-

FET has recovered +80% since early August lows.

Will the rally extend as more users record unrealized profit?

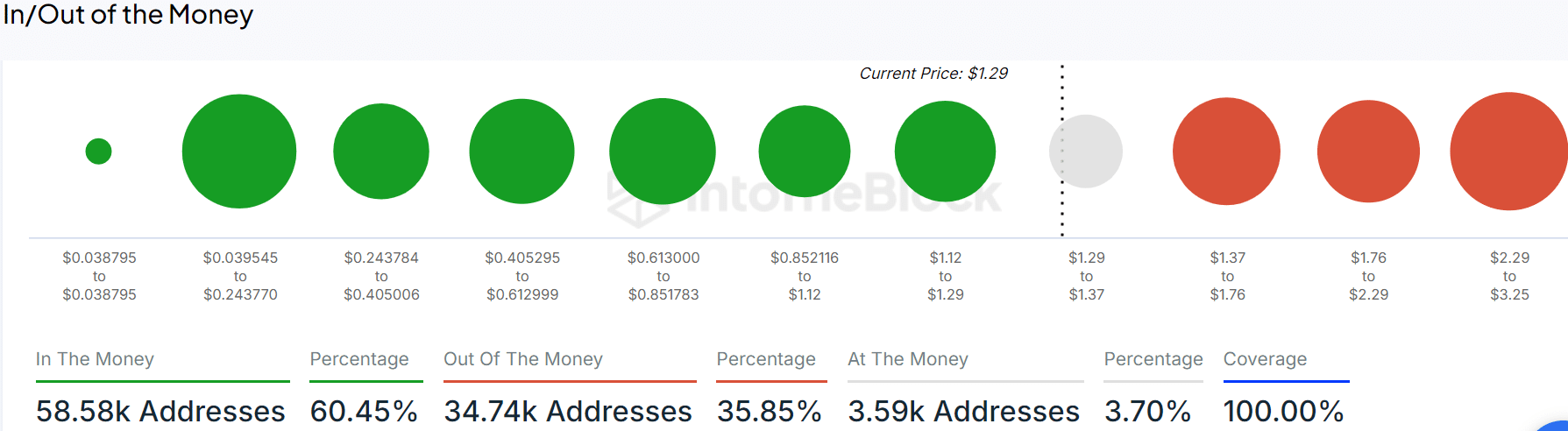

As a seasoned researcher with years of market analysis under my belt, I must admit that the recent surge in FET is indeed intriguing. The +80% recovery since August lows has been quite impressive and has flipped 60% of addresses into profit, as per IntoTheBlock data. However, it’s important to remember that every rally has its limits, and we might be approaching one now given the overbought conditions indicated by technical indicators.

As a seasoned investor with over a decade of experience in the cryptocurrency market, I have witnessed many altcoins rise and fall. However, this week’s performance by Artificial Superintelligence Alliance (FET) has truly caught my attention. Having closely followed the developments in AI technology, I am impressed by the potential that FET holds. The token’s impressive 60% surge over the past seven trading days, placing it second on weekly gainers on CoinMarketCap, is a testament to its strong fundamentals and promising future. As an investor who values technological innovation and profitability, I believe that FET could be an excellent addition to any portfolio focused on AI and altcoins.

Given its August lows, Fantom (FET) surged by approximately 80%, regaining significant annual support at a price point above $1. Might speculators in Fantom see additional profits following the recovery of this yearly support level?

FET back above $1 – What’s the next target?

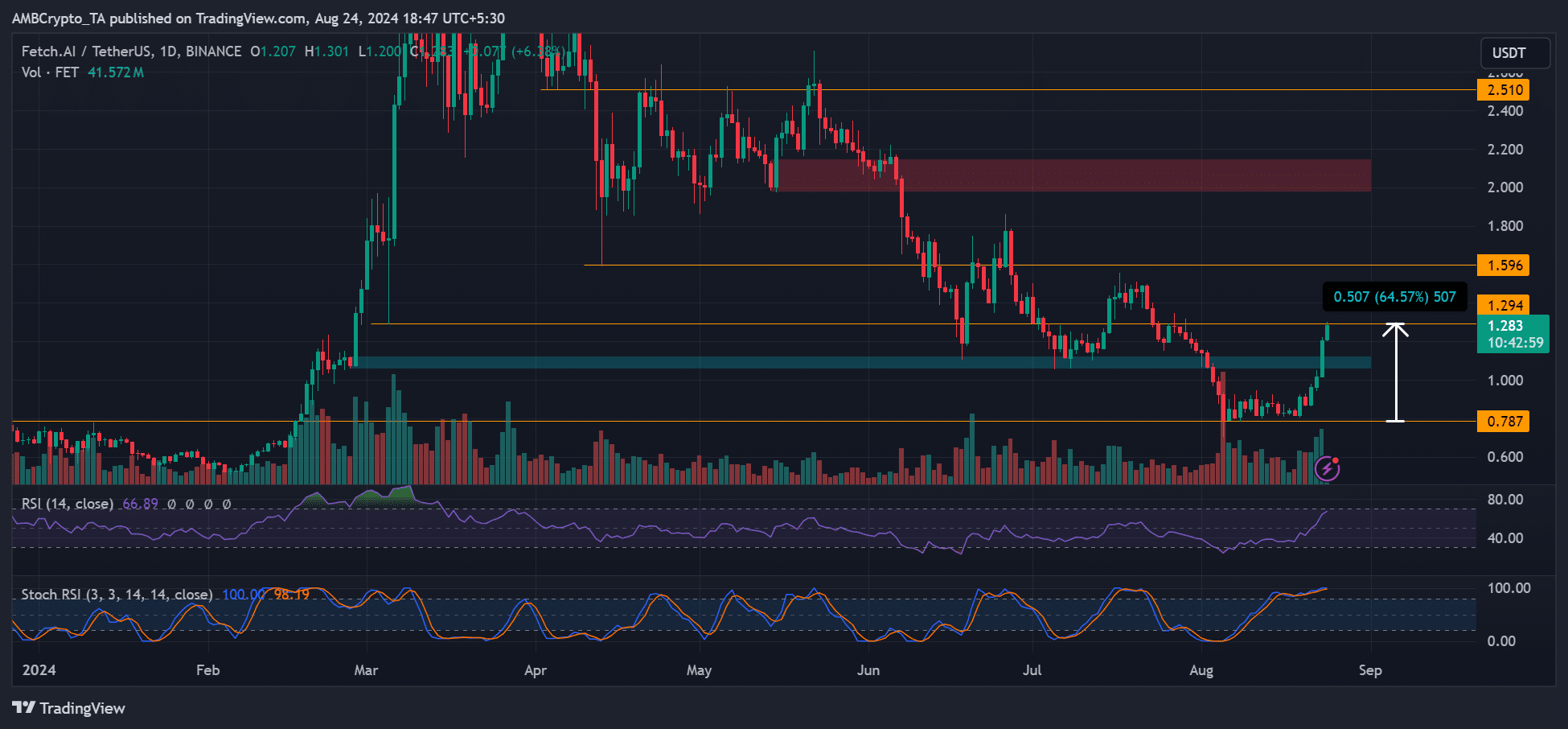

On a day-to-day basis, the $1.1 level, highlighted in cyan and serving as yearly support, was successfully regained. This reinforcement helped alleviate the declines in June and July, but it weakened during the initial August drop. The subsequent rise above this prior support point suggests a bullish outlook for FET‘s price increase to continue.

Yet, some crucial technical markers were approaching overbought levels, potentially implying that further growth might be capped for the bulls. Of particular note, the RSI (Relative Strength Index) was nearly touching the overbought threshold as of this writing.

Furthermore, the Stochastic RSI had reached an area indicating it might be overbought, which hinted at a potential slowdown or correction in its performance.

If the price surges past $1.3, it might propel a continuation towards the following objectives of $1.59 or even $2.0. On the other hand, a dip down to the annual support level could present opportunities for late investors to jump in.

65% of users in profit

Read FET Price Prediction 2024- 2025

Approximately 8 out of every 10 cryptocurrency holders have now moved into profit territory due to a strong recovery from the August lows, as reported by IntoTheBlock (ITB). However, an uptick in users who have yet to cash in their profits could potentially lead them to make minor sales, which might initiate a chain reaction and slow down the ongoing rally of FET.

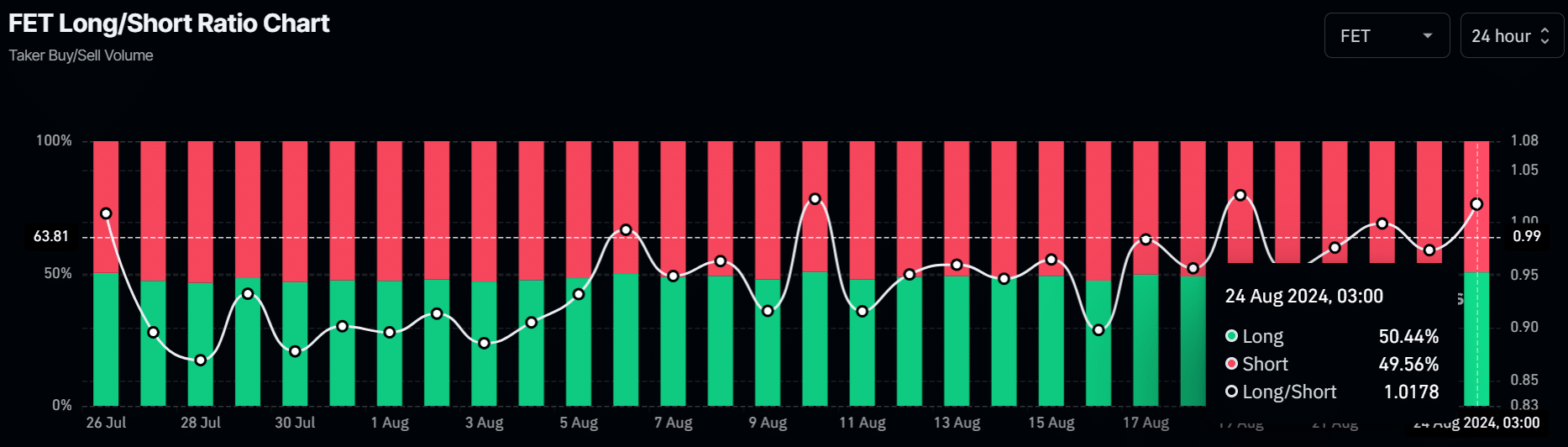

As a researcher, I must stress the importance of exercising caution when engaging in derivatives trading, particularly with FET, an altcoin I’m currently studying. According to data from Coinglass, speculators appear evenly divided on the coin’s next direction, with nearly equal amounts of short and long bets placed. This split sentiment suggests a market that is uncertain about its future direction.

The neutral sentiment in the futures market meant that FET could cool off or extend its rally.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-25 09:11