-

FET nears $1.77 resistance after a 22% rally, with technical and RSI indicators signaling momentum.

On-chain metrics show strong bullish signals, but increased exchange reserves suggest rising selling pressure.

As a seasoned crypto investor with battle-scarred fingers and a heart full of optimism, I find myself standing at the precipice of a tantalizing opportunity – Fetch.AI [FET]. The token’s recent 22% rally has brought it within striking distance of the $1.77 resistance level, leaving me with a mix of excitement and apprehension.

In a notable development, Fetch.AI (FET) has experienced a significant increase of more than 22%, breaking free from its prolonged downward trend and nearing the pivotal resistance level at $1.77. At the moment of writing, FET’s bullish energy is steady at $1.61, with a 1.48% growth over the last 24 hours.

The key question is whether this upward trend will hold and push the asset past this significant resistance level.

Price action analysis: Can FET break the $1.77 barrier?

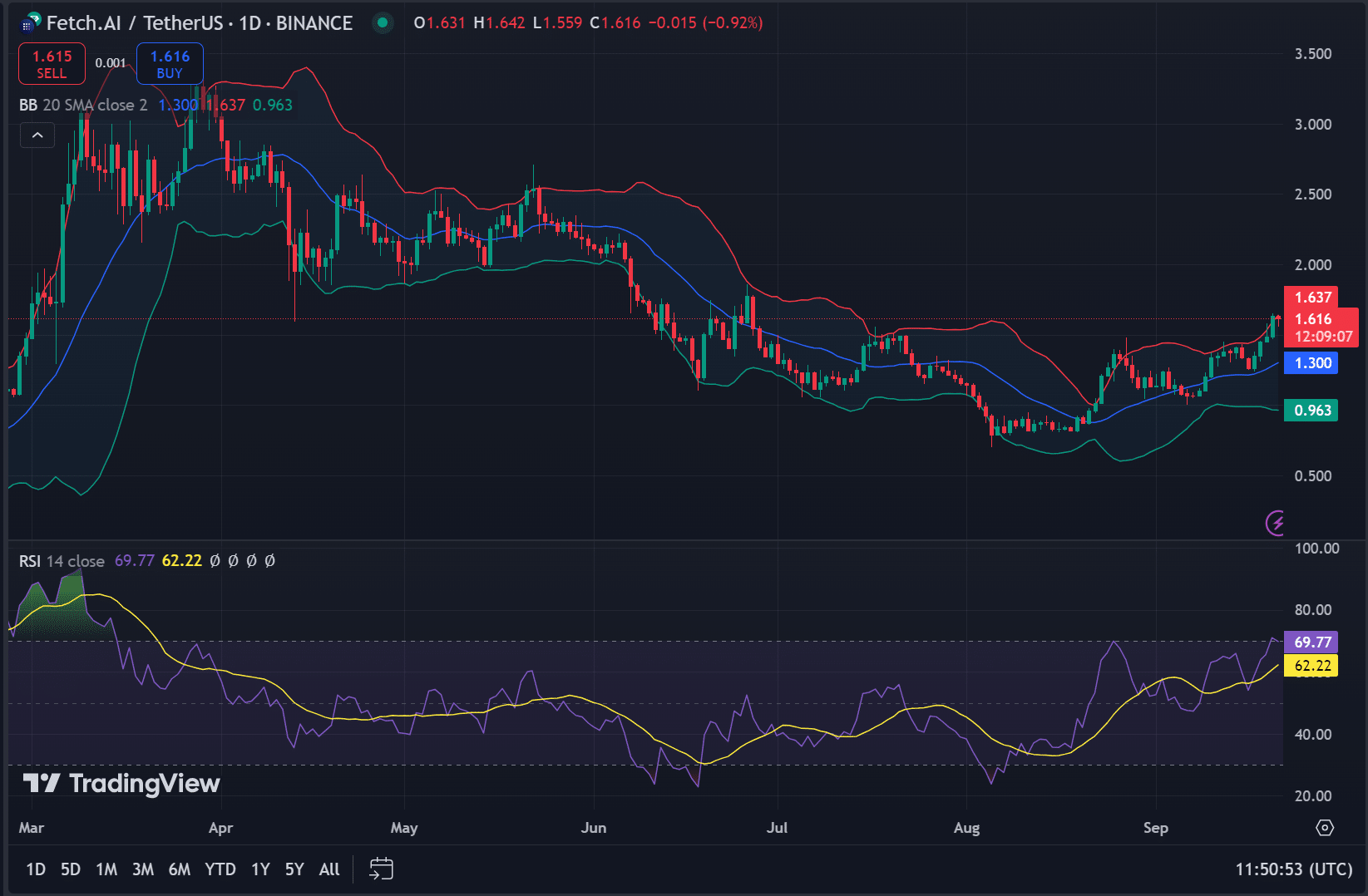

The current movement in FET‘s price suggests that it has touched the upper limit of its Bollinger Band at approximately $1.637, which is often a signal of an overbought situation. However, the Relative Strength Index (RSI) currently reads 62.22, implying there could be more growth potential while still hovering near the overbought area.

As I analyze the current market trends, it’s clear that the buying pressure is quite robust, and I’m keeping a close eye on the resistance at $1.77 for FET. Should we see a breakout above this point, it could be a strong indicator of a potential surge toward $2.00. Conversely, if the price doesn’t manage to breach this resistance, there’s a possibility that FET might retrace back to $1.30 as a potential support level.

Exchange reserves increase – Is selling pressure rising?

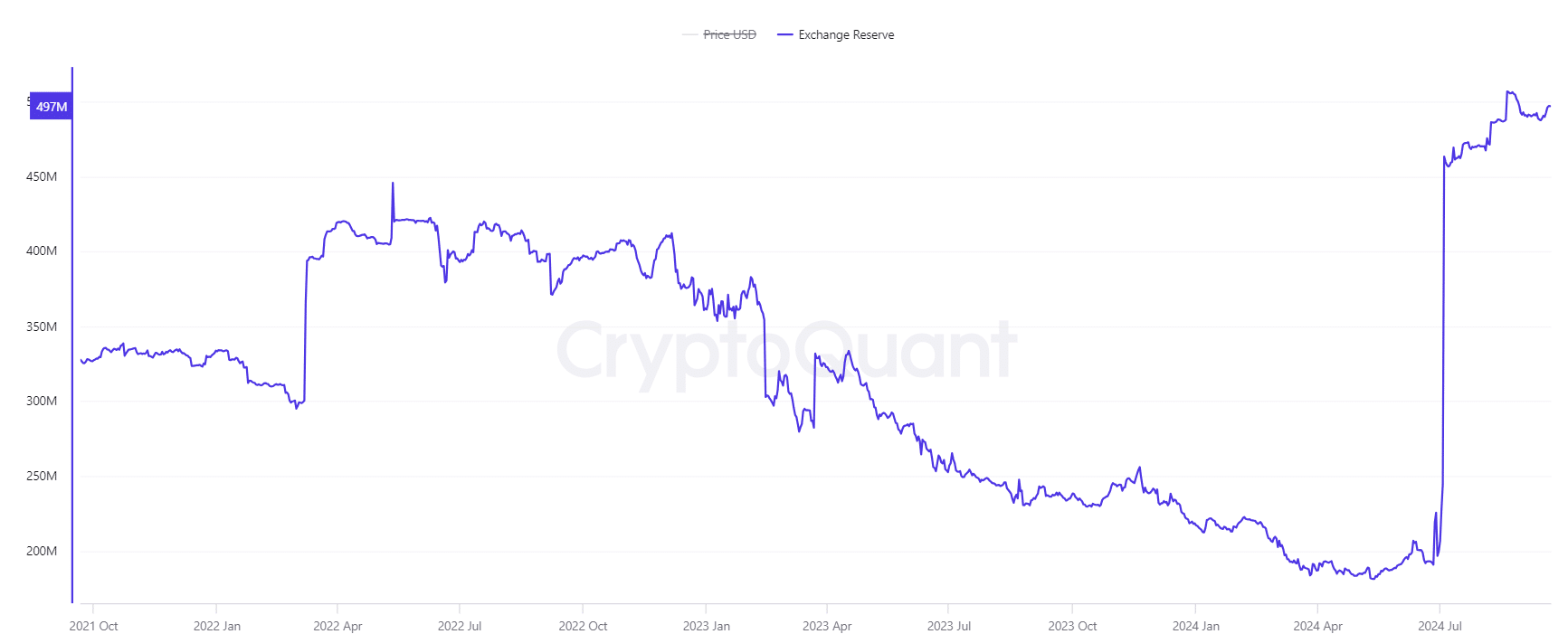

In the last 24 hours, FET‘s reserve of exchange tokens has gone up by 0.24%, totaling approximately 497.0971 million tokens. This increase might indicate a possible rise in selling pressure. When more tokens are kept on exchanges, it usually means traders are preparing to sell, which could impact price movements.

This trend may lead to a short-term price correction if sustained, making it a key factor to watch.

On-chain signals: bullish momentum still intact?

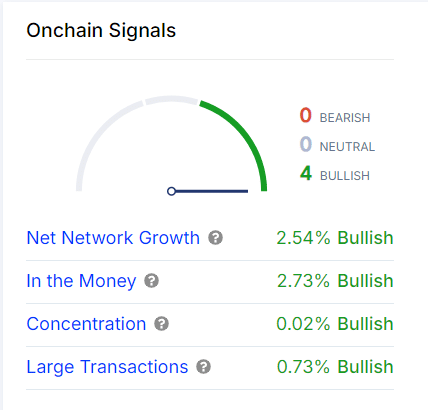

The on-chain signs from FET suggest a strong bullish trend. The network’s growth rate has increased by 2.54%, which means there’s an uptick in user involvement, and “In the Money” has gone up by 2.73%, implying more holders are realizing profits.

There’s been a modest rise in both focus on FET (Focused Ethernet Technology) and the size of its transactions, which suggests that investors remain optimistic about FET’s possible growth trend.

FET open interest rises—what could it signal?

The current open interest for FET futures is up by approximately 2.33%, amounting to around $105.82 million as we speak. This surge suggests an uptick in market engagement and a heightened expectation for a notable price shift.

With robust on-chain information supporting it, the increasing open interest indicates that FET may continue its upward trend.

However, traders should remain cautious, as excessive leverage could lead to a sharp correction.

Read FET Price Prediction 2024- 2025

The positive momentum for FET could solidify if it manages to surpass the $1.77 barrier. While on-chain indicators suggest potential growth, an uptick in exchange reserves suggests a need for vigilance. This increase might indicate selling pressure that could potentially curb the upward trend.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- PGA Tour 2K25 – Everything You Need to Know

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

2024-09-22 09:11