- FET ended its prolonged downtrend, and eyed a higher high of above $1.60.

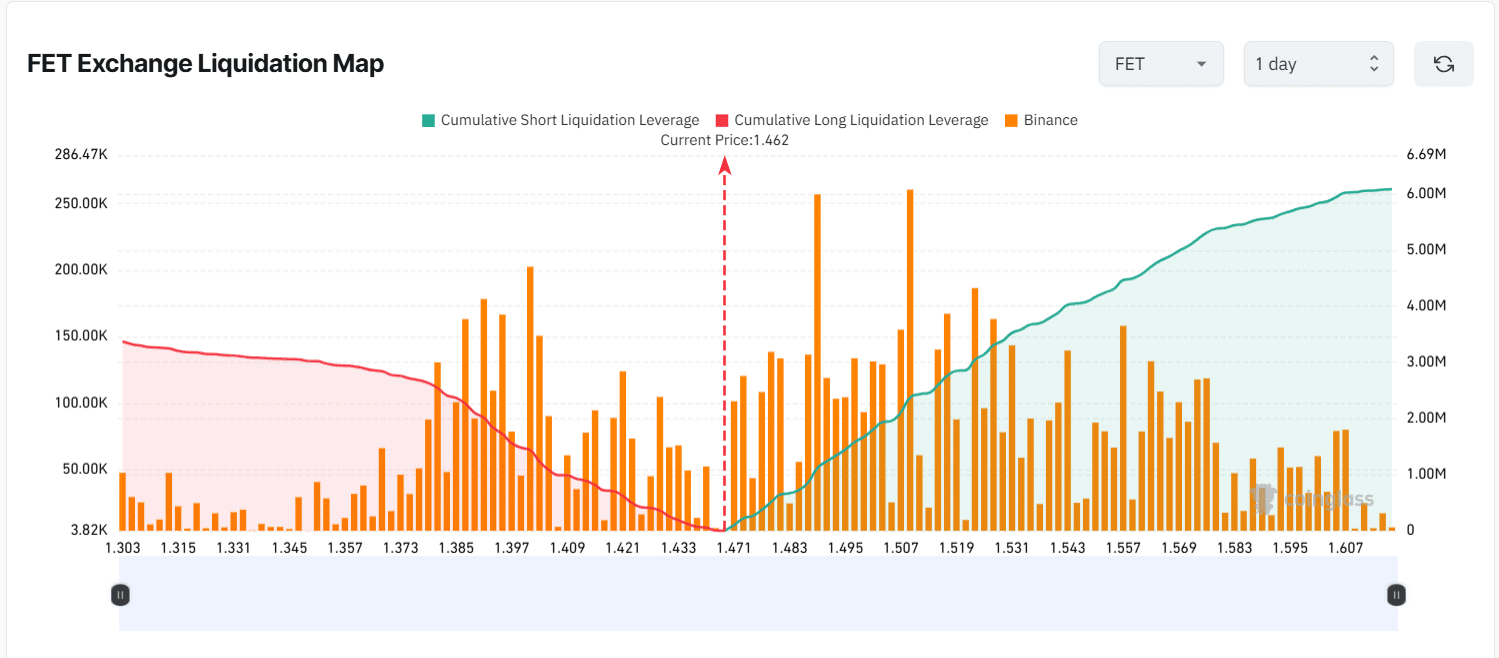

- Liquidation clusters at $1.50-$1.60 signaled leverage-driven volatility.

As a seasoned researcher with over a decade of experience in the crypto market, I have witnessed more than a few rollercoaster rides. The recent breakout by Artificial Superintelligence Alliance [FET] from its prolonged downtrend has piqued my interest. While I am cautiously optimistic about FET’s potential to breach the $1.60 resistance level, I cannot help but recall the old adage: “Markets tend to climb a wall of worry.

Artificial Superintelligence Alliance [FET] has recently broken a 266-day downtrend, signaling a potential trend reversal. The token’s price has increased by 7.88% over the past week, with a market cap of $3.46 billion.

However, analysts cautioned that FET faced a significant resistance at the $1.60 level.

Not passing beyond this level might result in a potential double-bottom pattern, more so if Bitcoin‘s price dips towards $80,000. In simpler terms, there’s a possibility of seeing a specific chart pattern (double-bottom) if the price of Bitcoin falls to around $80,000 and then recovers but doesn’t exceed this level.

Lower time frame analysis

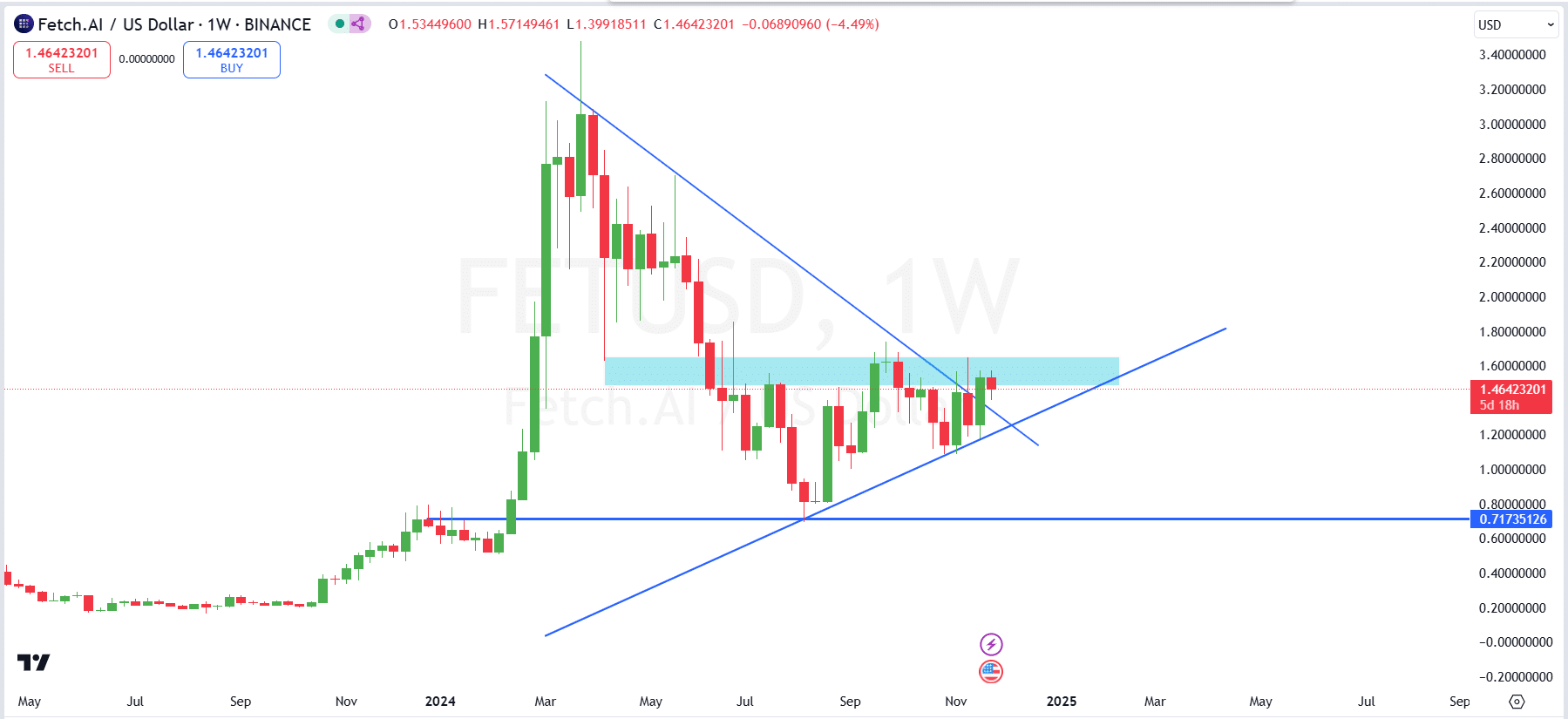

Following a 266-day period of continuous decline, the price of FET has managed to surge past its resistance trendline due to high trading volumes, suggesting that there is a substantial amount of buyers eager to acquire the asset.

Currently at $1.42 during this report, the surge symbolizes a significant advancement; however, the price is expected to encounter substantial resistance within the range of $1.60 to $1.65.

For the upward trend to be sustained and for us to aim towards the price ranges of $2.20 – $2.50 in the coming months, it’s essential that we surpass this current level with a significant increase in value. This high should ideally be maintained at a close above the mentioned level.

However, until FET clears this resistance, there remains the possibility of a Double Bottom formation, which could be triggered by a market pullback, potentially shaking out leveraged positions.

If the price doesn’t surpass $1.60, it might result in a retreat back to around $1.20 or possibly $0.72, as these areas show significant support.

Over the coming weeks, we’ll see if FET maintains its upward trend or instead stabilizes at a lower point.

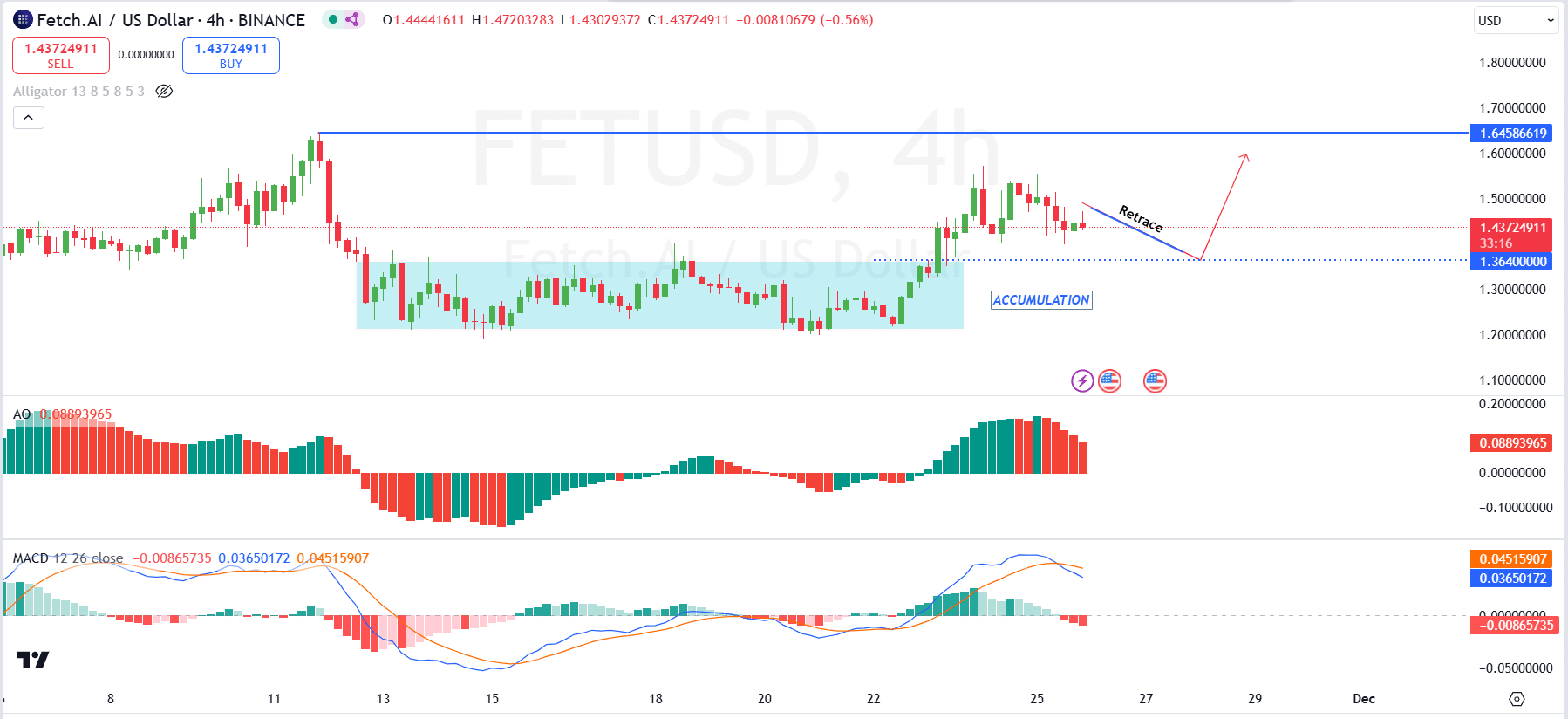

On a 4-hour timeframe, the price appears to be pulling back towards the area around $1.36, which was earlier marked by buyers amassing their positions before driving the price upwards.

Returning to this point gives traders a chance to match their positions with the moves of the ‘smart money’, possibly allowing them to catch another uptrend.

As a crypto investor, if the price manages to rebound from $1.36 and changes its direction, the upcoming significant barrier I’ll be keeping an eye on is at $1.645.

Signals such as the MACD, which indicates a lessening of strong upward movement that could lead to a bearish cross, and the Awesome Oscillator (AO), mirroring decreasing optimistic energy, hint at a temporary reversal or downturn in the short term.

FET shows strong network growth

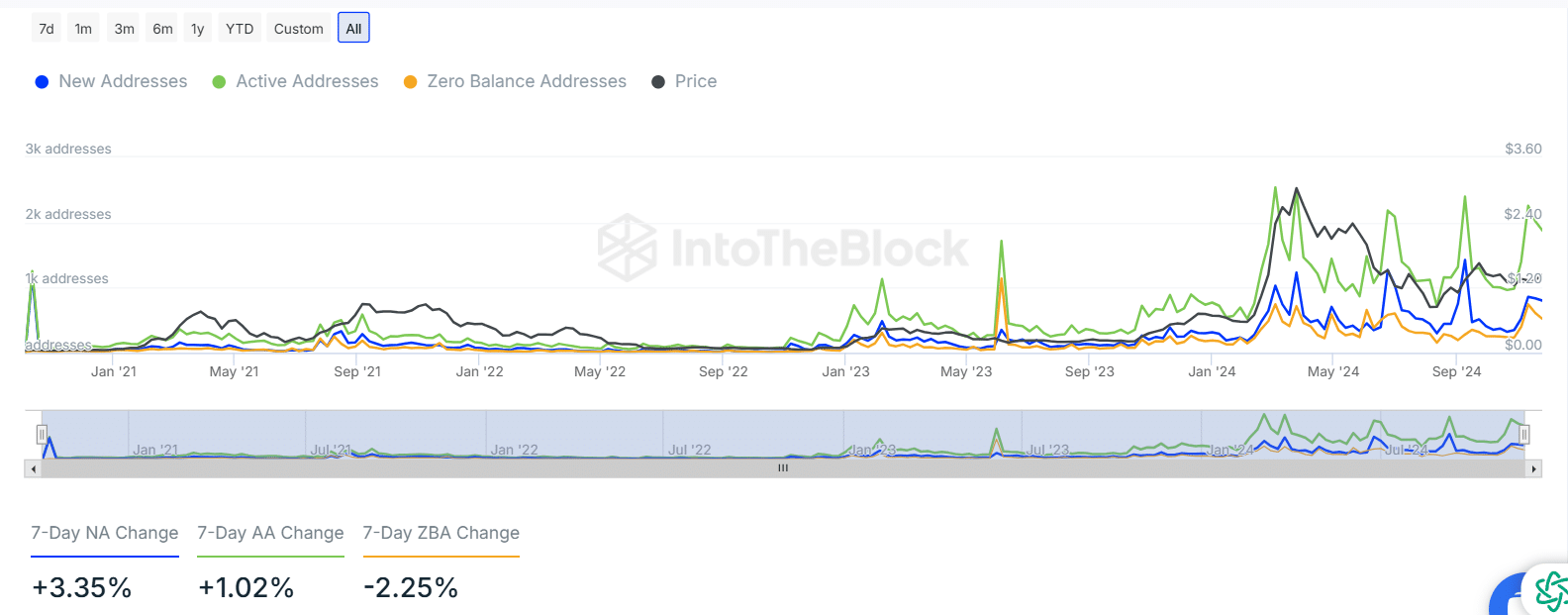

In recent times, there’s been a noteworthy surge in the activity level for Fetch.ai. At its peak, daily active addresses (represented by green) exceeded 2,400, while new addresses (indicated by blue) soared past 1,200. This trend suggests an expanding user involvement with the platform.

The number of zero-balance addresses (orange) has steadily increased, suggesting a surge of new users eager to interact with the network.

Over the past seven days, new addresses increased by 3.35%, and active addresses rose by 1.02%, further emphasizing growing adoption.

On the other hand, there was a 2.25% reduction in the number of zero-balances, indicating that some accounts have started being used actively.

The correlation between this action and price fluctuations is strong, as the highest point of $1.70 occurred alongside surges in both new and active user accounts.

The continuous increase in operational accounts highlights persistent acceptance, whereas the decrease in accounts with no value implies a transition from speculative intentions to practical usage and interactions.

From my perspective as an analyst, it’s worth noting a substantial buildup of long liquidations occurring above the $1.50 mark, with peak accumulation close to $1.60. This suggests that there are potentially over-leveraged long positions at play. If there’s a market retracement, these positions could face increased risk.

Instead, a higher concentration of short liquidations can be found beneath $1.40, with the level of intensity growing stronger as the price approaches $1.30.

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024 – 2025

Such a decrease in price, falling below $1.40, might set off a chain reaction leading to forced closures of short positions.

The map indicated a significant amount of risky trading, potentially causing sharp fluctuations as the prices approach areas with many pending liquidations.

Read More

2024-11-26 23:36