- FIL broke out of a falling wedge, signaling potential for a bullish reversal

- Market sentiment remains cautious as technical indicators revealed mixed signals of strength

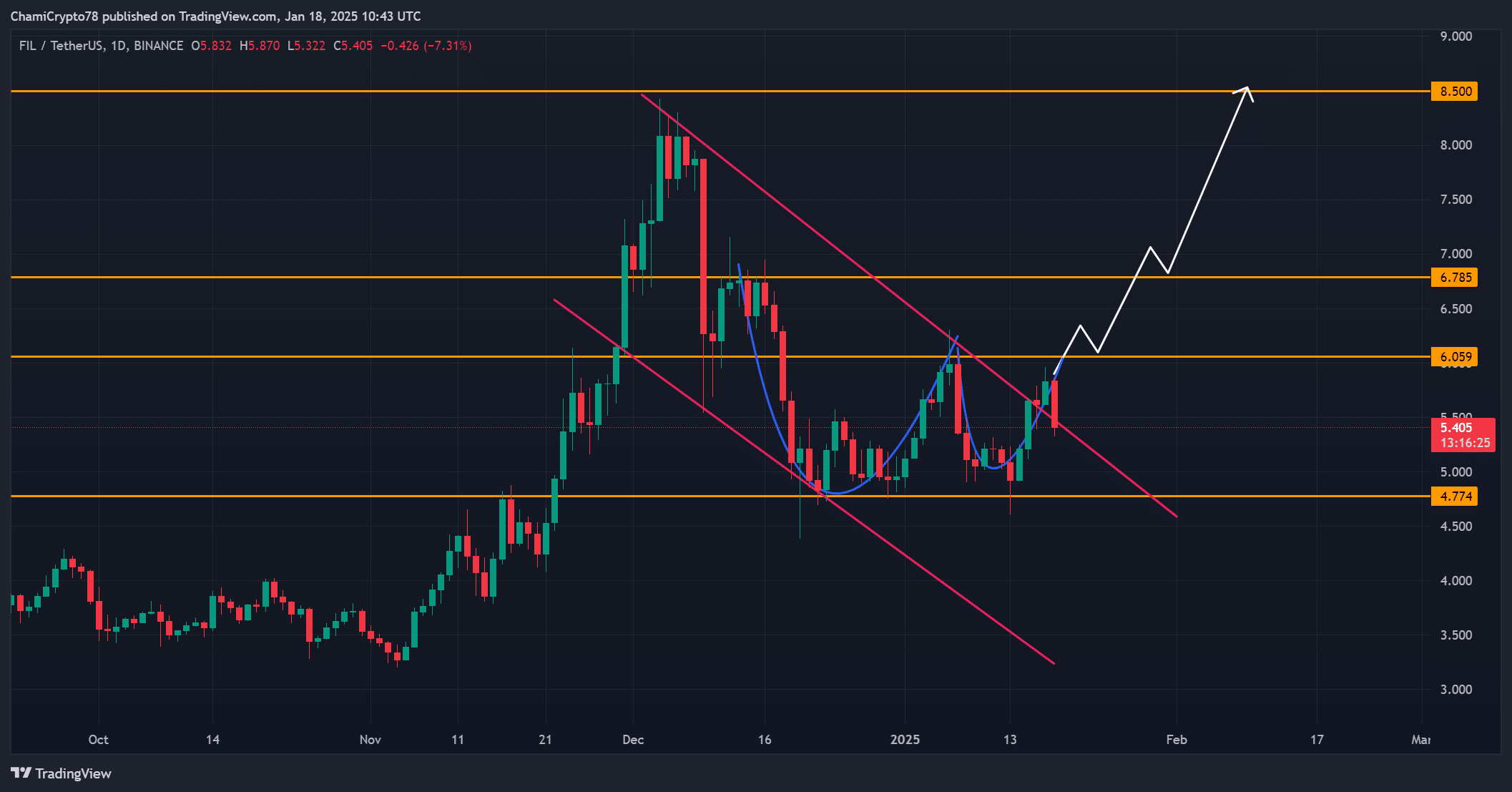

At this moment, it appears that Filecoin (FIL) has managed to break free from its downward trending formation known as a falling wedge on the 8-hour chart. This could indicate a change in direction for the price movement.

Although experiencing a surge, it’s worth noting that Filecoin (FIL) was trading at $5.40 at the time of press, representing a 7.37% decrease. This raises questions about whether this upward trend can persist. Will the market recover trust and potentially drive FIL prices upwards?

Will FIL rally after breaking the falling wedge?

The behavior of FIL suggests a substantial technical breakout from its downward wedge formation, often indicating a potential bullish turnaround. Yet, following the peak at $5.87, there was a pullback to $5.40, which could be interpreted as uncertainty among investors.

Right now, the price is encountering significant opposition at around $6.059. This is an important threshold that needs to be surpassed for any potential increase. On the contrary, $4.774 appears to be acting as a robust base, potentially hindering any further decrease.

How are Binance funding rates shaping sentiment?

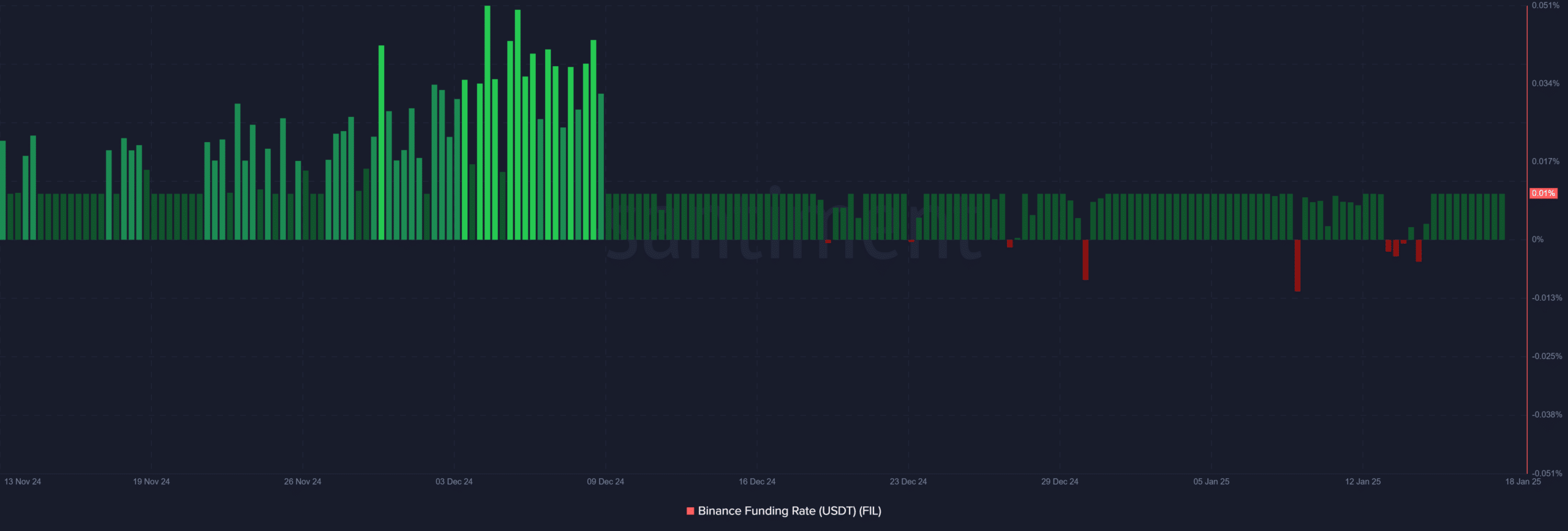

On Binance, the funding rate for Filecoin (FIL) was slightly positive at 0.01%, signifying a mildly optimistic market sentiment. This suggests that traders have leaned slightly towards bullishness rather than bearishness, but the fact that there were no major spikes in the funding rate implies a lack of strong conviction.

In other words, if FIL is going to significantly increase in value, interest rates on investments should rise due to growing demand. If not, the market could be relatively stable or unchanging for a while.

FIL social metrics lack momentum

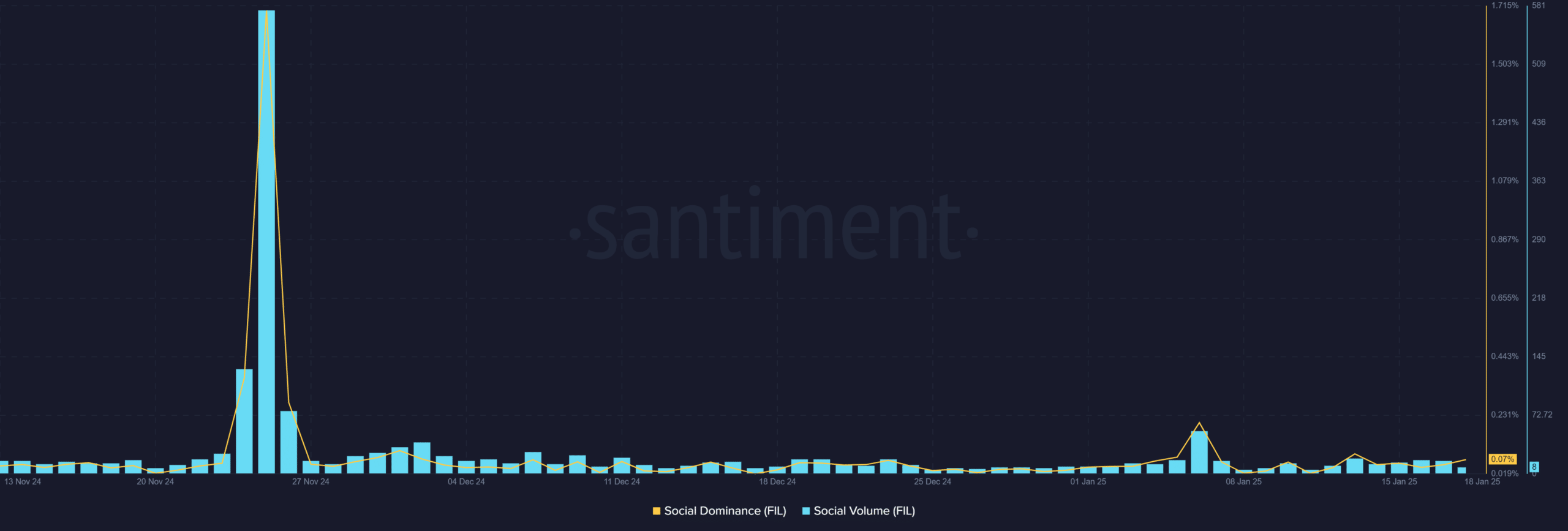

Although there was a surge in activity, Family Investment Limited (FIL) still hasn’t garnered significant social volume or influence, with only 8 references being made. This quiet online presence suggests minimal participation from individual investors, a group that typically drives market upswings.

Furthermore, since FIL has not yet gained much recognition within the larger cryptocurrency community due to its relatively low social influence, it’s crucial for a lasting bullish trend that social indicators improve to capture broader interest in FIL’s possibilities.

Technical indicators highlight market hesitation

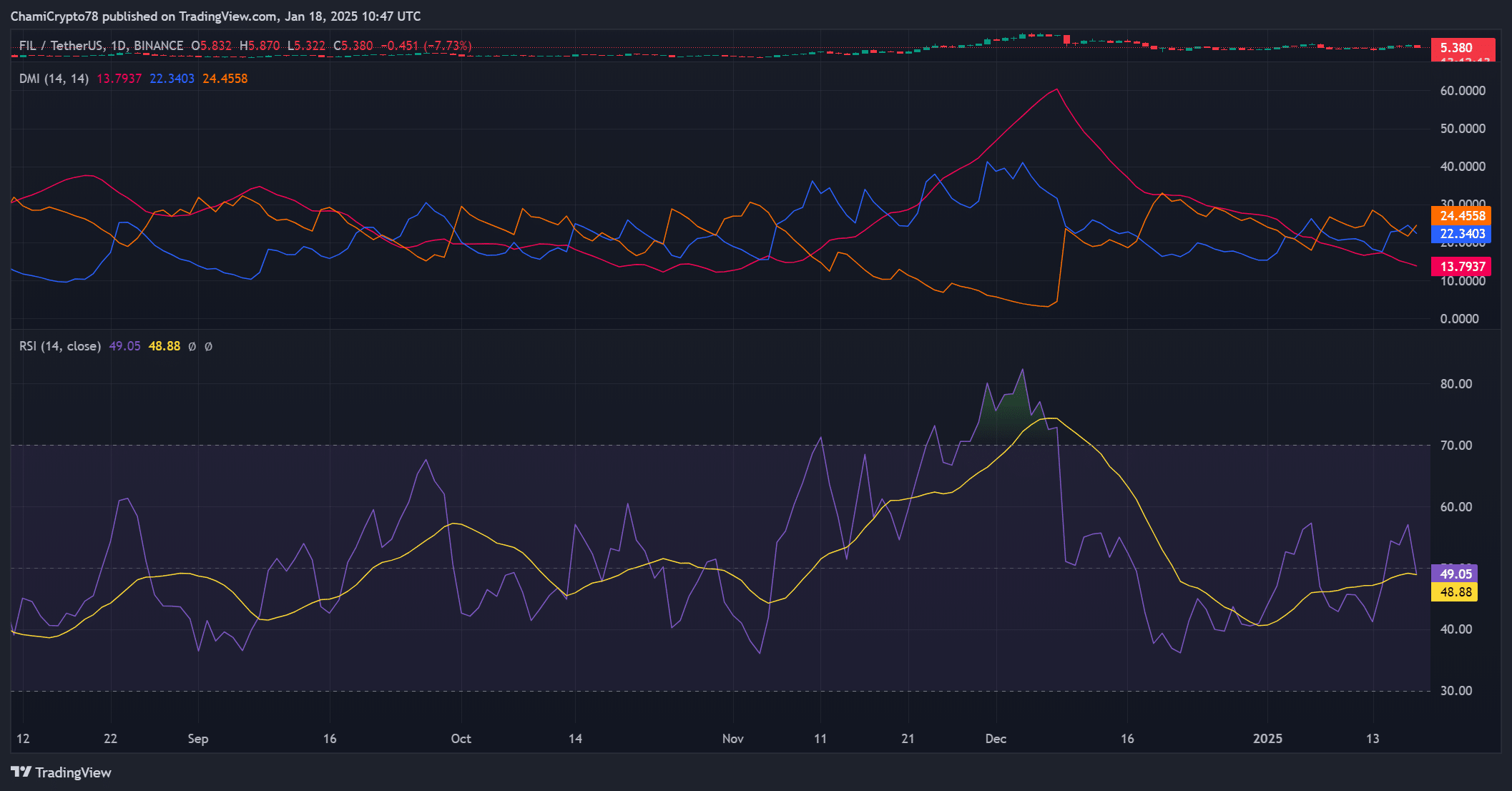

In simpler terms, the technical analysis showed some conflicting signals. The DMI (Directional Movement Index) showed a stronger bearish influence (-D at 24.45 compared to +D at 22.34). Meanwhile, the ADX (Average Directional Index) suggested a weak trend with a value of 13.79. Lastly, the RSI (Relative Strength Index) indicated neutral momentum at 49.05. This means that while there seems to be a slight edge towards bearishness, the overall trend and momentum are not definitively bullish or bearish.

Consequently, for Filecoin to have a defined upward trend (bull market) and restore investor trust, it requires more significant buying activity.

Market sentiment reflects cautious positioning

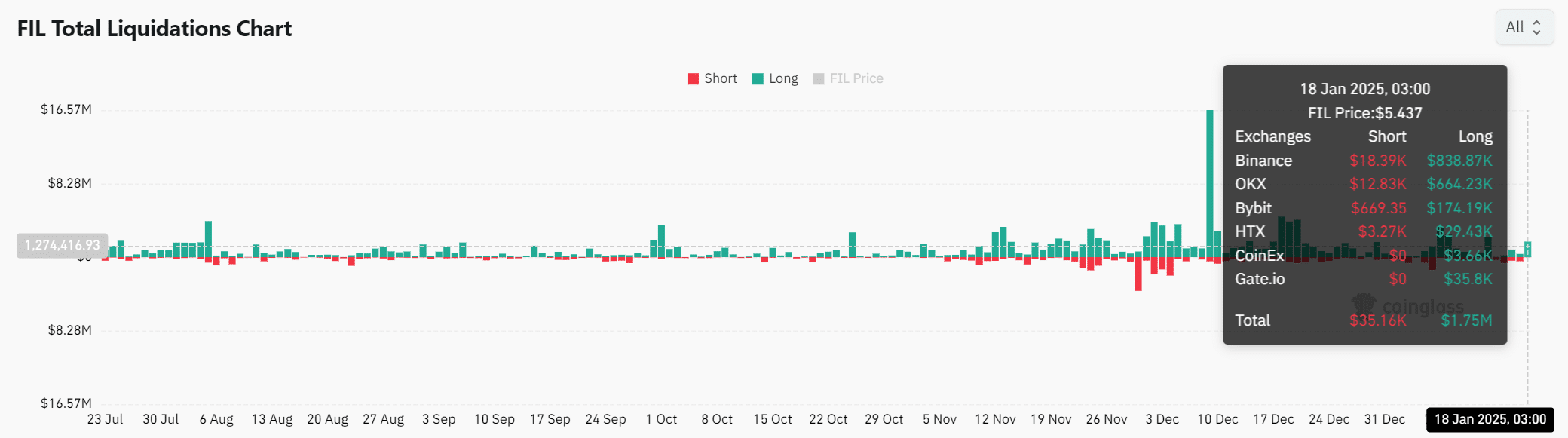

Ultimately, the Open Interest for Filecoin decreased by 5.79% to reach $324.7 million, suggesting a decrease in leveraged positions. Additionally, total liquidations amounted to $1.75 million, which favored long positions, indicating that traders’ confidence was low.

As the decreasing Open Interest suggested less market involvement, a turnaround might spark fresh enthusiasm for Filecoin’s possible price increase.

Read Filecoin’s [FIL] Price Prediction 2024–2025

Can FIL rally further?

filecoin’s surge is promising, yet its continued growth hinges on overcoming the key barrier at around $6.059 and attracting more substantial investor interest.

As an analyst, I find that for Fisher Investments Ltd (FIL) to maintain its positive trajectory, it necessitates enhanced funding rates, progress in social metrics, and increased Open Interest. While the current breakout presents an enticing opportunity, any further growth will hinge on the reemergence of strong buying pressure and market excitement.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-01-19 11:03