- FET stayed flat in October, but bulls have kept it consolidating.

- Now, it’s primed for a breakout, if the right conditions align.

As a seasoned analyst with over two decades of market experience under my belt, I must admit that the current state of Artificial Superintelligence Alliance [FET] has piqued my curiosity. Despite the general bullishness in the market, FET’s performance remains a puzzling enigma.

As an analyst, I found myself immersed in the electric atmosphere following the elections, as investors strategically diversified their portfolios to minimize risk. This dynamic market scenario propelled Bitcoin [BTC] to a staggering new all-time high of $77K. The AI token sector was equally rewarding, exhibiting robust weekly growth with many tokens registering double-digit increases.

Despite a 15% surge this week, the Artificial Superintelligence Alliance (FET) has maintained its solid position. Currently, it’s trading at $1.42, slightly below its desired price point of $2.00.

Generally speaking, a bull market such as the present one usually sets up FET for a recovery from its four-month downturn. Yet, its underperformance compared to other markets has recently piqued the interest of AMBCrypto.

Is FET set for a rebound?

As a researcher, I’ve noticed an intriguing pattern: The value of FET has been decreasing steadily since October. Contrary to expectations, even Bitcoin’s 5% surge to approximately $72K in December didn’t seem to influence the fluctuations of FET’s price movement.

One contributing factor has been the memecoin-led ‘supercycle’, with heavy liquidity flowing into meme-based tokens. DOGE, for instance, posted an impressive 11% daily gain.

Instead of the past cycles, this one exhibits a more even distribution of capital investment. Notably, smaller token investments are experiencing growth in the double digits, which could be an opportunity for those who support FET (Fantom), as suggested by CoinMarketCap’s data.

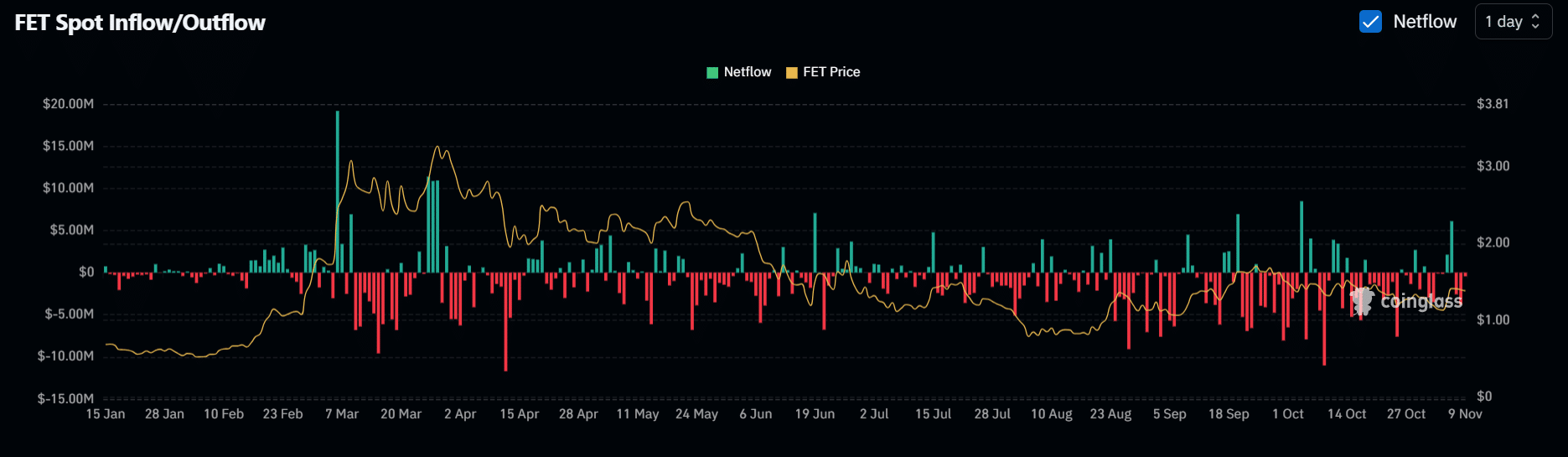

Source : Coinglass

Starting from mid-June, the FET bulls have attempted to surpass the $0.17 barrier for a total of four times, indicating that they are now amassing their positions, according to on-chain statistics.

Around four weeks past, around $11 million worth of FET tokens were taken out from trading platforms. This action has contributed to maintaining the stability of FET’s price range and lessened possible reversals.

Even though those forceful acquisitions have taken place, there’s been no noticeable effect on FET’s price as of now – implying a potential external factor that might be working against the market’s positive trend.

A short bias could derail the rally

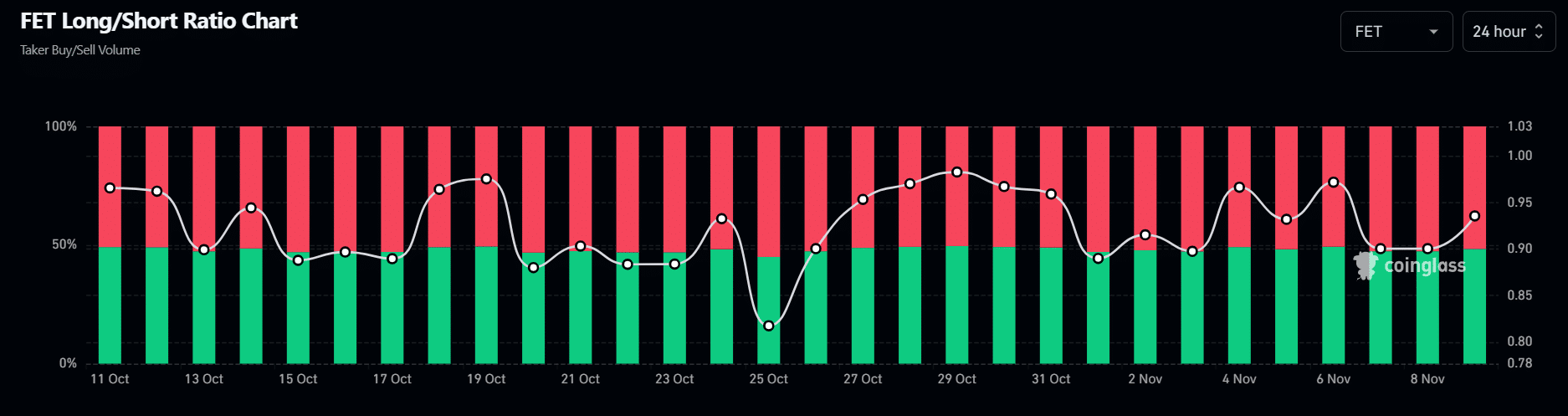

The significant breakout potential for FET is heavily influenced by the activities in the derivative market, where a strong tendency towards short positions can be noticed among large traders.

Over the past few months since October, I’ve noticed that short-selling strategies have been quite prevalent in the FET futures market, often serving as a substantial barrier to upward price movement.

As a crypto investor, I’ve noticed a significant number of short positions in the market. But here’s the catch: if the market trends change unfavorably for these shorts, they could swiftly flip to long positions. Right now seems like an opportune moment.

Source : Coinglass

Previously discussed, many investors have been shifting their investments towards smaller market cap tokens, a pattern that’s particularly significant given Bitcoin’s proximity to a potentially risky area.

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024–2025

Even though speculators taking advantage of price drops (spot traders) can indicate a positive trend, it may not necessarily trigger a breakthrough. To achieve that, big investors should resist selling their holdings.

In simpler terms, this situation could cause a significant increase in buyers, leading to a short-sellers’ predicament (called a “short-squeeze”). This, in turn, might initiate a surge or recovery in the market, making it more likely that prices will rise.

As an analyst, I’m observing that FET seems primed for a possible surge. At the moment, the Relative Strength Index (RSI) is hovering in a neutral zone, suggesting neither overbought nor oversold conditions. Under the right circumstances, these aligning factors could propel FET beyond its current resistance at $0.17, paving the way towards my projected target of $2.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-11-09 20:08