- FET consolidates near $1.33 as traders eye a breakout above $1.38 resistance.

- On-chain activity surges, while technical indicators and liquidations suggest potential bullish momentum.

As a seasoned crypto investor who has navigated through multiple market cycles, I find myself intrigued by Fetch.AI (FET) as it approaches a critical resistance level at $1.38. With my crystal ball slightly tarnished due to the unpredictable nature of this space, I can’t help but feel optimistic about this coin’s potential for a 20-30% rally if the breakout occurs.

Historically, FET has shown resilience in breaking out from similar setups, which makes me believe that it might just do so again. However, I’ve learned the hard way to never underestimate the market’s ability to surprise us, and I’m keeping my fingers crossed that this bullish scenario materializes.

The surge in on-chain activity and growing engagement within the FET ecosystem is certainly a promising sign, hinting at increased investor confidence and potential price movements. The fact that FET’s network activity is reminiscent of a busy beehive gives me hope that this coin could buzz its way to new highs.

Of course, there are always factors that may derail our best-laid plans, like the slight rise in exchange reserves and the weak trend strength indicated by the ADX. But as they say, even the darkest clouds have a silver lining—I’m hoping that these indicators will serve as a reminder for traders to exercise caution rather than dampen the bullish sentiment.

In the end, I can’t help but chuckle at the thought of liquidations potentially fueling a bullish momentum. It reminds me of the classic cartoon scenario where one character trips another, causing a domino effect that leads to chaos. In this case, if FET breaks above $1.38, it could be a series of short liquidations that create a price rally—a truly exciting spectacle for us crypto enthusiasts!

The Artificial Superintelligence Alliance (FET) is gaining noticeable interest as it approaches a possible breakout point that might initiate a surge of 20-33%. Currently, FET is valued at $1.33 per unit, representing a minor decrease of 1.19% over the past day.

Nevertheless, the increasing on-chain actions and robust technical signals hint that a bullish trend could be imminent. Will FET live up to these predictions and experience a significant surge?

Is a breakout above $1.38 on the horizon?

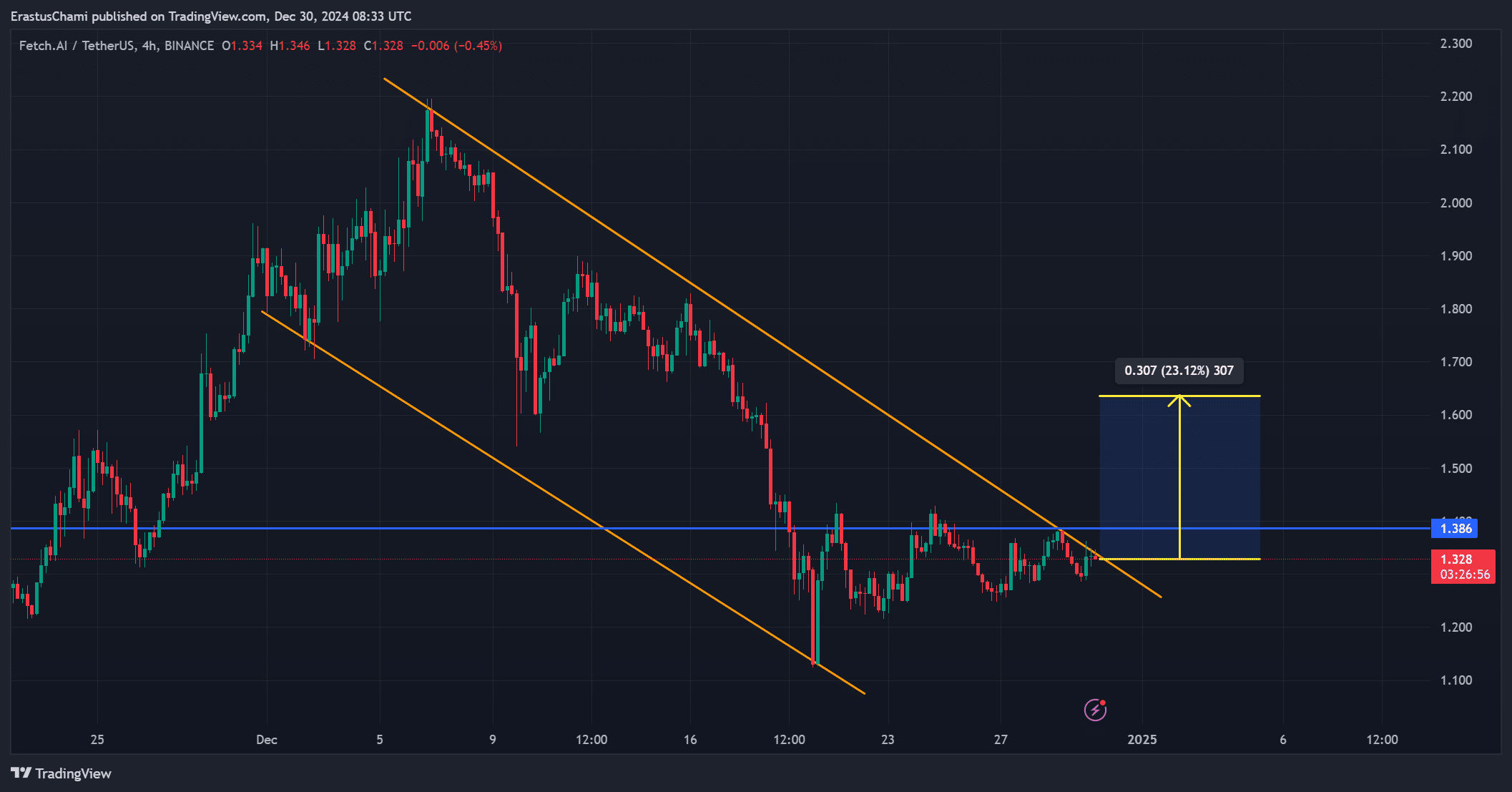

At present, the price of FET is moving inside a trend that appears to be a descending channel. The significant barrier for a potential upward surge, or bullish breakout, lies at the level of $1.38.

Stepping over this limit might boost the price up to around $1.60, which indicates a potential increase of 20-30%.

Previous market trends indicate that FET has managed to break free from similar situations before. But, for this pattern to truly hold, it requires continued trading volume and a strong upward trend to validate the situation and entice more investors.

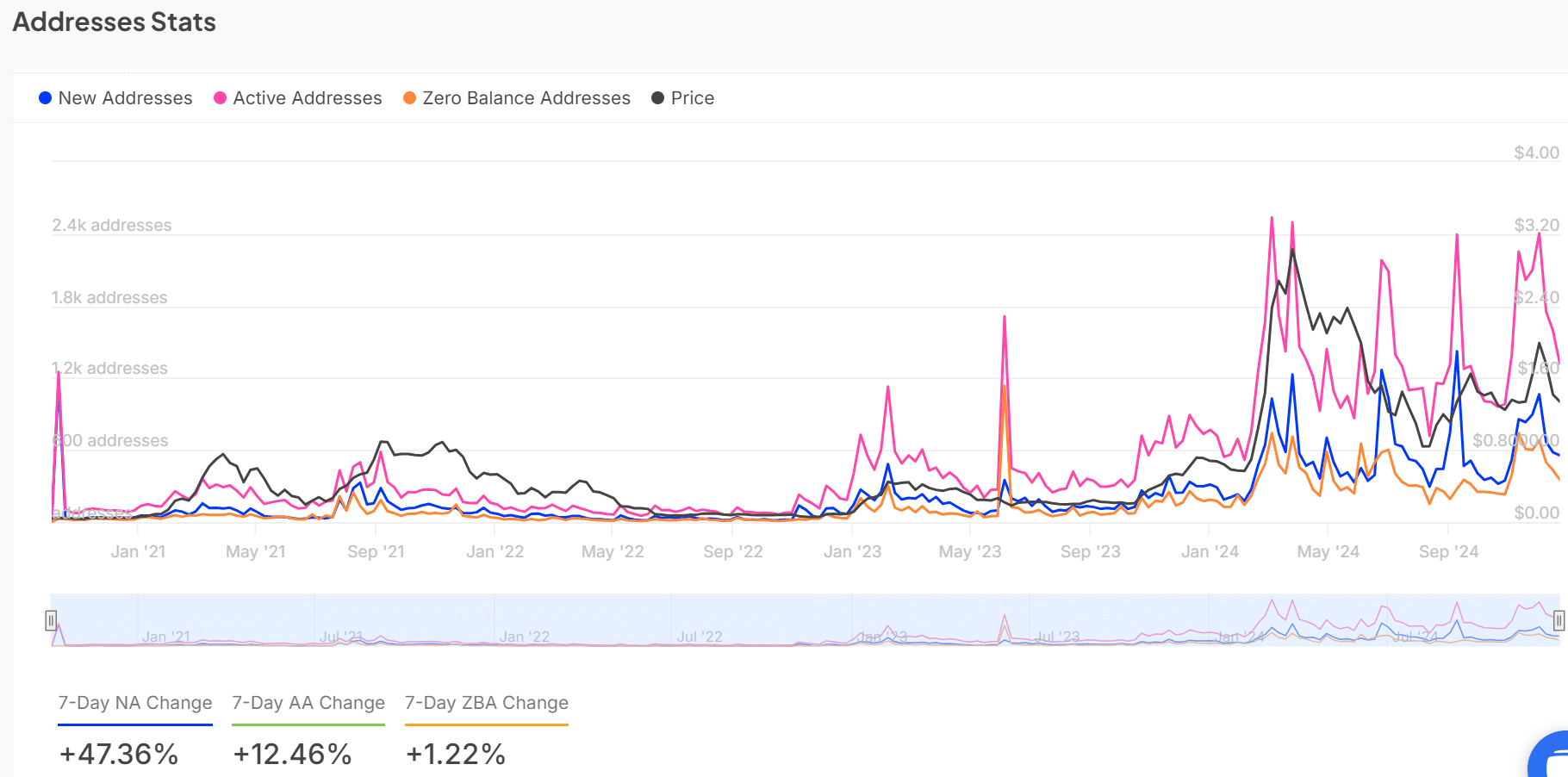

On-chain activity shows growing engagement

As a seasoned cryptocurrency investor with years of experience under my belt, I’ve seen countless trends come and go. But the recent surge in network activity on Fetch.AI is something that has caught my attention. Over the past week, new addresses have skyrocketed by an impressive 47.36%, while active addresses have also seen a significant increase of 12.46%. This kind of growth is not something you see every day in this market, and it’s definitely worth keeping an eye on. I’ve learned over the years that such spikes in activity can often be a sign of a project gaining traction, and I’m intrigued to see where Fetch.AI goes next. It’s always exciting to witness the rapid evolution of this industry, and I’m looking forward to seeing what the future holds for Fetch.AI.

These remarkable figures indicate a surge in popularity for FET, as well as increased utilization across its associated community.

Moreover, the heightened investor activity indicates a sense of assurance, usually a precursor for substantial price fluctuations.

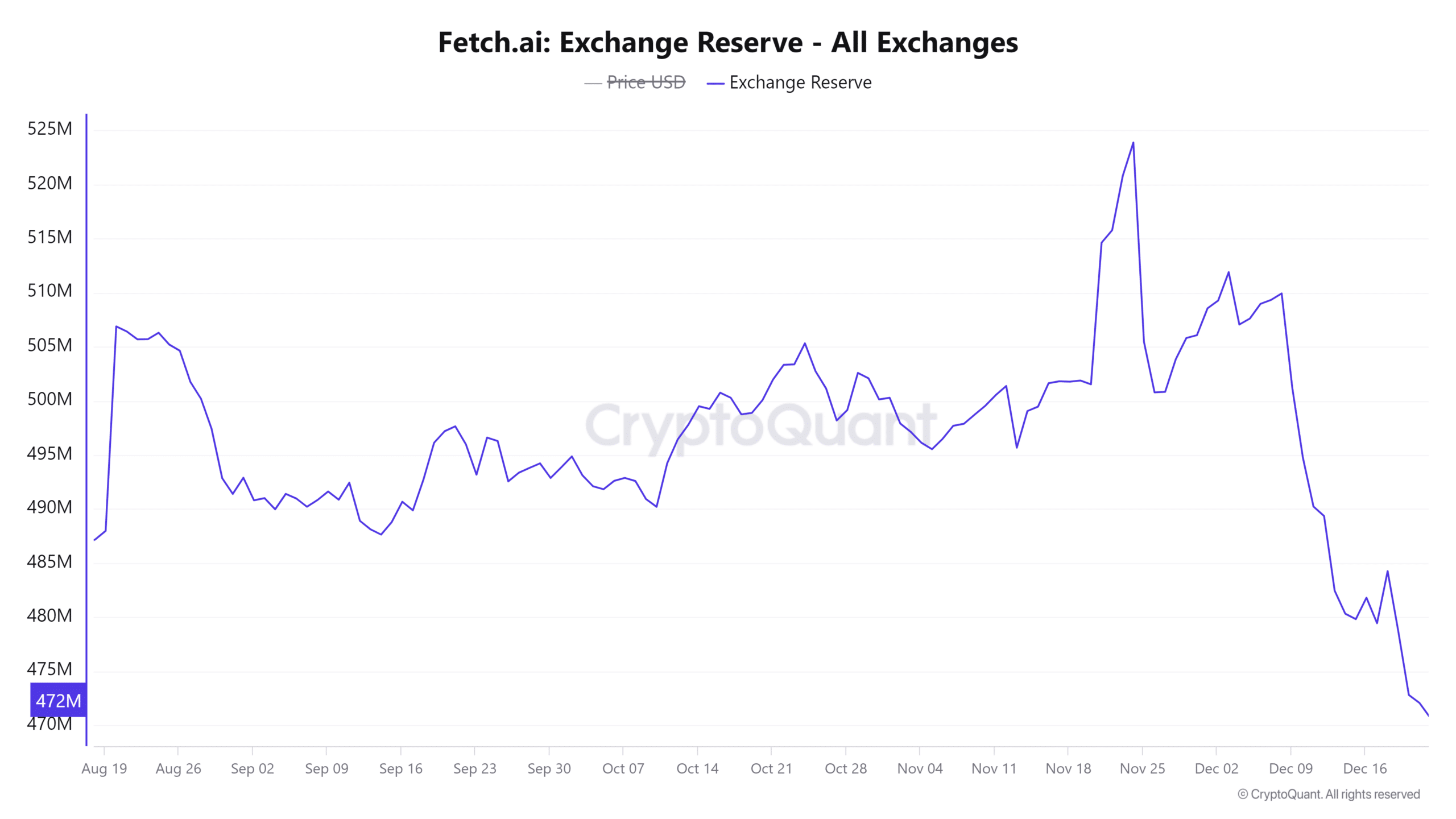

How exchange reserves signal market sentiment

Traders appear to be carefully keeping their FET coins on exchanges, as the reserve amounts have increased by a modest 0.12%, reaching approximately 471.4 million FET.

Alternatively, reducing reserves might suggest stockpiling, which can lead to increased prices due to demand.

Consequently, it’s essential to closely monitor this particular indicator as it helps in detecting shifts in sentiment and could signal positive trends.

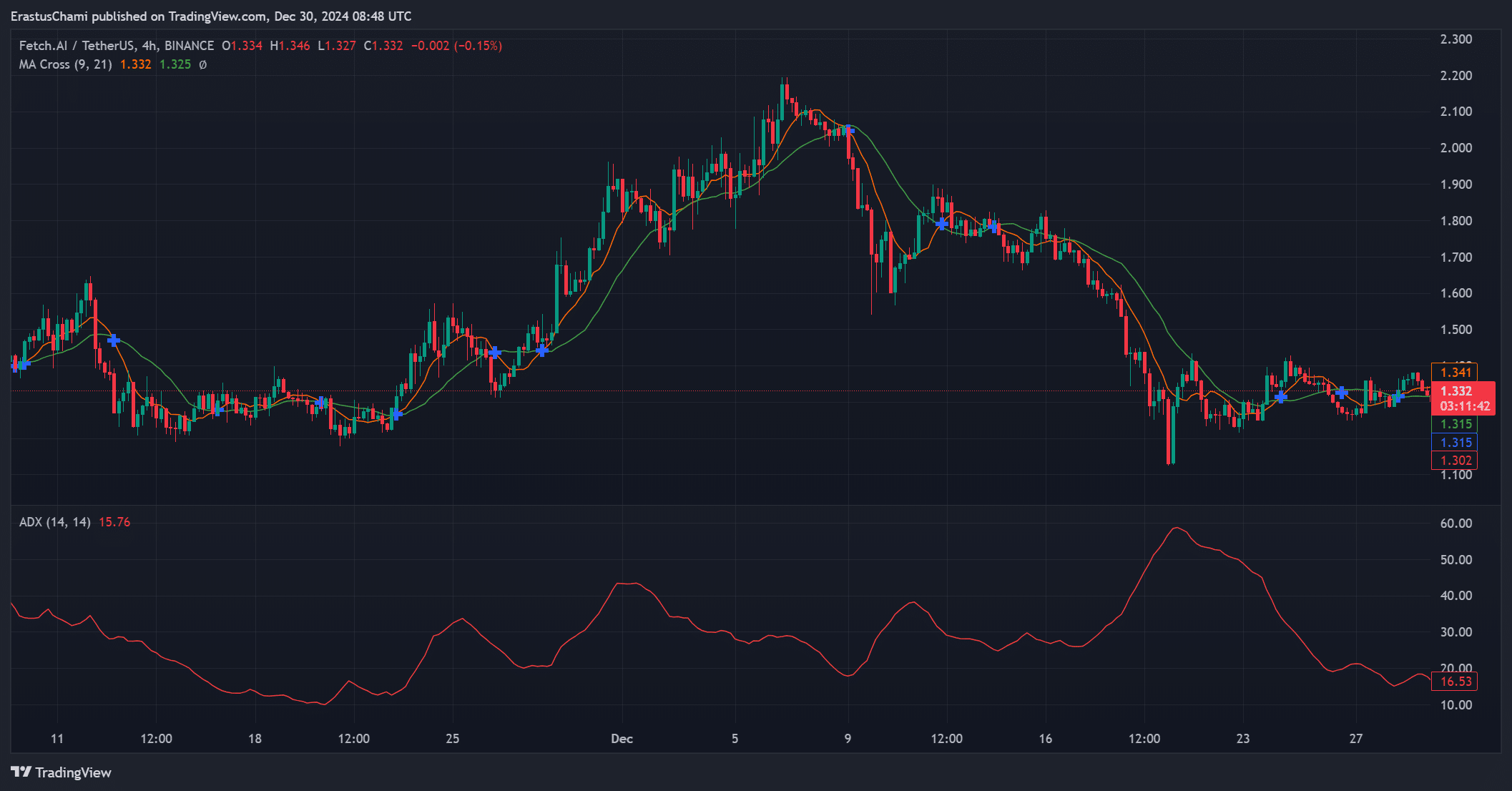

FET technical indicators hint at possible momentum

In simpler terms, the technical analysis of FET’s performance shows a combination of optimistic and cautious signs. The crossing of the moving averages hints at a potential rise in price, fueling positive expectations among investors.

Nevertheless, with an Average Directional Index (ADX) of 15.76, the trend strength appears to be relatively weak. Traders are now looking for additional confirmation from price movements and volume changes before making any decisions, as they anticipate more robust signals.

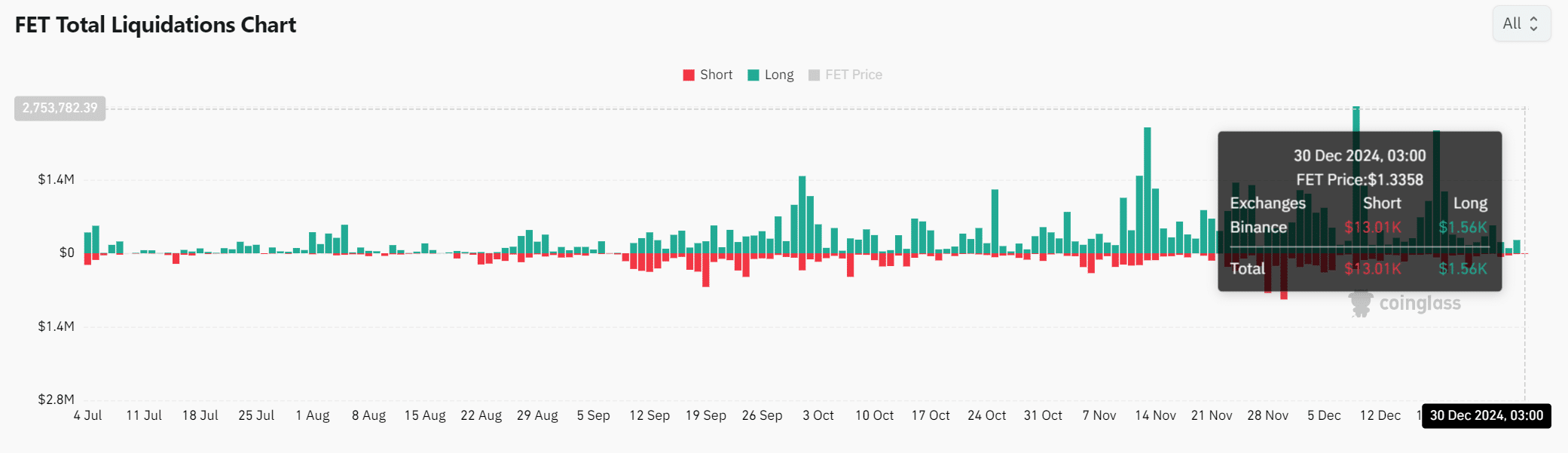

Liquidations could fuel bullish momentum

The data from the liquidation process indicates a difference of $13,000 in short positions versus only $1,560 in long positions, suggesting that bears have a stronger influence in the near future.

If the price surpasses $1.38, it might lead to a wave of short-sellers exiting their positions in panic, causing a swift increase in price. This situation could boost optimism among buyers and generate strong upward movement in the market.

Read Artificial Superintelligence Alliance [FET] Price Prediction 2024-25

As a seasoned crypto investor with over five years of experience under my belt, I believe Fetch.AI has strong potential for a significant rally if it manages to break above the $1.38 resistance level. Based on my analysis and market trends, this digital asset could surge by approximately 20-30% if successful in breaching that barrier. However, as always, it’s important to remember that cryptocurrency markets can be highly volatile and unpredictable. I would advise potential investors to do thorough research and consider their risk tolerance before making any investment decisions.

With rising network interactions, positive technological indicators, and possible liquidation events, it seems that FET is well-positioned for a significant bullish move. Consequently, we can anticipate FET to meet its predicted uptrend in the coming days.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-12-31 07:04