- Floki was nearing a breakout, with $0.00028980 as the critical resistance for bullish momentum.

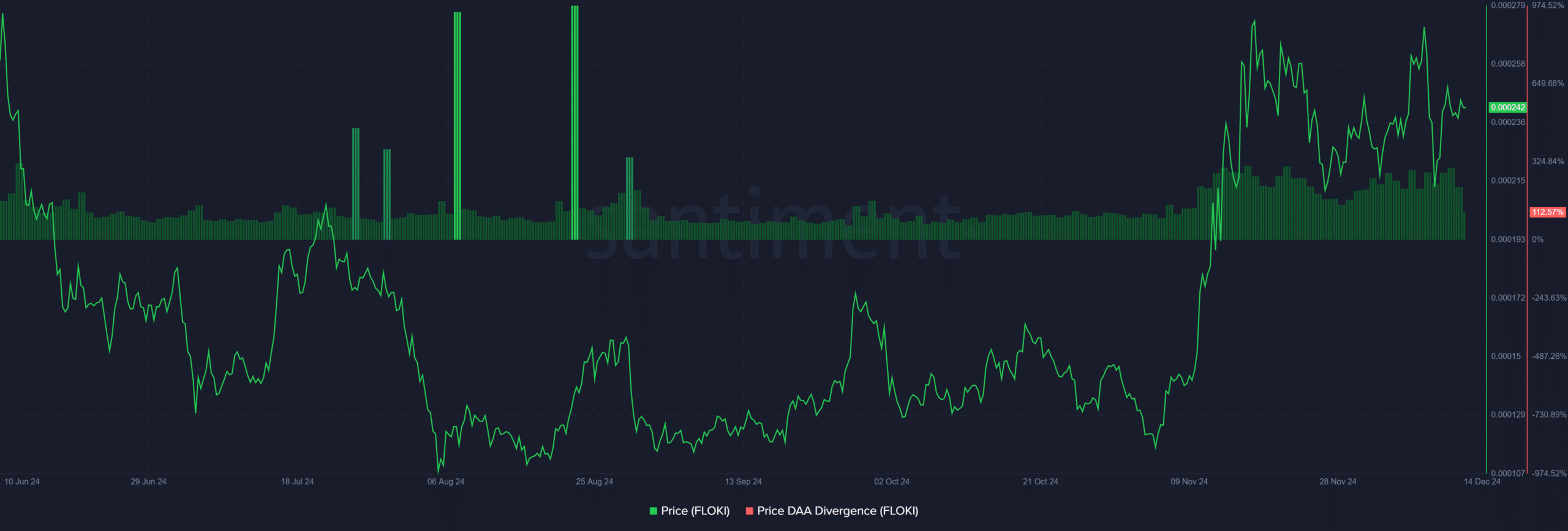

- Market metrics showed optimism, with a 112.57% price-DAA Divergence supporting potential upside.

As a seasoned analyst with years of market experience under my belt, I find myself intrigued by Floki’s [FLOKI] current situation. The token appears to be gearing up for a potential breakout, with $0.00028980 serving as the crucial resistance for bullish momentum.

Floki (FLOKI) is drawing more interest as it approaches potentially breaking free from a prolonged downward trending pattern. Currently, Floki is being traded at $0.0002417, marking a minimal decrease of 0.09% in the last 24 hours.

The cost is strengthening above the crucial support of $0.00021129, and a significant barrier lies at $0.00024862, which aligns with the 0.786 Fibonacci resistance level. In simpler terms, the price is rising above a key support, but a higher resistance level exists at $0.00024862 that corresponds to the 0.786 Fibonacci level.

Should Floki successfully surmount this hurdle, it might provoke a push towards approximately $0.00028980 and potentially continue its advance towards the next projected peak at around $0.00034883. Traders are keenly observing for a clear break to verify a bullish trend’s continuation.

Technical indicators suggest a potential for a rally

As a crypto investor, I’m keeping a close eye on the Fibonacci retracement levels, particularly $0.00024862. Overcoming this barrier could potentially trigger a breakout, pushing Floki towards testing $0.00028980 – a significant resistance point to watch out for. Meanwhile, the Relative Strength Index (RSI) stands at 56.21, hinting that the market is currently in a neutral zone, neither overbought nor oversold.

This implies that if purchasing activity strengthens, there could be potential for further price increases. Furthermore, the period of trading close to the resistance area suggests that traders are preparing for a breakthrough, which adds to the excitement about what might happen next.

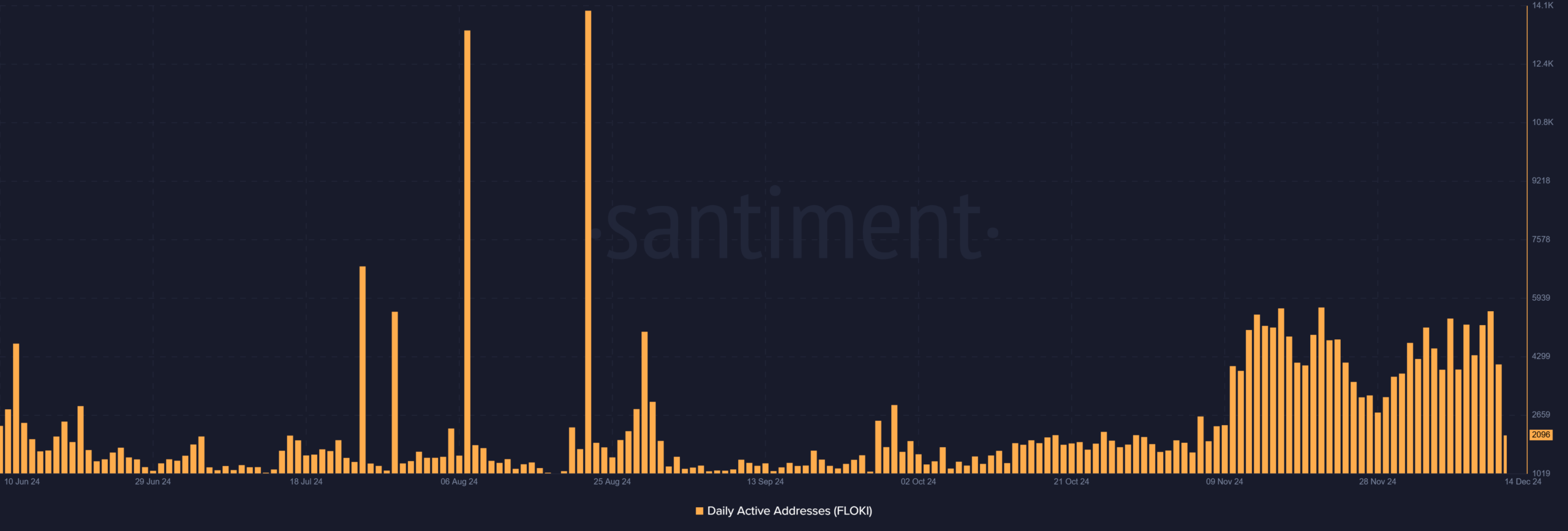

Daily active addresses show a decline

The number of daily active addresses belonging to Floki has noticeably decreased from 4,085 to 2,096, suggesting a drop in short-term network activity. This could be because traders are holding off on making moves until they see a definitive sign of a market breakout.

However, this decrease does not necessarily indicate a lack of interest. Instead, it may suggest caution among market participants as Floki nears a critical point in its price action.

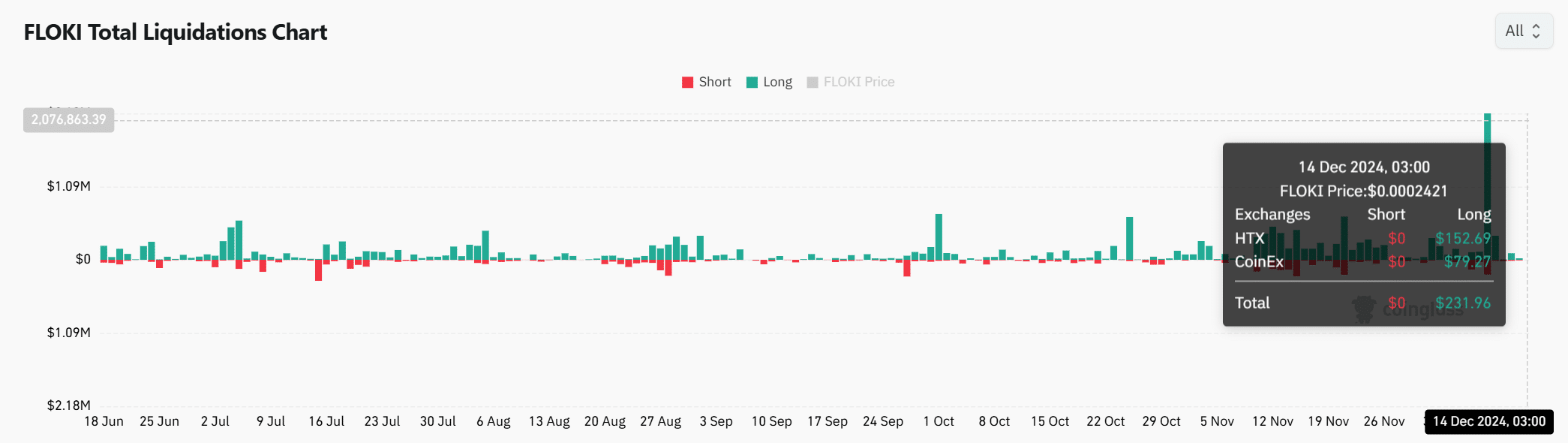

FLOKI liquidations remain low

It’s interesting to note that data from liquidations reveals a significant difference: long positions amounting to $231.96 compared to zero for short positions. This indicates that investors have been taking on more risk as bulls are positioning themselves ahead of a possible breakout, while bears seem to be holding back or avoiding the market.

As a crypto investor, I can sense the cautious atmosphere in the market right now, with liquidation activity at a minimal. However, if Floki manages to break through its resistance, it could trigger a surge in liquidation volumes, possibly leading to increased volatility.

Price-DAA divergence signals optimism

The significant jump in the disparity between Floki’s price and its Daily Averaged Averages reached 112.57%, indicating a strong belief among long-term investors, despite a drop in the number of daily active users.

This suggests a positive outlook for continued growth, particularly when significant resistance thresholds are surpassed.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

Can FLOKI confirm the breakout?

Currently, FLOKI stands at a crucial point in its market movement. A significant discrepancy between its price and DAA (Daily Active Addresses) indicates potential for change, while the Relative Strength Index remains steady. This technical setup suggests that FLOKI may attempt to surpass its resistance levels.

If Floki breaks through the current price level of approximately $0.00028980, it might lead to a surge towards around $0.00034883. But keep in mind that lower activity on the blockchain suggests less involvement, so be cautious. The upcoming movement will help us understand if Floki can capitalize on this potential momentum and continue its upward trajectory.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-12-15 09:11