-

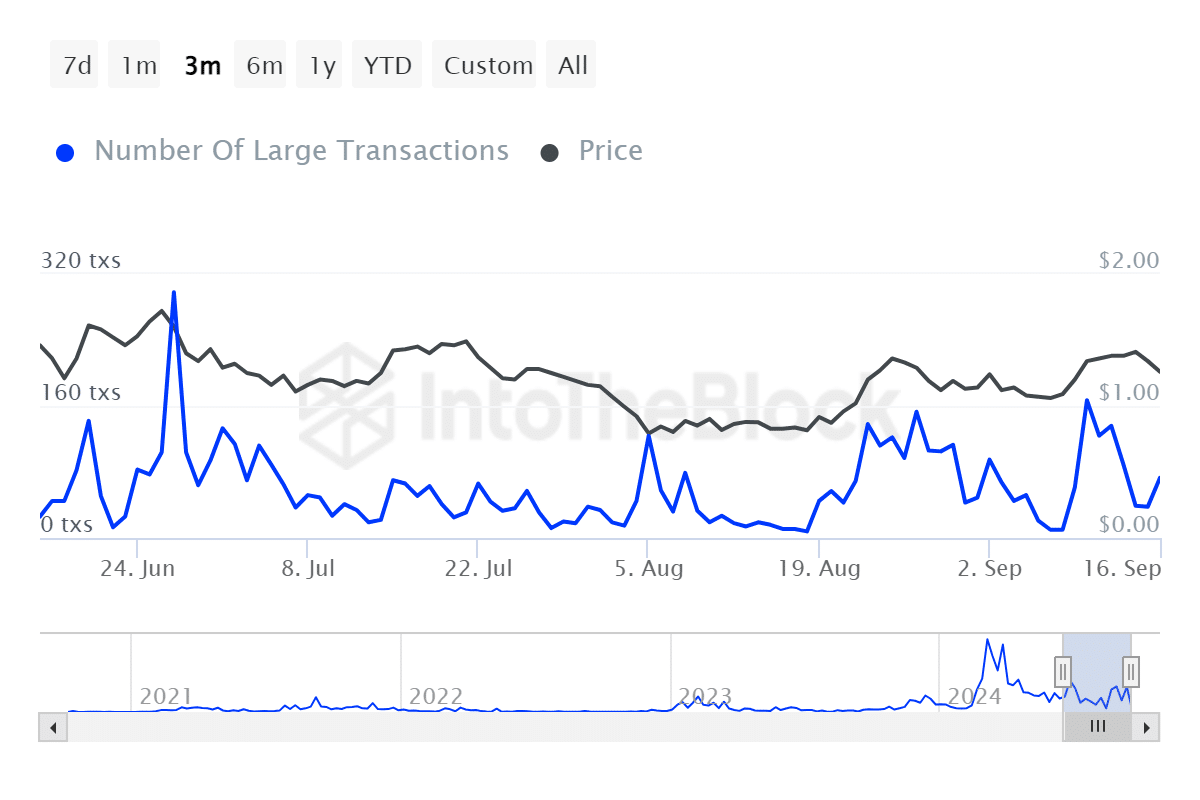

FET large transactions surge by 262%, driven by whale activity.

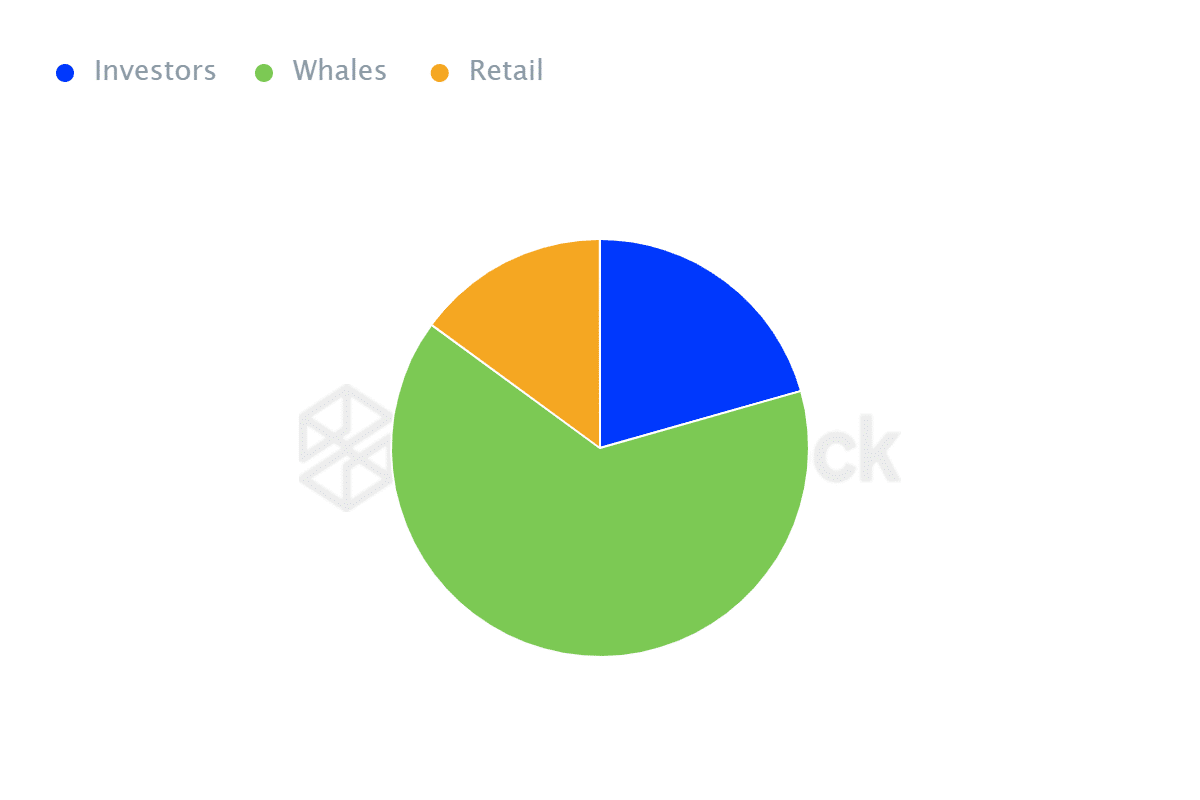

Despite a 10% dip in trading activity, whales hold 64% of the asset distribution.

As a seasoned crypto investor with battle-tested nerves and a knack for spotting trends, I can confidently say that the recent surge in large transactions of Artificial Superintelligence Alliance [FET] tokens is more than just an isolated event. Whale activity, as indicated by the 262% increase in large transactions, is a clear sign that the big players are gearing up for a significant price rally.

The activity of significant investors, or ‘whales’, in the Artificial Superintelligence Alliance’s FET tokens has skyrocketed, as reported by IntoTheBlock, with large transactions experiencing a 262% increase.

In simpler terms, the larger investors (whales) are entering the market, which could lead to a positive trend as the current peaks suggest that the prices may soon begin increasing.

As an analyst, I’ve noticed that a substantial 64% of the distribution of FET is managed by key players in the market. This significant control might suggest potential for a robust price surge in the near future.

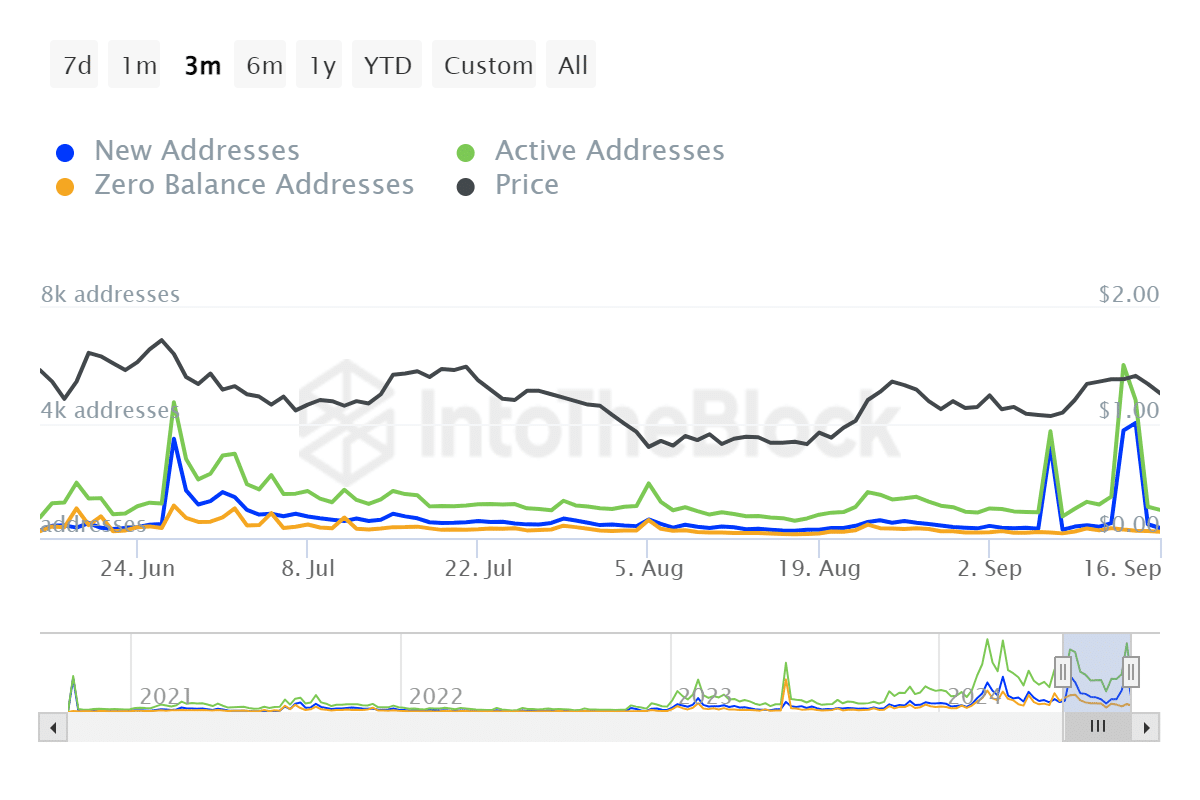

Trading activity sinks, but whales come for the rescue.

Although whales have a significant influence, FET‘s trading activity decreased by 10% nonetheless. Yet, this setback hasn’t discouraged major stakeholders, who remain committed to driving up the prices further.

Because they have a dominant share in the distribution of this particular asset, any action they take can have a substantial impact on the price of FET, even in markets where trading volume is relatively small.

It’s clear that major entities are gearing up for a possible surge, based on the growing number of substantial deals.

FET approaches a key symmetrical triangle breakout

In simpler terms, the stock known as FET has been moving within a symmetrical triangle formation since the end of March. Lately, it tried to break through the resistance at $1.42 but was unsuccessful, leading to a drop of approximately 12% in the past 48 hours.

However, with the latest spike in whale activity, the pullback could become short-lived.

A symmetrical triangle indicates a period of consolidation, during which the Future Electric Technology (FET) price action is approaching a highly significant point, making a sudden breakout quite probable.

In this scenario, such a configuration could potentially draw in purchasers, leading to increased prices if there’s a strong upward trend, or a “bullish breakout.” Moreover, it becomes even more likely when large investors, known as “whales,” enter the market to fuel the momentum.

Whale dominance and what it means for FET

As an analyst, I’ve observed that whales hold approximately 64% of the distribution for this asset. Given their substantial control, it’s plausible that their actions could exert a significant impact on the coin’s price fluctuations.

A significant increase of 262% in major transactions is due to large investors actively trading, potentially indicating a substantial market shift.

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024–2025

Indeed, if the current pace continues, the gathering or exchange of FET whales might push the asset beyond the symmetrical triangle’s resistance level, potentially causing an upward trend in the near future.

At the moment, all attention is shifting towards identifying any imminent breakouts, as the actions of whales significantly impact any price surges.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-09-18 09:43