- FLOKI crypto surged 40.72% in a week, supported by high trading activity.

- New addresses rose 331.93%, signaling growing adoption.

As a seasoned analyst with years of experience in the cryptocurrency market, I find myself intrigued by FLOKI’s recent surge and subsequent slight correction. The 40.72% gain over the last week is undeniably impressive, especially considering the significant increase in new addresses (331.93%) and trading activity. However, the 6.01% drop within the past 24 hours serves as a reminder that even the most bullish of markets can be volatile.

Currently, the price of Floki [FLOKI] stands at $0.000194, representing a 6.01% decrease within the past 24 hours. Despite this short-term dip, the token has experienced a significant 40.72% increase over the last week, suggesting a generally positive and growing trend.

Even though there was a temporary adjustment in price, trading stayed brisk with a daily transaction value of approximately $1.37 billion.

Initially, the number of FLOKI tokens in circulation was approximately 9.7 trillion. This resulted in a market value of around $1.88 billion. The latest dip could be attributed to a typical correction following the significant increases observed recently.

Key support and resistance levels

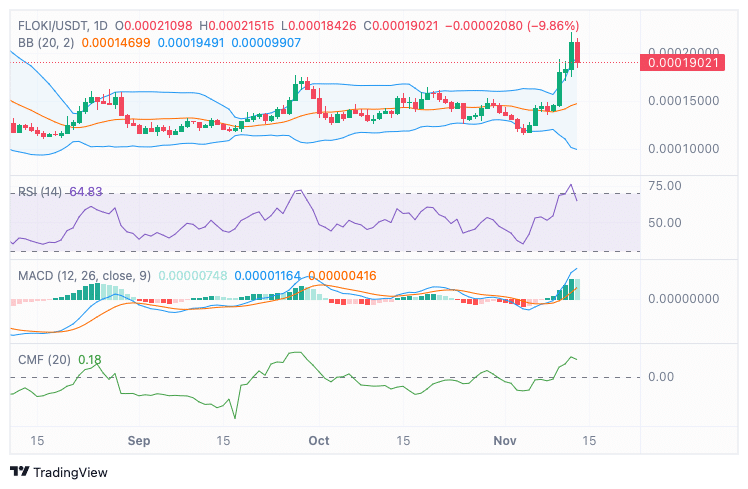

The technical details further underscored significant pricing thresholds. Particularly interesting was the location of the upper Bollinger Band at approximately $0.00021499, a point that might potentially trigger resistance when it comes to the asset’s movement.

At a lower price point, approximately $0.00009907 functioned as a crucial support level. This is an area where potential buyers might decide to enter the market.

At approximately $0.00014949, the central line of the Bollinger Bands functioned as a significant turning point. This level could switch between acting as support or resistance based on the direction in which the prices move.

At the moment, the Relative Strength Index (RSI) stood roughly at 64, indicating that the asset was still within a bullish zone but not yet showing signs of being excessively overbought.

As I observed the market, the Moving Average Convergence Divergence (MACD) displayed a positive trajectory, signaling an uptrend. Additionally, the Chaikin Money Flow (CMF) registered at 0.18, suggesting sustained buying pressure that reinforces the bullish trend I’m tracking.

Futures market activity adjusts

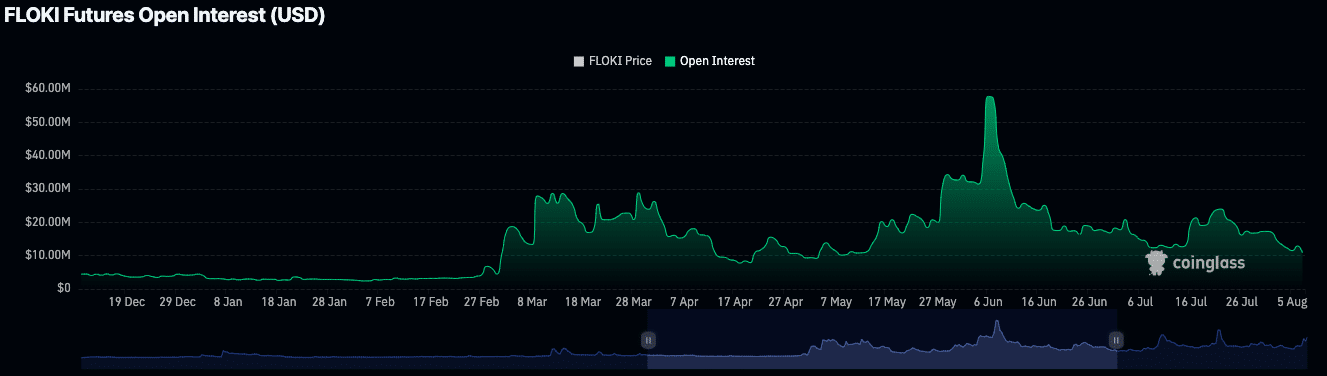

Open Interest in FLOKI Futures has dropped by 10.05%, totaling $28.48 million at press time.

This decrease suggests that traders may be winding down their leveraged trades, perhaps by realizing gains or minimizing risk after experiencing market volatility.

Despite this decline, the Futures market remained active, with trading volume rising 5.10% to $303.35 million.

This implies that certain traders are lowering their risks, but others continue to stay active, expecting more market movement in the future.

Network expansion ahead?

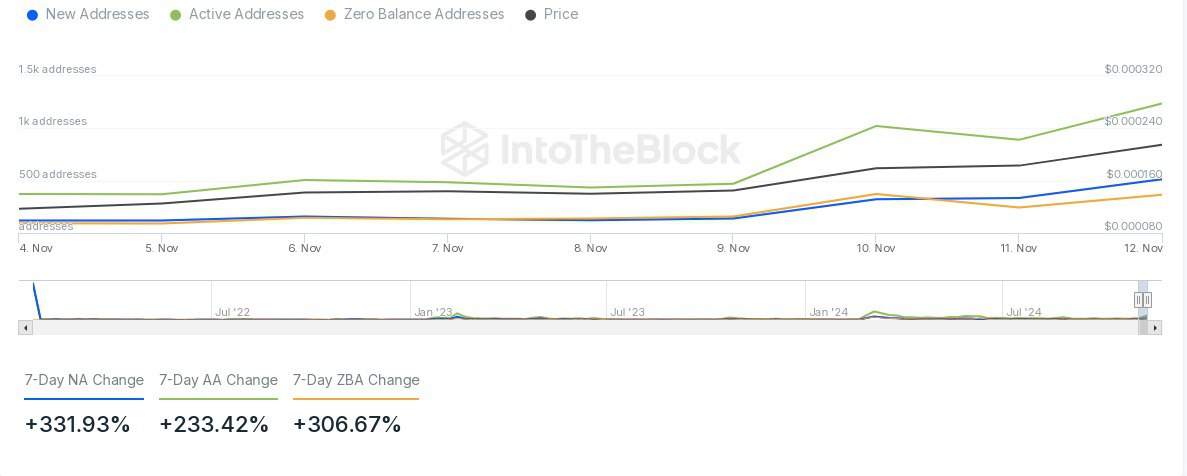

Over the last seven days, there’s been a significant rise in FLOKI’s on-chain interactions. The number of new wallets has skyrocketed by approximately 3.3 times (331.93%), and active wallets have increased by around 233.42%, suggesting that user adoption is steadily growing.

The involvement in the FLOKI ecosystem expanded, as seen by a rise in the number of wallets taking part in transactions.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

The number of zero balance addresses has also grown by 306.67%, which could indicate heightened speculative activity or the consolidation of funds across wallets.

These trends suggest expanding network usage, driven by recent market interest and price movements.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-14 05:11