-

Analysts warned that FTM’s $0.50 resistance could trigger a bull trap, with a correction to $0.465 likely.

Rising Open Interest and whale activity signaled growing bullish momentum, but caution remained at $0.50.

As a seasoned analyst with over two decades of trading experience under my belt, I’ve seen my fair share of bull traps and market manipulations. When it comes to Fantom [FTM], the recent price action has me both intrigued and cautious.

Recently, Fantom [FTM] has seen a substantial increase, yet analysts have sounded cautionary notes as the token approached a crucial resistance point.

Currently priced at $0.4874, Fantom experienced a minor decrease of 0.76% within the last 24 hours but managed to grow by 25.29% over the past week. Its market capitalization currently sits at approximately $1.36 billion, with a total supply of around 2.8 billion FTM coins in circulation.

According to the crypto expert at CryptoJobs3, there’s a possibility that the price of FTM might be deceiving us with a false upward trend near the $0.50 – $0.5050 zone, potentially leading to a trap for investors.

Citing a bearish divergence on the RSI, the analyst stated,

“A correction is possible; the price could revisit the $0.470–$0.4650 range.”

If the price surpasses $0.50, it could potentially rise to around $0.5200. However, the analyst advises exercising caution before investing in long positions right now.

Bullish momentum with caution

In simpler terms, while some important signals suggest a temporary rise (bullish momentum) in the market, it’s possible that the market is overvalued (overbought), which might trigger a brief drop.

According to the Bollinger Bands analysis, the price was close to the upper limit, which might suggest that the market could be experiencing overbought conditions.

The tight bands indicated low volatility, suggesting that a breakout may be imminent.

In simpler terms, the MACD (Moving Average Convergence Divergence) indicator displayed a bullish pattern where the MACD line surpassed the signal line and had positive bars, indicating increasing bullish strength. However, the trend is still relatively new and developing.

Meanwhile, volume remains low, which indicated weak conviction behind the recent price increase.

According to analysts, if the price exceeds $0.50 significantly with increasing trading activity, it might indicate a bullish market trend. However, should the price not surpass this mark, there could be a potential reversal or decline.

Fantom: Heightened market activity?

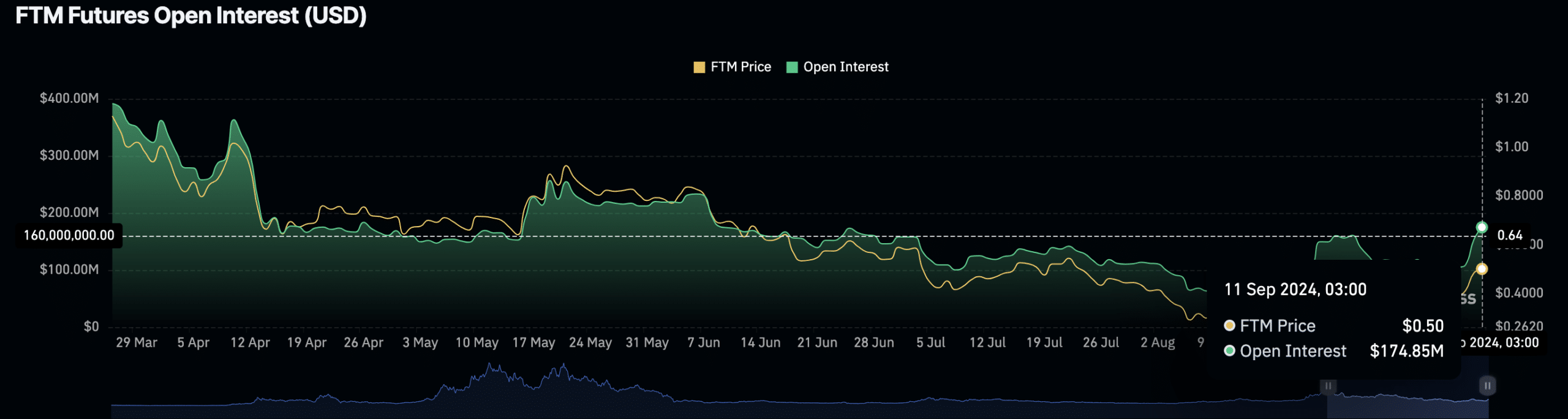

On September 11th, the chart showing future open interests for the FTM Futures showed a significant surge, now standing at approximately $174.85 million.

As the Open Interest grew, so did the price of FTM approach the $0.50 level, indicating a rise in trading activity by investors and speculators.

Over the past few months, I’ve observed that the Open Interest remained within the range of $100 million to $200 million. This consistent pattern suggests a relatively low level of trading engagement in my ongoing research.

A current trend showing an increase in price as well as Open Interest might indicate growing faith among traders about Future Trade Token’s (FTM) upcoming price trajectory, yet it may also point towards the possibility of heightened market turbulence.

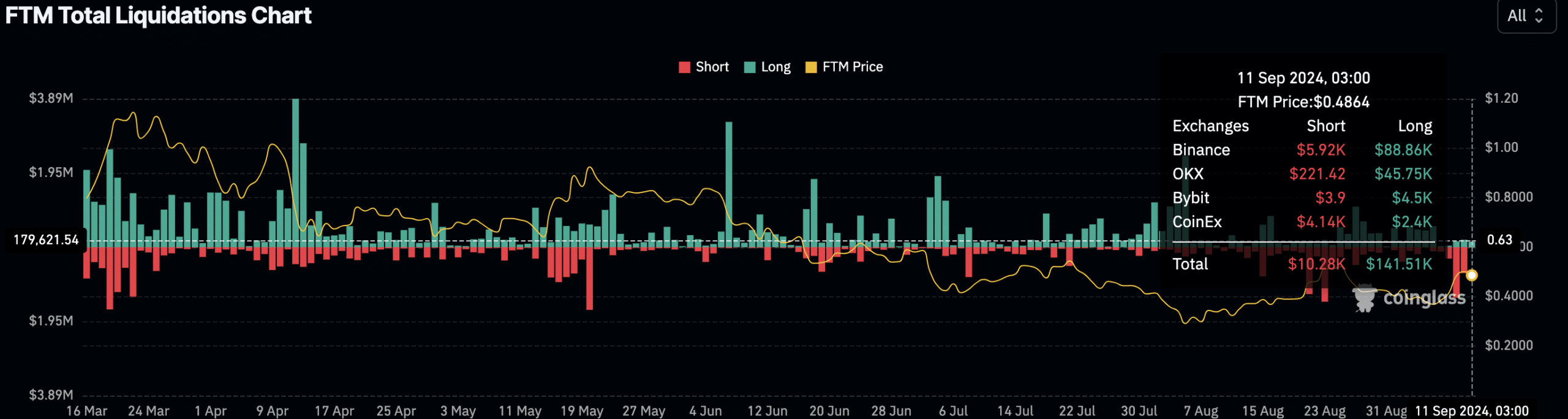

On September 11th, a total of $141,510 worth of long positions were terminated, whereas only $10,280 in short positions were liquidated. It was primarily Binance where most of the long liquidations occurred, amounting to $88,860.

These liquidations suggest that numerous traders found themselves unprepared for the recent price swings, particularly when the price approached the $0.4864 mark.

The analysis of the liquidation process indicated that long-term investors, specifically, had an excessively positive outlook on Future Token Market’s (FTM) ongoing growth, leading to forced sales as the price didn’t reach anticipated heights.

The ongoing uncertainty around the $0.50 resistance level meant that traders remain cautious.

Increased buying pressure

According to a latest report from AMBCrypto, there’s growing demand for FTM as the amount of FTM held on exchanges is shrinking, while the amount held off-exchange is swelling.

This trend indicates that investors are transferring their assets from exchanges, usually a signal that they have long-term faith in the asset’s value.

Read Fantom’s [FTM] Price Prediction 2024–2025

As a researcher, I’ve noticed an uptick in the whale activity surrounding Fantom (FTM). This surge is evident from the sudden rise in significant transactions, suggesting these ‘whales’ are increasingly active. It’s plausible that this heightened whale involvement and outflows of exchange have fueled the recent bullish momentum observed in FTM.

However, traders remain wary of a potential bull trap near the current price level.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-09-11 22:16