Bitcoin is cautiously wobbling, but a change in leadership at the US Federal Reserve could be the cosmic nudge that propels the cryptocurrency into a realm of record highs. Investors are watching with the intensity of a confused parrot, waiting for the next crypto explosion-because nothing says “excitement” like a 5% drop and a 100% chance of confusion. 🧠💸

A Victory at a Big Cost

Galaxy Digital CEO Mike Novogratz, ever the optimist, claims a strongly dovish Fed chair could be the biggest bullish driver for Bitcoin and the wider crypto market. Imagine that: a central bank so relaxed, it’s practically napping on the job. But beware, dear reader-such a path would likely leave the US economy in a state of existential dread and the Fed’s independence as fragile as a teacup in a hurricane. 🧊💣

President Donald Trump, ever the fan of “dovish” candidates, has reportedly narrowed his shortlist to Kevin Hassett, Christopher Waller, and Kevin Warsh-three names so bland, they could double as a cereal box. Waller, for instance, has previously advocated for earlier rate cuts, which markets interpret as “dollar-negative” and “crypto-friendly.” Because nothing says “economic stability” like a currency that’s constantly fleeing. 🏦📉

Bitcoin in a Crucial Zone

Technically, Bitcoin’s price action remains as fragile as a teacup in a hurricane, trading around $109,000 after a 5% decline. Analysts at Swissblock, ever the optimists, claim Bitcoin has been range-bound for ten weeks, fluctuating between $109K and $124K. It’s like a cosmic game of “Hot Potato,” but with more graphs and fewer potatoes. 🧠📈

Risk models suggest the market has entered a destabilization phase, but now it’s showing early signs of stabilization. Because nothing says “recovery” like a market that’s 50% likely to collapse and 50% likely to explode. 🌪️💥

Bitcoin lost $110K, and yet the Risk-Off Signal never triggered. 🧠

Despite trading close to $107.3K, the prior local low from August’s correction, the structure is holding. Like a cosmic tightrope walker, but with more numbers. 🕺

Bitcoin shows signs it may be preparing for a final round. 👇

Chart from @bitcoinvector

– Swissblock (@swissblock__) September 26, 2025

Swissblock noted that selling by long-term holders has slowed, and ETFs and treasuries continue to buy, which supports the market from below. Because nothing says “confidence” like a government buying assets at the same time it’s printing money. 🏦💰

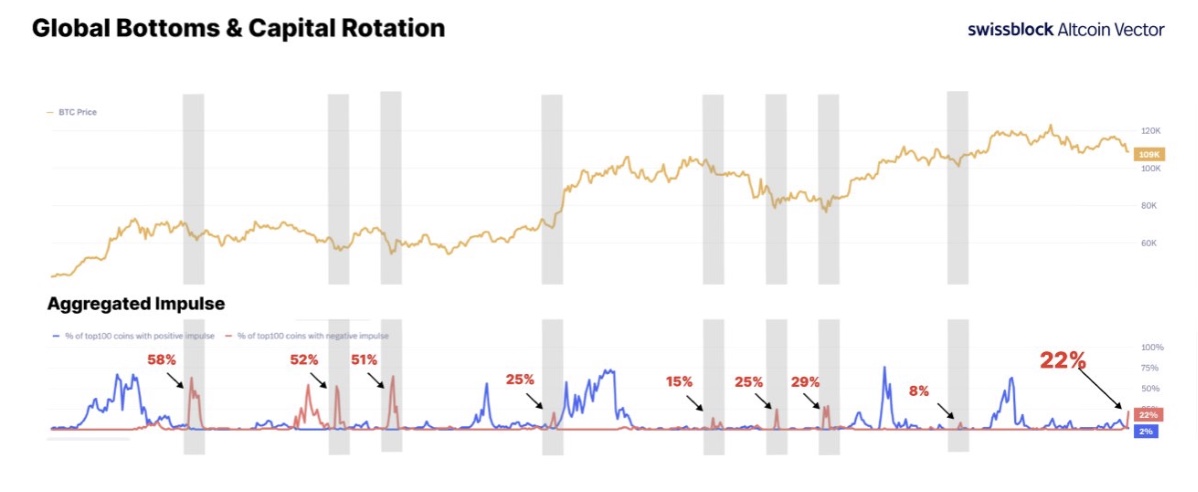

Their “Aggregated Impulse” indicator, built from price structures across hundreds of digital assets, suggests the market is in a reset phase. Historically, similar signals have marked major lows followed by strong rebounds in both Bitcoin and altcoins. Because nothing says “recovery” like a market that’s been low enough to qualify for a tax break. 🧮📉

Swissblock’s aggregated impulse indicator | Source: Swissblock

On the other hand, October and November often bring favorable conditions for crypto, and a potential Fed easing cycle would act as a macro tailwind. Because nothing says “economic growth” like a central bank that’s more relaxed than a sloth on a beach. 🌊🐢

If the next Fed chair adopts a notably dovish stance, a weaker dollar and lower yields could accelerate flows into cryptocurrencies as investors seek higher returns. Because nothing says “rational decision-making” like chasing profits in a market that’s as predictable as a quantum physics equation. 🧠🚀

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Gold Rate Forecast

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Felicia Day reveals The Guild movie update, as musical version lands in London

- 10 Movies That Were Secretly Sequels

- Best Thanos Comics (September 2025)

2025-09-27 15:10