- FlokiFi Locker’s $165.6 million TVL, neutral RSI, and growing holder base suggest potential bullish momentum.

- Mixed on-chain signals and stable liquidation data indicate caution, but bulls may still prevail.

As an analyst with over two decades of experience in the crypto market, I must say that FlokiFi Locker’s impressive TVL and growing holder base are certainly catching my attention. However, I always remind myself to approach any analysis with caution, given the volatile nature of this industry.

FlokiFi Locker has reached an unprecedented TVL (Total Value Locked) of $165.6 million, surpassing well-known memecoins such as Dogecoin and Shiba Inu in this aspect. Each lock placed on the ETH and BSC networks results in a deflationary burn, thereby decreasing the supply of Floki’s native token [FLOKI].

With this milestone, FLOKI is poised to leverage its momentum for a potential price breakout.

Are technical indicators pointing to a bullish surge?

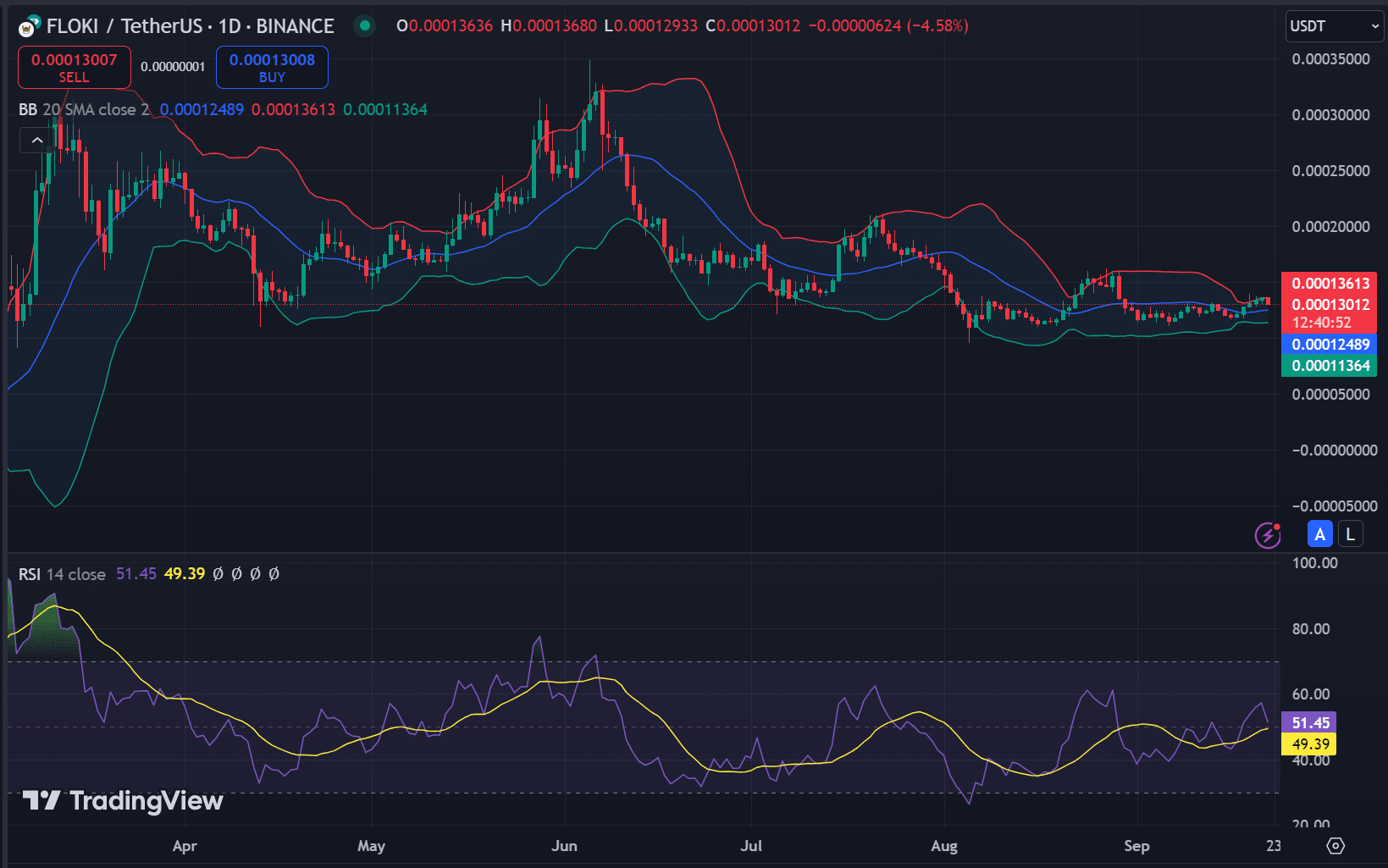

Right now, the value of FLOKI is holding steady, moving between a tight band priced at approximately 0.000136 USD. The Bollinger Bands indicate low market turbulence, often a precursor to a significant price shift. In simpler terms, we’re seeing FLOKI trading in a narrow range, and this pattern usually means a major change is about to happen.

The main point is still uncertain: where might it head next? At present, the Relative Strength Index (RSI) stands at 51.45, indicating it’s neither overly bought nor sold.

Consequently, traders should keep a close eye on the price fluctuations, as they may indicate a rise or fall. Exceeding the Bollinger Bands’ upper boundary might suggest an impending bullish trend, but it’s important to exercise caution.

Growing holder base: A bullish signal?

By mid-September, a total of 595 individuals were holding FLOKI, indicating a rise in investor faith and hinting at an upward trend in the token’s popularity among investors.

Furthermore, increased demand paired with decreased supply due to deflationary burns might potentially cause prices to rise in the upcoming weeks. The expanding community of holders serves as a significant positive signal for investors to keep an eye on.

On-chain data: What are the signals telling us?

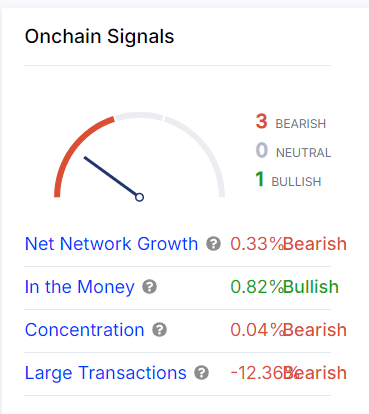

The information derived from on-chain analysis paints a somewhat ambiguous scenario. On one hand, the “In the Money” indicator suggests a bullish trend at 0.82%. However, other indicators present a less optimistic outlook. For instance, network growth has decreased by 0.33%, and large transactions have dropped by a significant 12.36%, which points towards mounting bearish pressure.

Although there are some encouraging signs, it’s important to exercise caution since these potential downward trends might influence the short-term market movements.

Liquidation data: Can bulls take control?

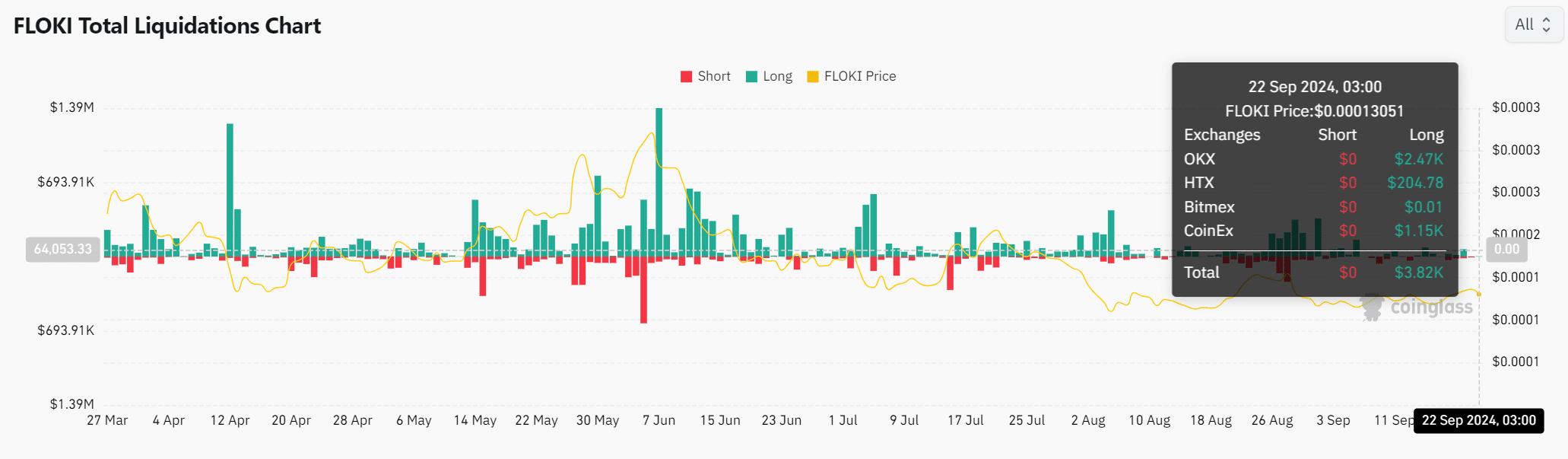

Recent liquidation data indicates that long positions outweigh shorts, with $3.82K in long liquidations recorded on September 22. This suggests that bullish traders still dominate the market.

A small number of sell-offs suggests market resilience, implying there might be an opportunity for prices to rise further.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

Is FLOKI ready for a breakout?

With an all-time high Total Value Locked (TVL), an expanding community of holders, and positive on-chain indicators, it appears that FLOKI is primed for significant growth or a surge in value.

As an analyst, I’ve noticed a blend of on-chain activity and low market volatility may cause some uncertainty among traders. Nevertheless, FLOKI exhibits promising bullish tendencies. However, it is crucial to remain vigilant and wait for clear confirmation signals before making any significant investment moves.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Elden Ring Nightreign Recluse guide and abilities explained

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-09-23 12:07