- Floki has surged with 4.66% after weeks of decline.

- Key on chain data and technical indicators showed a possible reversal of the current bearish trend.

As a seasoned crypto investor, I’ve seen my fair share of market volatility and trends in the cryptocurrency space. The recent surge of Floki Inu [FLOKI], with a gain of 4.66% in just 24 hours after weeks of decline, is an interesting development that has caught my attention.

Floki Inu (FLOKI), the widely-used meme cryptocurrency, experienced a noteworthy growth of 4.66% over the past day. This uptick comes after several weeks of downward trends. As reported by CoinMarketCap, FLOKI’s market capitalization expanded by approximately 4.57%, reaching a value of $1.69 billion.

Over the past week, there’s been a decrease of 25.92%, representing a 25.92% drop. Additionally, the trading volume has dwindled by 10.03%, bringing the total down to $288.44M.

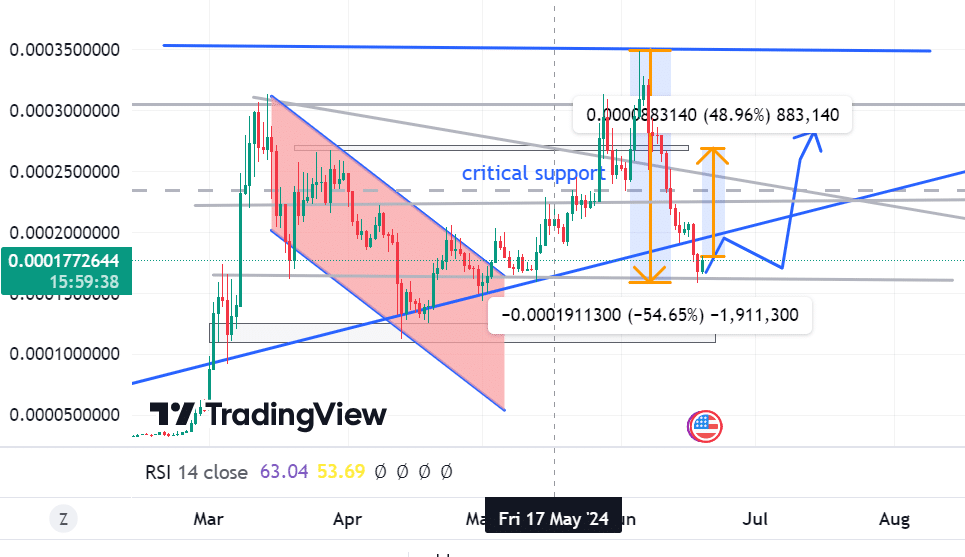

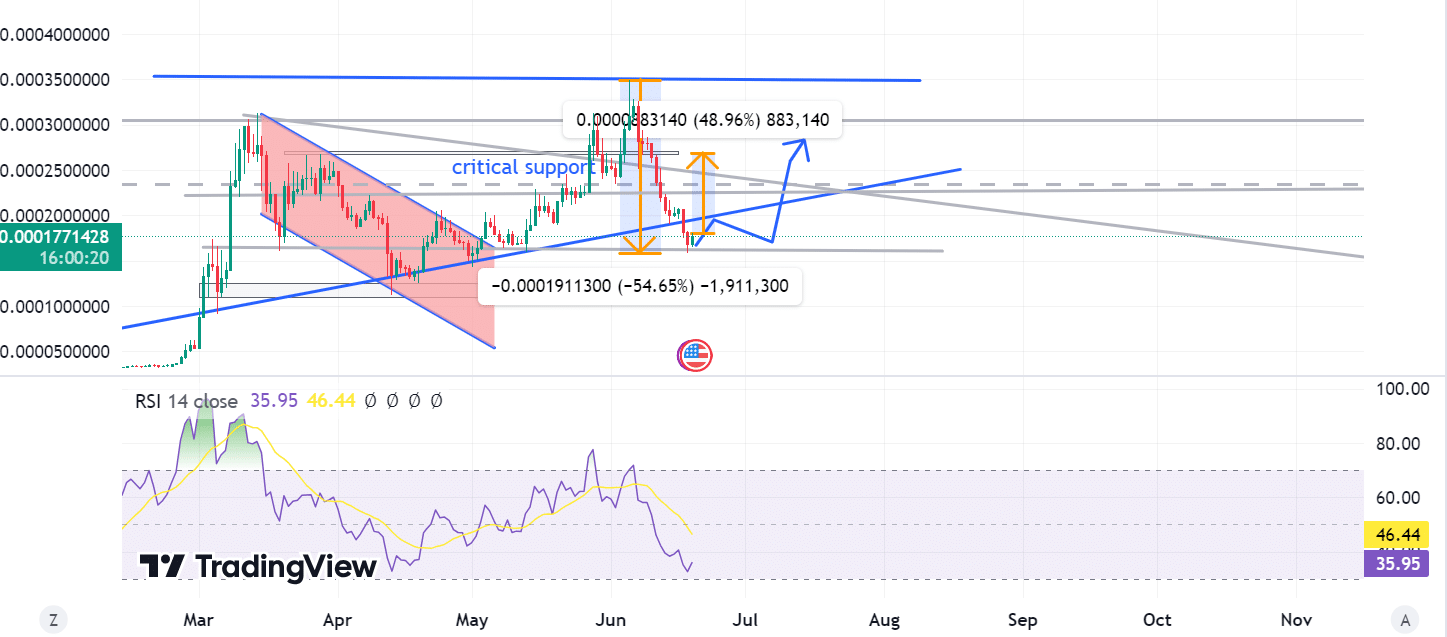

Based on AMBcrypto’s assessment, FLOKI may experience a significant price increase following its touch of the ascending trendline’s bottom.

The price has dropped by approximately 54% to reach $0.000160. It appears that an uptrend is the most probable scenario, with potential new support levels at $0.000221 and $0.000231. The crucial support zone lies around $0.00234.

If the ongoing price rebound for FLOKI is sustained, it may hit its prior resistance at approximately $0.000268 – marking a significant gain of around 48.9%. In a more optimistic outlook, FLOKI could experience a substantial rise to reach its previous peak of $0.000348.

As an analyst, I’ve observed that the Relative Strength Index (RSI) has been indicative of a weakening bearish trend. Specifically, the RSI value climbed from 33 to 36 over a 24-hour period. This increase suggests that the selling pressure may be starting to ease. Moreover, the RSI’s ascent toward an RSI moving average (MA) of 46 hints at the possibility of a price reversal around current market conditions.

Thus, the continued rise of RSI towards RSI-based MA could strengthen the momentum for reversal.

As a researcher, I would interpret an RSI (Relative Strength Index) of 36 as approaching oversold conditions. This signifies a potential buying opportunity, subsequently leading to heightened network activity.

What does market sentiment indicate?

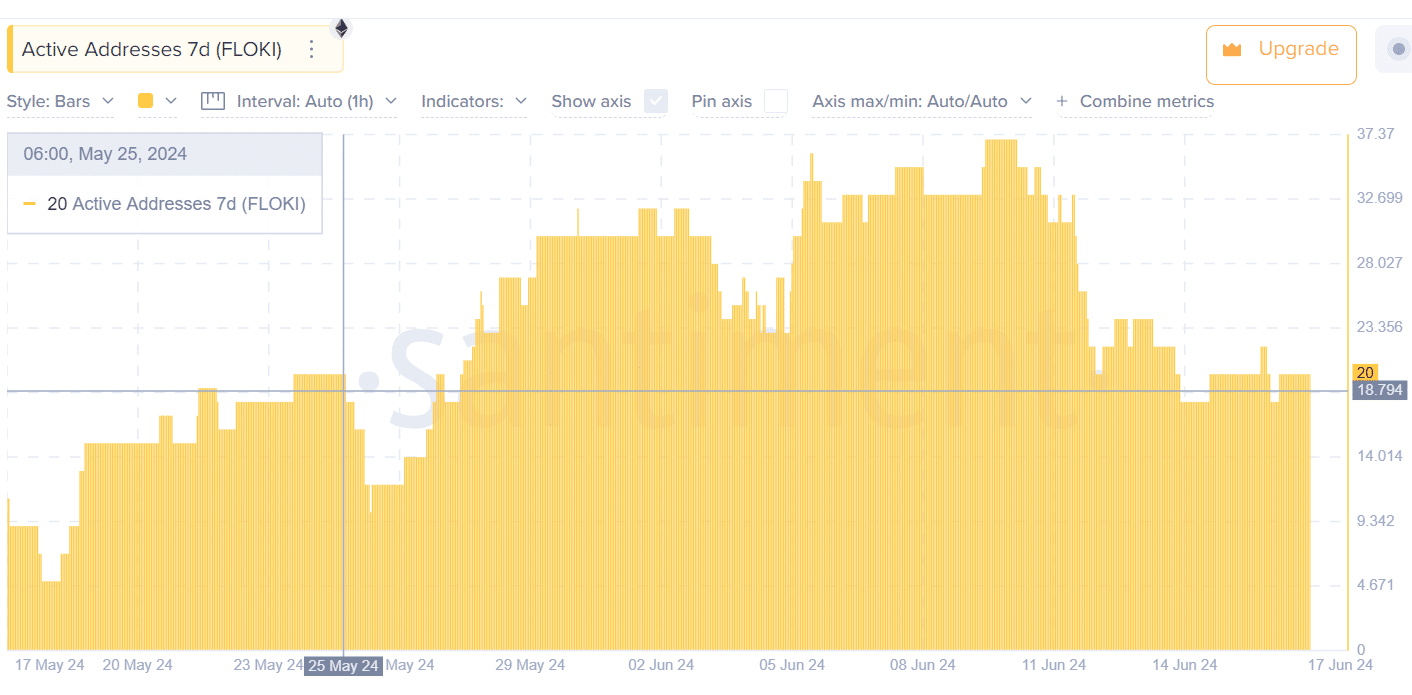

Based on Santiment’s data, there has been a significant increase in the number of active FLOKI addresses over the past week. Specifically, this figure has grown from approximately 4.9 million to around 19.9 million, representing a substantial 300% rise.

As an analyst, I’d interpret an uptick in network activity and adoption as a favorable development. This surge suggests heightened engagement and broader acceptance of the underlying technology or asset. Consequently, increased usage could potentially lead to price growth.

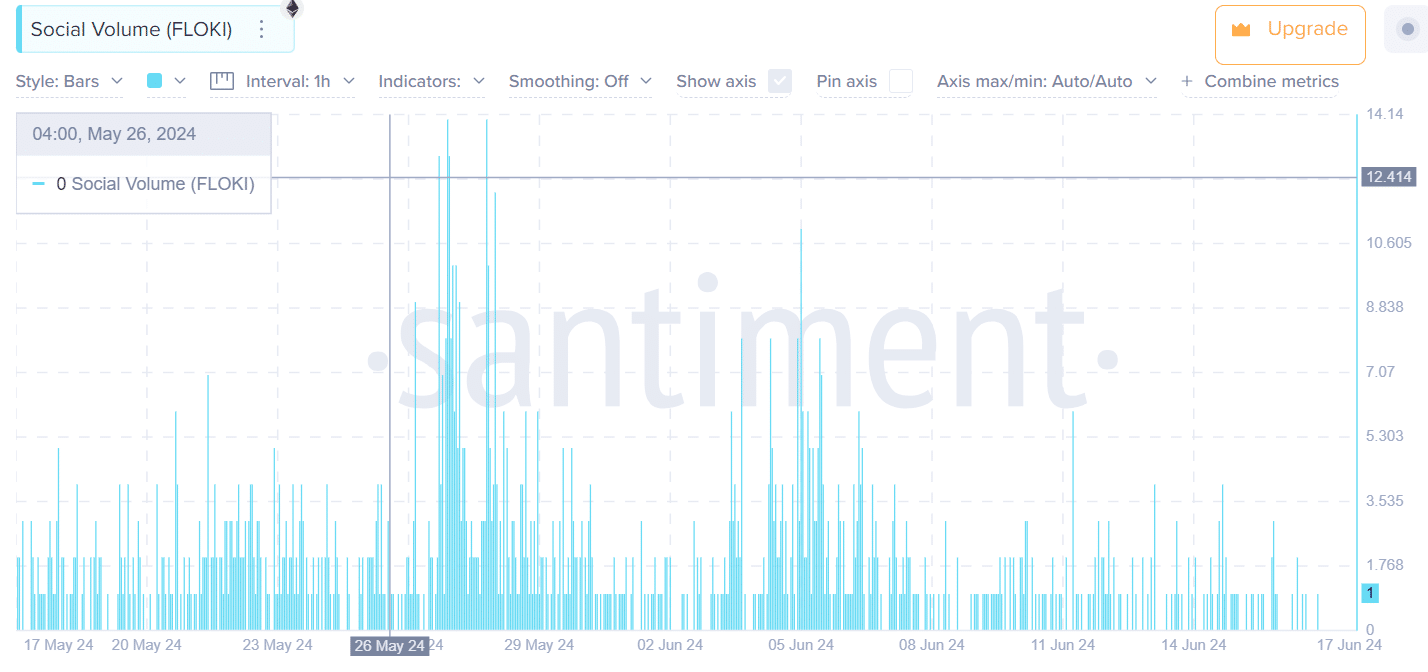

Similarly, Santiment indicates a significant drop in social activity for FLOKI over the past week. The social media buzz went from 14,017 to just 945 interactions.

It’s beneficial when the general public exhibits less interest in cryptocurrencies because it goes against market sentiment. Lower public engagement indicates market stability. Furthermore, the crypto market currently shows decreased negativity, which is essential for a shift in patterns.

Can Floki Inu’s surge maintain?

Based on several important indicators, Floki appears poised to shift trends, set a fresh support benchmark, and make an attempt to surpass existing resistance thresholds.

Over the past week, Floki has seen a significant decrease of more than 50%, with each day’s candlestick showing a gain in writing time.

As a crypto investor, I’ve noticed some positive signs based on technical indicators and data, which suggest a potential upswing in the market. However, if the price fails to hold above $0.00159 during the daily candlestick close, then the bearish trend is likely to continue. Conversely, if the daily candlestick manages to close above $0.000180, we can expect a bullish trend to take shape.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-06-19 20:07