mirroring an uptick in whale activity, as per data from IntoTheBlock. This surge saw a 500% increase in large transactions over the past day – a clear indication of heightened interest among wealthy investors.

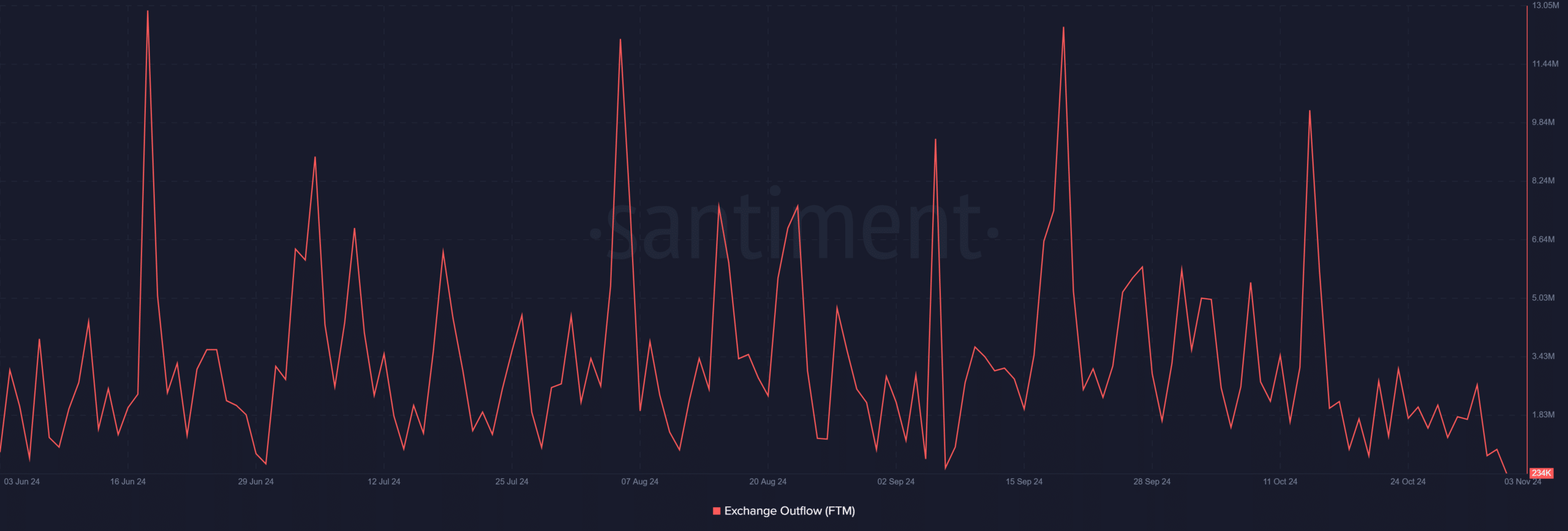

Instead, outflows decreased to their smallest amount since June 3rd. This decrease in FTM’s outflows indicates increased demand, which is expected to drive up its price as shown on the charts.

Liquidity data hints at a short-term correction

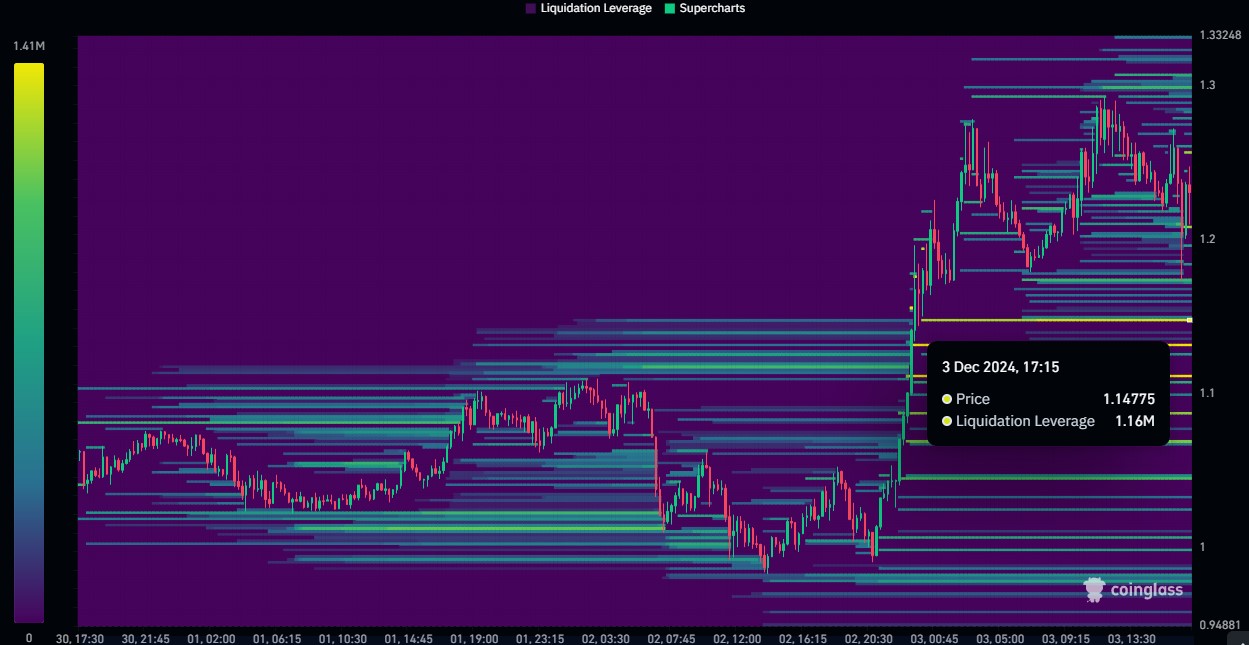

In summary, an examination by AMBCrypto of Coinglass’s liquidity figures unearthed intriguing details about the near-term price fluctuations for FTM. The presence of a large liquidation pool at $1.15 implied a potential short-term reversal for FTM, preceding its continuation of a bullish trend.

It appeared that this followed the general direction of the overall market movement, as smaller adjustments frequently occur before prolonged surges.

A significant rise for FTM beyond multiple resistance points has bolstered its argument for a bullish trend. Nevertheless, it’s possible that the price may experience a brief decline around the $1.15 region, after which this cryptocurrency might aim for the resistance at $1.68.

Given the rising liquidity and increased investor attention, it’s possible that FTM could maintain its upward trajectory over the coming weeks, unless there are unexpected changes in the market.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What You NEED to Know!

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

2024-12-04 10:15