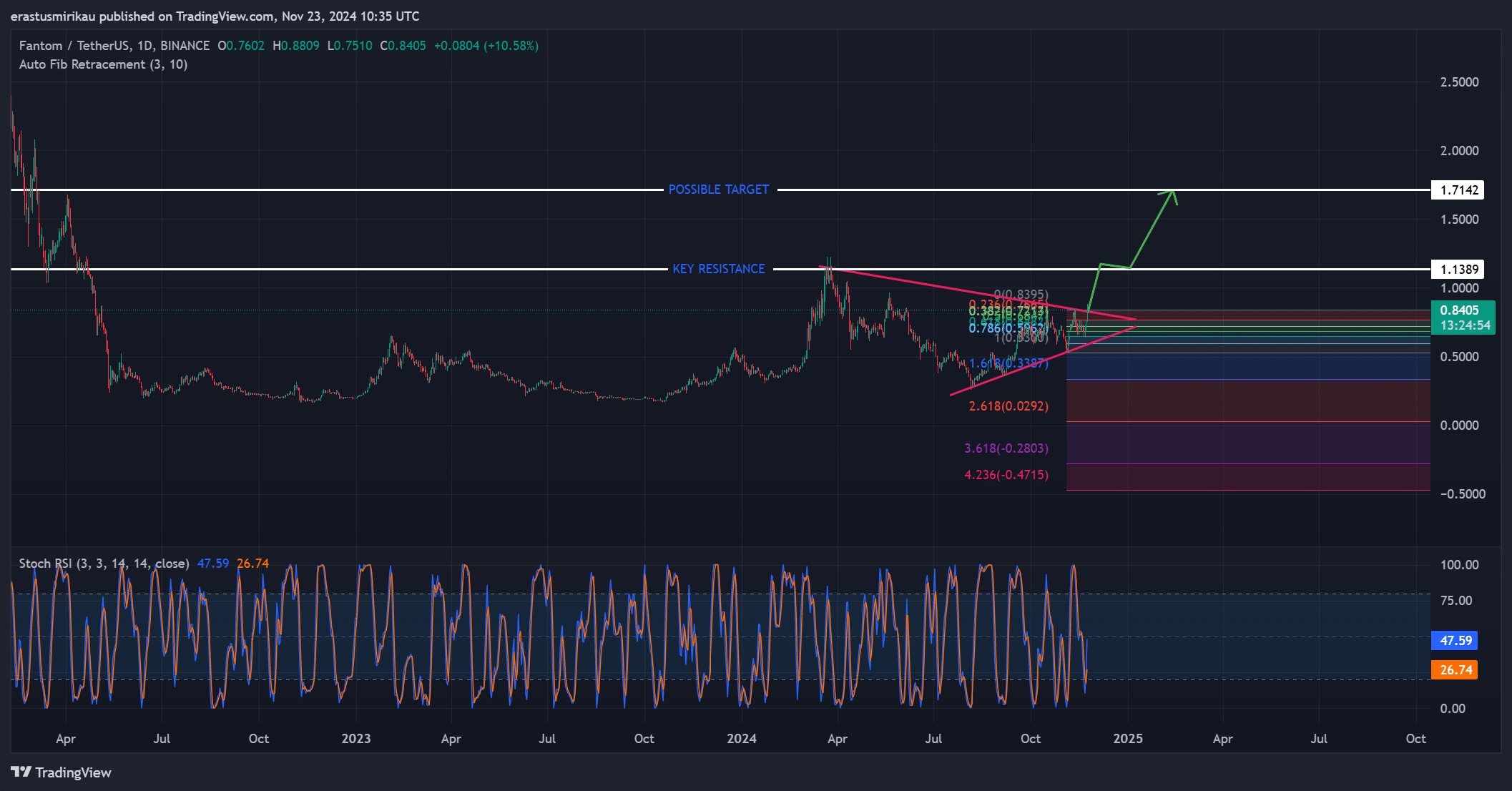

- Fantom’s breakout from consolidation aligned with bullish technical indicators, targeting $1.14 and $1.71.

- On-chain metrics and a $9B TVL milestone boosted investor confidence in sustained growth.

As an analyst with over two decades of experience in the financial markets, I’ve seen my fair share of bull runs and market corrections. But Fantom’s current trajectory is certainly catching my attention. The recent breakout from consolidation aligning with strong technical indicators, coupled with the $9B TVL milestone, has boosted investor confidence significantly.

In the cryptocurrency sphere, Fantom (FTM) is generating a stir, experiencing an impressive surge of more than 20% within the past 24 hours, and currently trading at approximately $0.8563 as we speak.

After several weeks of stability, this recent surge suggests that FTM could potentially initiate a substantial upward trend, sparking anticipation among investors.

Given the alignment of significant hurdles and technical indicators, it’s possible that Fantom may approach its potential next level at around $1.71.

A bullish rally takes shape

In simpler terms, the cryptocurrency Fantom has managed to escape from a common bullish formation known as a descending triangle, which is often followed by significant price increases.

As a result, the price has climbed above previous levels of resistance, indicating increased demand from buyers.

Currently, our attention is drawn towards the significant $1.14 barrier. This level might serve as a crucial turning point in the future path of FTM.

Should the current level be exceeded, Fantom could potentially continue its upward trend towards approximately $1.71. This price point was previously reached during past bullish market phases.

Moreover, Fibonacci retracement levels served as additional confirmation of the continuing uptrend. The price of Fantom Token (FTM) surpassed the 0.618 retracement level with ease, signaling a robust bullish signal.

Additionally, the Stochastic RSI suggests that Fantom may continue to rise, since its momentum remains strong and hasn’t yet touched the overbought zone.

Yet, traders need to exercise caution when approaching resistance points, as temporary selling due to profit-taking might momentarily pause the upward trend.

Fantom TVL milestone boosts confidence

FTM’s bullish sentiment was also driven by its rising Total Value Locked (TVL), which recently surpassed $9 billion.

This increase in Total Value Locked (TVL) showcases an uptick in user engagement and confidence within the Fantom network’s ecosystem, especially among its Decentralized Finance (DeFi) projects.

Therefore, this milestone strengthens the narrative of long-term growth potential for FTM.

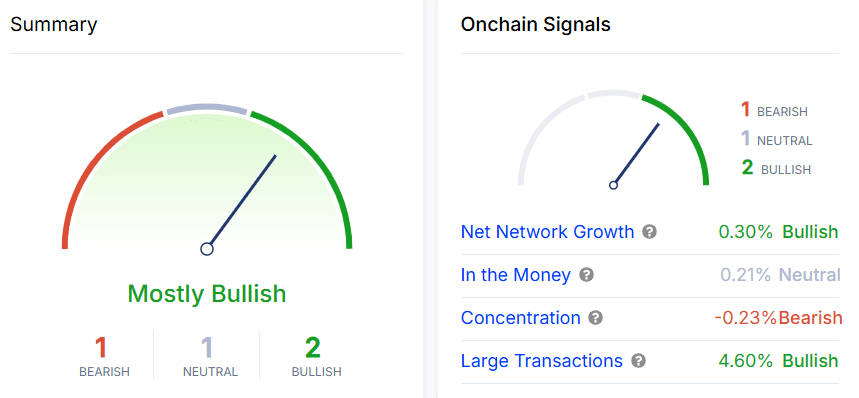

FTM’s on-chain activity suggested optimism

As a crypto investor, I’ve noticed that on-chain indicators continue to bolster my optimistic view towards Fantom. For instance, the increase in Net Network Growth suggests a steady adoption rate, which is promising. Moreover, the number of large transactions has spiked by 4.6%, indicating increased activity and potential interest in the network.

This indicated that institutional players or whales are engaging with the network.

Despite a slight hint of bearishness indicated by the concentration metric, it’s primarily the robust bullish signs that hold more weight.

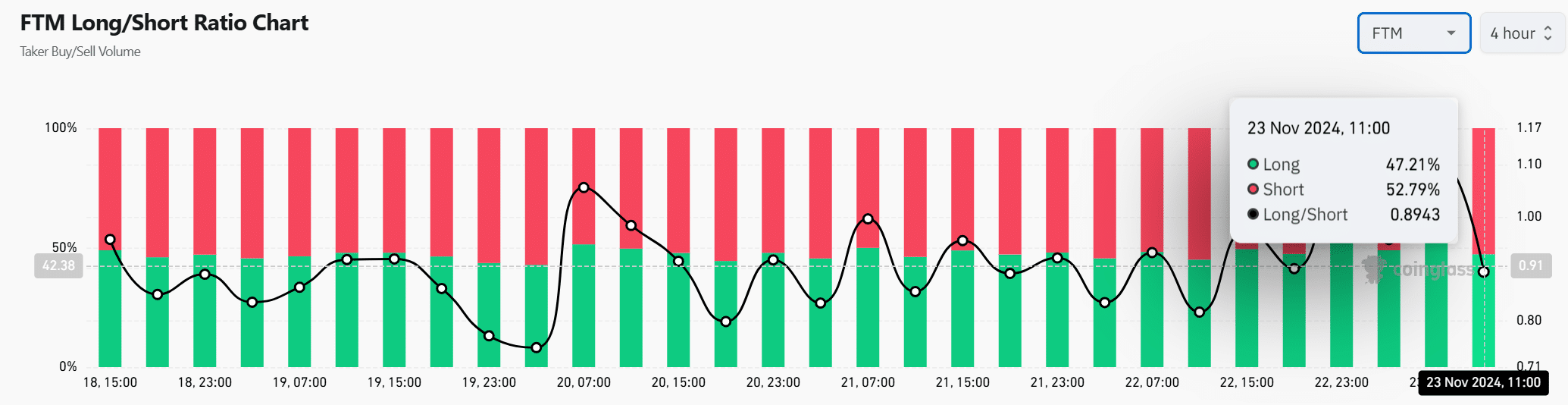

Long/Short Ratio shows mixed sentiment

It’s worth noting that the Long/Short Ratio for Fantom indicates a somewhat cautious market stance. In this case, slightly more than half (52.79%) of the positions are held short, but long traders still represent 47.21%, suggesting a balanced situation where neither side holds a clear advantage over the other.

Consequently, volatility could increase near resistance levels as opposing strategies clash.

Read Fantom’s [FTM] Price Prediction 2024-25

CFTM likely to hit $1.71 if…

According to the momentum Fantom has shown recently, along with positive on-chain actions and technical indicators, it seems highly likely that there will be more price increases ahead.

Should FTM drop significantly below $1.14, a potential rise towards $1.71 seems possible. But keep a close eye on the market dynamics as we approach resistance zones.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-11-24 06:16