- SEC concluded its 14-month Ethereum 2.0 probe without charging Consensys

- Consensys asserts that the fight continues, with two more SEC probes being contested

As an analyst with a background in law and experience following the crypto industry, I believe this development is a positive step for Consensys and the Ethereum community. However, it’s crucial to acknowledge that the legal battle isn’t over yet.

It seems that the protracted legal dispute between the US Securities and Exchange Commission (SEC) and ConsenSys, the company responsible for MetaMask digital wallet, has reportedly reached a conclusion.

For nearly 14 months, the SEC had been investigating Ethereum [ETH] 2.0 and Consensys.

As a researcher exploring the evolution of Ethereum, I’ve come across an interesting perspective by Consensys. While the Ethereum network has transitioned from Proof of Work (PoW) to Proof of Stake (PoS) with the Merge, Consensys asserts that this is not the end of the struggle.

Impact of SEC ending the investigation into ETH 2.0

The announcement of this new development has created waves throughout the crypto world, prompting an essential discussion: How will this affect the larger crypto market?

As the Head of Litigation & Investigations at ConsenSys, I shared my insights with CNBC regarding the ongoing issue.

It was a pleasant surprise for us to learn that the Ethereum 2.0 investigation has ended, bringing no accusations against Consensys.

She added,

“A year ago, that was the expected outcome, the one that was destined to occur. However, the battle isn’t concluded just yet.”

Brookover highlighted that the Ethereum probe is merely one of the three ongoing investigations Consensys is contesting in their ongoing lawsuit in Texas.

I noted that these investigations represent a crucial aspect of our efforts to safeguard our own operations and contribute to the larger Ethereum community through the ongoing legal proceedings.

The story so far…

Back in 2018, the Securities and Exchange Commission (SEC) hinted that Ether did not fall under the category of securities. Fast forward to 2023, and without much fanfare, the SEC shifted its stance, claiming jurisdiction over Ether as a security and commenced an investigation into Ethereum.

On April 25, 2024, Consensys initiated a legal action against the SEC, asserting that their investigation into the Ethereum ecosystem infringed upon its operations. The lawsuit requested the court to issue an injunction, as the plaintiffs believed that Ether should be classified as a commodity and therefore fall beyond the SEC’s regulatory purview.

The SEC’s investigation into Ethereum 2.0 ignited great apprehension amongst policymakers, such as Congress members and the public at large.

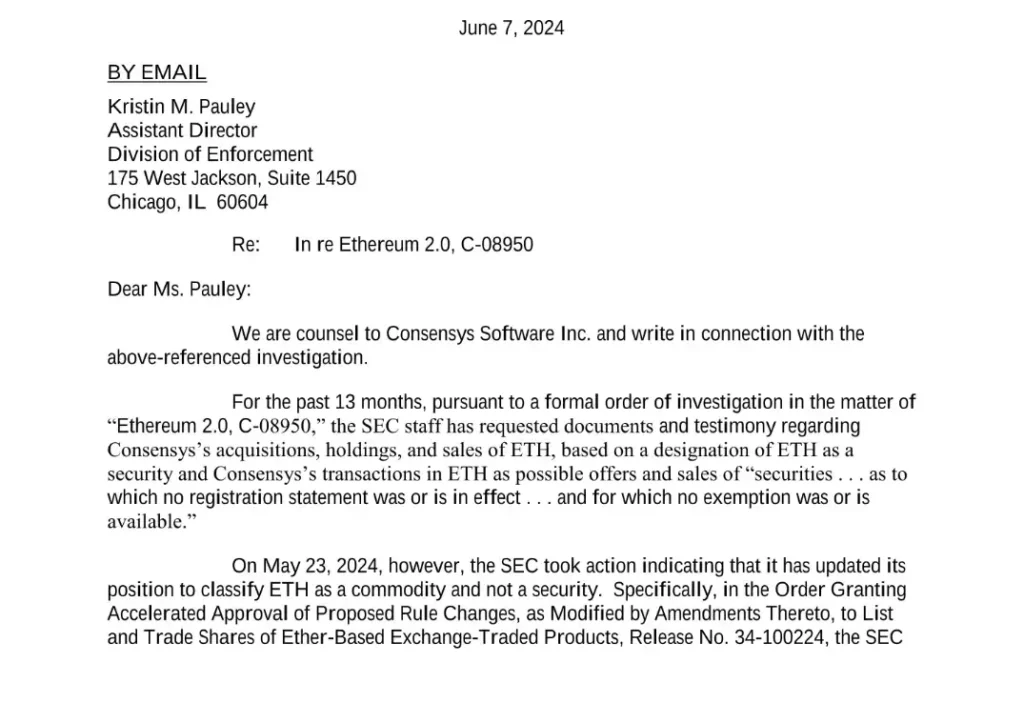

On June 7th, Consensys submitted a letter to the Securities and Exchange Commission (SEC) requesting clarity on the implications of their previous decision in May, which labeled Ether as a commodity for exchange-traded fund (ETF) approvals. This confirmation from the SEC was hoped to put an end to the ongoing Ethereum 2.0 investigation.

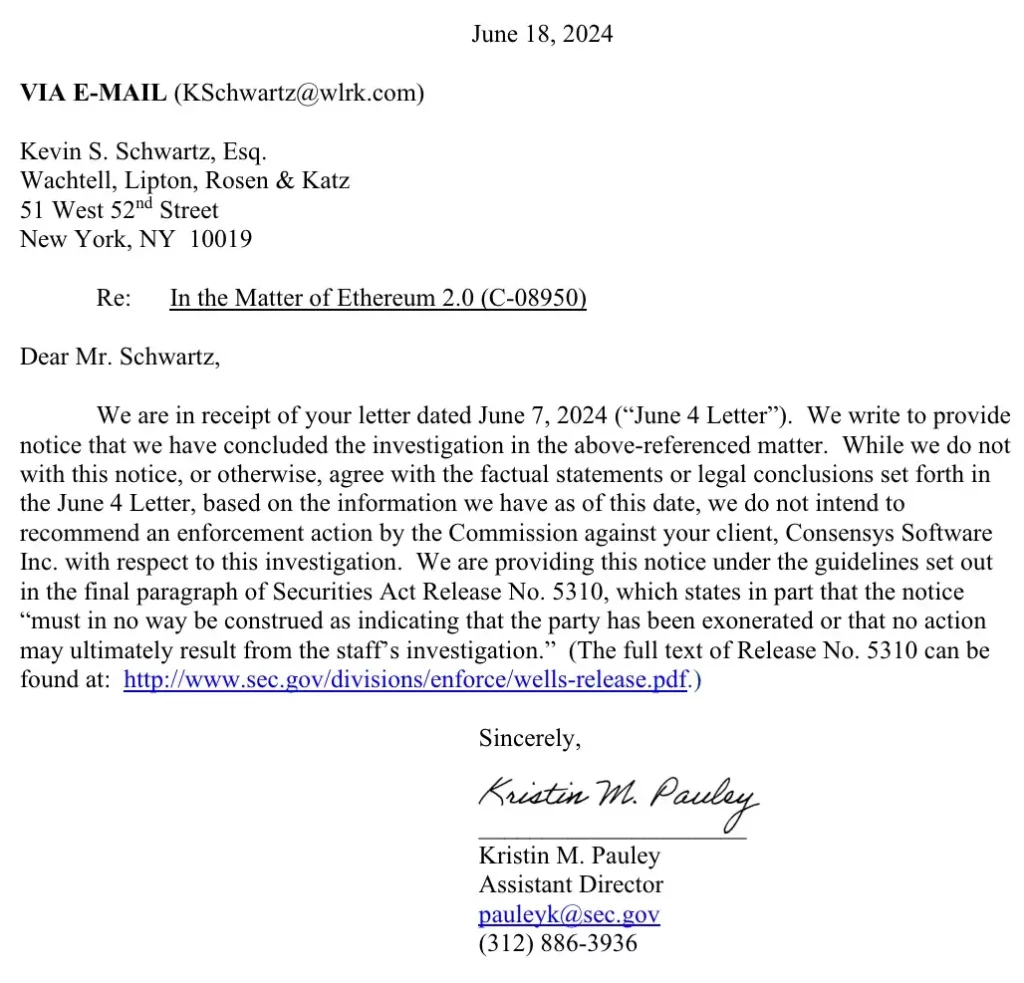

Responding to the same, the SEC in an 18 June letter claimed,

“The Commission does not plan to take enforcement action against Consensys Software Inc. regarding this investigation.”

The fight isn’t over yet

As a researcher examining the SEC’s decision to close an investigation, I cannot help but notice the lack of clarity in their communication. While I understand that the investigation has been concluded, I am left questioning why this was the case and how it may impact other ongoing probes and enforcement efforts. A more transparent explanation from the SEC would go a long way in assuaging industry concerns and ensuring trust in their regulatory processes.

Many queries remain unresolved after this, emphasizing the importance of more definite rules in the dynamic world of cryptocurrencies. In Brookover’s words, “this situation highlights the necessity for more explicit regulatory frameworks in the rapidly changing cryptocurrency marketplace.”

“We’ll continue our efforts to defend against this legal action regarding security until we receive satisfactory answers and a court decision in our favor.”

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-06-22 19:03