-

FLOKI has a strong bullish market structure.

The recent surge underlined bullish intent and demand backed the meme token’s bullish expectations.

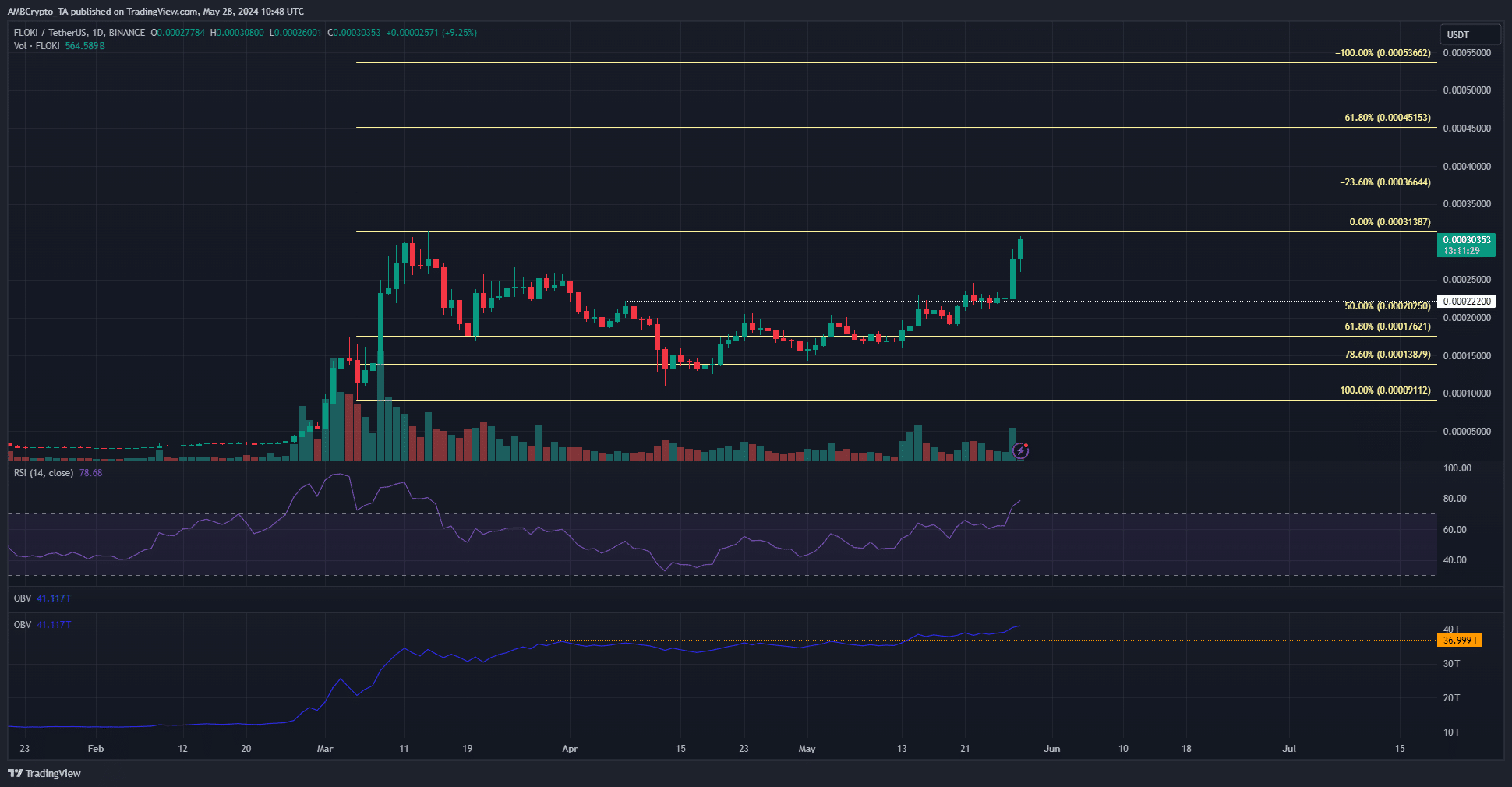

As a researcher with experience in analyzing cryptocurrency markets, I find FLOKI‘s current market structure to be strongly bullish. The recent surge in price has been underpinned by solid demand and a clear intent to buy, as evidenced by the flipped resistance levels on the daily chart.

As a crypto investor, I’ve noticed an impressive surge in the price of Floki Inu [FLOKI]. Since Monday, the 27th of May, it has experienced a significant uptrend, registering a 35% gain. The token is now only 3% away from hitting resistance levels that previously halted its progress back in March’s first half.

Based on the technical analysis of the daily chart and the positive price movements, the forecast for FLOKI‘s price showed a significantly bullish trend, indicating a potential increase of approximately 50%. The optimistic outlook was further reinforced by reports that large investors, or “whales,” were purchasing substantial amounts of FLOKI.

The bullish structure break saw FLOKI prices skyrocket

The white line marking $0.000222 was among the noteworthy lower highs that the memecoin reached during its pullback starting mid-March. Likewise, the 50% retracement point at $0.000202 functioned as a short-term resistance level.

Over the last ten-day period, I’ve observed a reversal where the previously supporting levels have now transformed into resistances. Simultaneously, the On Balance Volume (OBV) index surpassed a local resistance level, highlighted in orange on the chart, which underscores the presence of substantial buying pressure.

On the daily chart, the Relative Strength Index (RSI) stood at 78, placing it within the overbought territory. This indicator doesn’t necessarily indicate an imminent correction but rather highlights the robustness of the bulls during their recent advance. Anticipate further growth in the ensuing days.

Dipping down to the range between $0.000275 and $0.000284 presents a potential buying opportunity. Following this purchase, investors may look to set their profit goals at the 61.8% and 100% extensions of the Fibonacci sequence, which lie at $0.00045 and $0.00053, respectively.

The bullish sentiment was present in both spot and futures markets

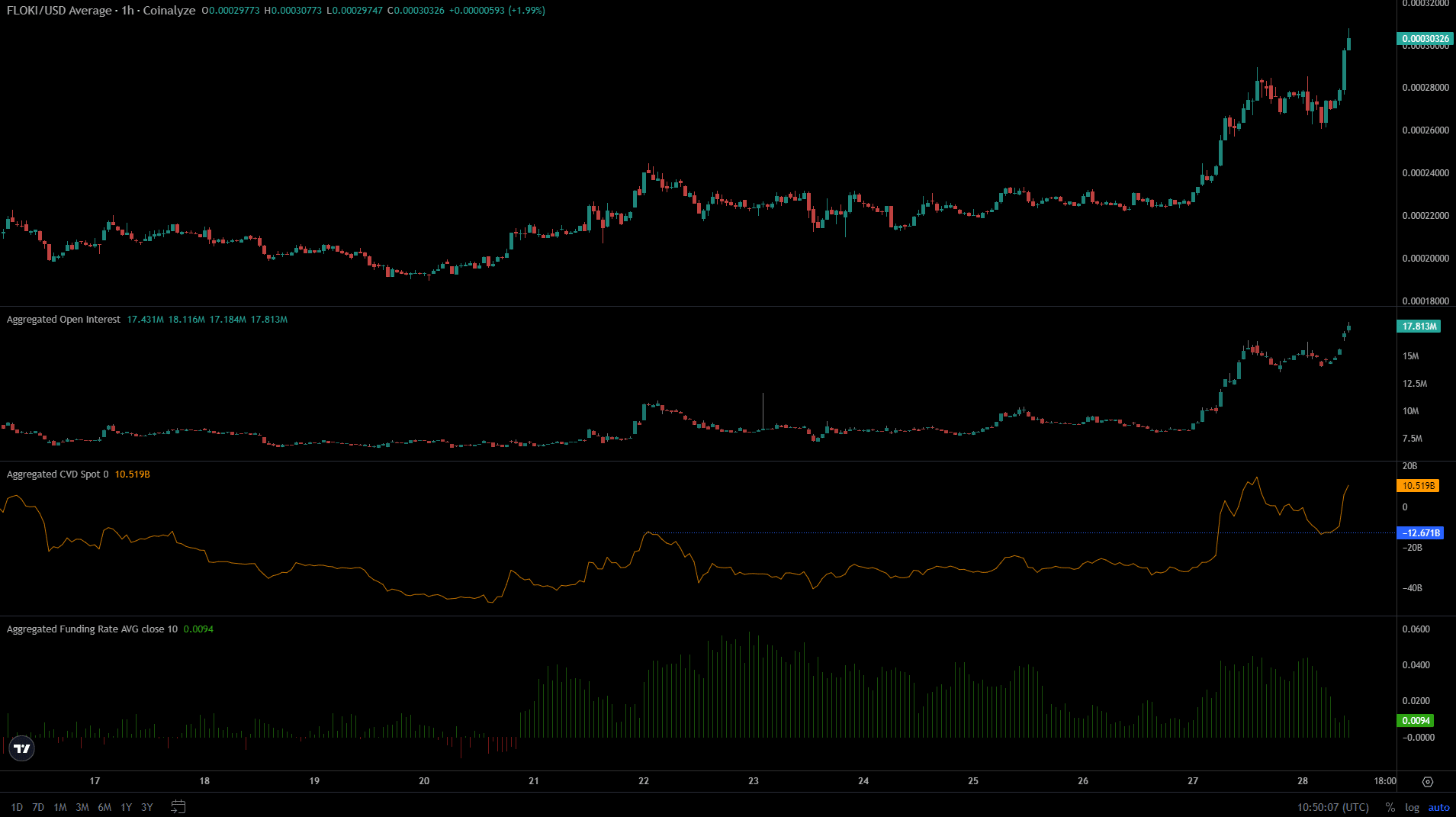

In a similar vein to the Old Big Vehicle (OBV), the Cardiovascular Disease (CVD) index regained a previous resistance level as a new support floor. As a result, the CVD index has experienced a notable uptick within the past 24 hours, indicating a substantial increase in demand from market participants.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

The Open Interest also saw a frenzied uptrend in the past two days alongside the price.

As a crypto investor observing the market, I’ve noticed that the funding rate has remained positive but has begun to dip in the past few hours. This could potentially indicate that certain futures traders hold the belief that the market has reached an extended state and have chosen to exit their long positions.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-05-28 21:11