- FET overall outlook was bullish despite starting off with 11% drawdown this week.

- Over $1.2B in leveraged positions risk liquidation if price trades back to around $2.

As an analyst with over a decade of experience in the cryptocurrency market, I find myself intrigued by the FET outlook. Despite the recent 11% drawdown, the bullish sentiment remains palpable. The chart patterns suggest a possible hike towards $3.5, which would mean an over 99% increase from its current price levels.

Over the past 24 hours, the Artificial Superintelligence Alliance (FET) experienced a drop of over 11%, but there was a significant increase in daily trading volume by more than 150%. Interestingly, a review of the FET/USDT weekly chart shows a bullish trend as the price has yet to dip below $1.74 – a level that could signal a change in structure if breached.

As a crypto investor, I’ve witnessed an impressive upward trend with Fantom (FET) over the past few months. The price has steadily climbed from $0.5 in September to its current price of $1.74 at press time. This market structure is defined by a sequence of progressively higher lows and highs, which suggests robust buying pressure, signaling a strong investor interest in FET.

74 dollars serves as a crucial point because it’s where optimistic and pessimistic feelings have been shifting back and forth. Yet, the tiny upward tail at the bottom of this week’s candle hints that the positive trend could persist.

In simpler terms, the tiny flame (wick) symbolizes buyers aiming to increase the price, but they encounter some obstacles around the $2 mark. Essentially, the graph’s patterns hint at a potential rise towards $3.5, assuming the ongoing bullish trend continues.

Should the current upward trend persist and if market circumstances continue to be advantageous, there’s a possibility that we may see the price touching or exceeding $3.5 in the coming weeks or months. This represents a significant jump of more than 99% compared to its current value.

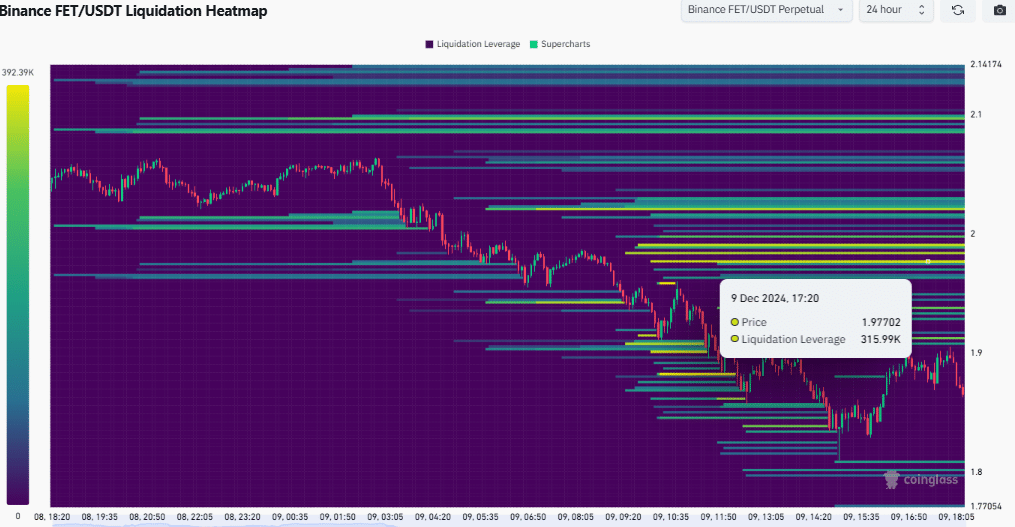

Key liquidation zones for FET

On Binance, the 24-hour FET/USDT Liquidation Heatmap offered insights into significant liquidity areas and possible dangers related to high leverage positions.

Given that the price of FET is close to $2.00, it appears that positions totaling over $1.2 billion could face liquidation due to their leveraged nature. This would particularly occur if the price surpasses the typical price ranges.

At the $1.8 mark, a crucial area for potential price stabilization lies. A significant amount of sell orders at this point may lead to more downward price movements if executed.

Instead, it was discovered that the resistance zone was located around $2.1, a point where liquidations might spark price increases.

In simpler terms, this situation suggests that prices might be unstable, moving towards areas with high trading activity, which could dramatically alter market behavior.

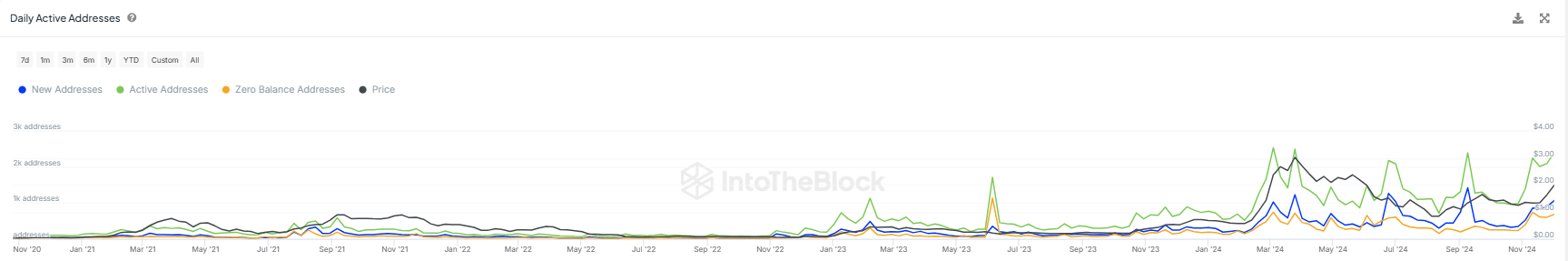

Daily active addresses

Investigating the behavior of FET on the blockchain network has uncovered notable patterns in user interaction over a period. Notably, the number of active addresses reached unprecedented peaks more recently. Moreover, it’s worth mentioning that increases in active addresses often coincide with price surges.

This pattern seems to show increased network action, usually happening alongside price increases – It might be hinting at strong purchasing demand or elevated trade activity.

During these timeframes, the newly assigned addresses showed a surge as well, suggesting either an increase in new users adopting FET or heightened interest in FET.

In other words, there wasn’t a clear link between zero balance transactions and price changes, suggesting that these transactions might be more about finalizing transactions rather than driving price fluctuations directly.

It appears this activity aligns with Fantom’s (FET) positive price trend. This implies that an increase in user interaction with the network, either via transactions or by owning FET, may boost its demand – a sign of optimism.

Read More

2024-12-10 13:11