- Fidelity is seeking the SEC’s permission for staking on its ETF ETFs

- ETF staking could offer an extra 3% yield to investors.

In a rather audacious display of optimism, Fidelity, through the venerable CBOE exchange, has submitted an application to the SEC, requesting the green light for staking provisions on its Ethereum [ETH] ETF product. This comes hot on the heels of a similar plea from 21Shares and Grayscale back in February, as if the crypto gods themselves have whispered sweet nothings about the potential of staking features in U.S. spot ETH ETFs. How quaint! 😏

These products, which made their grand debut last summer, now boast a staggering $7 billion in total net assets, all snugly locked away in custody accounts. One can only imagine the cozy little parties those assets must be having! 🎉

Should these assets be staked, they could generate a delightful extra yield—by delegating a portion of ETH to validators, thus securing the blockchain network and rewarding them with additional tokens. It’s like a little financial soirée, where everyone leaves with a party favor! 🎈

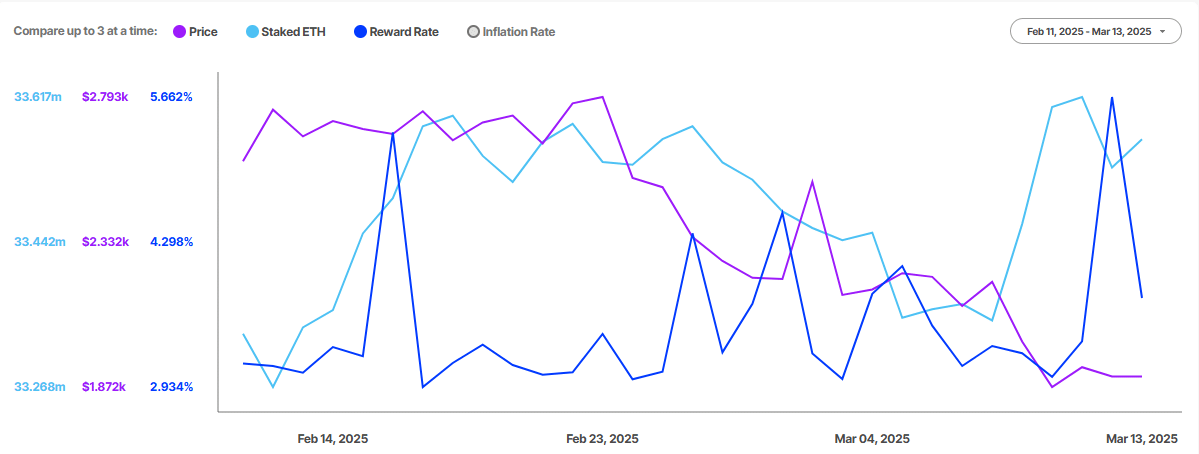

ETH Staking Rewards

Even Bitwise, in a fit of inspiration, is contemplating a similar filing in the U.S., claiming it would enhance investor returns. In a recent tête-à-tête with Bloomberg, Matt Hougan, the CEO of Bitwise, proclaimed,

“ETPs should stake. We’ve seen in Europe that staking ETPs work and help increase investor returns and boost network security.”

Meanwhile, the founder of Etherealize, Vivek Raman, lamented that the absence of staking has “dampened” ETH ETF adoption. According to him, ETH ETF staking,

“Can open up more money, it can open up a differentiated narrative around Ethereum.”

According to the ever-reliable Staking Rewards, staked ETH is currently attracting a rather respectable 3.7% annualized return. These extra rewards could be the cherry on top for investors, driving demand for the ETH ETF like moths to a flame. 🔥

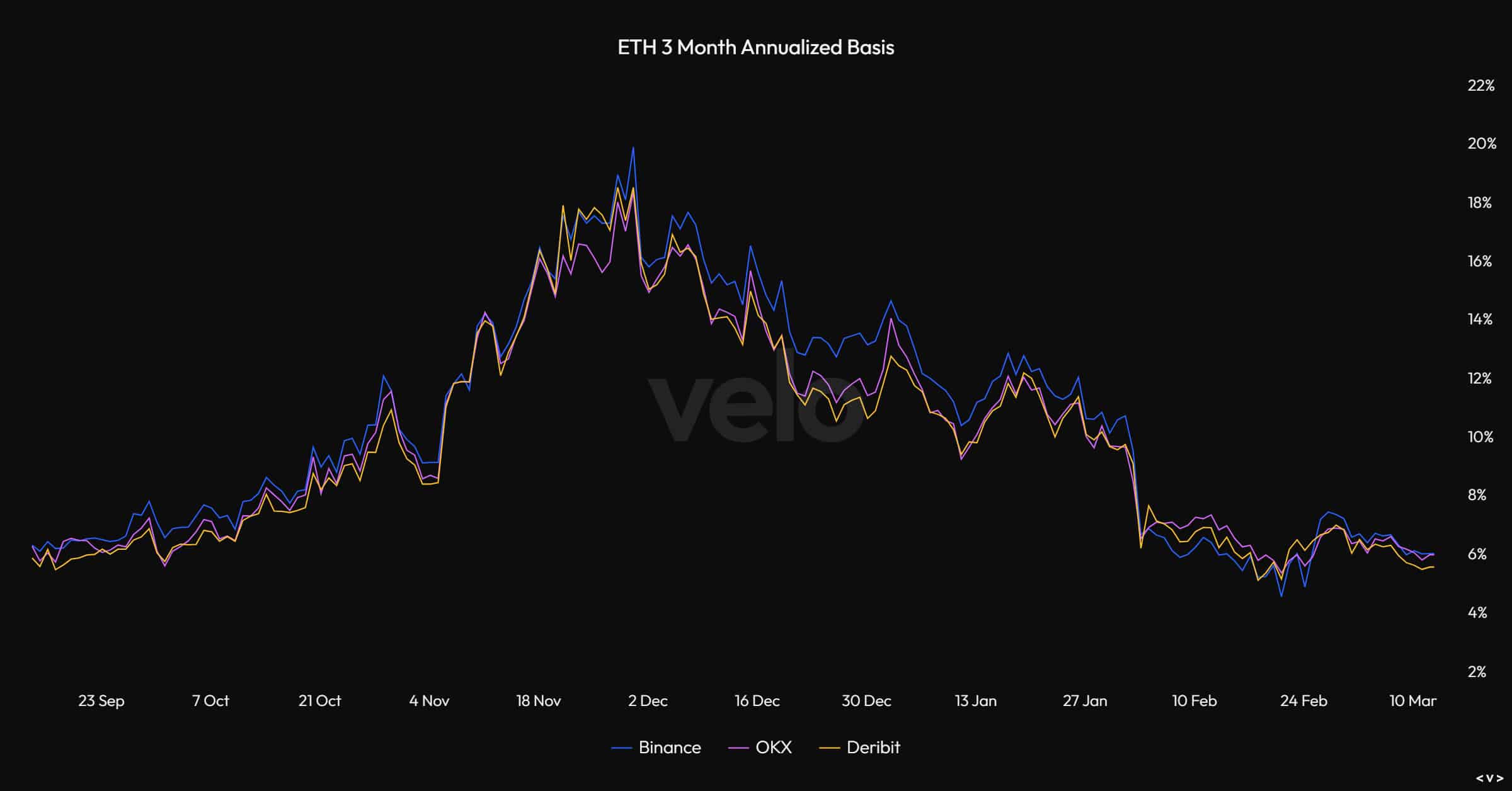

At present, the only yield that asset managers can exploit through the ETH ETFs is the CME Ethereum basis trade. This involves purchasing spot ETH ETF and simultaneously opening a short on the CME Futures to pocket the price difference (yield or basis). Quite the clever ruse, wouldn’t you say?

During last November’s euphoric uptrend, the CME ETH basis trade yielded nearly 20%. If one were to include staking rewards, that figure would balloon to a staggering 23%. Oh, the possibilities! 🎊

However, due to a rather dismal broader sentiment, the CME basis trade has plummeted to about 6% at press time. Yet, if one were to factor in staking returns, this could collectively offer a tantalizing 9% yield for ETH ETF investors. What a rollercoaster ride! 🎢

Meanwhile, ETH was valued at a modest $1.88k at the time of writing, down a staggering 54% from its record highs of $4k. Whether ETF staking will breathe new life into the altcoin’s value remains to be seen. Stay tuned, dear reader! 📉

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2025-03-13 09:15