- An analyst has outlined key conditions that must be met before FET can break through its resistance levels.

- At the same time, growing selling activity among traders could pressure the asset lower.

As a seasoned analyst with over two decades of market experience under my belt, I find myself torn between the promising bullish trends displayed by Artificial Superintelligence Alliance [FET] and the mounting pressure from sellers.

The Artificial Superintelligence Alliance (FET) has maintained an optimistic pattern, consistently rising, on various time scales such as monthly, weekly, and even daily, with returns ranging from 12% to 16%.

It appears that Future Electronics Technology (FET) could see another surge based on recent trends, however, its sustained growth depends on fulfilling certain prerequisites.

FET encounters key challenge as rally progresses

As per analyst Crypto Leo’s analysis, it was noted that FET was currently following a symmetrical triangle structure on the weekly chart, which is typically preceded by an upward trend.

Based on my years of trading experience, I’ve noticed that a pattern where price movements occur within converging support and resistance levels often indicates an imminent breakout. This phenomenon is not just a theoretical concept, but rather a practical tool in the world of finance, where understanding market trends can significantly impact one’s investment decisions. In my own journey as a trader, I’ve learned to pay close attention to such patterns, as they have proven to be valuable indicators of potential breakouts.

Nevertheless, the rally might experience a postponement because of resistance points surfacing inside the pattern. These points are recognized for their strong selling pressure, which may spark a price decline.

A break above this resistance would likely propel FET to at least $3.50, as indicated by the chart.

Yet, resistance is not the only obstacle to FET’s potential rally. Other key indicators suggest an ongoing sell-off, which could further hinder the asset’s upward momentum.

FET faces a major sell-off

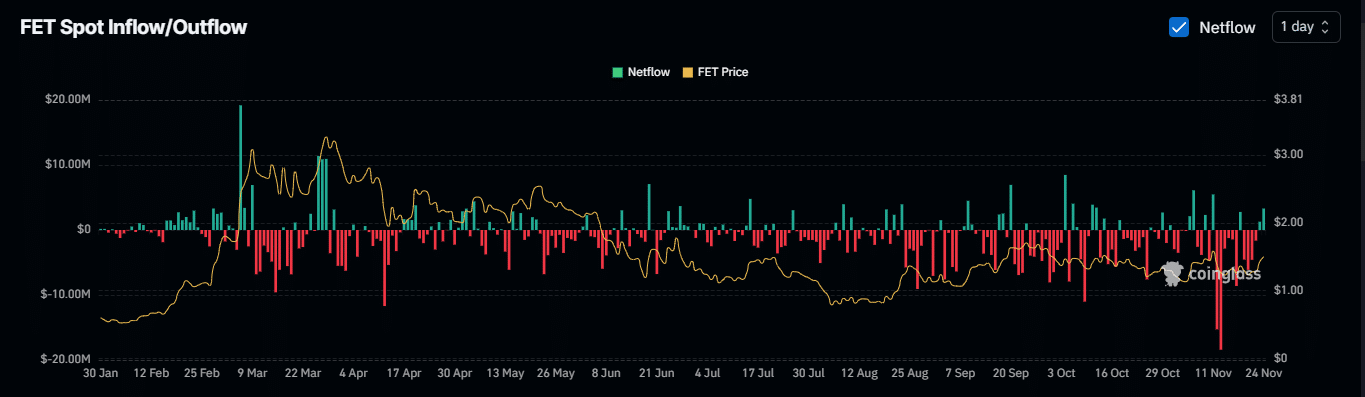

Over the last 24 hours, I’ve observed a substantial wave of selling amongst FET holders, as they seem to be transferring their tokens to exchanges, possibly for liquidation purposes.

For the past while, approximately $4.34 million in FET has moved to trading platforms. Should negative market feelings persist and more investors decide to sell, this digital asset might see a drop from its present values.

Furthermore, there’s been a forced closing of long positions totaling approximately $820,490 due to the market’s unexpected shifts, as reported by Coinglass.

With both metrics working against long traders, FET’s rally is likely to be delayed.

Open Interest remains bullish

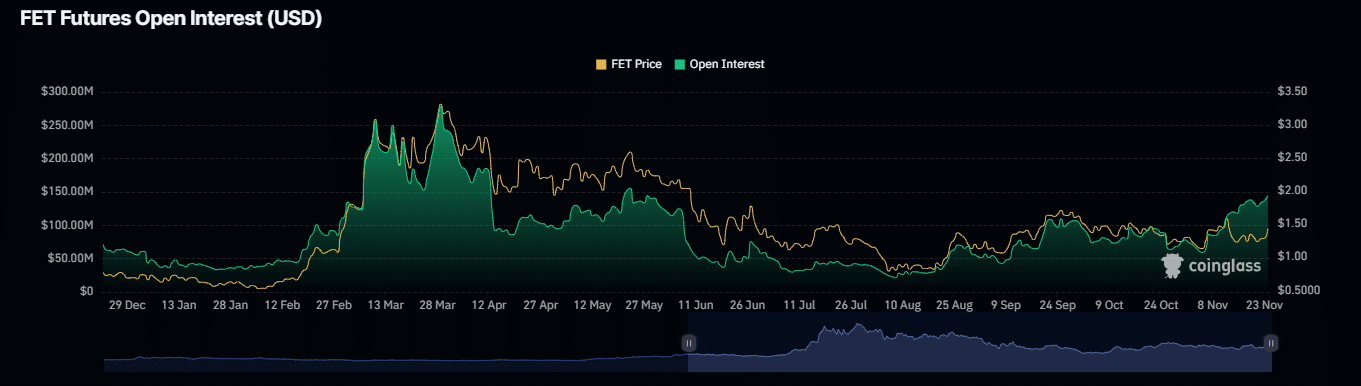

The number of ongoing derivative agreements for a specific asset (in this example, FET) that is monitored by Open Interest offers a glimpse into potential future trends or movements for that asset.

Recently, Open Interest surged by 10.20%, reaching $154.86 million.

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024–2025

This rise indicates that the market maintains a generally positive trend, and may continue to move upwards if other factors also support this optimistic perspective.

Until that point, it seems quite improbable for FET to burst free from its symmetrical triangle formation and attain fresh record highs.

Read More

2024-11-25 06:15