Last week, the markets took a pause from the rollercoaster of headline-driven chaos, while institutional bitcoin accumulation plodded along at its own pace. Meanwhile, tokenized equities made their grand entrance, and a broader reckoning is underway as investors take a long, hard look at the Fat Protocol thesis. Spoiler: It’s not looking too good.

This editorial hails from last week’s edition of the Week in Review newsletter. Want this fresh out of the oven every week? Subscribe, and get it before your neighbor does!

The Fat Protocol Thesis Is Cracking—Revenue Is the New Narrative

Let’s begin with the macro picture, shall we? For over a month, macro headlines were the puppet masters, pulling the strings of every market move, until last week. Thursday’s better-than-expected U.S. non-farm-payrolls report utterly smashed hopes of a July Fed rate cut, and instead, pushed the whispers of a rate cut to the far-off, mystical September meeting.

On a longer timeline, last week brought signs that the influence of monetary policy is on the wane, while fiscal policy is making a valiant rise – fiscal dominance, if you’re feeling fancy.

The European Central Bank signaled its intentions to meddle in capital allocation, saying, “There’s an urgent need to channel retail savings into capital markets to develop those markets and finance EU priorities.” Well, that’s one way to get retail savings working for you.

Michael Green, the oracle of passive investing, pointed out that:

If Europe adopts a 401K-style default passive/target date fund model, i.e., shifting a sizable chunk towards European countries, it will have a permanent impact on “American Exceptionalism.” Well, that’s one way to poke the bear!

Now, on to Bitcoin. Bitcoin’s been hanging around below its all-time high for the entire week. Institutions and corporate treasuries are still adding to their piles, but an informal Crypto Twitter poll reveals that many crypto natives still haven’t jumped in, waiting for Bitcoin dominance to peak before the great altcoin season kicks off. Oh, the suspense!

Could the approval of U.S. spot altcoin ETFs spark the start of the alt season? James Seyffart and Eric Balchunas seem to think so, expecting a wave of new ETFs in the second half of 2025. Personally, I think Bitcoin’s got a bit more room to run before that happens.

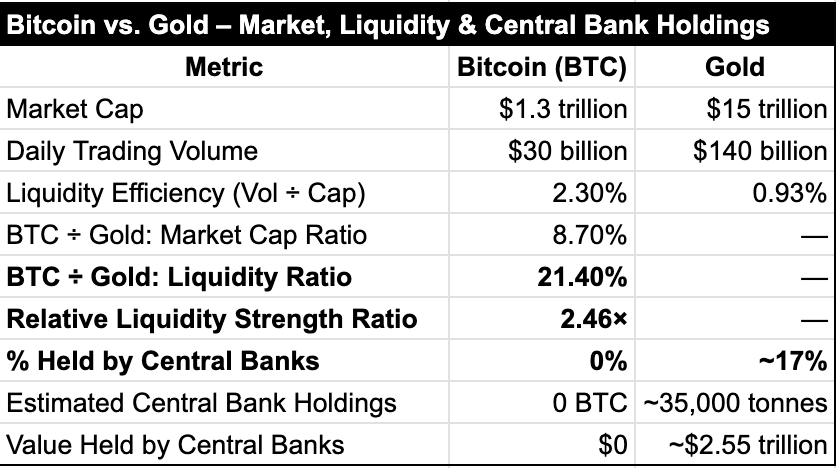

Speaking of Bitcoin, here’s some hopium for you. This chat shows the market, liquidity, and Central Bank holdings of Bitcoin and Gold, giving us a glimpse of Bitcoin’s potential growth. Careful, though—it might give you a high! 🚀

In other news, equities have made their debut on the blockchain. Solana and Robinhood unveiled tokenized stocks. The dream of 24-hour trading, DeFi composability, and global access is alive and well—but this initial rollout is… well, let’s just say it’s not quite there yet. Check out this post for a reality check.

Still, settlement ledgers at the DTCC, Euroclear, or JASDEC will be on-chain in the future. Once equities become true on-chain primitives, you’ll see dividends airdropped, stocks serving as DeFi collateral, and corporate actions executing themselves. It’ll be a slow, glacial adoption—until suddenly, bam! It’s the default.

Speaking of slow changes, here’s one of the biggest shifts currently underway: the belief that the Fat Protocol thesis might just be a load of baloney. Joel Monegro’s 2016 Fat Protocol post argued that base-layer protocols would capture most of the value in crypto, but now it seems like a lot of people are changing their tune. Maybe we were all wrong after all?

This shift is well underway, as many Layer 1 and Layer 2 tokens have struggled despite having impressive tech. Why? Because creating a chain is easier than ever. Robinhood’s announcement of its new Layer 2 blockchain shows how easy it is to proliferate. Bold captured this in a great comic—because who doesn’t love a good comic?

And finally, a revenue-centric narrative has begun to take hold. Crypto investors are demanding to see some cold, hard cash flows attached to tokens. My co-host Graham Stone on the Token Narratives podcast joked that in crypto, simply asking how much money a project is making and whether that cash reaches token holders feels like a radical concept. We’ve come so far… yet so little. 🤑

Read More

- Best Controller Settings for ARC Raiders

- How to Get the Bloodfeather Set in Enshrouded

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Gold Rate Forecast

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Yakuza Kiwami 3 And Dark Ties Guide – How To Farm Training Points

- How to Build a Waterfall in Enshrouded

- Meet the cast of Mighty Nein: Every Critical Role character explained

- These Are the 10 Best Stephen King Movies of All Time

- Best Werewolf Movies (October 2025)

2025-07-14 00:57