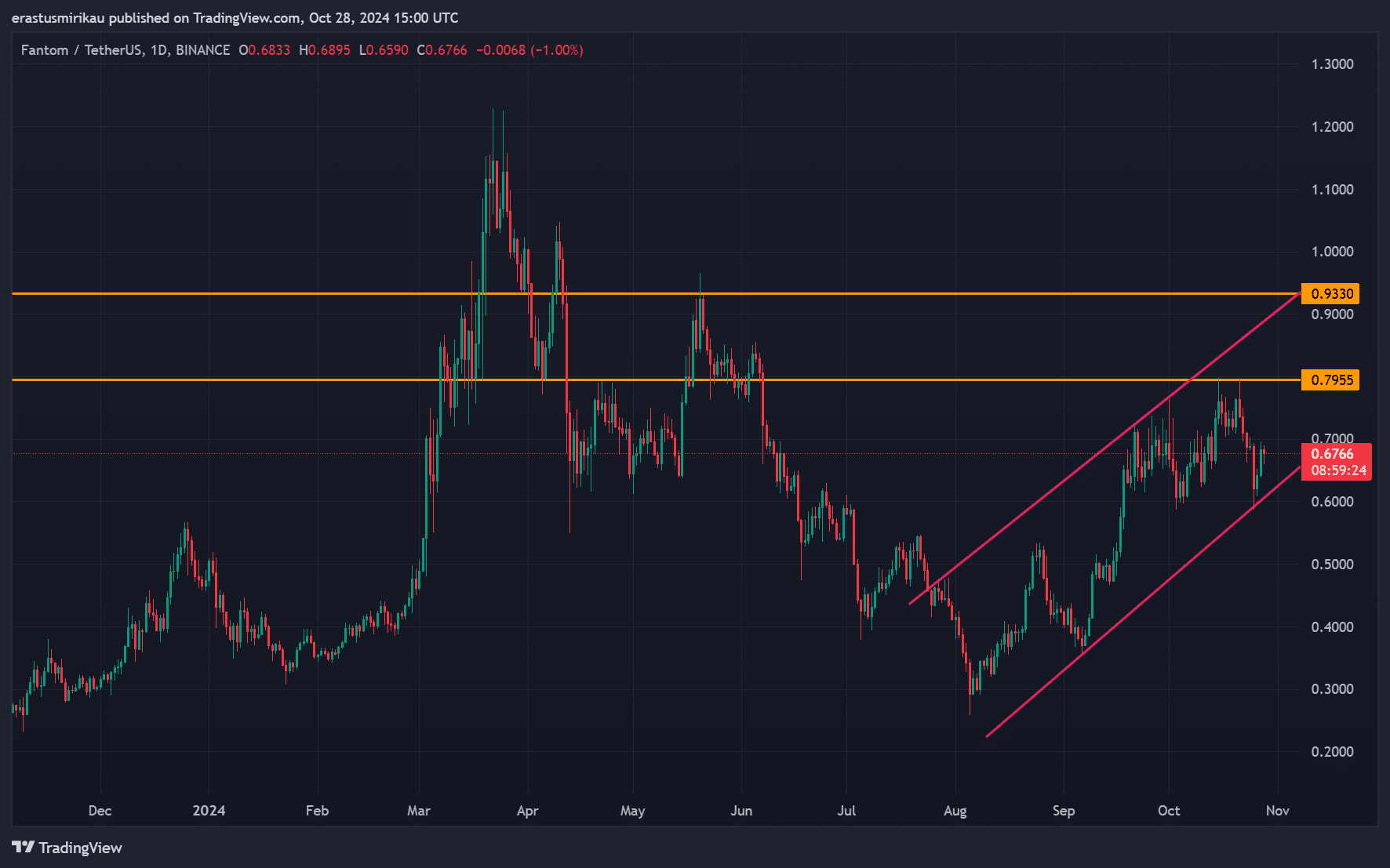

- FTM’s bullish trend persisted within an ascending channel, with key resistance at $0.7955

- Mixed on-chain signals underlined cautious optimism as liquidations had their say

As a seasoned analyst with years of market observation under my belt, I find myself optimistic about Fantom (FTM) as it navigates its ascending channel. The bullish trend is undeniable, yet I can’t help but feel a bit like a cat on a fence – eager to see how high FTM can go before gravity takes hold.

In the last 24 hours, Fantom’s [FTM] price rose by approximately 6.31% and was trading at $0.6786 at the time of reporting. The coin had a market capitalization of around $1.90 billion, while its 24-hour trading volume experienced a significant increase of about 68.26%, reaching nearly $142.91 million.

The current behavior of the altcoin’s price movement maintains Fantom (FTM) within an upward-sloping channel, with potential resistance levels at $0.7955 and $0.9330 in sight. Given the increasing market momentum, one might ponder whether Fantom can sustain its bullish trend.

Analyzing the ascending channel – Will this support hold?

In simpler terms, the graph shows that the price of FTM has been moving upwards within a rising channel, indicating a strong bullish market trend. As long as FTM adheres to the upper and lower boundaries of this channel, it is likely to continue its upward movement.

Furthermore, surpassing the $0.7955 barrier could strengthen the optimistic outlook, potentially driving the price upwards toward the subsequent target at $0.9330.

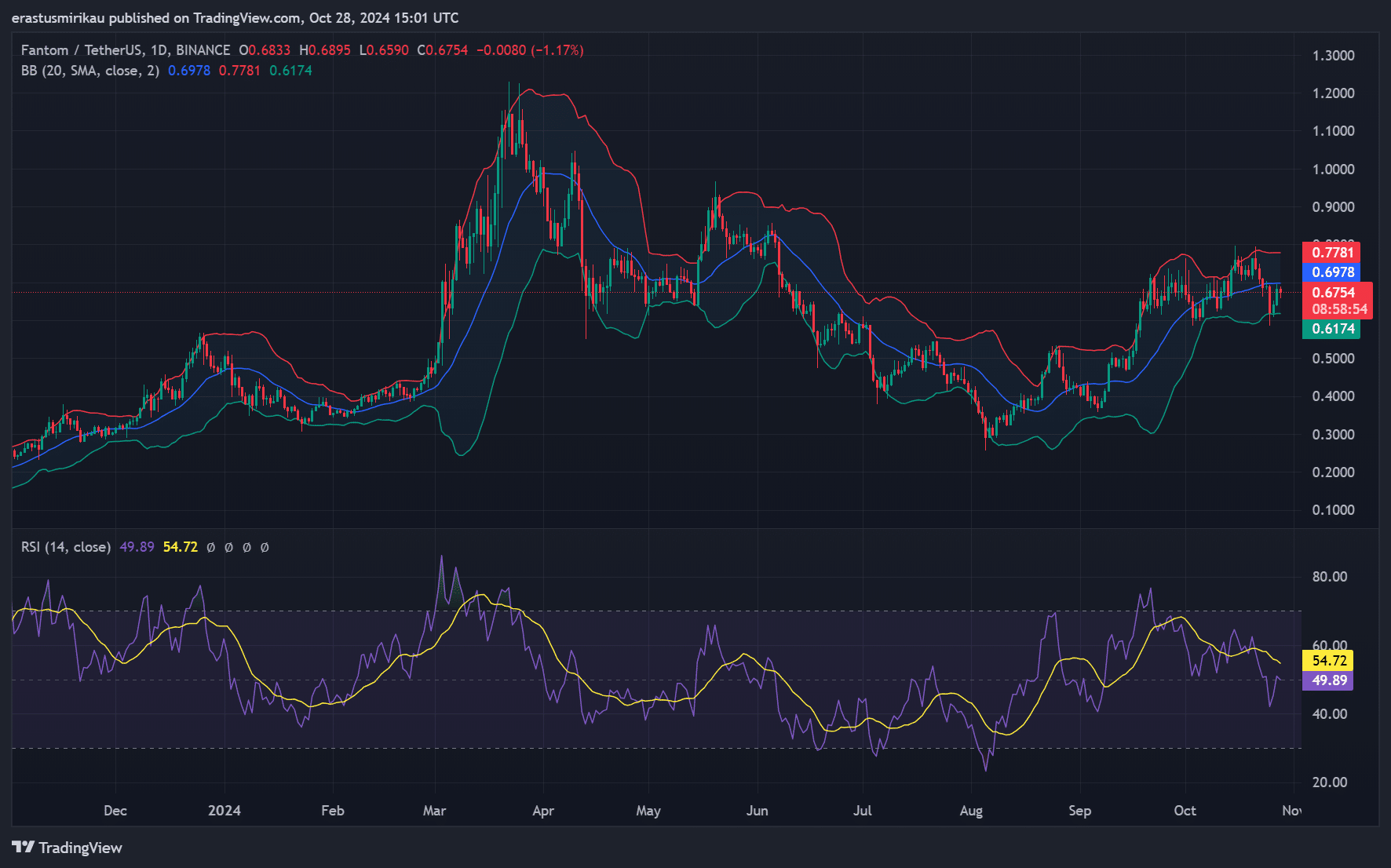

Bollinger bands and RSI’s findings

Currently, at this moment, the Bollinger Bands appear to be expanding, suggesting increased volatility is on the horizon as FTM gets closer to the upper band. Typically, this expansion suggests that buyers are in control of the market trend. If the price persists in staying close to the upper band, it could hint at an upcoming breakout towards new record highs.

At the current moment, the Relative Strength Index (RSI) stands at approximately 54.72, indicating it’s still in a neutral range for FTM. This means there might be more potential for FTM to rise further without encountering overbought conditions. In simpler terms, the RSI value at press time hints that additional increases could occur if buying activity continues.

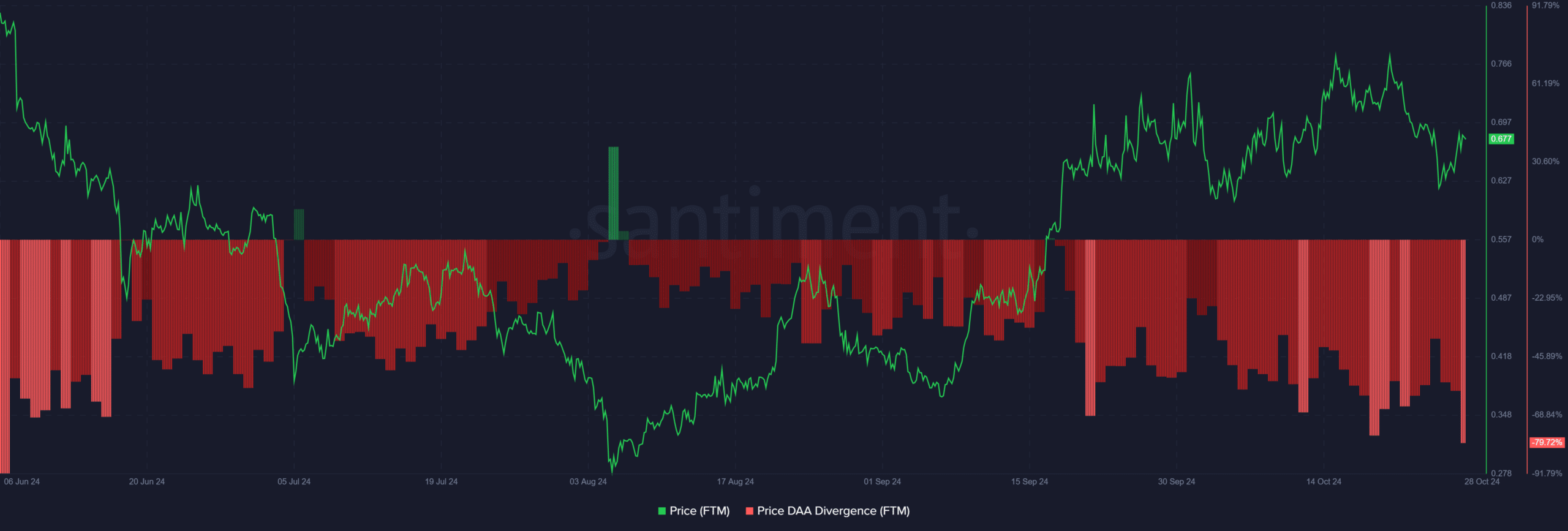

Price DAA divergence – A potential red flag?

The significant decrease in Daily Active Addresses (DAA) by 79.72% indicates that fewer users are actively participating on the network, despite recent price increases. This disparity between price and user activity also underscores a possible slowdown in underlying network growth, which can often indicate reduced longevity for the current rally.

Furthermore, a decrease in active addresses could potentially undermine Fantom’s base when faced with increased selling pressure. This situation might prompt traders to look out for a possible price correction, should the activity of addresses not recover swiftly.

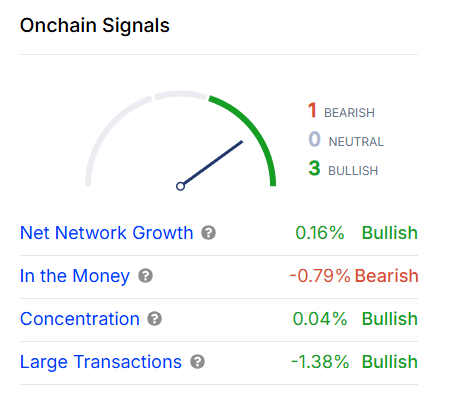

FTM On-chain signals – Mixed sentiment?

In summary, Fantom’s on-chain data showed a blend of positive and neutral signs. The increase in network growth by 0.16% suggests a steady expansion in its user base, which is a promising sign. However, the rise in large holder concentration by 0.04% implies that key investors are holding onto their positions rather than selling – usually seen as a bullish trend. On the flip side, the number of large transactions dropped by 1.38%, suggesting less pressure to sell from big players, which could be interpreted as a potential reduction in selling activity.

However, the “In the Money” metric revealed a slight bearish tilt at -0.79%, indicating a small fall in profitable positions. Consequently, these mixed on-chain signals reflected cautious optimism, with investors closely monitoring market sentiment shifts.

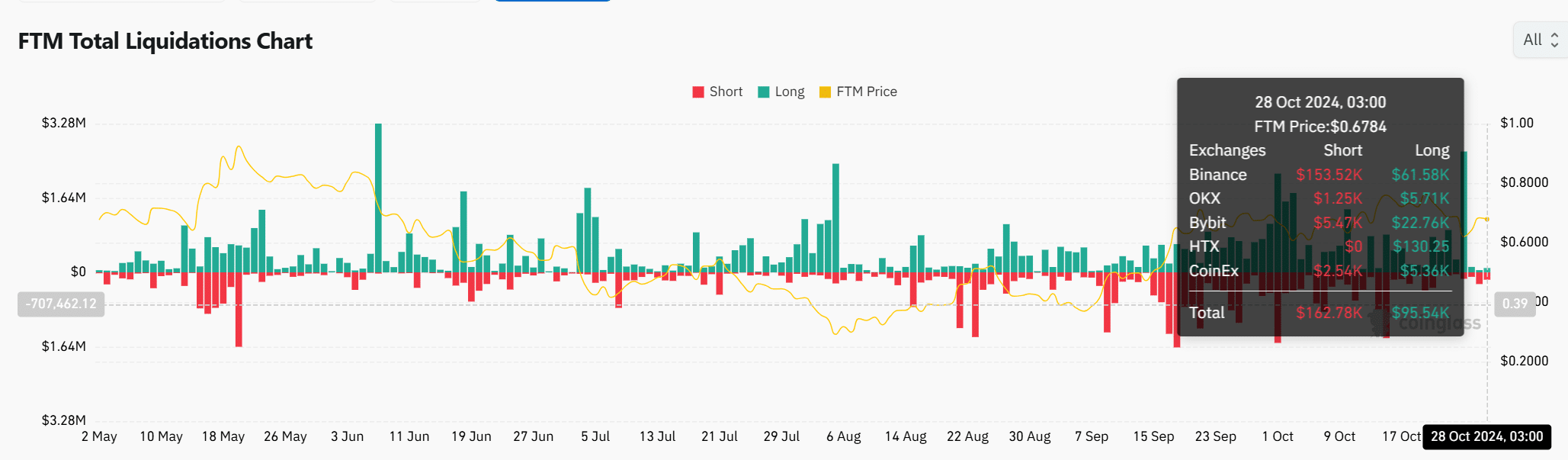

FTM liquidations- Short traders face pressure

Ultimately, the liquidation figures for FTM revealed substantial closing out of short positions worth approximately $162,780, while long positions were closed at a lower rate of around $95,540.

As a result, this pattern suggests a negative outlook for short traders, as they may be underestimating the direction of the price. If FTM remains strong above $0.67, additional short sellers cashing out might propel the price upwards.

Read Fantom’s [FTM] Price Prediction 2024-25

According to the current situation, Fantom appears to have a promising future as its momentum at the present value, backed by favorable technical signals and a well-balanced blockchain activity, suggests a positive forecast for this altcoin.

Nevertheless, the Price DAA Divergence and the somewhat pessimistic “In the Money” indicator suggested a note of caution. If FTM manages to break past the $0.7955 resistance level with significant volume, it could potentially push forward towards new highs within its current channel.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-10-29 13:44