-

The bullish market structure and buying pressure could see FLOKI extend its rally

Liquidation data showed that a price dip was likely

As a seasoned analyst with years of market analysis under my belt, I see a promising rally for Floki Inu (FLOKI) on the horizon. The bullish momentum and buying pressure are undeniable, with FLOKI outperforming Bitcoin [BTC] by a significant margin since the August 5 dip. This could potentially propel FLOKI back to its pre-July price levels.

The bounce back for Floki Inu (FLOKI) has been quite robust since August 5th. Currently, FLOKI is up nearly 52%, while Bitcoin [BTC] has only seen a rise of 31%. Furthermore, the daily chart of FLOKI shows a bullish market pattern.

As a seasoned crypto investor with years of experience under my belt, I believe that this recent development could potentially pave the way for the memecoin to regain its previous levels prior to the steep price drops in late July. Based on my observations and analysis, it seems likely that we might witness a 20% surge in the coin’s value. This is an exciting opportunity for those who have been holding onto their memecoins during these challenging times, as they may finally see some positive returns. However, as always, I advise caution and careful consideration when making investment decisions.

Daily close encourages another move higher

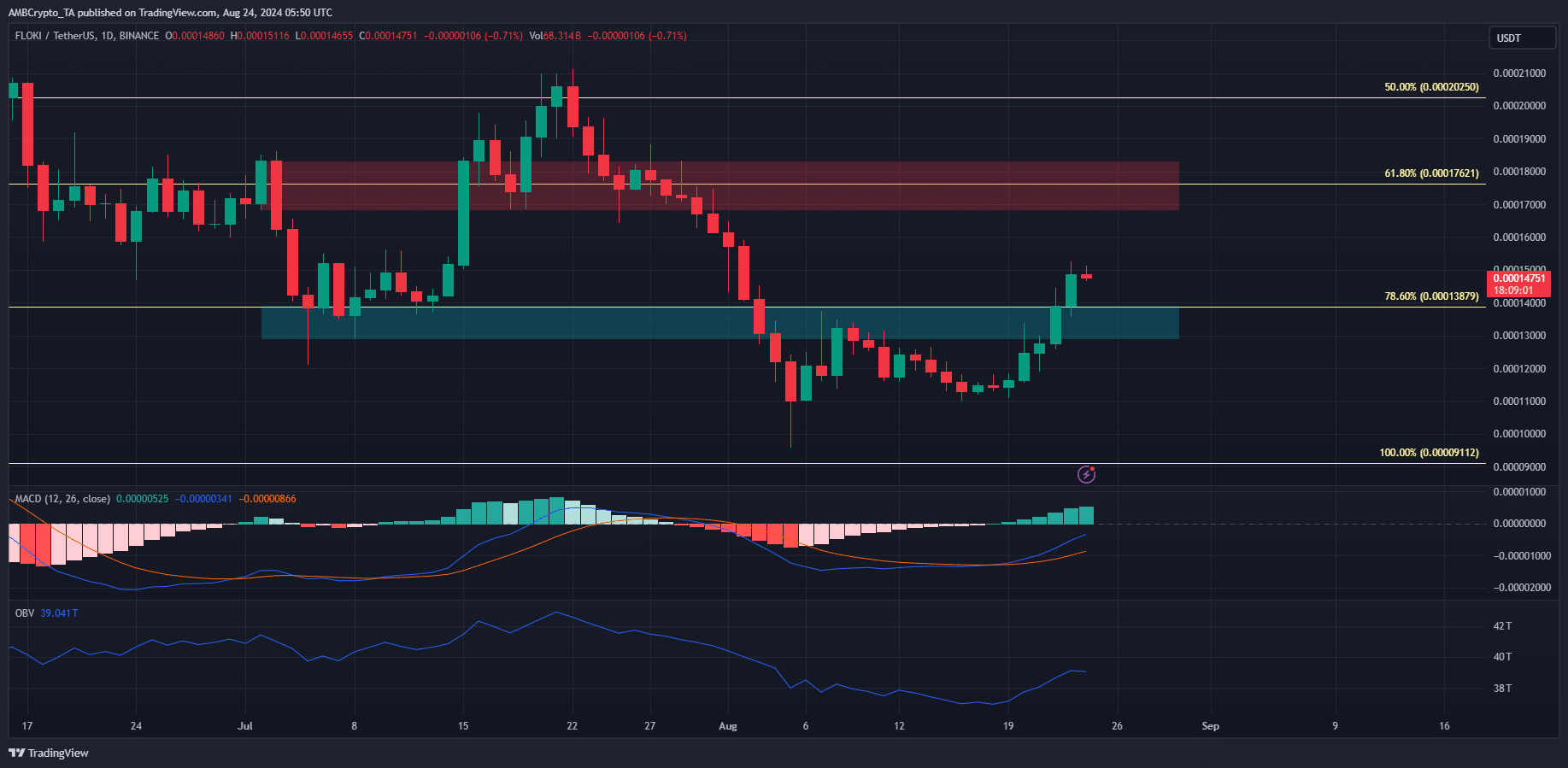

On the one-day graph, the price trend has turned optimistic following its surge beyond $0.00014. A return to $0.000138 could offer a chance to buy, with potential gains aiming at $0.000176, a notable resistance level ahead.

Despite the MACD being below zero, it recently underwent a bullish cross-over, suggesting that the declining trend might be weakening. Meanwhile, the On Balance Volume (OBV) has ascended over the past week, yet it remains far from the peak levels reached in late July.

It’s important to highlight that FLOKI seemed to reverse its downward trend in the daily chart, yet it eventually dropped. A notable instance of this happened on July 21st, as a local resistance area was overcome, but the buyers failed to maintain control over it.

FLOKI liquidity levels show strong bullish bias

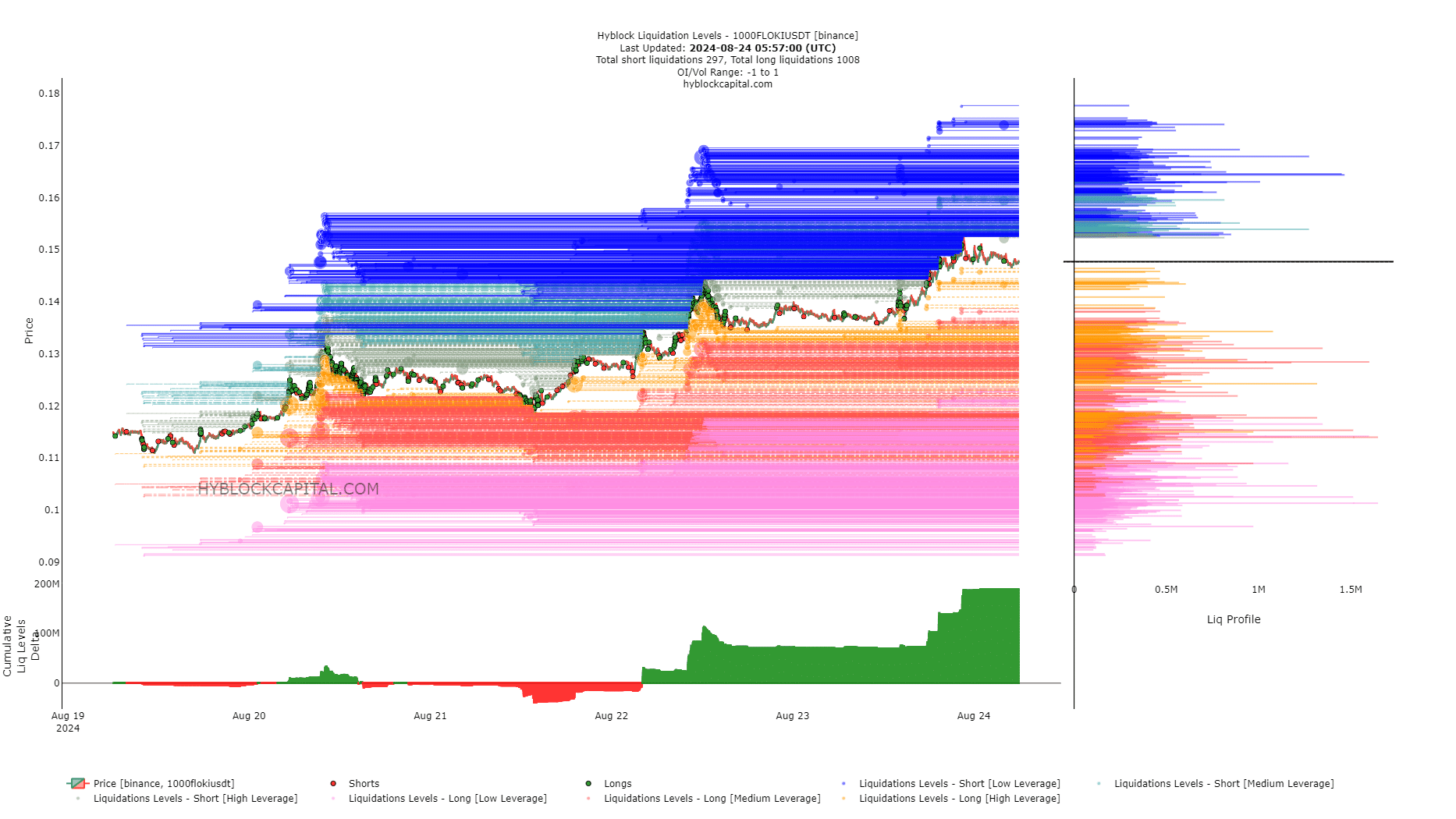

As a crypto investor, I’ve noticed that the total liquidation levels gap between long and short positions has significantly increased recently, suggesting a substantial disparity. This bullish trend might lead to a compression of long positions, but it’s important to remember that this is not a guaranteed outcome by any means.

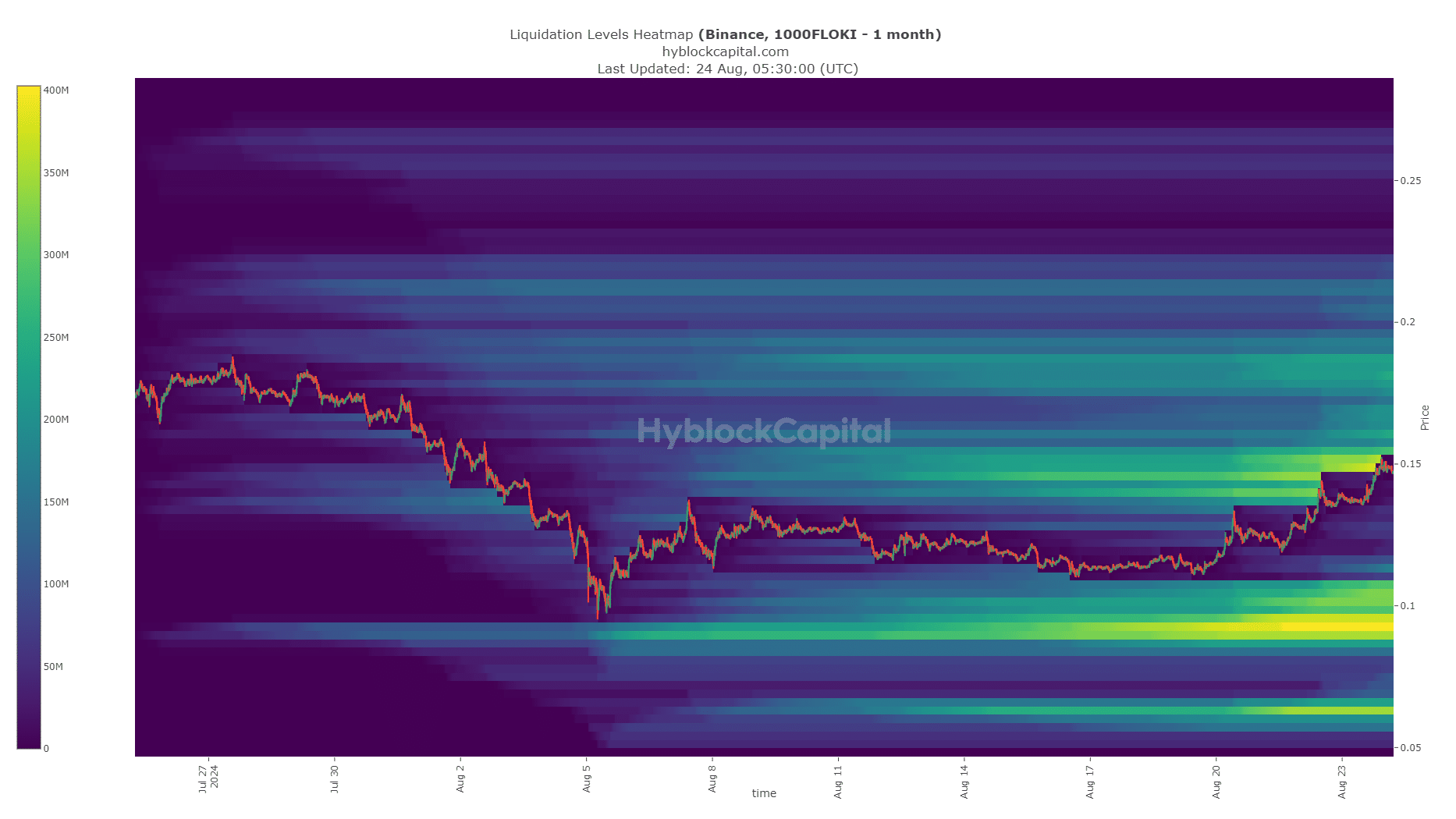

The liquidation heatmap provides additional support for pessimistic outlooks. Over the past 24 hours, a significant liquidity group at $0.00015 appears to have been depleted, serving as a crucial point to the north.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

As a crypto investor, I’ve noticed the market becoming more liquid at these higher levels, but I can’t help but feel a bit cautious about a potential short-term bearish reversal. If we see a continued decline below $0.000128, it might suggest that our next stop could be $0.0001.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-08-24 17:11