- Floki’s bullish symmetrical triangle pattern and rising trading volume signal potential for a strong breakout.

- Positive technical indicators and increasing open interest reflect growing confidence in a major rally.

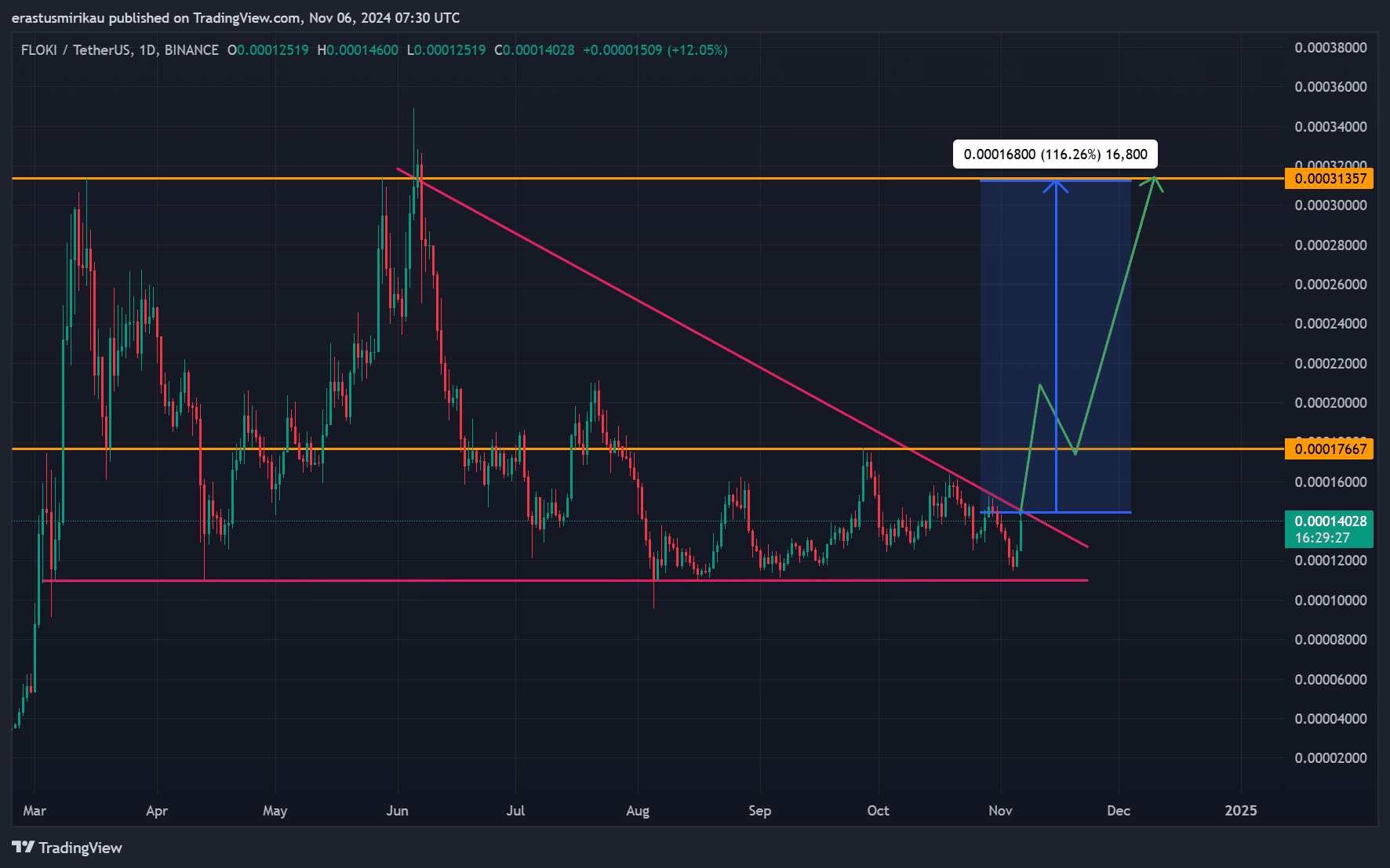

As a seasoned analyst with years of experience navigating the cryptocurrency markets, I’ve seen my fair share of bullish and bearish trends. However, Floki’s [FLOKI] current technical setup is undeniably intriguing. The symmetrical triangle pattern and rising trading volume suggest that we might be on the brink of a major breakout.

Following several months of stagnation, the digital token Floki seems ready for a significant leap, sparking considerable attention from investors. Currently valued at $0.0001404, it has experienced an increase of 15.77% as of now. Notably, Floki has witnessed a dramatic spike in trading activity and market capitalization, with the former rising by 108.53% and the latter increasing by 15.80%.

This increased action indicates a possible change in market direction, potentially leading to a bullish surge. Consequently, investors are keeping a close eye on whether Floki can surpass its current holding pattern, as such a move might open up fresh price horizons.

Analyzing the symmetrical triangle pattern: Key levels to watch

Each day’s graph shows an emerging symmetric triangular pattern, a common technical setup that typically precedes significant price fluctuations. The top line of this triangle is nearing crucial resistance points at approximately $0.00017667 and $0.00031357.

Should Floki surpass the specified levels, there’s a possibility it might initiate a strong upward trend. Analysts predict potential increases ranging from 100% to 150%.

Furthermore, historical symmetrical triangles on Floki’s chart have led to substantial price increases after the resistance was breached. Given this pattern, it could provide an attractive trading opportunity for those seeking a breakout in the current situation.

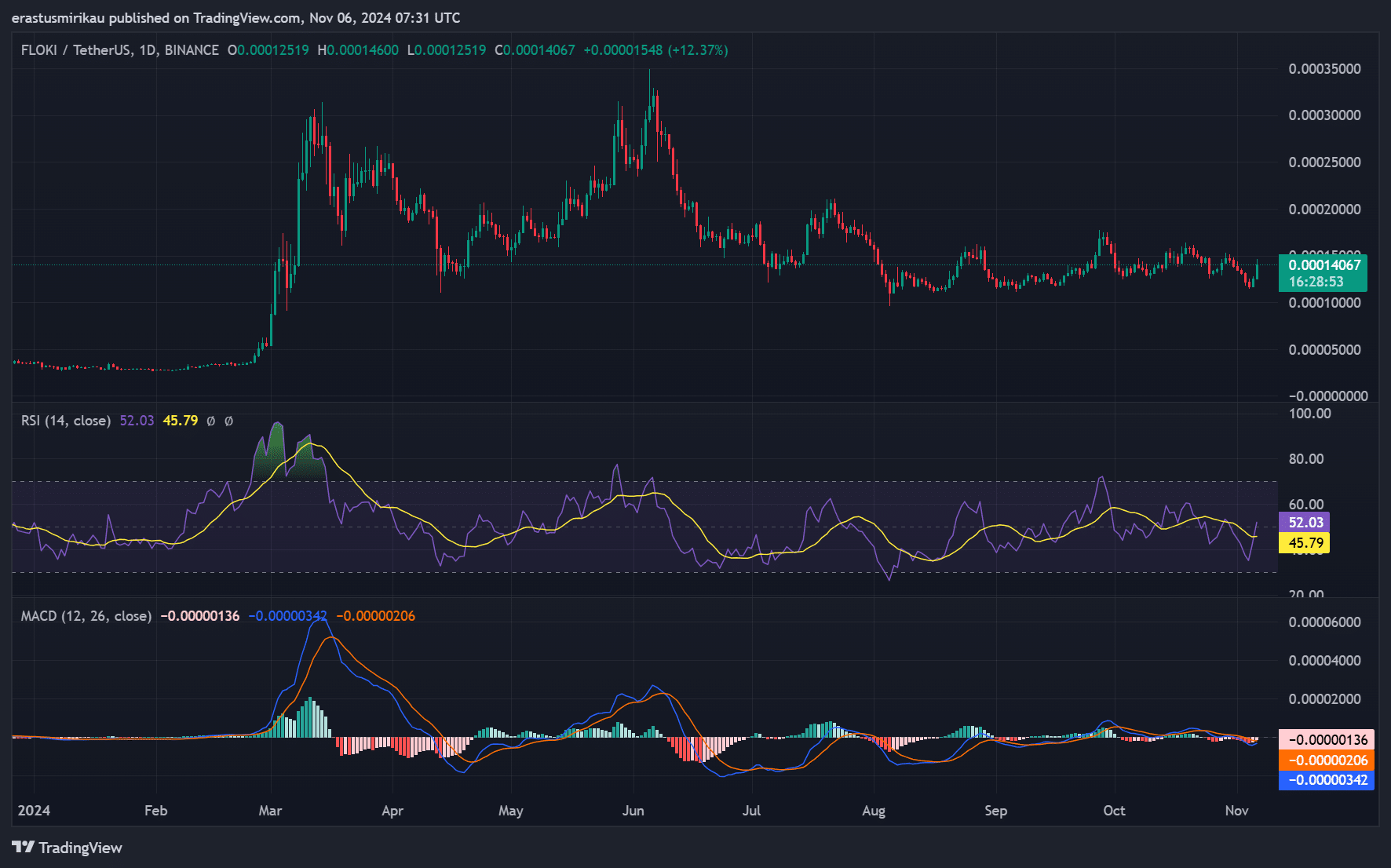

FLOKI MACD and RSI indicators support a bullish outlook

In simpler terms, both the MACD and RSI charts suggest an increase in bullish power. The MACD is starting to show signs of a change, implying that buyers might be taking charge. On the other hand, the RSI currently reads 52.03, indicating strength without venturing too close to the overly bought region.

This arrangement indicates that there’s potential for Floki to advance further before encountering barriers or resistance, as suggested by these indicators.

Thus, these signs hint at Floki preparing for a significant surge, adding credence to the optimistic view derived from the symmetrical triangle formation’s interpretation.

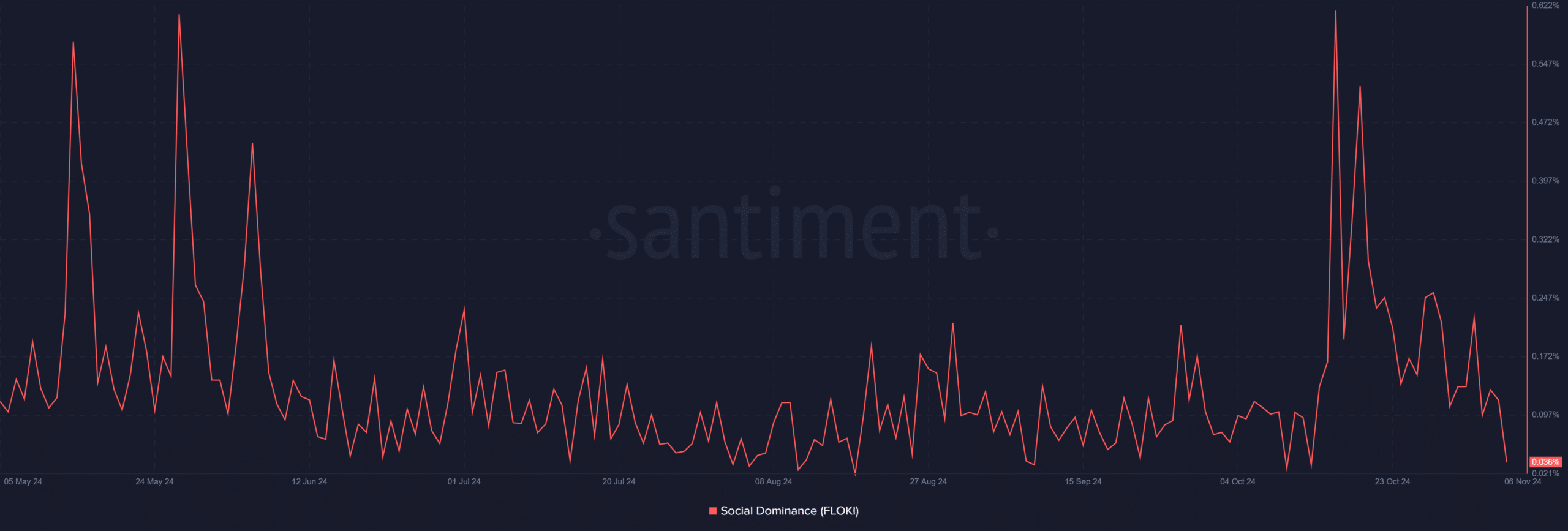

Social dominance is mixed, but could be a hidden catalyst

It’s worth noting that Floki has a relatively low social dominance rate of 0.036%, suggesting there may be less retail excitement driving the market. However, this could equally mean that long-term investors are amassing their holdings independently of social media hype.

If social dominance starts to increase alongside a price surge, it might serve as an extra driving force. This increased visibility could draw in more retail investors, potentially intensifying the upward trend.

Consequently, keeping an eye on this particular indicator is essential in the near future since it frequently indicates changes in retail sentiment.

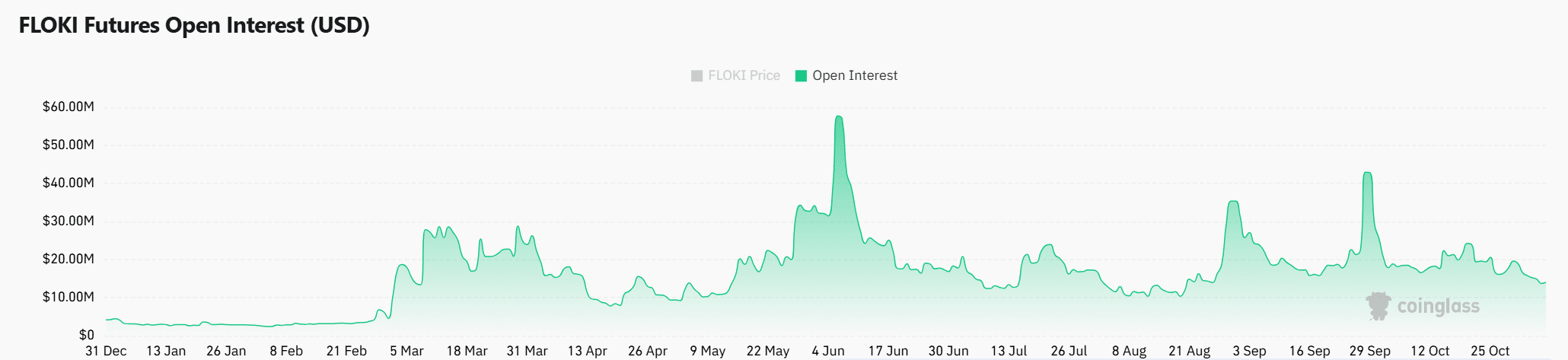

FLOKI open interest surge reflects growing market conviction

The level of open interest has significantly increased by 21.96%, reaching $16.98 million, suggesting a rising confidence among traders. A higher open interest usually points to more robust optimism and anticipation for heightened market turbulence in the future.

Consequently, the increase in open positions implies that traders might be preparing for a possible price surge (bullish breakout), reinforcing the significance of the symmetrical triangle pattern and positive signals from technical indicators.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

In summary, based on its technical setup and market signals, FLOKI appears poised for a possible surge. Notable resistance levels serve as temporary objectives for this anticipated upward movement.

Should it manage to overcome these obstacles, FLOKI might kick off a substantial surge, and the possible price objectives could extend up to 2-3 times its current value, considering the robust history of symmetrical triangles.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-11-07 01:11