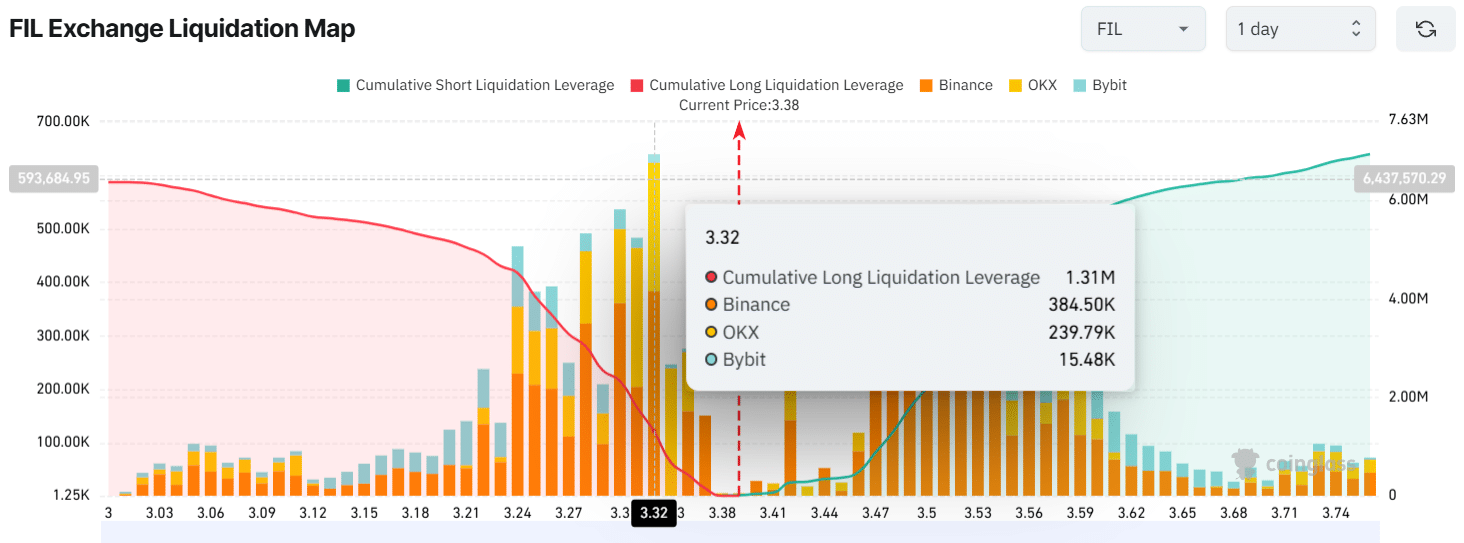

- Ah, the intraday traders, those daring souls, found themselves over-leveraged at the $3.32 level on the lower side and the $3.42 on the upper side, like tightrope walkers in a circus of finance.

- On-chain metrics, those delightful little whispers from the blockchain, revealed that exchanges have witnessed an outflow of FIL tokens worth a staggering $1.30 million. Quite the spectacle, isn’t it?

In the grand theater of market uncertainty, where cryptocurrencies pirouette and stumble, we find our protagonist, Filecoin [FIL], teetering on the edge of a crucial support level, ready to either ascend to the heavens or plummet into the abyss.

Current price momentum

As of this very moment, Filecoin dances around the $3.37 mark, boasting a modest price gain of 0.50% in the past 24 hours. A mere flicker of hope in a sea of despair!

Yet, during this same fleeting period, its trading volume surged by 16%, a sign of growing interest from traders and investors, as if they were moths drawn to the flickering flame of bullish price action.

Filecoin price action and upcoming levels

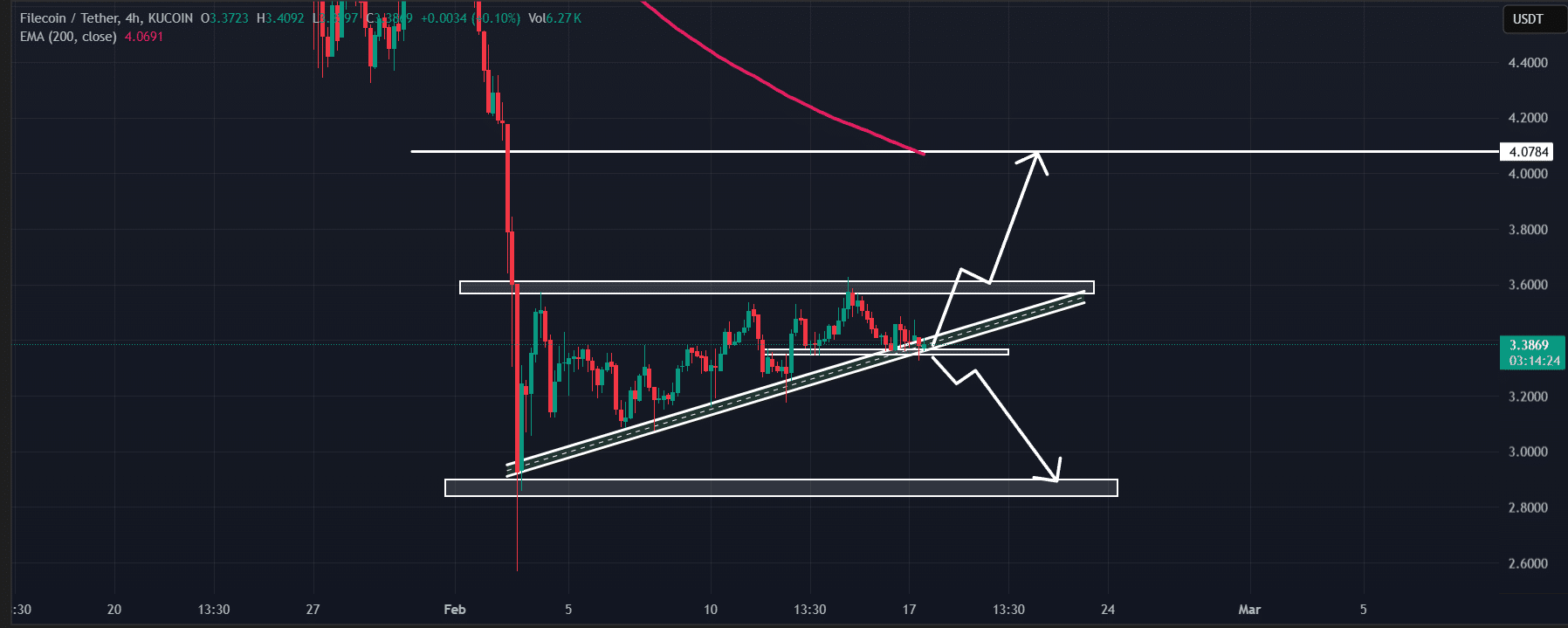

According to the oracle of AMBCrypto’s technical analysis, Filecoin has formed an ascending triangle pattern in the four-hour timeframe. A classic case of geometry meets finance!

However, amidst the recent price drop, our dear asset has reached the ascending trendline support, creating a make-or-break situation that could make even the most stoic investor sweat.

Should FIL manage to cling to the $3.38 level, it could soar by 20% to reach $4.05. But beware! If it fails to hold this level and closes a four-hour candle below $3.30, it might just tumble by 14% to a dismal $2.92. The drama unfolds!

At the time of this literary endeavor, FIL was trading below the 200-day Exponential Moving Average (EMA), a clear indication of a downtrend. Oh, the irony!

Bullish on-chain metrics

Despite the critical situation, our brave intraday traders were betting on Filecoin’s long positions, as reported by the on-chain analytics firm Coinglass. A bold move, indeed!

Data revealed that these traders, holding long positions, were over-leveraged at the $3.32 level, totaling $1.31 million in long positions. Meanwhile, those betting on short positions were over-leveraged at $3.42, holding a mere $268,620. The stakes are high!

These over-leveraged positions suggest that bulls are currently dominating the asset, despite the ominous clouds of negative market trends looming overhead.

In addition to the valiant efforts of intraday traders, long-term holders are accumulating tokens like squirrels hoarding acorns for the winter. Data from Spot Inflow/Outflow revealed that exchanges witnessed an outflow of FIL tokens worth $1.30 million in the past 24 hours. A sign of hope?

This suggests a gathering storm of accumulation by investors and long-term holders, ready to unleash their buying pressure and drive further upside momentum. Will they succeed? Only time will tell!

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-02-17 23:40