Friday was anything but ordinary. Imagine this: Governor Waller of the Federal Reserve, a chap who probably spends his weekends ironing dollar bills for fun, popped up on CNBC for a chinwag. This was just 48 hours after the Fed, in a show of spectacular indecision, chose to do absolutely nothing with interest rates for the fourth thrilling time in a row. Excitement!

Waller Whispers, Bitcoin Wiggles, Markets Lose Their Marbles 🪙🤹♂️

U.S. President Donald Trump, a man who’s never met a microphone he didn’t like, has spent weeks flinging spicy nicknames at Federal Reserve Chairman Jerome Powell (think schoolyard meets Wall Street). Now, just as the president was running out of creative insults, Fed Governor Christopher Waller (clearly not tired of living dangerously) hinted that the Great Rate Cut might be arriving in July. That’s sooner than a bored child eating a Wonka Bar can find a golden ticket!

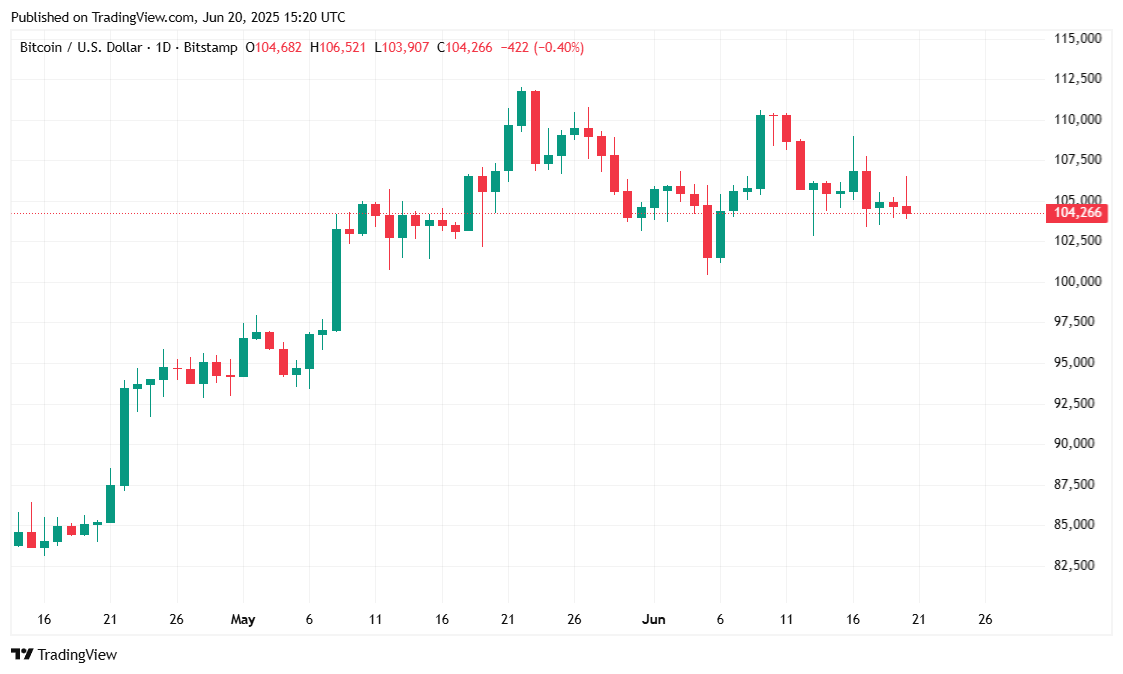

Markets snapped to attention — for about as long as a goldfish remembers its own name. Bitcoin soared past $106K, did a pirouette, then slipped right back to $104K, perhaps tripping over its own shoelaces. Stocks wobbled like jelly: The Dow crawled up 0.16% (bravo, Dow, you tiny overachiever) while the S&P 500 and Nasdaq stumbled around, down 0.26% and 0.64%. Crypto? It flexed, then flopped. The whole affair was about as stable as a three-legged table at Mike Teavee’s birthday party.

In a dazzling display of presidential banter, Trump christened Powell with new names: “numbskull,” “dumb,” and — in a twist Dickens would admire — “Too Late.” Basically, Trump wanted those rates sliced faster than a pâté at a bankers’ picnic. After all that heckling, Waller piped up, saying:

“I think we’re in the position that we could do this and as early as July,” — which in Fed-speak is practically shouting “free sweets for everyone!” Whether the rest of the committee agrees or is simply busy doodling during the meetings, only time will tell.

Market Nonsense in Numbers (and a Bit of Drama) 📉🤔

At last look, Bitcoin hovered near $104,294.98, dancing between $103,932.09 and $106,539.38 like a jittery Oompa Loompa. Price dipped a modest 0.05% for the day — barely a sneeze — but sagged 1.22% over a week, which in crypto terms means “hardly anything exploded.”

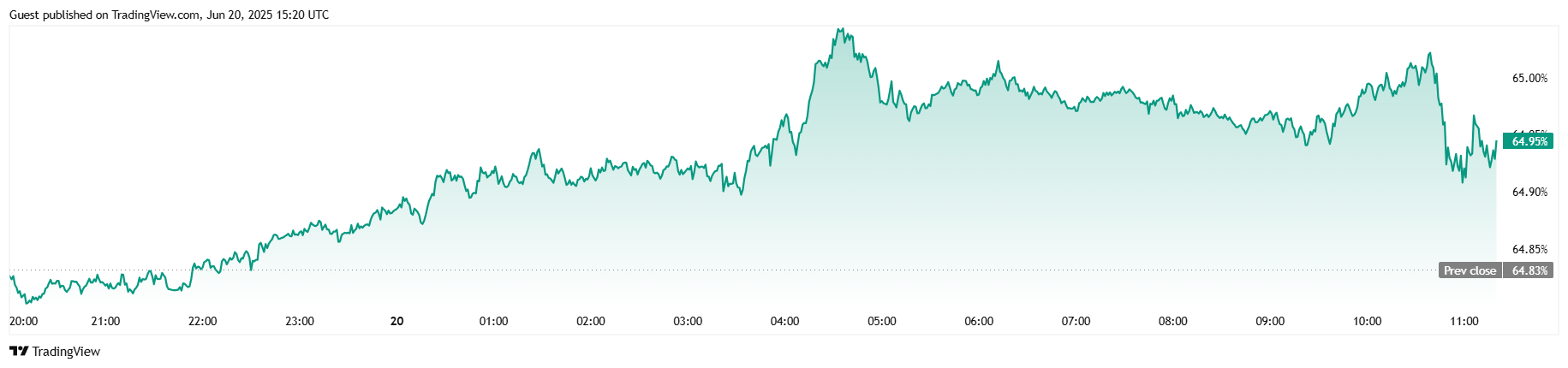

Trading volume tiptoed up 1.54% to a cheeky $42.65 billion — proof there are still plenty of brave souls out there stabbing at keys and shouting “HODL!” (or vice versa). Bitcoin’s market cap trimmed a snip off the top, falling to $2.07 trillion — a drop so slight, even Augustus Gloop would call it disciplined. Meanwhile, BTC grabbed a slightly bigger slice of the pie, hitting 64.94% dominance, meaning the other coins collectively cried into their digital pillows.

And in the land of futures? Open interest wiggled up 0.90% to $70.09 billion — a bit like Grandpa Joe feebly stretching before leaping out of bed. Meanwhile, $40.03 million worth of greedy bulls got liquidated chasing rainbows, while $22.61 million shorts got zapped too. In total, $62.64 million was sent to the Crypto Liquidation Graveyard in the past 24 hours. Chocolate factory, this is not. And yet, the entertainment never ends. 🍫💸

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-06-20 20:08