- FLOKI’s pullback hit 20% ahead of the U.S elections

- Will the pullback extend as FLOKI’s accumulation trend picks momentum?

As a researcher with a knack for deciphering market trends and a keen eye for detail, I find myself intrigued by the current state of FLOKI. The 20% pullback preceding the U.S elections was a stark reminder of the volatile nature of memecoins and the unpredictable influence of global events on their performance.

Despite memecoins leading the charge in October’s market performance, November got off to a rocky start. These digital assets were among the initial losses during risk reduction prior to a potentially volatile U.S election week. For instance, FLOKI plummeted by 20%, wiping out all of its gains from October.

But, how far can the pullback go before a potential recovery attempt?

FLOKI’s pullback

We placed a Fibonacci retracement tool (yellow) between July’s highs and August’s lows. Throughout October, the 78.6% Fib level ($0.00012) has been a key short-term support. The next immediate support was April’s low, which stopped the intense August sell-off.

These two support levels could help stop FLOKI from extra bleeding, especially if Bitcoin [BTC] reverses its recent losses after the U.S elections.

If the broader market experiences a downturn following the elections and FLOKI doesn’t manage to maintain its current support levels, then the low from August and approximately $0.00069 might become significant points of focus in the future.

In simpler terms, the low RSI value indicated that bears were still dominating the FLOKI market, while the slow On-Balance Volume suggested a weak recent demand for FLOKI, indicating few strong buyers.

Metrics signal steady accumulation

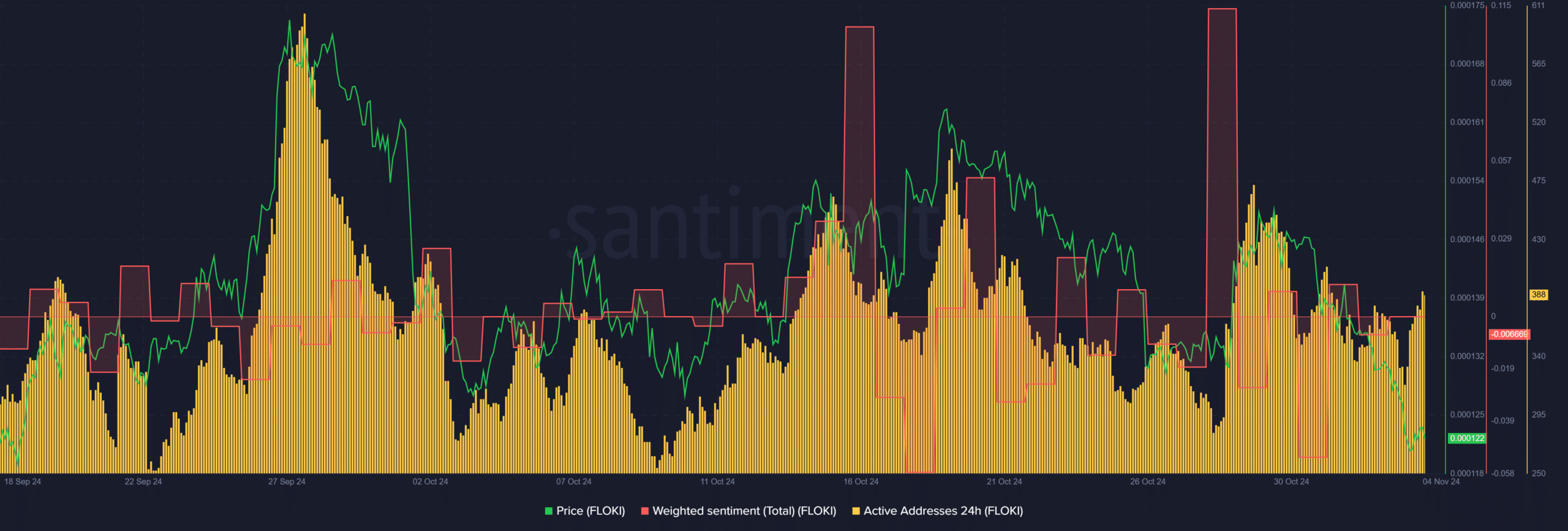

Based on on-chain data, there appears to be a consistent buildup, indicating a possible recovery might be imminent. Currently, the overall market feeling is balanced, implying FLOKI’s prices could either decrease or increase at this point in time.

Despite a recent drop due to pre-election jitters, the surge in daily active addresses indicates growing market interest. This increase might signal an impending rise surpassing the support levels indicated on the price graphs, potentially marking a reversal trend.

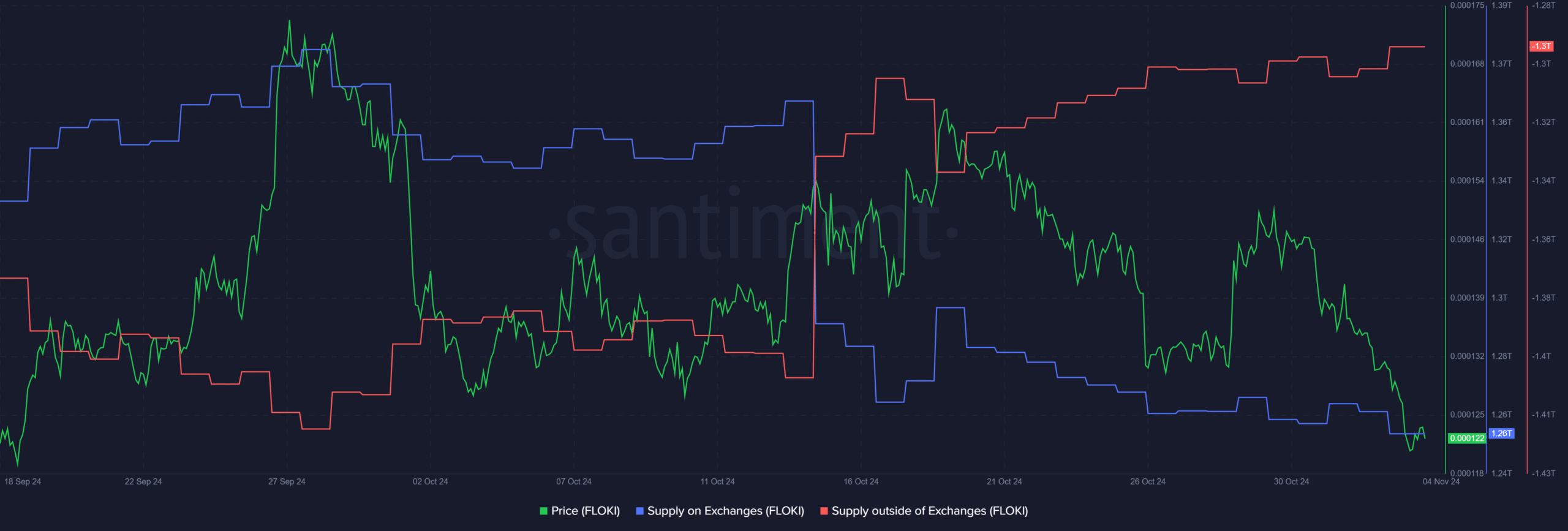

From my perspective as an analyst, the positive projection I hold is reinforced by the consistent and escalating buildup of FLOKI tokens off exchanges, a trend that has been evident since mid-October, as indicated by the gradual increase in supply outside of trading platforms.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

It seems that the significant factor was the decreased selling pressure from exchanges, even with the 20% drop in value. Since late September, the supply of the cryptocurrency on exchanges has been dwindling, suggesting fewer units of FLOKI were up for sale on centralized platforms.

Due to a decrease in excess supply, there may be room for FLOKI to bounce back. Yet, the outcome of the U.S election will significantly impact near-term market mood and investor response towards FLOKI.

Read More

- OM PREDICTION. OM cryptocurrency

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Solo Leveling Season 3: What You NEED to Know!

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Beyond Paradise Season 3 Release Date Revealed – Fans Can’t Wait!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

2024-11-04 16:07