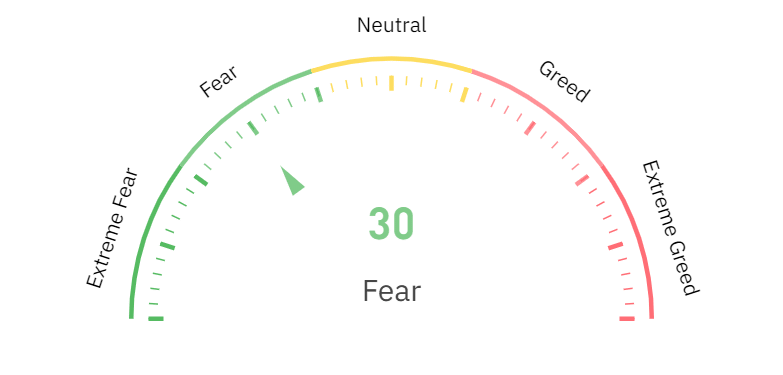

- Crypto Fear and Greed showed that the market has descended into fear.

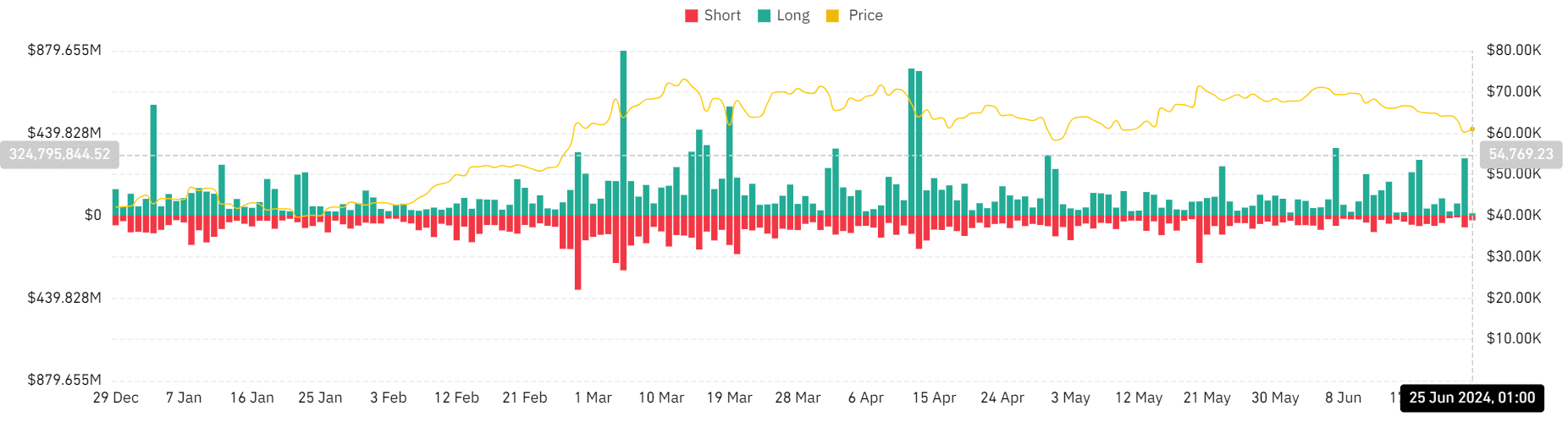

- Long liquidation volume also spiked.

As a researcher with extensive experience in studying cryptocurrency markets, I cannot help but be concerned by the recent turn of events. The Fear and Greed crypto index, which I closely monitor, has plummeted to a reading of 30, indicating that fear is dominating market sentiment. This shift was further underscored by the significant spike in liquidation volume on June 24th, with long positions accounting for over $305 million of the total $367 million in liquidations.

The decrease in Bitcoin‘s [BTC] value over the past few days has caused a substantial wave of influence throughout the cryptocurrency sector. This price drop has noticeably affected investors’ confidence, as indicated by fluctuations in the Fear and Greed Index for digital currencies.

The impact of the price drop was also visible in the liquidation map.

Fear dominates crypto

Based on the latest reading from the Fear and Greed Crypto Index on Coinglass, which stands at 30, it’s evident that fear is currently driving the market mood.

As a cryptocurrency market analyst, I would assess the overall sentiment amongst investors by collecting information from diverse sources. These sources encompass market fluctuations, social media trends, emerging patterns, and other significant indicators.

With a score of 30, investors express apprehension and anxiety, indicating their focus on possible market losses. This mindset frequently emerges following distressing market occurrences, like substantial price declines.

This can lead to a more cautious approach among investors.

Under certain circumstances, I would hesitate to make new investments due to the fear of incurring greater losses. Alternatively, I might choose to sell my existing holdings in anticipation of further price declines to minimize potential losses.

The increasing apprehension and pessimism regarding the market’s imminent future is reflected in this trend toward fear.

Market sees increased liquidation

On the 24th of June, there was a substantial increase in liquidations as shown in the chart, amounting to over $367 million.

Long positions, representing over $305 million in liquidations, played a significant role in driving the recent change toward fear in the Crypto Fear and Greed Index.

As a researcher studying market trends in the crypto space, I’ve observed that massive liquidation of long positions suggests a significant number of investors, holding beliefs that cryptocurrency prices would upwardly trend, were compelled to sell off their holdings.

This can lead to a sharp decline in prices as the market is flooded with sell orders.

With a smaller volume of short liquidations under $62 million, it can be inferred that a lesser number of traders who had betted against the market forcibly closed their positions.

This suggested that investors expected continued growth, which did not materialize.

How Fear and Greed crypto could have shaped up

The disparity between lengthy and brief sale orders frequently intensifies declining price trends, fueling apprehension and doubt among traders. Conversely, a surge in short sales can reverse this trend.

Pessimistic traders are being pushed out of the market as prices continue to rise, which could lead to a change in investor sentiment from fear to greed if this trend persists.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a crypto investor observing the current market scenario, I can’t help but notice that recent liquidations serve as crucial signs reflecting the prevailing market sentiment and trends.

The price actions of individual traders mirror not just their responses to market fluctuations, but also the collective psychological state shaping future trading dynamics.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-06-25 23:03