-

FLOKI has fallen below a key support level.

Key technical indicators suggest the possibility of a further price decline.

As a researcher with extensive experience in cryptocurrency analysis, I’ve closely monitored the recent developments of Floki Inu (FLOKI). Based on my findings, FLOKI has fallen below a key support level, which is a concerning sign. The technical indicators suggest that there is a possibility of further price declines.

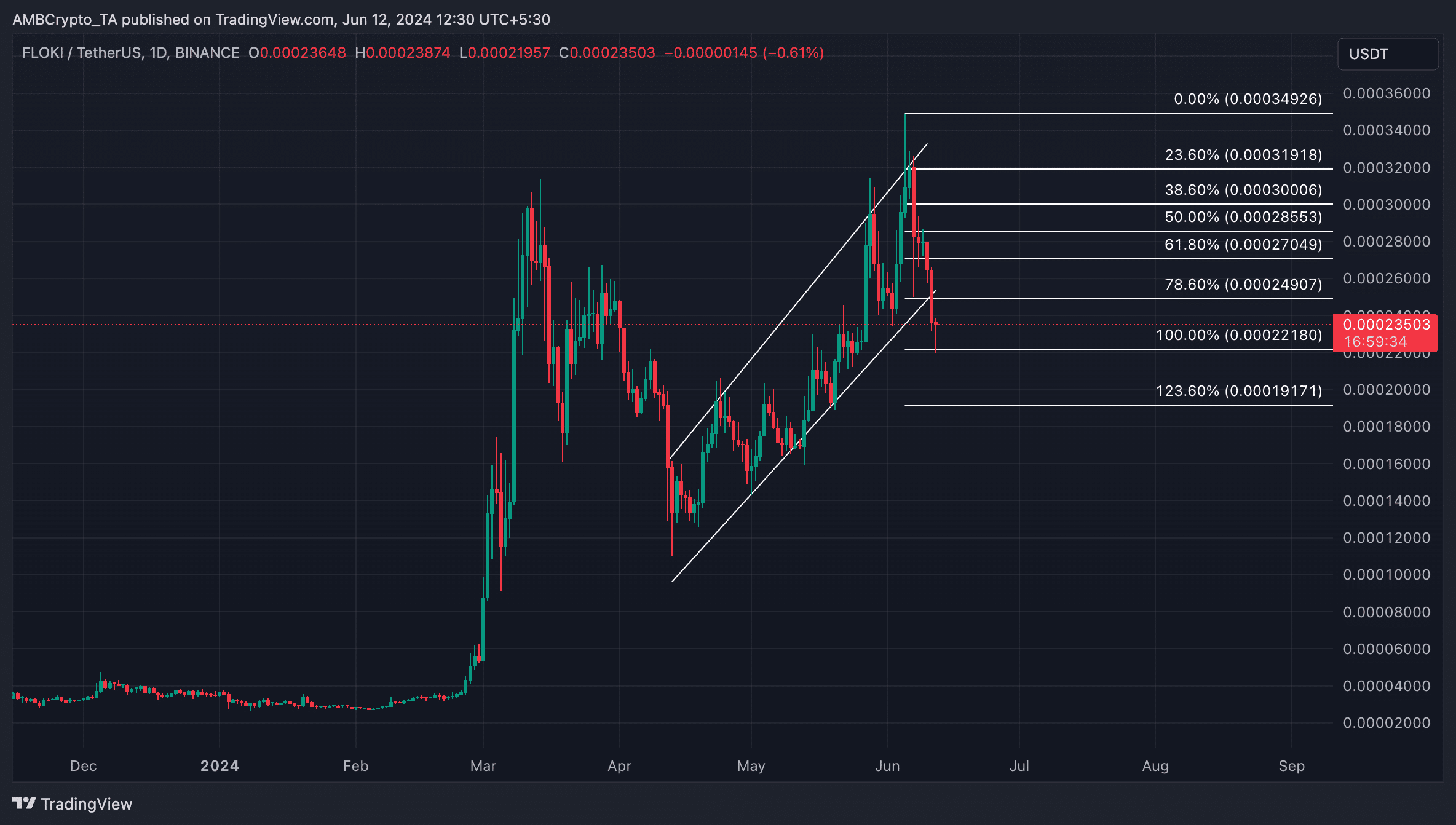

As a researcher examining the cryptocurrency market, I discovered that FLOKI, the cryptocurrency represented by the ticker symbol [FLOKI], dipped below its ascending channel’s lower boundary on June 11th and closed beneath its support level, according to AMBCrypto’s findings.

As of now, a single meme coin was being traded for approximately $0.00023 on various cryptocurrency platforms. Over the last week, this digital asset suffered a substantial loss, amounting to 28%, based on data from CoinMarketCap.

On the 13th of April, FLOKI‘s price started to surge, causing it to gain popularity and become a trending topic within the ascending channel. An ascending channel is typically formed when an asset’s price pattern consistently exhibits rising highs and rising lows.

As a crypto investor, I’ve noticed that by the 5th of June, FLOKI‘s price reached an unprecedented peak of $0.00035. Since then, however, it has started to slide downward. The trend has been leading me towards the lower boundary of the channel where it previously found support at $0.00025.

On the 11th of June, the token’s price fell below support to close at $0.00023.

More declines on the horizon?

Based on an examination of significant factors, AMBCrypto concluded that there were signs suggesting a potential decrease in FLOKI‘s value.

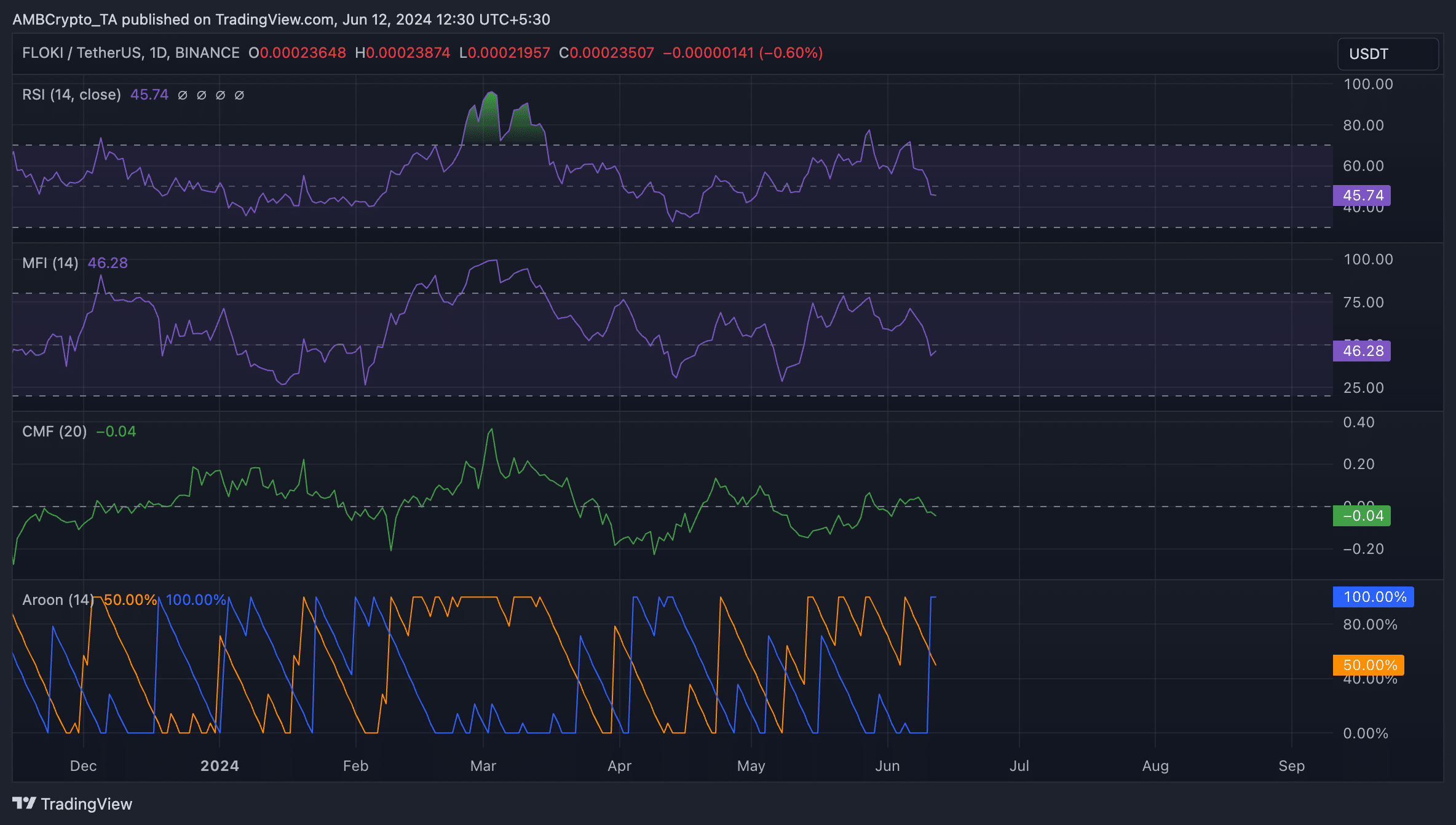

The RSI and MFI of FLOKI, which serve as important momentum indicators, fell short of their respective median values. Specifically, the RSI stood at 46.55, while the MFI was measured at 46.32.

As a researcher studying market trends, I would describe these indicators as tools that help me determine overbought or oversold conditions in a market based on the momentum and price changes of an asset. In simpler terms, they provide insights into whether an asset has been bought too heavily (overbought) or if its price has fallen too much (oversold), allowing for potential buy or sell opportunities.

As a researcher analyzing financial data, I’ve observed that based on the readings of FLOKI‘s Relative Strength Index (RSI) and Money Flow Index (MFI) at the current moment, there appears to be more selling activity than buying pressure in the market.

As a researcher examining the behavior of a meme coin, I’ve noticed that its Chaikin Money Flow (CMF) has been showing negative values recently. This particular technical indicator helps me gauge the net flow of money into and out of the asset by calculating the difference between the closing price and the average of the high, low, and closing prices over a specific time frame. The negative CMF suggests that there has been more selling pressure than buying pressure in the coin, potentially indicating a bearish trend.

As a crypto investor, I’d interpret a negative Cumulative Moving Average (CMA) value as a sign of market vulnerability. This means that the selling pressure is stronger than the buying pressure, leading to increased liquidity exits. In simpler terms, it’s a bearish signal, and I would view it as a potential warning for further price decreases.

As of this writing, FLOKI’s CMF was -0.04.

Additionally, the Aroon Down Line of FLOKI, indicated in blue, strongly signaled the continuation of its ongoing downward trend at a reading of 100% as of the present moment.

This indicator measures an asset’s price trend strength and identifies potential reversal points.

When the Down Line nears 100%, the descent is robust, indicating that the latest low point was attained not too long ago.

Realistic or not, here’s FLOKI’s market cap in DOGE terms

Should the current trend persist, the value of FLOKI could potentially drop below the $0.0002 mark and trade at around $0.0001 instead.

If the invalidation of this factor leads to a resurgence in demand for FLOKI, its price could potentially rebound and reach or even exceed the support levels of $0.00025.

Read More

2024-06-12 22:15