-

An analyst has predicted that FLOKI could gain up to 180%.

Rising Open Interest signaled growing investor confidence, but fluctuating active addresses raised concerns about sustained momentum.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I have seen my fair share of bullish predictions and bearish realities. However, when it comes to FLOKI, I find myself intrigued by the technical outlook put forth by Javon Marks.

Over the last seven days, there’s been a consistent rise in the value of FLOKI, a well-liked meme token within the realm of digital currencies.

Over the past day, FLOKI‘s price has increased by 2.6%. At the moment, its trading value stands at approximately $0.0001372.

Lately, we’ve observed an increase which aligns with a larger upward movement in the token’s price. Earlier this week, it reached a peak of approximately $0.0001431.

The persistent strong growth of FLOKI is catching the eye of many analysts within the cryptocurrency world, leading to discussions about the token’s possible future increases in value.

Technical outlook suggests a 180% rally

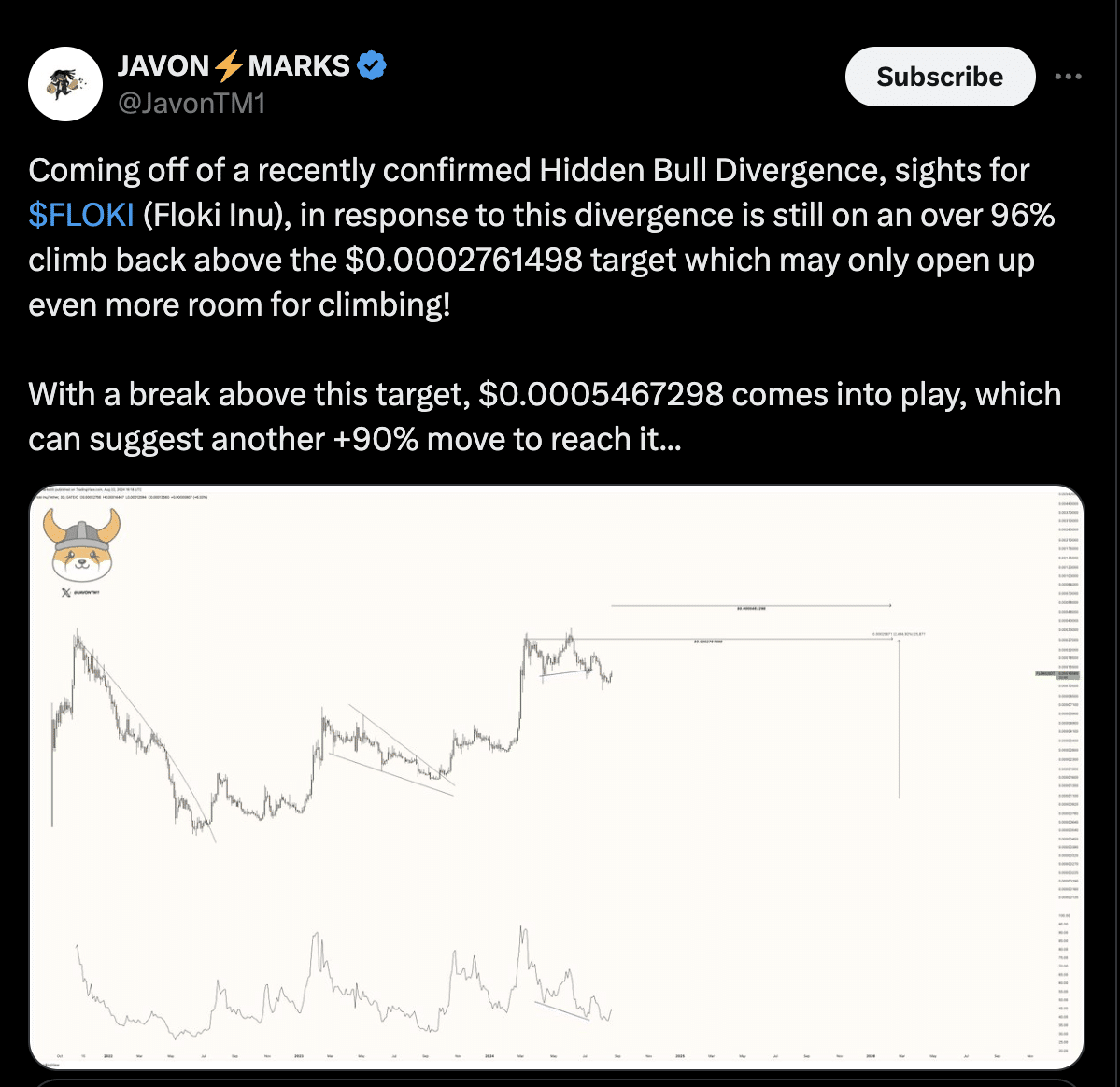

Crypto expert Javon Marks has expressed his views on the potential price fluctuations of FLOKI, predicting possible large-scale shifts over the coming days, as shared on platform X (previously known as Twitter).

Marks pointed out that FLOKI is coming off a recently confirmed Hidden Bull Divergence, a technical pattern often seen as a precursor to bullish price action.

Based on Mark’s analysis, there is a strong possibility that FLOKI could experience a significant increase, aiming for approximately $0.0002761498. This potential rise would signify an increase of more than 96% compared to its current value.

Mark also proposed that if the price surpasses this level, it might pave the way for further growth, potentially taking us to a value of $0.0005467298, which represents a potential rise of about 90%.

Fundamental analysis on FLOKI

Although FLOKI‘s technical forecast seems optimistic, examining its underlying qualities will help decide if this asset is indeed ready for a substantial price surge as suggested.

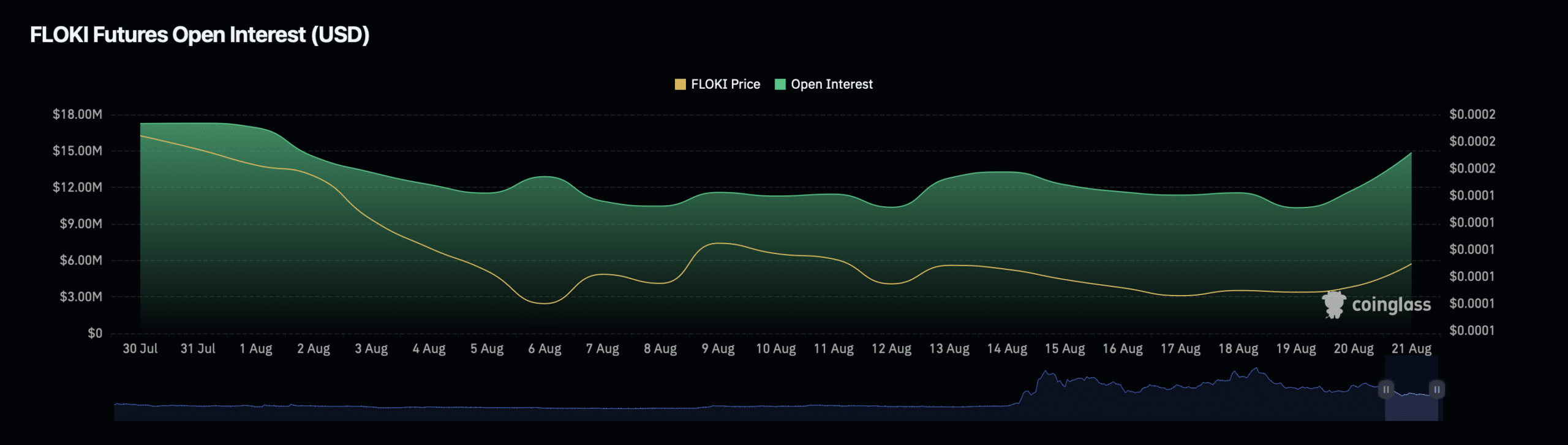

An illustration of this concept is the Open Interest of FLOKI, which represents the overall sum of active derivative agreements associated with the specific asset.

According to data from Coinglass, the Open Interest for FLOKI has risen by about 12.34% within the last 24 hours, currently standing at an evaluation of approximately $15.76 million as we speak.

During the specified period, an increase in Open Interest occurred simultaneously with a substantial 60% boost in the asset’s Open Interest volume. At the time of writing, this surge has resulted in an impressive $109.44 million valuation.

As an analyst, observing the market dynamics, I noticed a significant surge in Open Interest and trading volumes associated with FLOKI. This growth indicates a heightened level of investor engagement and involvement in the FLOKI market.

When the Open Interest increases together with the price, it usually signals that fresh funds are entering the market, potentially causing prices to rise even more.

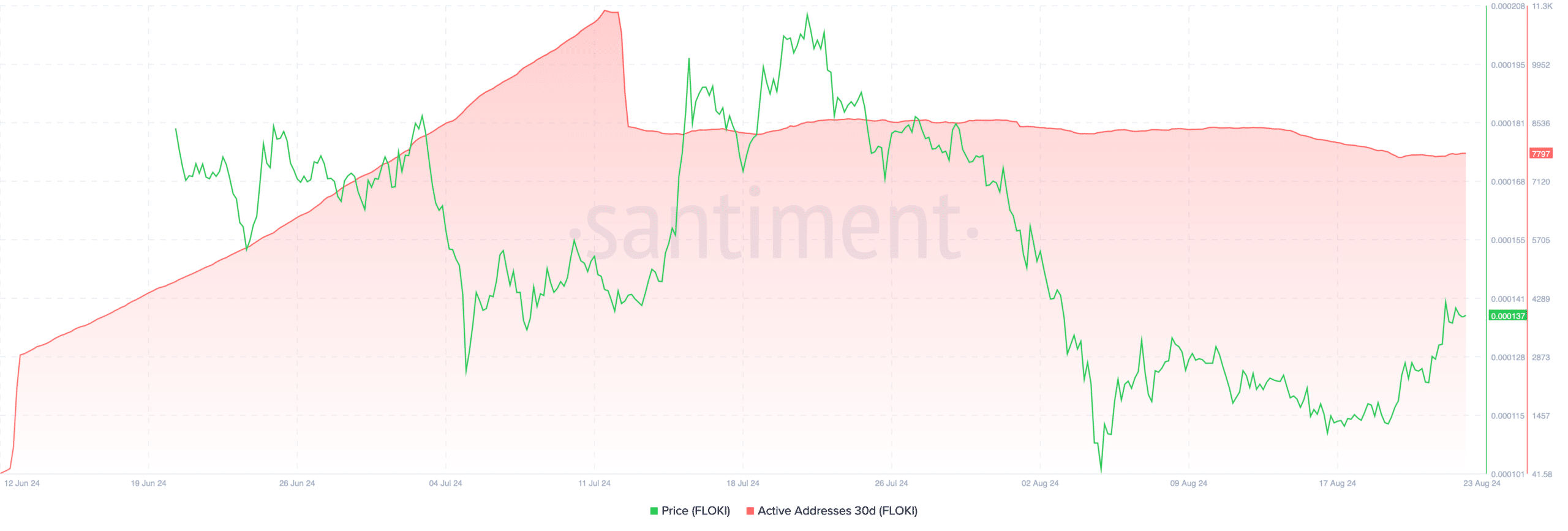

Another important metric to consider is the number of active addresses, which provides insight into the level of user engagement with the asset.

Based on information from Santiment, it’s been observed that the number of FLOKI‘s active wallets has seen some ups and downs, notably after peaking at more than 11,200 on July 12th.

Since then, the number of active addresses has settled just below 8k.

The consistent pattern of activity in FLOKI‘s active addresses implies that people are still quite interested in it, but the level of user engagement hasn’t reached its former high point just yet.

The fluctuation in active addresses could have implications for FLOKI’s price.

An consistently high or growing count of active wallets often reflects robust user interaction and interest, a factor that may contribute to maintaining price stability or fostering growth.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

Instead, if we see a decrease or leveling off in active addresses, it could indicate a decreasing enthusiasm, which may lead to a drop in price due to reduced demand.

For FLOKI, maintaining or increasing the number of active addresses will be crucial for sustaining its current price levels and achieving the bullish targets suggested by analysts like Javon Marks.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-08-23 19:36