-

FET broke a key long-term trendline resistance.

However, bearish bets increased and could derail the recovery.

As a seasoned researcher with years of experience in the cryptocurrency market under my belt, I have to say that the recent surge in FET is indeed intriguing. It’s like watching a phoenix rise from the ashes, especially considering its past struggles. However, as we all know too well, every rally has its challenges, and this one seems to be no exception.

Artificial Superintelligence Alliance’s [FET] digital currency experienced a significant increase this week, rising approximately 30%. Its value started at $1.05 on September 8th and peaked at $1.3 on September 10th.

Has the surge pushed the AI token’s price over a significant long-term resistance line, suggesting an uptrend? Is this upward momentum likely to persist?

FET price prediction

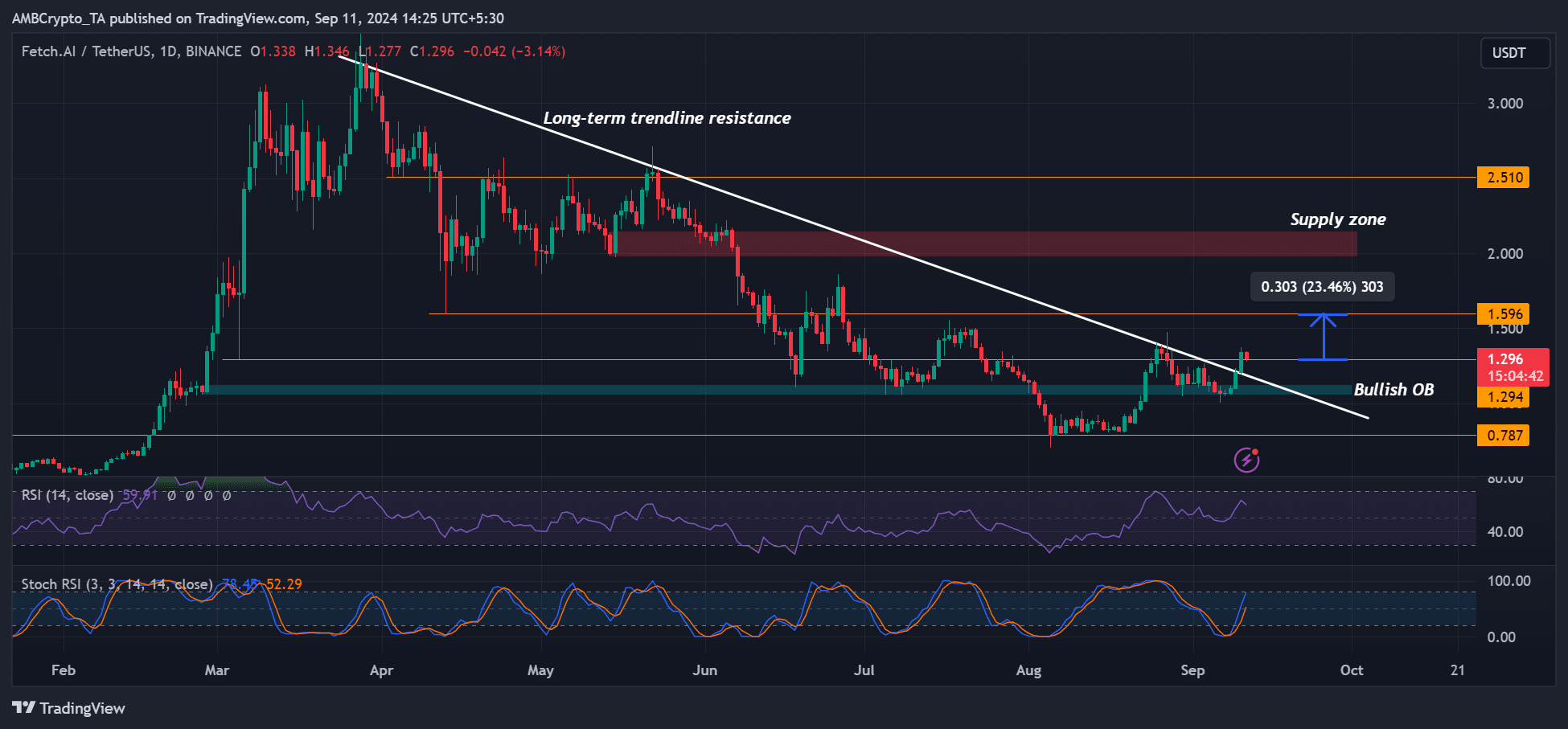

As a researcher, I’ve noticed that the previous two Financial Exchange Traded (FET) recoveries encountered resistance near the $1.5 mark. While it’s important to acknowledge that another price rejection is possible, the daily price chart indicators I’m observing seem to suggest an ongoing uptrend.

As of now, the demand is robust, evident from the higher-than-usual readings on the Relative Strength Index (RSI). Yet, it hasn’t surpassed the threshold for being overbought, implying there may still be room for further growth in the rally.

In this favorable market trend, an additional increase might result in approximately 23% profit if the price reaches $1.59, and potentially as much as 55% profit if it touches the resistance area around $2.00.

On the other hand, the Relative Strength Index (RSI) showed signs of approaching overbought territory, providing a somewhat ambiguous indication and potential alerts for short-term investors. A fall below $1.3 could contradict the positive forecast.

In such a case, a drop to the support zone and daily bullish order block (OB) at $1.05 — $1.12 (marked cyan) could follow.

FET’s valuation and sentiment

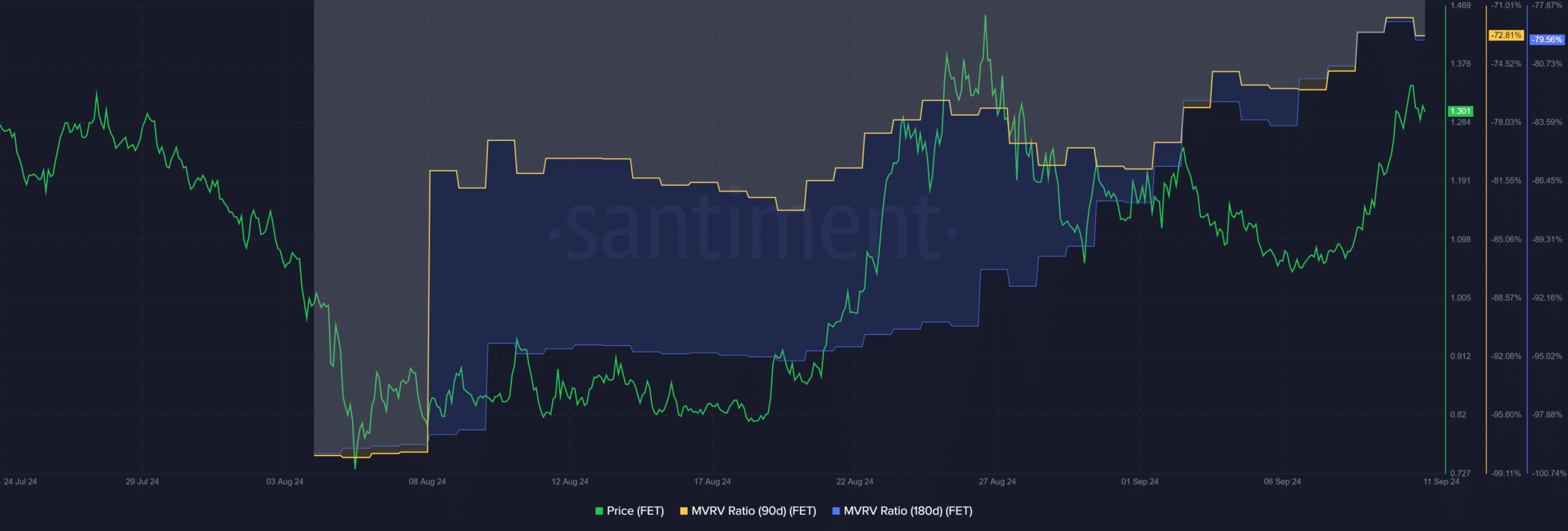

Even though there was a 30% increase, individuals who purchased the FET token, labeled as an AI token, within the last three or six months are still experiencing losses.

Based on the 90-day and 180-day MVRV (Market Value to Realized Value) analysis, it’s shown that investors experienced a loss of approximately 72% and 79% in unrealized gains, respectively.

This also meant that the AI token was still grossly undervalued at current prices.

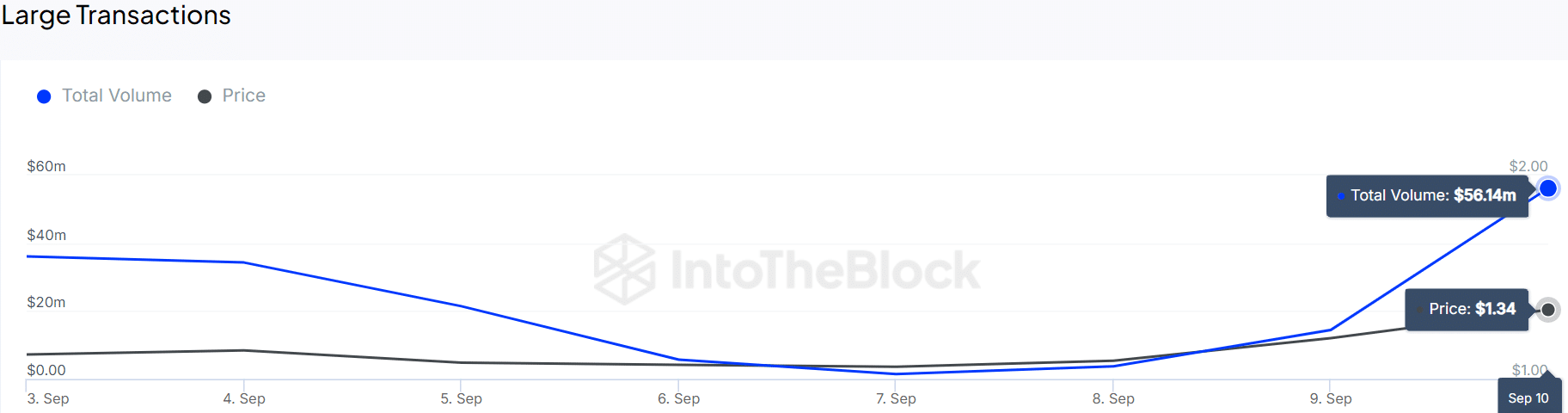

Keeping an eye on the actions of larger players (whales) could be beneficial for latecomers aiming to re-enter or invest again. As evidence from IntoTheBlock data indicates, the recent price increase is largely due to significant transactions made by these large entities.

On the 10th of September, FET saw a total volume of $56.14 million, which triggered an 11% gain.

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024–2025

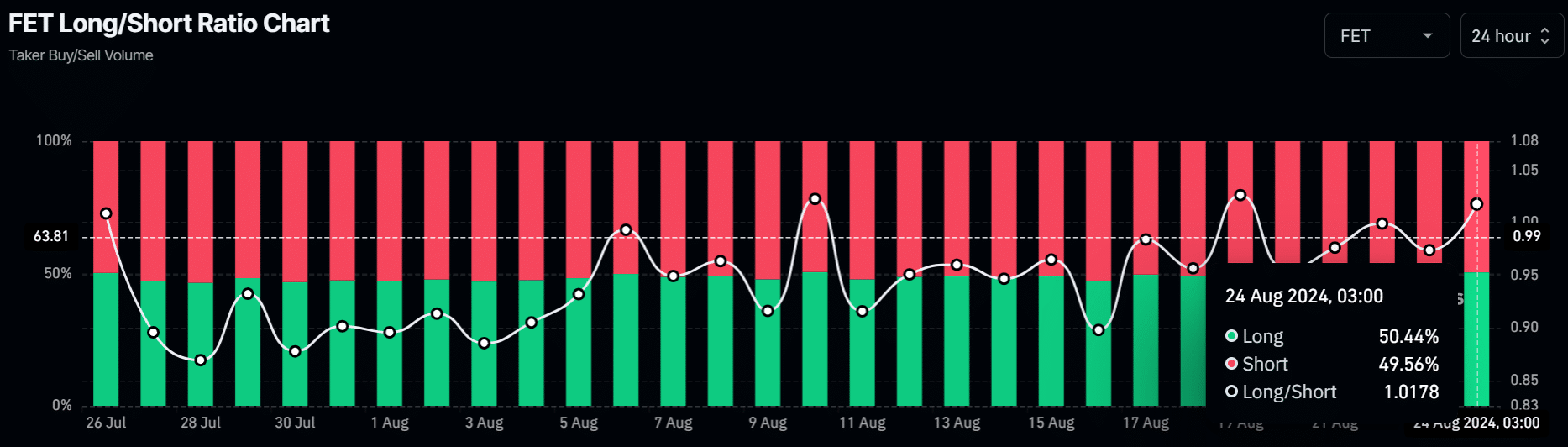

Currently, there’s an increase in pessimistic wagers on the token in the futures market. As I type this, about 52% of these positions involve selling FET, indicating that most traders predict a dip following the recent surge in prices.

In summary, while there’s promise for growth in the future, FET might experience a temporary dip before resuming its upward trajectory. It may return to the resistance line or support area (indicated in light blue) first, which could halt the pullback and then prepare for a possible surge.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-11 19:35