-

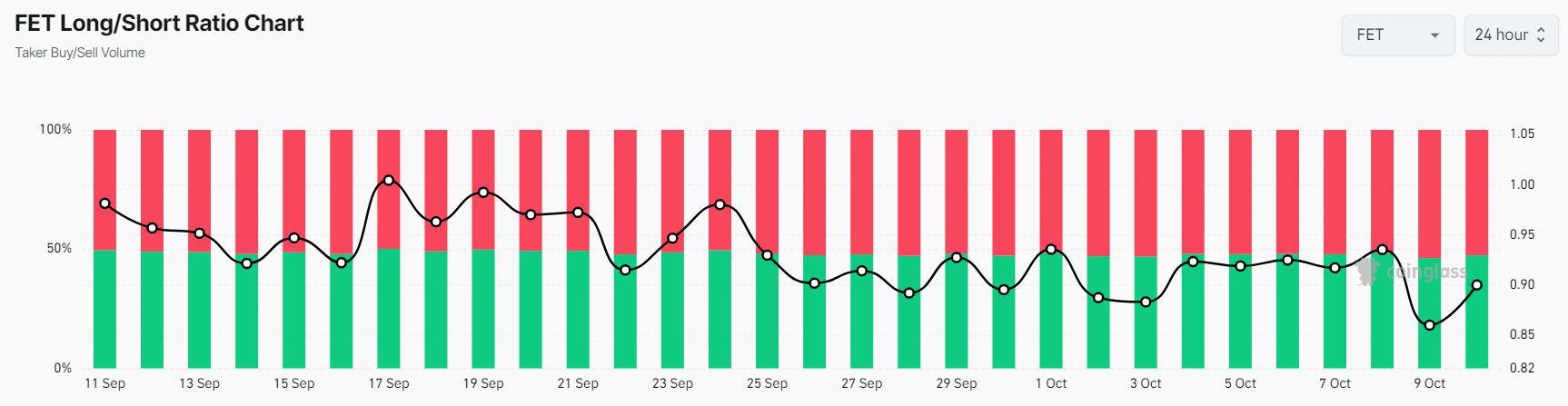

FET’s Long/Short Ratio was at 0.90, indicating strong bearish market sentiment among traders.

53.2% of top traders held short positions, while 46.8% held long positions.

As a seasoned researcher with over a decade of experience in the volatile world of cryptocurrencies, I must admit that the current state of FET is causing me some concern. The Long/Short Ratio at 0.90 and the overwhelming preference for short positions among top traders are strong indicators of a bearish market sentiment.

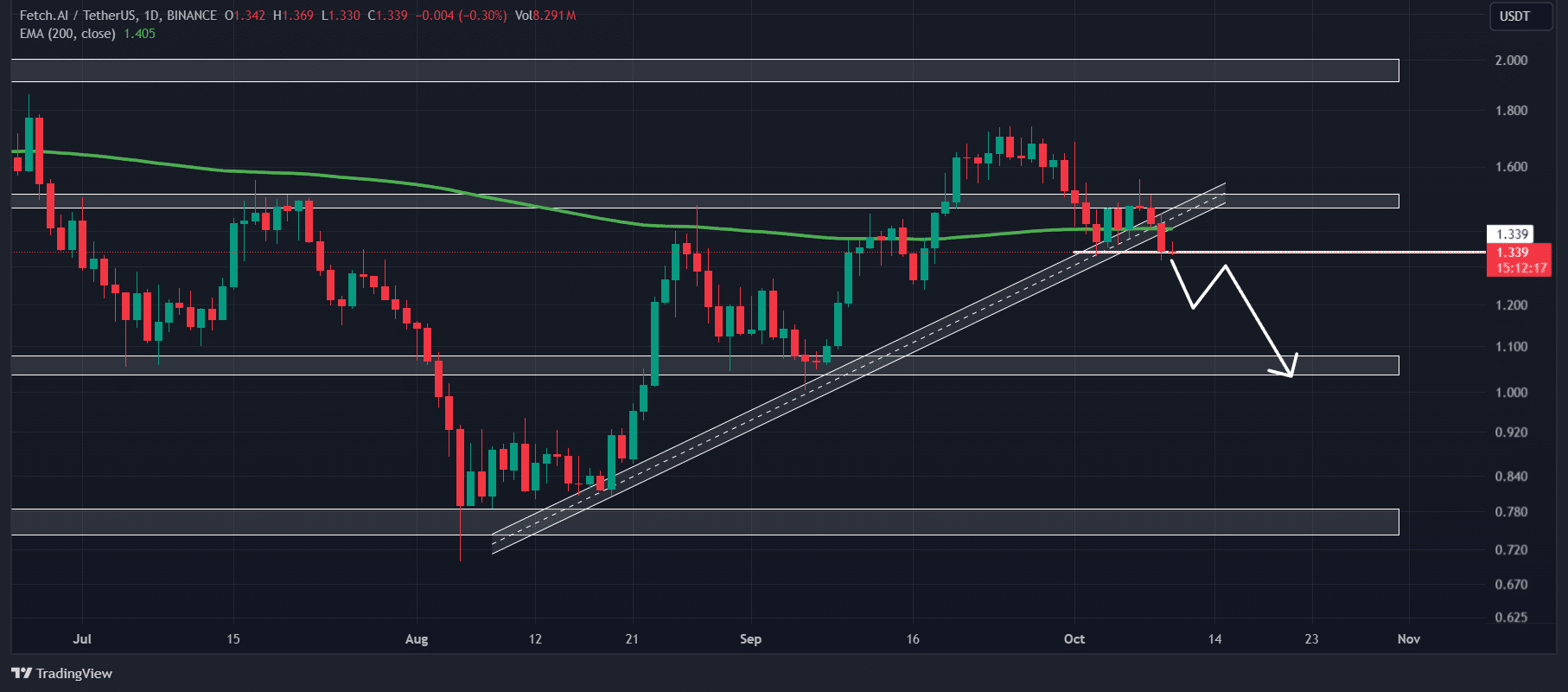

Despite the persisting negative market atmosphere, the Artificial Superintelligence Alliance’s FET Price Forecast indicates a significant drop in value may be imminent due to its failure to maintain a critical support point.

In my exploration of the digital currency landscape, I’ve noticed that significant players like Bitcoin (BTC) and Ethereum (ETH) have faced a challenging 24-hour period. These cryptocurrencies have witnessed substantial drops in their prices.

Current price momentum

Currently, FET is close to $1.35 per unit following a 4.7% decrease in price within the last day. Simultaneously, the trading volume decreased by 4.9%, suggesting less involvement from traders and investors during this timeframe.

In simpler terms, the Future Electric Corporation’s (FEC) stock has dropped below a significant line of resistance, a stable area where prices have been moving sideways, and its 200-day moving average on a daily chart.

The day’s close occurred beneath the consolidation area, signifying that the breakout was indeed successful.

Given the past trends in FET‘s price movement, it appears likely that its value might decrease by approximately 20%, potentially dropping down to around $1.03 over the next few days.

Even though the overall sentiment seems negative, the Relative Strength Index (RSI) indicates it’s currently oversold, which could signal an impending price increase.

However, this seems unlikely at the moment, due to the prevailing bearish market sentiment.

Bearish on-chain metrics

The altcoin’s negative outlook is further supported by on-chain metrics.

As reported by the analysis company Coinglass, the Long/Short Ratio for FET stood at 0.90 at the moment of reporting, suggesting that a significant majority of traders are holding a bearish outlook on the market.

Furthermore, there’s been a 6.7% decrease in Futures Open Interest over the last day, and this figure has consistently gone down, indicating persistent negative market sentiment.

At press time, 53.2% of top traders held short positions, while 46.8% held long positions.

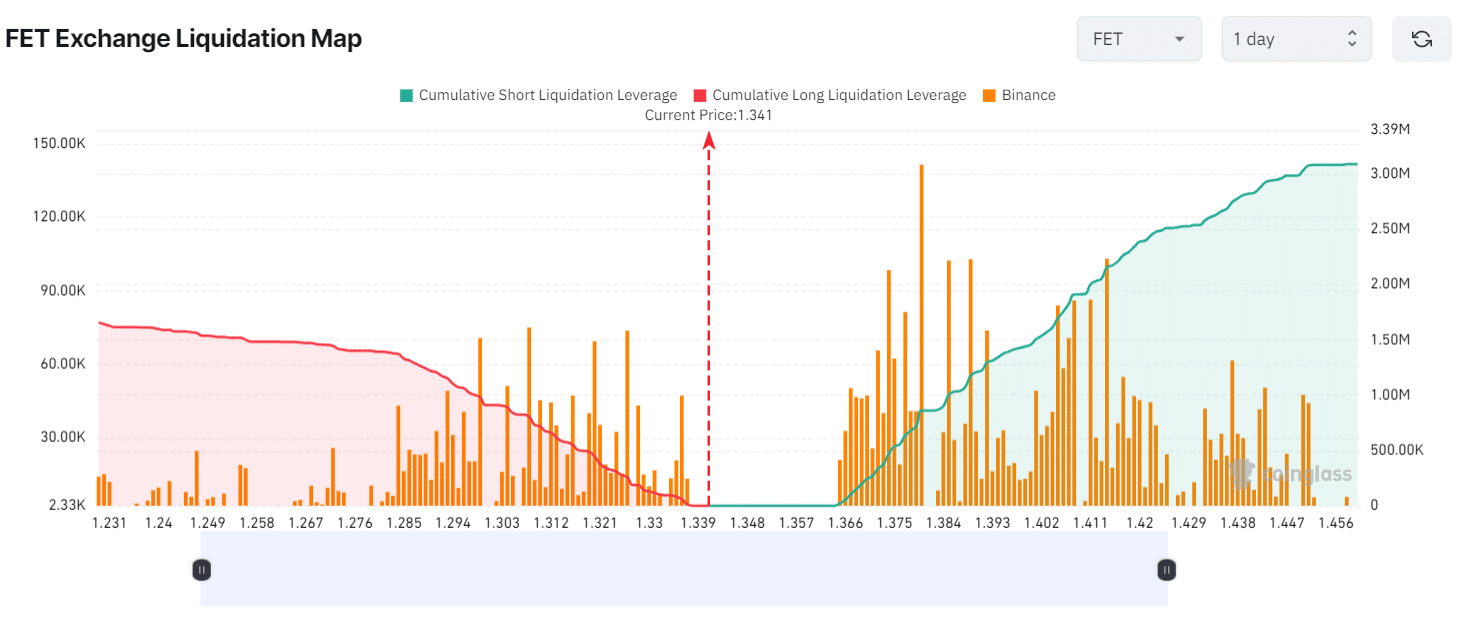

According to Coinglass data, significant sell-off points were found at $1.30 (on the downside) and $1.38 (on the upside). Traders were found to be heavily invested at these price points, suggesting potential market volatility.

As a crypto investor, if the market holds steady and Filecoin (FET) dips down to $1.30, it’ll mean approximately $807,000 worth of long positions will be automatically closed due to their stop-loss settings.

If the sentiment changes and the price increases to around $1.38, it would result in roughly $2.17 million being recouped from positions that were previously shorted.

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024–2025

Over the last day, it appears that short sellers have been taking substantial wagers on negative market positions.

It seems that by merging technical analysis methods with indicators like open interest and Long/Short Ratio, we can observe that bears have the upper hand in the market at this moment. This could potentially lead to a significant drop in the asset’s price.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-10-10 15:36