So, the US Fed is gearing up to spill the beans on interest rates after their July shindig this Wednesday. You know, because who doesn’t love a good financial cliffhanger? 😅

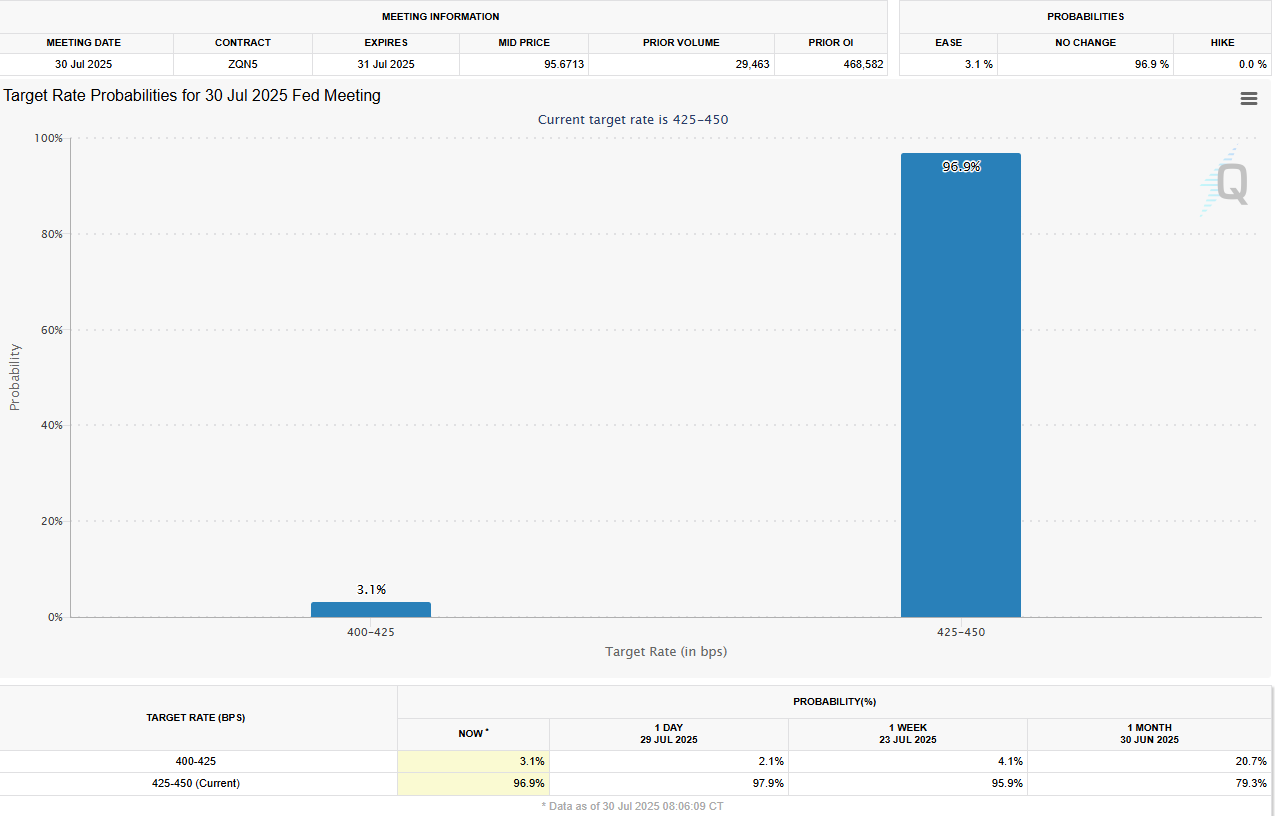

Everyone’s betting the farm that they’ll keep things steady for the fifth time in a row, ever since they slashed rates by a measly 25 bps back in December, landing us in the 4.25%-4.50% boredom zone. Yawn. 💤

No Rate Cut in Sight from the Feds? Puh-lease!

According to this fancy CME FedWatch thingy, investors are about as excited for a July cut as I am for a kale smoothie – basically zero chance. But come September, there’s a 64% shot at a 25 bps dip. So, the dollar’s playing hard to get, teetering on the edge of chaos. 🤷♀️

The June SEP update had the bigwigs penciling in 50 bps cuts for 2025, with a couple more 25 bps nibbles in ’26 and ’27. Generous, aren’t they? 🙄

Out of 19 Fed folks, seven are basically saying “nah, no cuts in 2025,” two are mildly optimistic for one, eight think two might happen, and two are dreaming of three. It’s like a bad first date – everyone’s got different expectations. 😂

Post-June meeting, Governor Waller was all gung-ho for a July cut, blabbering about not waiting until the job market tanks before loosening the purse strings. And Governor Bowman? She’s casually dropping that she’s open to a cut as soon as July, ’cause inflation’s chilling out. Sure, Jan. 😏

Meanwhile, Trump can’t resist butting in, pressuring the Fed to slash rates like it’s a Black Friday sale. Chatting with PM Starmer, he moaned that the economy could be fabulous if only rates were lower. Because, obviously, Trump’s always right. 🙄

“Expect the FOMC to play it safe and keep rates at 4.25%-4.50% next week,” quipped the TD Securities crew. “Powell will probably drone on about being patient and data-driven, maybe hinting at September action. And hey, dissents from Bowman and Waller? Totally on the cards.” Yeah, because nothing says excitement like committee disagreements. 😆

When will the Fed announce its interest rate decision and how could it affect EUR/USD? Spill the tea!

Mark your calendars: Rate reveal and policy statement drop on Wednesday at 18:00 GMT, followed by Powell’s presser at 18:30 GMT. If he teases a September cut, blaming it on those shiny trade deals with Europe and Japan, the dollar might just faceplant. Sell, sell, sell! 💸

Eren Sengezer from FXStreet is dishing out the technical dirt: “EUR/USD’s looking bearish AF. RSI under 50, trading below the 50-day SMA for the first time since February – ouch! Bear market blues incoming.” Thanks for the doom, Eren. 😭

“If things go south, watch for support at 1.1440 (that Fibonacci level), then 1.1340 (100-day SMA), and 1.1200 (more Fib nonsense). Upside? Resistance at 1.1700 (20-day SMA), 1.1830 (trend end), and 1.1900 (just a round number). Classic chart chatter.” Said with all the enthusiasm of reading the fine print on a diet plan. 📉

On the flip side, if Powell channels his inner snail and preaches patience, harping on that stubborn June inflation and the job market’s annoying resilience, the dollar could strut its stuff. Investors might hold their horses and wait for fresher data before betting on a cut. Smart move, or just more stalling? 🤔

In this wait-and-see world, it’s all about not jumping the gun – or the rate cut. Stay tuned, folks; this economic soap opera isn’t over yet. 🎭

Read More

- Best Controller Settings for ARC Raiders

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Ashes of Creation Rogue Guide for Beginners

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 Most Brutal Acts Of Revenge In Marvel Comics History

- Khloe Kardashian Details “Draining” Reunion With Ex Lamar Odom

- Michael Turner and Geoff Johns’ Ekos Vol. 2 Reveals First Look Preview as Kickstarter Shatters Funding Goal (Exclusive)

2025-07-30 16:47