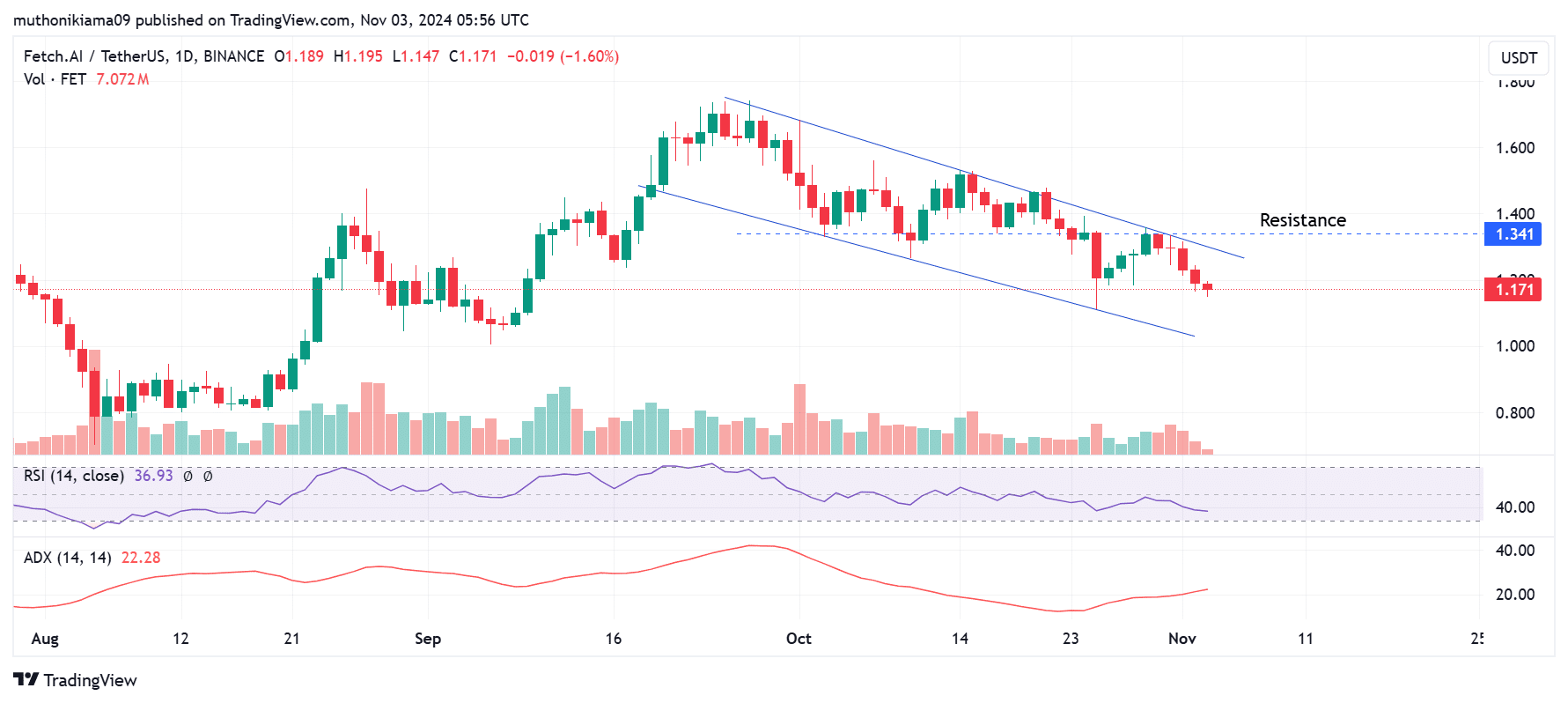

- FET has been under bearish pressure after failing to break out of a descending channel.

- A drop in exchange reserves as whale activity spikes suggests that a trend reversal is imminent.

As a seasoned researcher with years of experience in the cryptocurrency market, I have learned to read between the lines and interpret charts like a treasure map. The current bearish pressure on Artificial Superintelligence Alliance [FET] has me intrigued, not frightened. The descending channel is a familiar sight, but the drop in exchange reserves and spike in whale activity are telling a different story.

The Artificial Superintelligence Alliance [FET] has seen a significant drop of 14% over the past fortnight, causing a pessimistic outlook that’s hindering it from breaking free from its downward-sloping trend line.

At the moment of writing, FET was exchanging hands for approximately $1.18. This digital currency has been encountering resistance at roughly $1.34, a level that coincides with the upper boundary of its downward trending channel. The decrease in demand from buyers seems to be a contributing factor.

The Relative Strength Index (RSI) stood at 37, indicating high selling pressure. Moreover, the RSI has been making lower lows, pointing towards a strengthening bearish sentiment.

The Average Directional Index (ADI) is on an upward trend as well. This suggests that the present downward trend may persist unless there’s a change in demand dynamics.

Although the daily price trend appears bearish, the on-chain indicators suggest potential bullish recovery is underway.

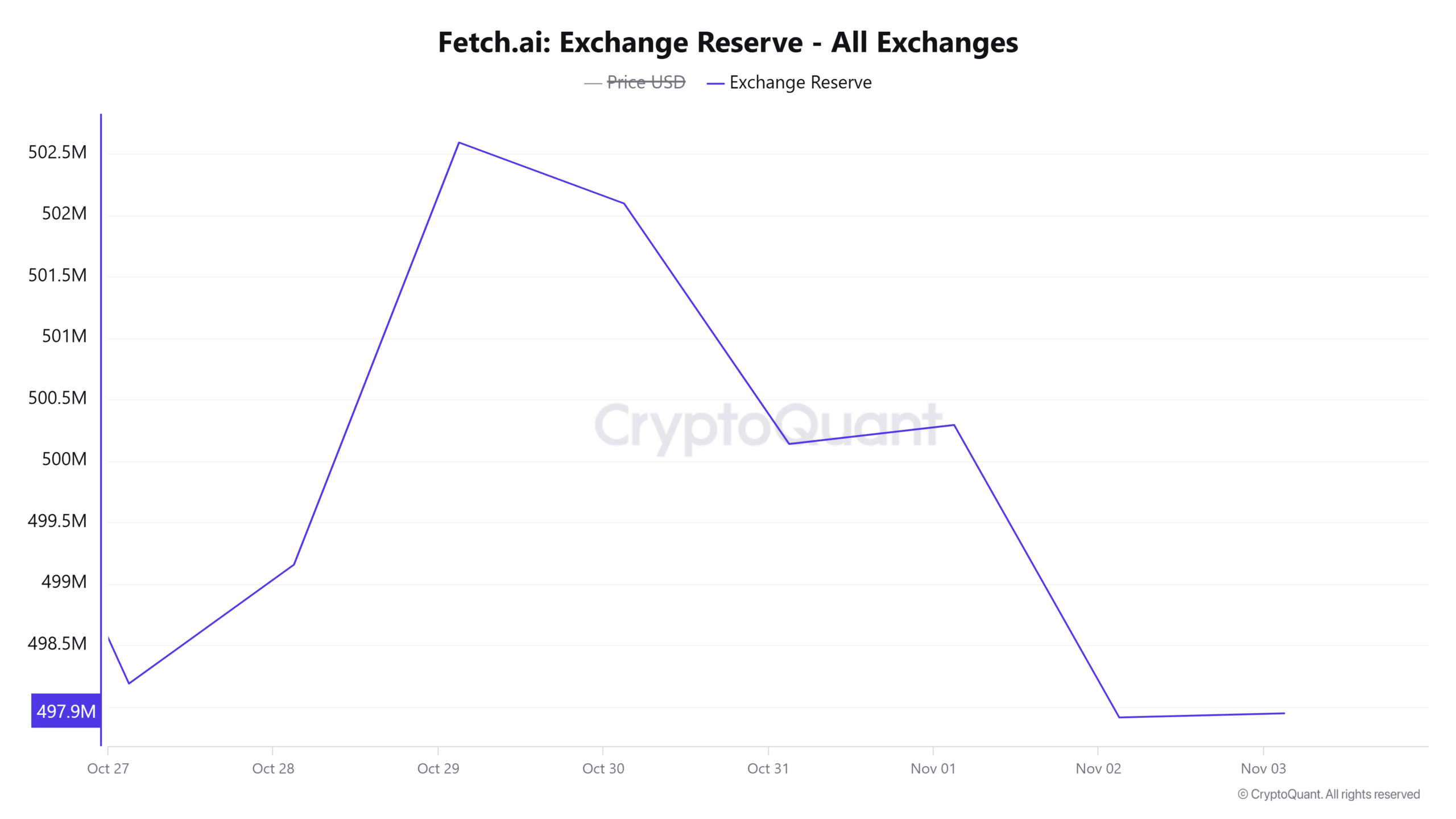

FET exchange reserves drop

As a researcher, I’ve been closely monitoring the data from CryptoQuant, and it appears that the reserves for FET have experienced a substantial decrease over the past four days. Initially standing at 502 million, the reserves have now dipped to a weekly low of 497 million.

As exchange reserves decrease, there’s less selling pressure on the market, which can lead to an increase in prices. If this trend persists over the next few days for FET, it might result in a reduction of selling activity around the token, setting the stage for potential price recovery.

A drop in this metric also suggests that the recent downtrend shook out the weak hands that have been contributing to the high-selling activity.

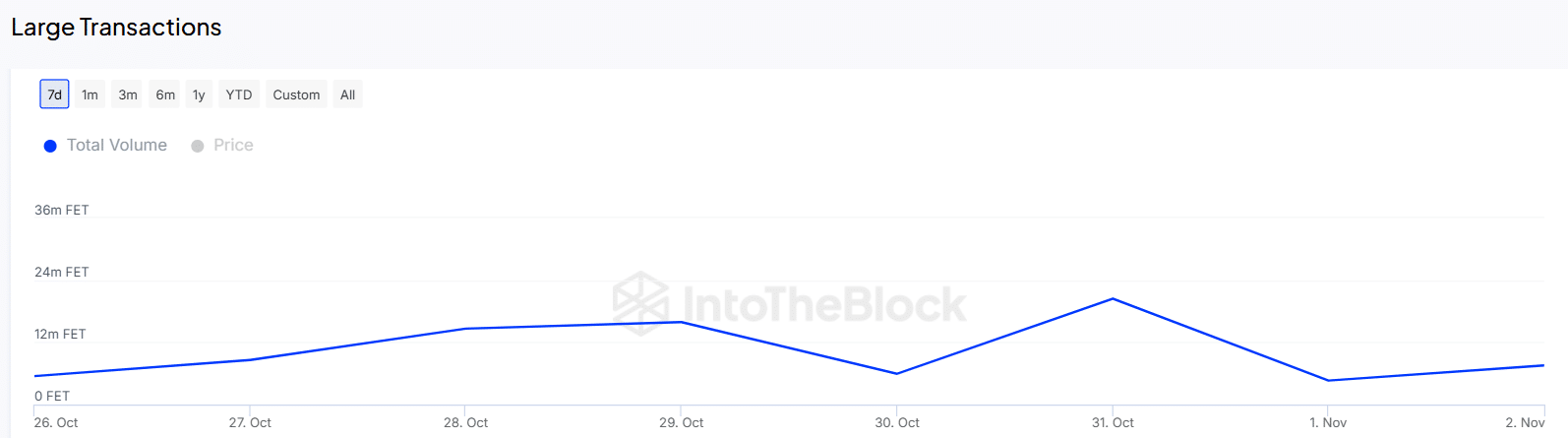

Whale activity on the rise

Additionally, there’s been a noticeable rise in whale interactions related to the FET token. Data from IntoTheBlock indicates that in a 24-hour period, large transactions exceeding $100,000 for FET went from 4.63 million to 7.56 million.

Based on my years of experience in cryptocurrency trading, I have noticed that a sudden increase in whale activity around a particular altcoin is often a strong indicator of heightened interest within the whale community. As someone who has witnessed both the positive and negative effects of whale involvement in the market, I can confidently say that such spikes should not be ignored.

Whales significantly impact the fluctuations of FET’s price due to their large ownership of the tokens. Specifically, they hold approximately 63% of the total supply, so increased activity among them may lead to more volatile price changes.

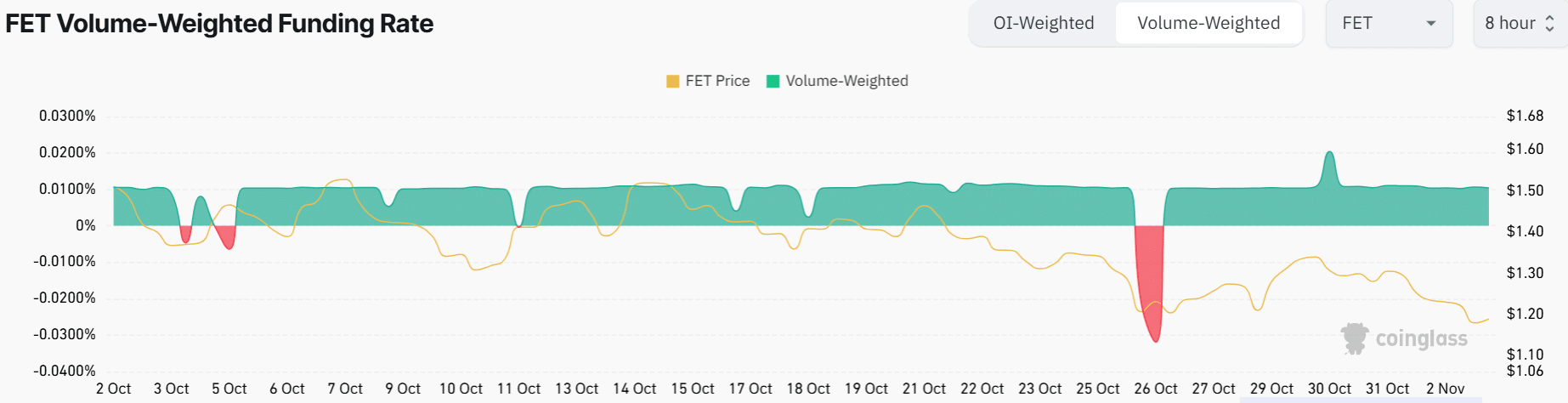

Long positions are still dominant

As an analyst, I’ve observed a pattern in the funding rates: It appears that there are more traders opting for long positions on FET compared to those going short.

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024–2025

This data shows that long traders are paying a premium to maintain their positions. However, given that open interest had dropped by 5% at press time, it suggests that there is weak demand for new long positions.

Even though funding rates are still favorable while open interest decreases, it suggests that the optimistic attitude among traders in the derivatives market might be waning. If new purchases and requests for long positions don’t materialize, pessimism could continue to dominate.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-11-03 18:15