- FLOKI remained in a month-long ascending channel on the daily time frame, which could limit its ability to break higher.

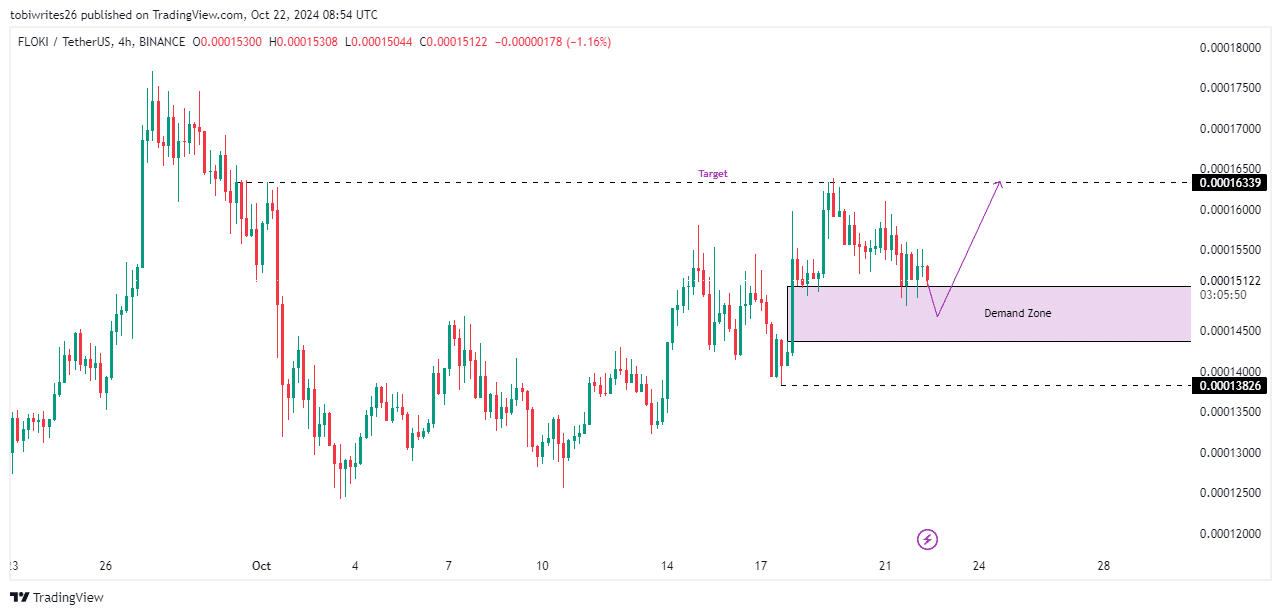

- A key factor to watch is the memecoin’s reaction to the 4-hour demand zone.

As a seasoned crypto investor who has navigated through numerous market cycles and witnessed countless altcoin fluctuations, I find myself cautiously observing FLOKI’s current trajectory. The coin’s recent performance reflects a familiar dance with resistance levels, which has resulted in a slight dip over the past week.

As a researcher, I’ve observed that my ongoing study on FLOKI’s market trends has revealed a challenging encounter with a significant resistance level, leading to a 3.53% decline over the past day. Furthermore, the weekly trend indicates a minimal decrease of 0.08%.

Although its monthly performance has taken a hit, it still clung to a 14.59% gain.

Could a change in the current pessimistic perspective flip things around for FLOKI’s success story? Let’s see what AMBCrypto predicts about its future steps.

No clear signal for a rally just yet

Despite finding itself within a significant demand area, FLOKI’s reaction has been relatively slow, failing to deliver the robust recovery that is typically observed when assets hit such zones.

Because of the lackluster response, FLOKI could potentially keep falling further, reaching as low as the middle portion of its demand range, which is approximately 0.00014377 to 0.00015055.

If this area maintains its position, FLOKI might attempt to rebound and ascend again towards the resistance at 0.00016339 – the price point that initiated its recent steep decline.

If there’s sufficient demand, FLOKI might push past its current resistance level, challenging the limitations set by the upward trendline.

If the support zone doesn’t hold up, FLOKI might drop even lower, potentially reaching 0.00013826. Dropping beneath this point could signal that it will continue to trade along its upward trend established over the past month.

Traders eyeing a lower FLOKI

Current market behavior indicates that investors might be preparing for a possible decrease in FLOKI’s value, which could lead it to settle within the middle section of its current demand area.

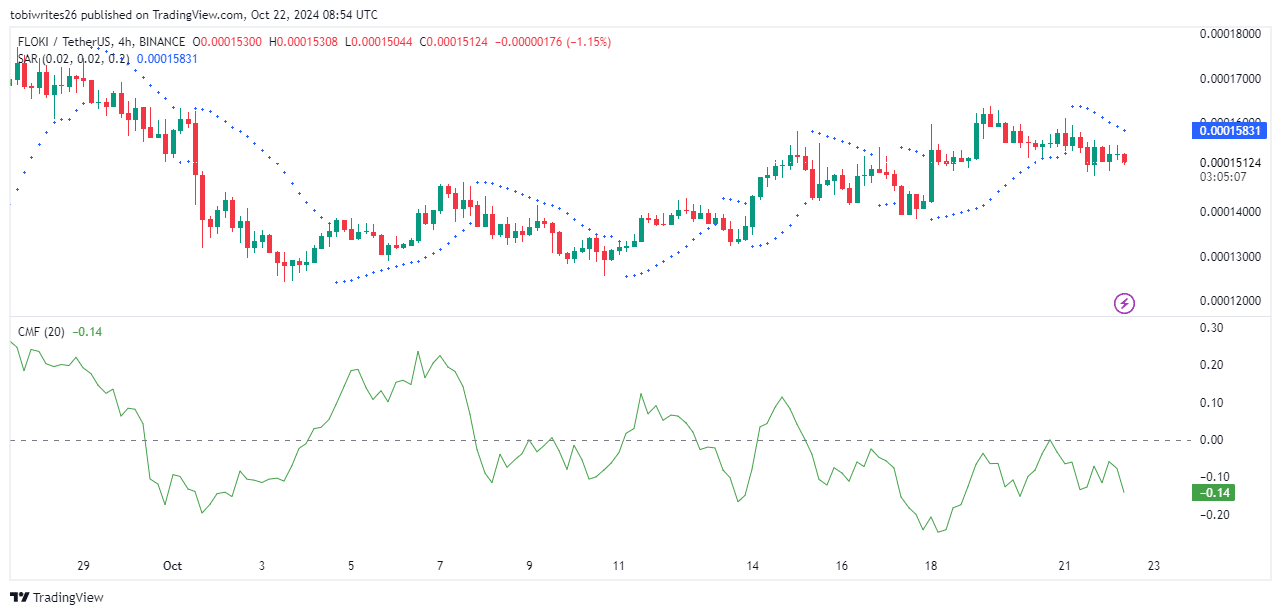

As a researcher, I’m examining the market trends of FLOKI using the Parabolic SAR (Stop and Reverse) method. This technique employs dots to trace price movement. At present, these dots are appearing above FLOKI’s price, suggesting a potential bearish trend.

Furthermore, the Chaikin Money Flow has consistently dropped, indicating a substantial exit of funds from the asset. This trend may imply that FLOKI’s value could decrease even more as selling pressure intensifies.

Traders align for a drop

Data from Coinglass further supported this bearish sentiment, showing that FLOKI is likely to fall from its current price.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

The level of Open Interest (OI) has dropped significantly by 7.57%, currently standing at approximately $19.83 million. This suggests that an increased number of short positions are being established, as traders anticipate a decrease in prices.

Should this pattern persist, there’s a likelihood that FLOKI could face more drops before possibly witnessing an upturn.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

2024-10-23 03:35