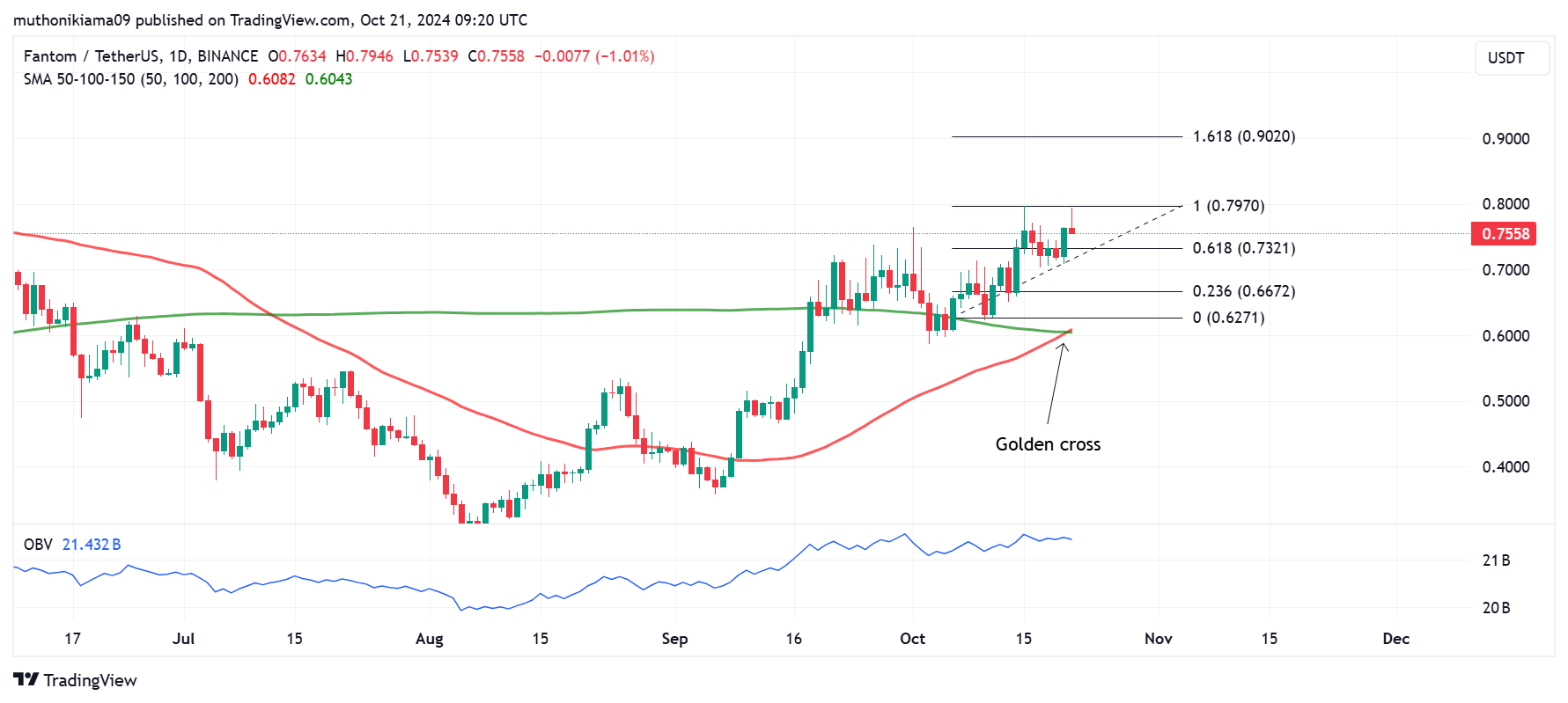

- Fantom has formed a golden cross, with the 50-day SMA crossing above the 200-day SMA.

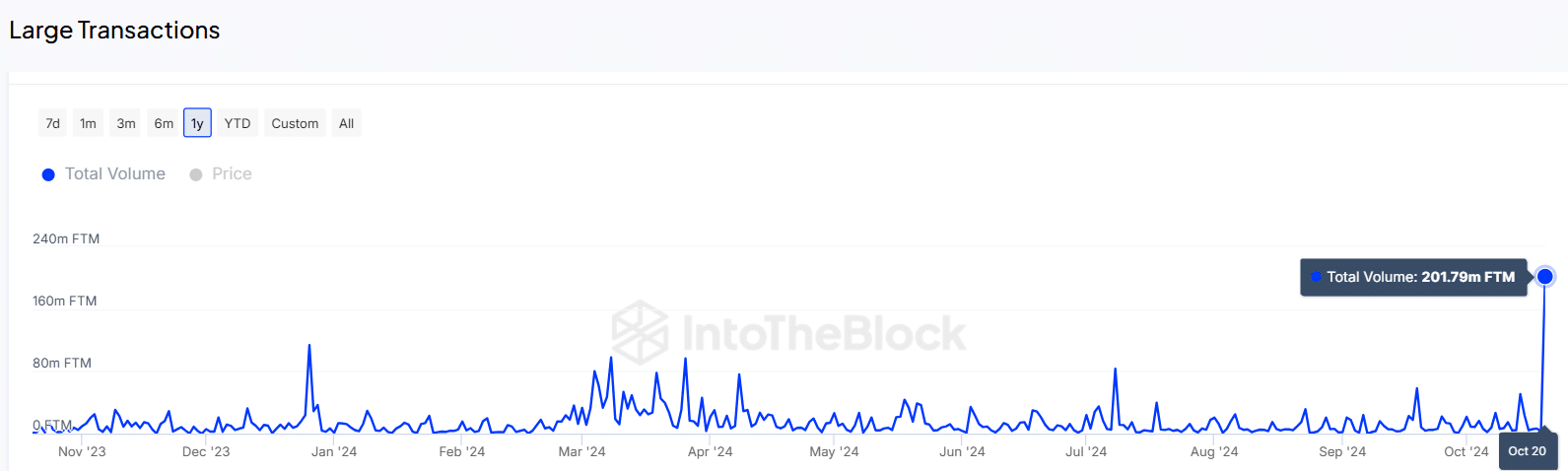

- Large transaction volumes have also increased from 3M to a yearly high of 201M.

As a seasoned analyst with years of experience in the cryptocurrency market, I’ve seen my fair share of golden crosses and whale transactions. The current situation with Fantom [FTM] is particularly intriguing.

Over the last month, I’ve seen some impressive returns on my investment in Fantom [FTM]. This cryptocurrency has been on a roll, outperforming many other altcoins with a solid 20% increase in value. At the moment of writing, it’s trading at $0.755. Quite an exciting ride!

Even though FTM has been steadily rising, it doesn’t seem to be slowing down just yet, considering that trading volumes have surged approximately 140%, as indicated by CoinMarketCap.

The spike in trading volumes coincided with rising whale activity. Per IntoTheBlock, trading volumes for FTM transactions exceeding $100,000 have increased from 3M to 201M within 24 hours.

The current high transaction volumes mark a peak for the year, implying increased activity among Fantom’s significant investors following recent price increases.

Approximately 73% of the Fantom’s total supply is managed by whales. Given the current spike in high-volume transactions, it’s possible that Fantom Token (FTM) may experience substantial price fluctuations.

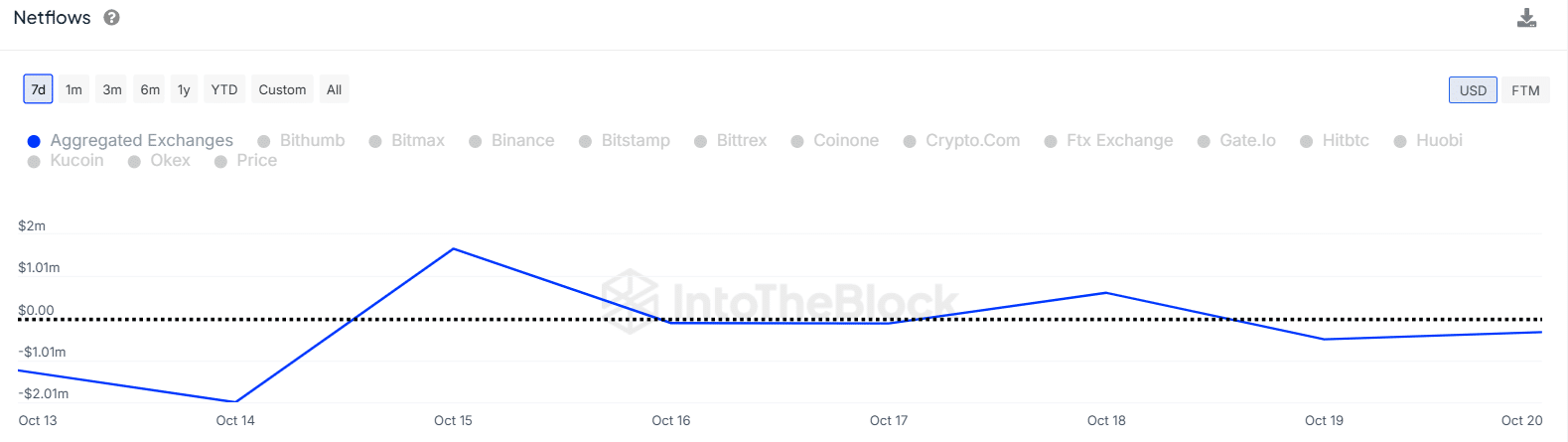

Simultaneously, it’s observed that traders are moving their FTM tokens out of exchanges, as indicated by the cross-exchange flow data. Over the past two days, these FTM exchange flows have generally been negative, suggesting a decrease in supply and potentially alleviating selling pressure.

Negative exchange netflows give room for FTM to extend its gains as it shows traders are not keen on booking profits.

Fantom forms a golden cross

The bullish momentum appears likely to carry on, as Fantom recently displayed a “golden cross” formation on its daily chart, suggesting an upward trajectory in the near future.

As a savvy crypto investor, I’ve noticed an encouraging sign in the market dynamics recently: the 50-day Simple Moving Average (SMA) has surpassed the 200-day SMA. This suggests that the short-term momentum is picking up steam and could potentially indicate a long-term positive trend.

The robustness of this ‘golden cross’ pattern is underscored by the increasing trend observed in the On-Balance Volume (OBV) indicator. This upward movement signifies a progressive buildup in buying actions, crucial for maintaining the ongoing surge.

Following the formation of the golden cross, Fetch.ai (FTM) tried to build on its gains but faced obstacles once more at $0.797. If the price manages to surpass this point, Fetch.ai could potentially surge by 20% and reach the 1.618 Fibonacci level, which is approximately $0.902.

If buyers show reluctance to invest at the current price and the predicted crossover doesn’t occur, FTM might fall to retest its support level at $0.732.

Read Fantom’s [FTM] Price Prediction 2024 – 2025

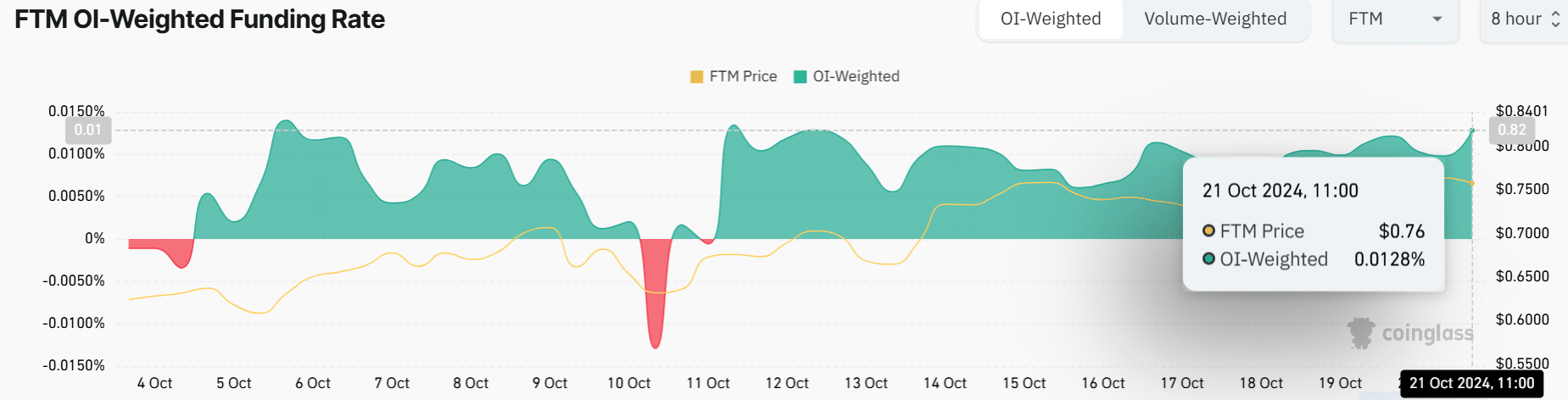

Based on data from Coinglass, it appears traders are optimistic about a continued upward trend, as Funding Rates have reached their highest point in over a week. This suggests an increase in the number of traders who are choosing to hold long positions on FTM.

This increase indicates that there’s a favorable opinion towards the token, as long-term investors are ready to spend more to maintain their investment.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Elden Ring Nightreign Recluse guide and abilities explained

2024-10-22 04:07